Delinquent Property Tax List Massachusetts

The following is a list of tax foreclosures in which title has been vested in the name of the City by a decree of the Land Court. Once a delinquent property makes the Tax Delinquent List it becomes a golden opportunity for real estate investors and wholesalers.

Boston Massachusetts Ma Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Boston Massachusetts Ma Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

508 949-8037 Contact Info Town of East Brookfield Delinquent.

Delinquent property tax list massachusetts. The transcripts are updated weekly. This listing does not contain the physical address of the property. Interest accrues on the day after the due date and each following month thereafterThe interest rate as of July 1 2016 changed to an annual rate equal to the bank prime loan rate as posited by the Board of Governors of the Federal Reserve System in statistical release H15.

Town of Dudley Collector of Taxes 71 West Main Street Room 207 Dudley Massachusetts 01571 Phone. Our work in the Collecting Division involves collecting property taxes and all other monies due to the City while serving taxpayers in a professional courteous manner. The Tax Title Lien Properties List represents the Town of Weymouths list of secured rights to unpaid property taxes through a tax lien process and is subject to change.

You may search for transcripts of properties currently available by County CS Number Parcel Number or by the persons name in which the property was assessed when it sold to the State. Search tax liens nationwide for your next tax lien investment. Tax FAQs and Glossary of Tax Terms.

Collector Treasurer Stephen Lonergan Collector-Treasurer City Hall Room 112 36 Court Street Springfield MA 01103 M-F 830 am. All taxes remaining unpaid after the city and county due dates are delinquent and are subject to interest and penalties. First the delinquent tax list that occurs the day after you are late on your property taxes.

Yarbrough Cook County Clerk 118 N. TIFs Tax Increment Financing Map Room. Also in the event of a foreclosure your tax lien results in you successfully acquiring the property.

We prepare and file tax takings and tax certification liens issue municipal lien certificates and prepare petitions for foreclosures with the Law Department. Contact for View the Public Disclosure Tax Delinquents List DOR Contact Phone. For issues related to individual property tax bills please contact your city or town.

We mail all tax bills and collect both current and delinquent taxes. Are tax liens a good investment. For many cities and towns property taxes are the.

Nothing contained herein supersedes alters or otherwise changes any provision of the Massachusetts General Laws DOR Regulations DOR rulings or any other sources of the law. So once you have the delinquent list you have insider knowledge. The homeowner hasnt been delinquent long enough for the county to put them on the tax lien property list.

Delinquent Property Tax Search. An account is delinquent when Real Estate Tax is still unpaid on January 1 the following year the tax was due. Once you have found a property for which you want to apply select the CS Number link to generate an online.

With bank deposit account rates at an all-time low tax liens are a great opportunity to get much higher interest rates on your money. Cook County Clerks Office. No information on what type.

Property Tax Delinquencies This is a dataset that shows the Philadelphia properties with tax delinquencies including those that are in payment agreements. The sale disposition of these properties are through public auction as. Municipalities can later foreclose the rights of owners to redeem the property to get clear title to the property returned to them by paying the taxes.

Tax foreclosure can occur in as little as one year though most states allow a property to get 2 years behind in taxes before seizing it. Each parcel on this list owing property taxes has had a lien recorded at the Norfolk County Registry of Deeds after being properly advertised in the legal notice section of the Towns local. Cities and towns in Massachusetts in an effort to collect back taxes have the right to file a lien against a property owner in the Registry of Deeds.

Tax Delinquent Properties for Sale Search. Business and individuals who owe more than 25000 in taxes to Massachusetts are posted on an online public list. Only taxpayers owing more than 25000 were listed.

Our goal is to provide valuable information to individuals and firms involved in the investment of tax sale property. Chapter 60 Section 63 the Treasurer Collector of Taxes shall receive money paid to him instead of the purchaser provided the amount tendered equals the amount stated in the Tax Collectors deed plus additional interest at the rate of 16 per year and costs from the date of the sale. Thursday until 6 pm.

Jefferson-Birmingham Mobile Montgomery Autauga Baldwin Barbour Bibb Blount Bullock Butler Calhoun Chambers Cherokee Chilton Choctaw Clarke Clay Cleburne. The delinquent tax list is essentially list of properties in your area that. Below is a listing by county of tax delinquent properties currently in State inventory.

About Property Index Number PIN Property Tax 101. View How to Read County Transcript Instructions. These properties are under the care custody and control of the Tax Title Custodian.

View the tax delinquents list online. Clark Street Room 230 Chicago IL 60602. You selected the state of Massachusetts.

And the second is the tax lien property list which happens down the road. Notice of Delinquent Property Taxes.

Springfield Massachusetts Ma Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Boston Massachusetts Ma Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Boston Massachusetts Ma Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Treasurer Tax Collector Georgetown Ma

Treasurer Tax Collector Georgetown Ma

Springfield Massachusetts Ma Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Suffolk County Property Tax Records Suffolk County Property Taxes Ma

Suffolk County Property Tax Records Suffolk County Property Taxes Ma

Https Www Mass Gov Doc Workshop A Local Tax Administration Download

Https Www Masscta Com Education Programs Files 794 Tax Title Assignments Under Mgl Ch 60 Section 2c 52 Part 2

Springfield Massachusetts Ma Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Chemung County Hosts Online Auction For Tax Foreclosed Properties Wetm Mytwintiers Com

Chemung County Hosts Online Auction For Tax Foreclosed Properties Wetm Mytwintiers Com

Https Www Donaanacounty Org Sites Default Files Pages Nmpropertytaxcode 0 Pdf

The Divorce Process In Massachusetts Everything You Need To Know

The Divorce Process In Massachusetts Everything You Need To Know

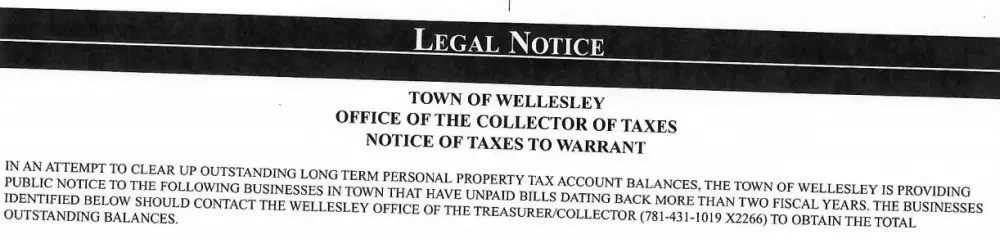

Pandemic Freed Up Wellesley Resources To Pursue Overdue Personal Property Taxes The Swellesley Report

Pandemic Freed Up Wellesley Resources To Pursue Overdue Personal Property Taxes The Swellesley Report

The Divorce Process In Massachusetts Everything You Need To Know

The Divorce Process In Massachusetts Everything You Need To Know

Boston Massachusetts Ma Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Boston Massachusetts Ma Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Top 100 Property Tax Delinquents Owe Holyoke 7 Million Masslive Com

Top 100 Property Tax Delinquents Owe Holyoke 7 Million Masslive Com

Https Www Newtonma Gov Home Showdocument Id 41399

San Diego County Ca Property Tax Faq S In 2021

San Diego County Ca Property Tax Faq S In 2021

Labels: list, massachusetts, property

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home