Property Tax Record Miami Dade

Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Apply for Business Tax account Edit Business Tax account Run a Business Tax report Run a Real Estate report Run a Tangible Property report Get bills by. We administer state laws local ordinances and policies to properly collect current and delinquent real and personal property taxes as well as delinquent accounts for various County departments.

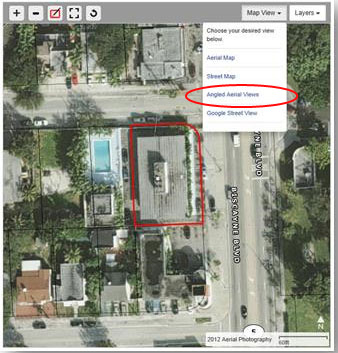

Property Search Help Miami Dade County

Property Search Help Miami Dade County

Treasurer and tax collector los angeles county property search help miami dade county property search help miami dade county king county parcel viewer.

Property tax record miami dade. To 8 am on our Online Tools which may affect usability. There are certain risks associated with the bidding at tax deed sales. Important Message We will be performing scheduled maintenance on Saturday October 12 from 12 am.

The Property Appraiser and Miami-Dade County assumes no liability see full disclaimer. Include your propertys folio number on the cashiers check certified funds or money order. Go to Data Online.

How can I record a document. This website may not reflect the most current information on record. Miami-Dade County collects on average 102 of a propertys assessed fair market value as property tax.

Search all services we offer. If payment is brought in person the payment must be received by May 28 2021. Garcia Has Mailed Important Property Tax Saving Exemption Benefits Information to Miami-Dade County Homeowners See More Property Appraiser.

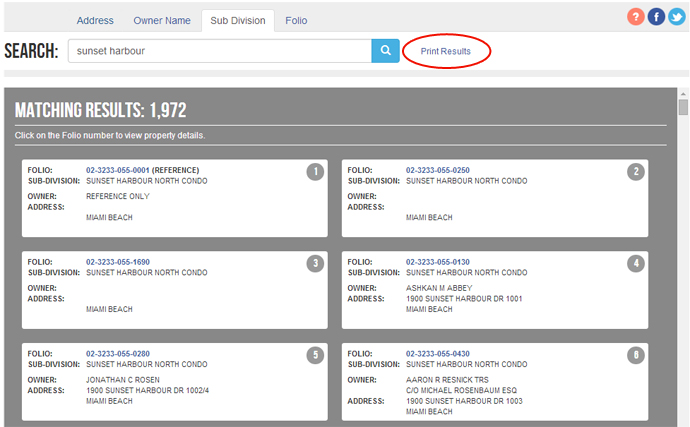

Please call 305-270-4916 for information. Search Enter a name or address or account number etc. Search Tax Records.

Important Message We will be performing scheduled maintenance on Saturday October 12 from 12 am. Documents submitted for recording by mail or in person without a self-addressed stamped envelope will not be processed. Real estate property taxes are collected annually and can be paid online only 2020 taxes until May 31 2021.

The Office of the Property Appraiser released the July 1st Preliminary Certification of Taxable Values to taxing authorities across Miami-Dade County totaling 324362997164. Your Essment Notice And Tax Bill Cook County Essor S Office. Before buying real estate property be aware that non-ad valorem assessments may have a significant impact on your property tax bill.

View all posts by Alex Post navigation. Miami-Dade County Recorder PO. Please enter the information below for the current tax year to view and pay your bill.

Government Center downtown Miami or South Dade Government Center. Combined Tax and Assessment. Miami-Dade Tax Collectors Office Tax Records httpwwwmiamidadegovtaxcollectorproperty-tax-paymentasp View Miami-Dade Tax Collectors Office real estate tax information including tax bills tax notices discounts and delinquent taxes.

Before buying real estate property be aware that non-ad valorem assessments may have a significant impact on your property tax bill. Miami-Dade Tax Collectors Office Tax Records httpwwwmiamidadegovtaxcollectorproperty-tax-paymentasp View Miami-Dade Tax Collectors Office real estate tax information including tax bills tax notices discounts and delinquent taxes. Yearly median tax in Miami-Dade County The median property tax in Miami-Dade County Florida is 2756 per year for a home worth the median value of 269600.

