College Property Management Miami University

College Pads helps students find all of the Miami University off-campus housing options in town. Real Estate Department The Real Estate department is responsible for the Universitys overall real estate strategy including acquisition and disposition of real estate assets enterprise-wide leasing strategies and management of University owned real estate property.

Pin On Multifamily Property Management News Tips Ideas Jobs

Pin On Multifamily Property Management News Tips Ideas Jobs

Learn the core competencies of project management following the Project Management Institutes A Guide to the Project Management Body of Knowledge PMBOK Guide.

College property management miami university. Starting in Fall 2021 the Honors College will be a residential college requiring all first-year Honors students to live in the Honors residence halls listed below. College Property Management Miami - Miami University. 271 likes 2 talking about this 21 were here.

View Directions on Google Maps. The School of Continuing Education and Professional Developments SCEPD. Property management degrees are available at both the.

This program focuses on the core competencies of project management in the Project Management Institute A Guide to the Project Management Body of Knowledge PMBOK Guide. 163RD STREET North Miami FL 33160. Just click the rental youre interested in to see reviews photos property details and more.

We offer investors the perfect strategy to maximize their return on investments. College of Liberal Arts and Applied Science Follow MiamiRegionals. North Miami 3577 NE.

Continuing education for Florida licensees Florida real estate investments post-licensing management guide for real estate brokerages in. Management Miami LLC is a full service commercial residential real estate brokerage company specializing in asset and property management. Miami Dade College is following the guidance of public health and government agencies to safeguard the health and safety of all our community.

There are 5 private colleges within the Miami city limits and 18 private colleges within a 50 mile radius. The residential component of the Honors College fosters a comprehensive and transformative experience by combining community activities with courses and enhanced academic support. A native of Miami Daniel earned a finance and marketing degree from Florida International University where he served on the Leadership Advisory Board for the College of Architecture and The Arts and he holds a Masters in Business Administration from University of Miami.

Prestigious Student Housing for Miamis Elite. Whether you are looking for apartments or houses for rent in Oxford OH you can compare tons of landlords all at once on one site. Student Rentals off-campus housing houses for rent Oxford OH apartments for rent student houses Miami University.

Poplar Street Oxford OH 45056 5135249340. Become proficient in the knowledge areas process groups skills and techniques delineated in the PMBOK Guide to execute projects effectively and efficiently through all stages. Classes Fingerprinting Grading Textbook Pickup.

Red Brick Property Management LLC. Red Brick Property Management LLC Oxford OH. Welcome to the University of Miami Project Management Professional Certificate Program Effective project management is an integral skill in a wide variety of careers.

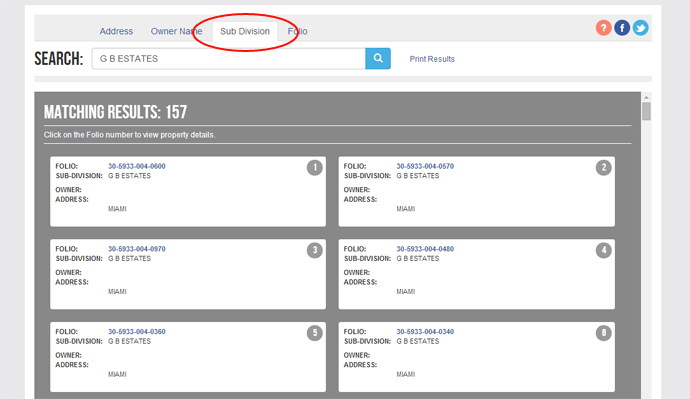

Our services range from acquisitions renovations leasing management construction and development. If youre looking for an Oxford house or apartment for rent near Miami University youll want to check out the listings below by College Property Management. The College of Liberal Arts and Applied Science CLAAS currently offers 19 forward-focused bachelors degree options across Miamis Regional Campuses and online plus pathways to 100 majors that.

Miami Dade College offers four courses in this category. Anthony De Yurre LLM05 RPD Advisory Board Co-Chair. In terms of cost South Florida Bible College and Theological Seminary offers the lowest in-state tuition for private colleges in the Miami area.

CollegeUniversity Location Institution Type Degrees Offered Undergraduate Tuition 2015-2016. Remote learning for students will continue through the end of the Summer Term. If youre looking for a large school Nova Southeastern University enrolls the most students.

Read more »Labels: college, management, miami, property