Property Taxes In Solon Ohio

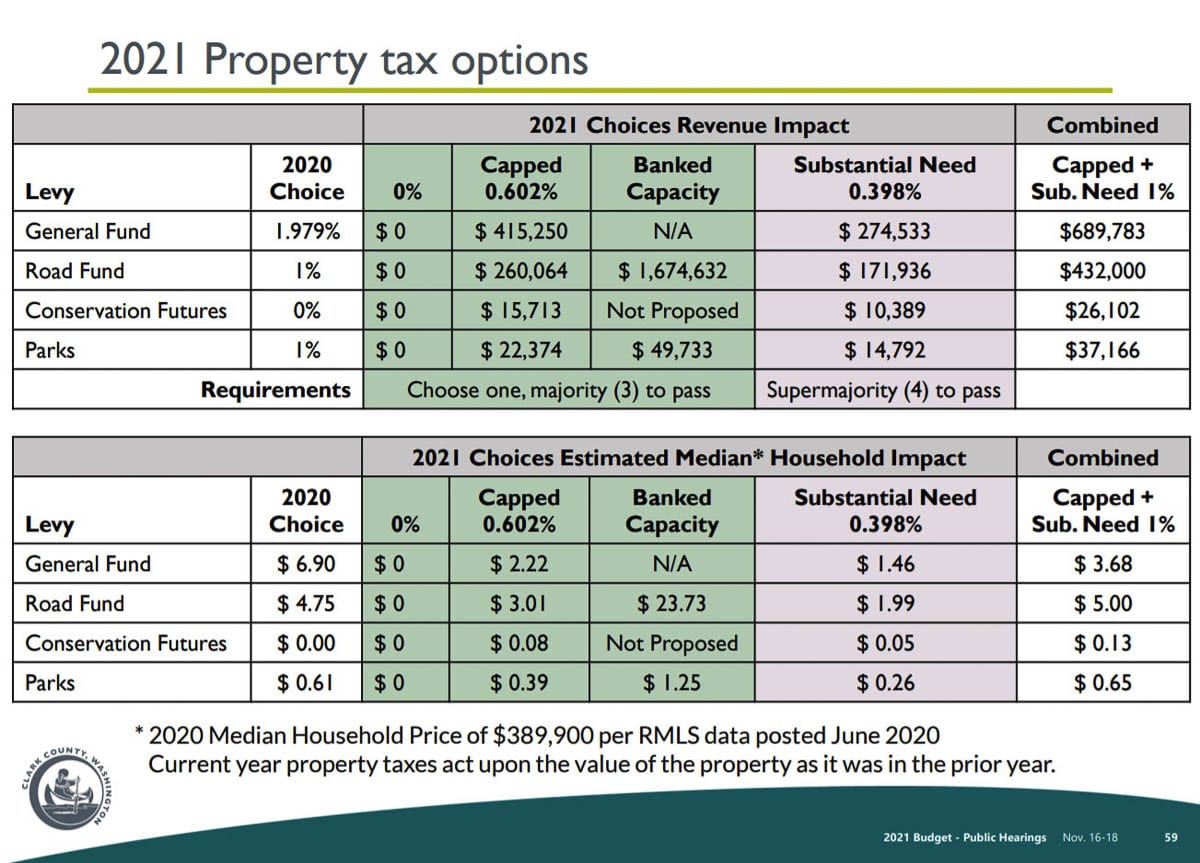

Counties in Ohio collect an average of 136 of a propertys assesed fair market value as property tax per year. The departments Tax Equalization Division helps ensure uniformity and fairness in property taxation through its oversight of the appraisal work of local county auditors.

34205 Aurora Rd Solon Oh 44139 Loopnet Com

34205 Aurora Rd Solon Oh 44139 Loopnet Com

Effective January 1 2015 the Regional Income Tax Agency RITA will begin collecting municipal income tax for the City of Solon.

Property taxes in solon ohio. While this years increase is only slight. Compare the best Property Tax lawyers near Solon OH today. 2240 2009 Property Taxes.

The median property tax in Ohio is 183600 per year for a home worth the median value of 13460000. According to the Plain Dealer Solon homeowners will pay 2265 per 100000 of home value in their 2013 tax bills up from 2224 per 100000 last year. Use our free directory to instantly connect with verified Property Tax attorneys.

For those taxpayers choosing to utilize mail the remittance address for RITAs secured lock box center is. Median property tax is 183600. After January 1 2015 all City of Solon tax payments and tax forms for current and prior tax years are to be filed with RITA.

The township Assessor determines the value of the property as of December 31 tax day of each year. The list is sorted by median property tax in dollars by default. TO ESTIMATE REAL PROPERTY TAX Formula.

The real property tax is Ohios oldest tax. It has been an ad valorem tax meaning based on value since 1825. Don 5685 Ledgebrook Lane Solon OH 44139 Find homes for sale market statistics foreclosures property taxes real estate news agent.

Box 477900 Broadview Hts Ohio. The City of Solon chose RITA for its ability to offer residents and businesses free on-line filing. You can sort by any column available by clicking the arrows in the header row.

Ohio is ranked number twenty two out of the fifty states in. You can also find information about assessed property values and real estate brokerages. Aurora Road Azalea Circle Bainbridge Bainbridge Road Baldwin Road Blue Heron Drive Blue Pond Trail Bockboard Lane Boulder Creek Boulder Creek Drive.

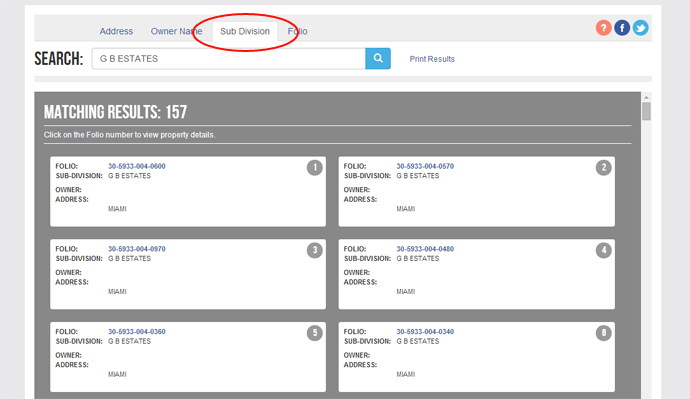

BSA Software and Solon Township have created a partnership to help provide a fast and convenient way for constituents to view valuable data online. Cuyahoga County Administrative Headquarters 2079 East Ninth Street Cleveland OH 44115 216 443-7400. Market value X annual as of market value Example.

This interactive table ranks Ohios counties by median property tax in dollars percentage of home value and percentage of median income. City of Solon 34200 Bainbridge Rd Solon OH 44139 Phone. Click HERE to create your account and access your property tax information.

Apply to Housing Manager Tax Analyst Construction Assistant and more. After January 1 2015 all City of Solon tax payments and tax forms for current and. Free e-payment capabilities and to maximize the Citys tax collection efforts.

Property Record Research Locations in Solon OH When looking to purchase Solon OH real property records you can use our real property record data search to find them. Example uses Solon School District residential rate Market value of property is 100000 Residential annual tax as a percent of market value is 232 100000 X 232 2320 annual property tax City of Solon Income Tax. Tax Information Ohio Taxes Solon Tax Rates.

Read more »