Make your payment payable to Miami Dade Tax Collector. Visit the Tax Deed Unit or the Online Tax Deed Auction to review information on the different properties offered for sale and for future tax deed sale dates. Miami-Dade Tax Collector 305 270 - 4916.

Pay for confidential accounts. Property owners are encouraged to. 22 NW 1st Street 1st Floor Miami FL 33128.

The Office of the Property Appraiser does not verify ownership but can confirm the owner of record through the Property Search Application. Box 011711 Flagler Station Miami Florida 33101 Or for items requiring signature use our physical address. The property appraisers office and Miami-Dade County disclaim liability for any errors either by omission or commission regarding this real property tax estimator and the estimates produced by its use.

The Tax Collector is part of Miami-Dade Countys Finance Department. The Office of the Property Appraiser is continually editing and updating the tax roll. Review the Clerks Administrative Order 13-05 Electronic Tax Deed Sales Procedures for detailed information on bidding for the properties offered for sale.

The countywide taxable value for 2020 increased by 51 compared to 2019. Enter a name or address or account number etc. Last years total taxes.

01082021 Property Appraiser Pedro J. To 8 am on our Online Tools which may affect usability.

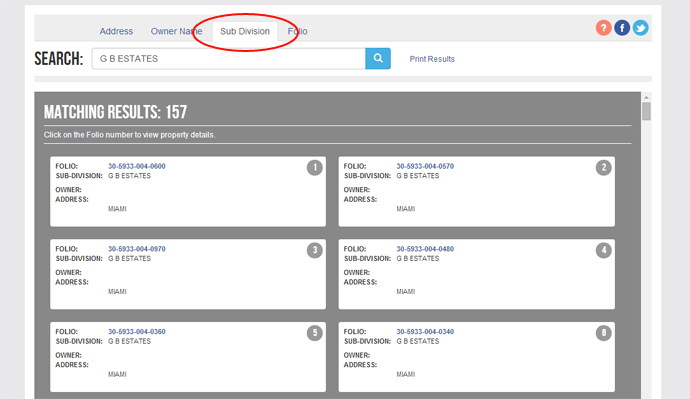

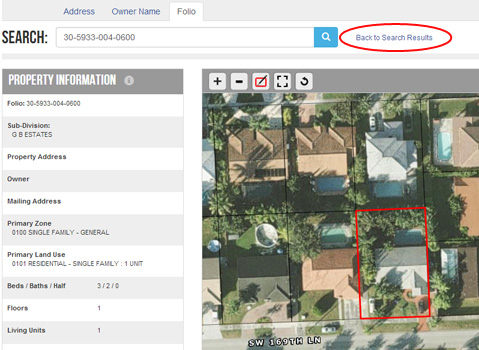

Property Search Help Miami Dade County

Property Search Help Miami Dade County

Property Search Help Miami Dade County

Property Search Help Miami Dade County

Property Search Help Miami Dade County

Property Search Help Miami Dade County

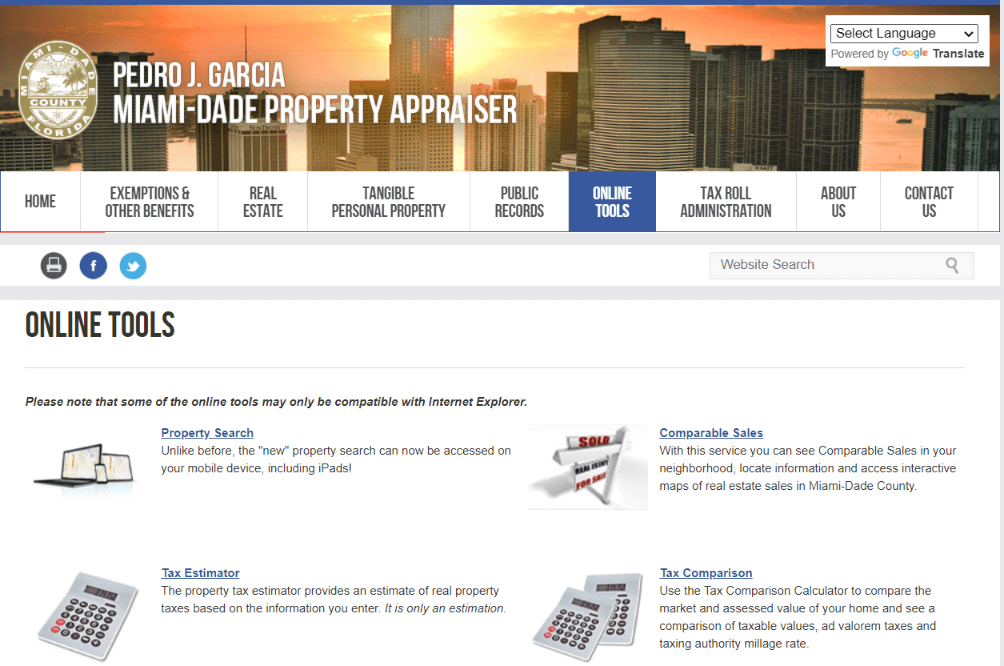

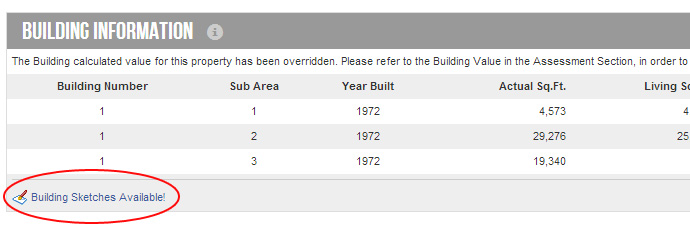

Miami Dade County Property Appraiser How To Check Your Property S Value

Miami Dade County Property Appraiser How To Check Your Property S Value

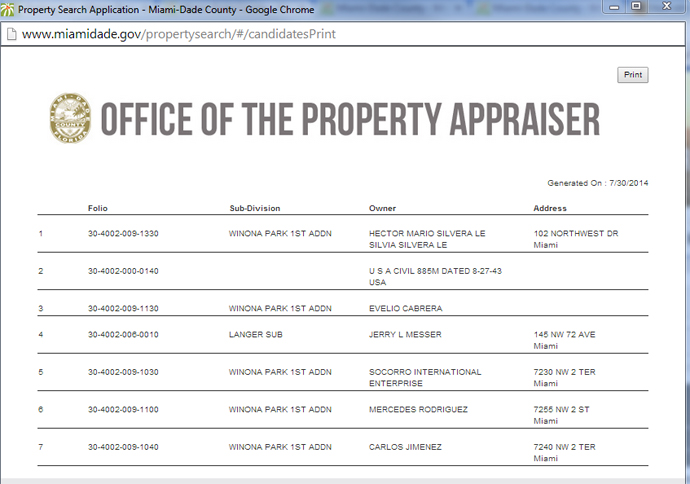

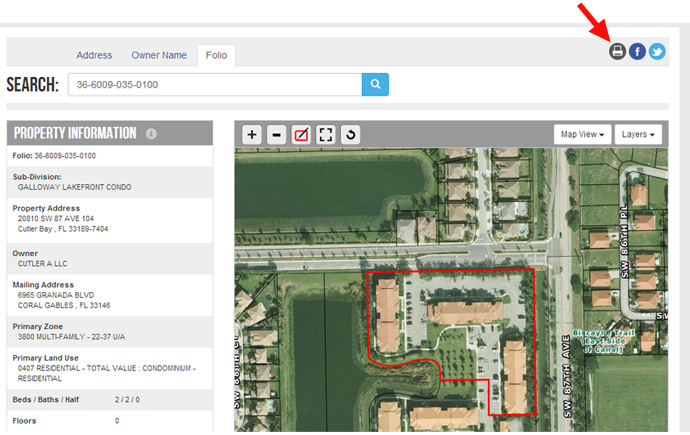

Property Search Application Miami Dade County

Property Search Application Miami Dade County

Property Search Help Miami Dade County

Property Search Help Miami Dade County

Property Search Help Miami Dade County

Property Search Help Miami Dade County

Property Search Application Miami Dade County

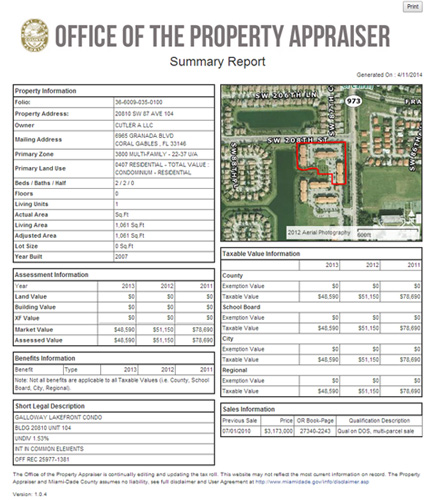

