Property Tax On Vacant Land Ontario

3140 properties found List. 40 FOREST HILL ROAD.

Many of these properties are vacant land some may have derelict building on them.

Property tax on vacant land ontario. Amounts exceeding 55000 up to and including 250000. The property tax and what the property tax pays for. Canandaigua NY 14424 Map Ph.

At the time I didnt own a home. 2021 interim and final due dates property tax bill types fees. Assessors in Attendance Dates.

The Property We Tax The property tax is an indirect tax imposed on wealth. Ownership changes address changes tax certificates. Most sales of vacant land by individuals are HST tax free including the following examples.

Provincial land tax is a property tax on land located in non-municipal areas. Amounts up to and including 55000. Moving selling and real estate.

Lots and lands for sale Ontario. The current rebate is 30 of the property tax for vacant commercial space and 35 for vacant industrial space. So the problem with vacant land is not as easy as A-B-C or even Do Re Mi.

An investor can also deduct property taxes paid on vacant land as a personal itemized deduction on Schedule A. The sale of land that had been kept for personal use. Land and improvements constructed on the land are referred to as real property while.

For first time home buyers there is a maximum 4000 tax rebate on the Ontario land transfer tax. This deduction is not limited to the amount of net investment income. This is Ontarios official record of land property or land registration system.

The tax helps to support the local share of a number of services in these areas. Blindly assuming that interest and taxes may be added to ACB could become a costly trap in the end This entry was posted in Canadian Income Tax and tagged Canada Canadian Income Tax Canadian Tax Consultant CRA David Wilkenfeld interest Law Montreal. In 2000 I bought 100 acre parcel of bush land for 30000.

Ontario Lots and lands for sale. The Municipal Act property tax sales sale of land by public tender. Switching to online land registry services Effective October 13 2020 land registration services including self-service options will only be accessible online.

These tax foreclosure sales occur across Ontario all of the time. 166 JOHNSONS LANE KB REALTY INC. Hotel and short term accommodation tax.

If you fail to pay the taxes the municipality can and will seize the property. Lot for sale Unique Opportunity To Build Your Waterfront Paradise. Or The sale to a relative or to a former spouse or common-law partner for their personal use of a parcel of land created by subdividing another parcel.

Commercial and industrial properties or portions of these properties in the Vacant and Excess Land Property Tax Subclasses are. The sale of the severed portion of vacant land would not be subject to GSTHST since it is not capital property used primarily more than 50 in a business and it. Amounts exceeding 400000 where the land contains one or two single family residences.

Vacant Land Rates Commercial and industrial vacant land is taxed at a rate that is approximately 30 lower then the respective full tax rate. If you own a commercial or industrial property that is partially or entirely vacant you may be able to get a partial rebate of provincial land tax and education tax for the period of the vacancy. Vacant and Excess Land Property Tax Subclass.

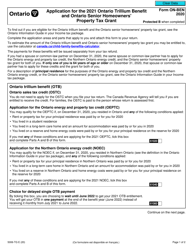

Overview The NonResident Speculation Tax NRST is a 15 per cent tax on the purchase or acquisition of an interest in residential property located in the Greater Golden Horseshoe Region GGH by individuals who are not citizens or permanent residents of Canada or by foreign corporations foreign entities and taxable trustees. Residential vacant land low density-single family semi-detached etc - Vacant residential and built on residential properties are taxed at. Program is administered by municipalities.

I want to know how to avoid paying tax on a land sale. 11 Acres Of Waterfront Land. Ontario land transfer tax rebate 3.

Others are long forgotten about by the original owners. History of the Ontario Land Transfer Tax Introduced to Ontario in 1974 the Conservativeontario governmentpresented the provincial Land Transfer Tax to property buyers with a starting percentage of 03 for up to 35000 of the purchase price of property and 06 for the rest. Based on Ontarios land transfer tax rates this refund will cover the full tax for homes up to 368000.

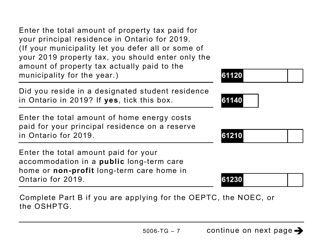

The form of wealth being taxed is the value of property owned. Property does however come in various forms. Tax is calculated on the value of the consideration at the following rates.

Real Property Tax Department 20 Ontario St.

Read more »