Property Tax Bill Miami Dade County Property Walls

Property Tax Bill Miami Dade County Property Walls

Advanced Search Taxsys Miami Dade County Tax Collector

Advanced Search Taxsys Miami Dade County Tax Collector

Property Search Help Miami Dade County

Property Search Help Miami Dade County

Miami Dade County Property Appraiser How To Check Your Property S Value

Miami Dade County Property Appraiser How To Check Your Property S Value

Property Search Application Miami Dade County

Miami Dade County Tax Collector Property Taxes Property Walls

Property Search Help Miami Dade County

Property Search Help Miami Dade County

Miami Dade County Property Appraiser How To Check Your Property S Value

Miami Dade County Property Appraiser How To Check Your Property S Value

Property Search Application Miami Dade County

Property Search Application Miami Dade County

Property Search Help Miami Dade County

Property Search Help Miami Dade County

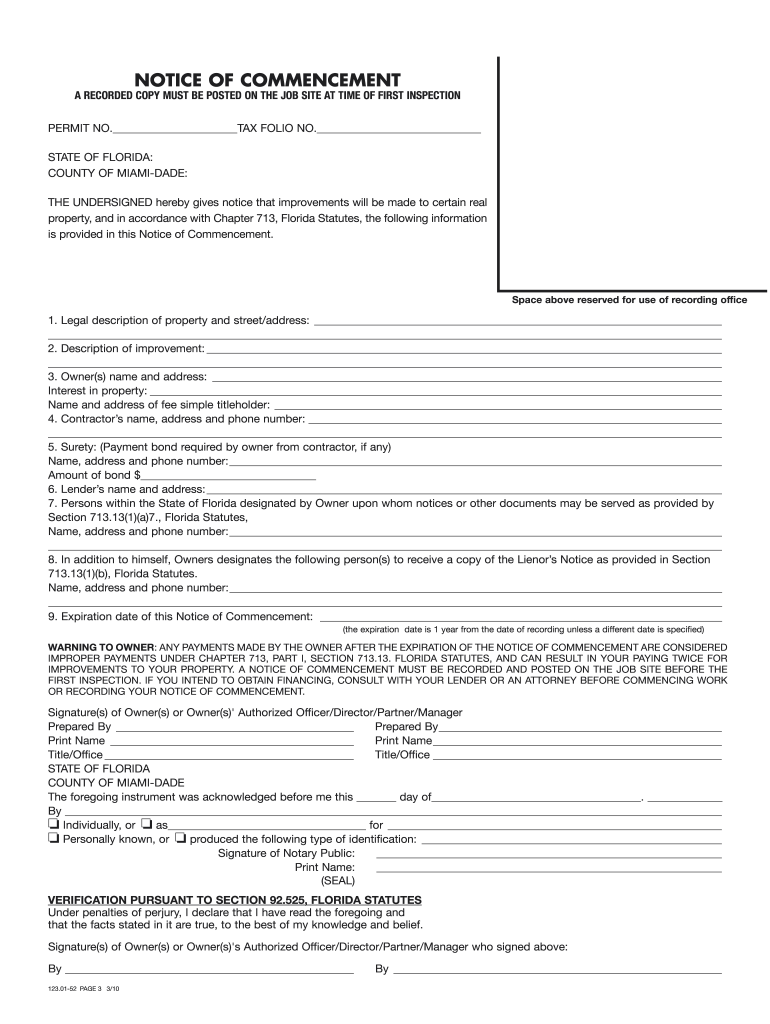

Notice Of Commencement Miami Fill Online Printable Fillable Blank Pdffiller

Notice Of Commencement Miami Fill Online Printable Fillable Blank Pdffiller

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home