Which Property Brother Got Married And Divorced

Marital Property Generally marital property is everything that either of you earned or acquired during your marriage unless you agree otherwise. Property that was owned prior to the marriage is usually considered separate property along with individual gifts inheritances personal injury awards property acquired in just one spouses name that is not used for the benefit of the other spouse and property agreed to be separate.

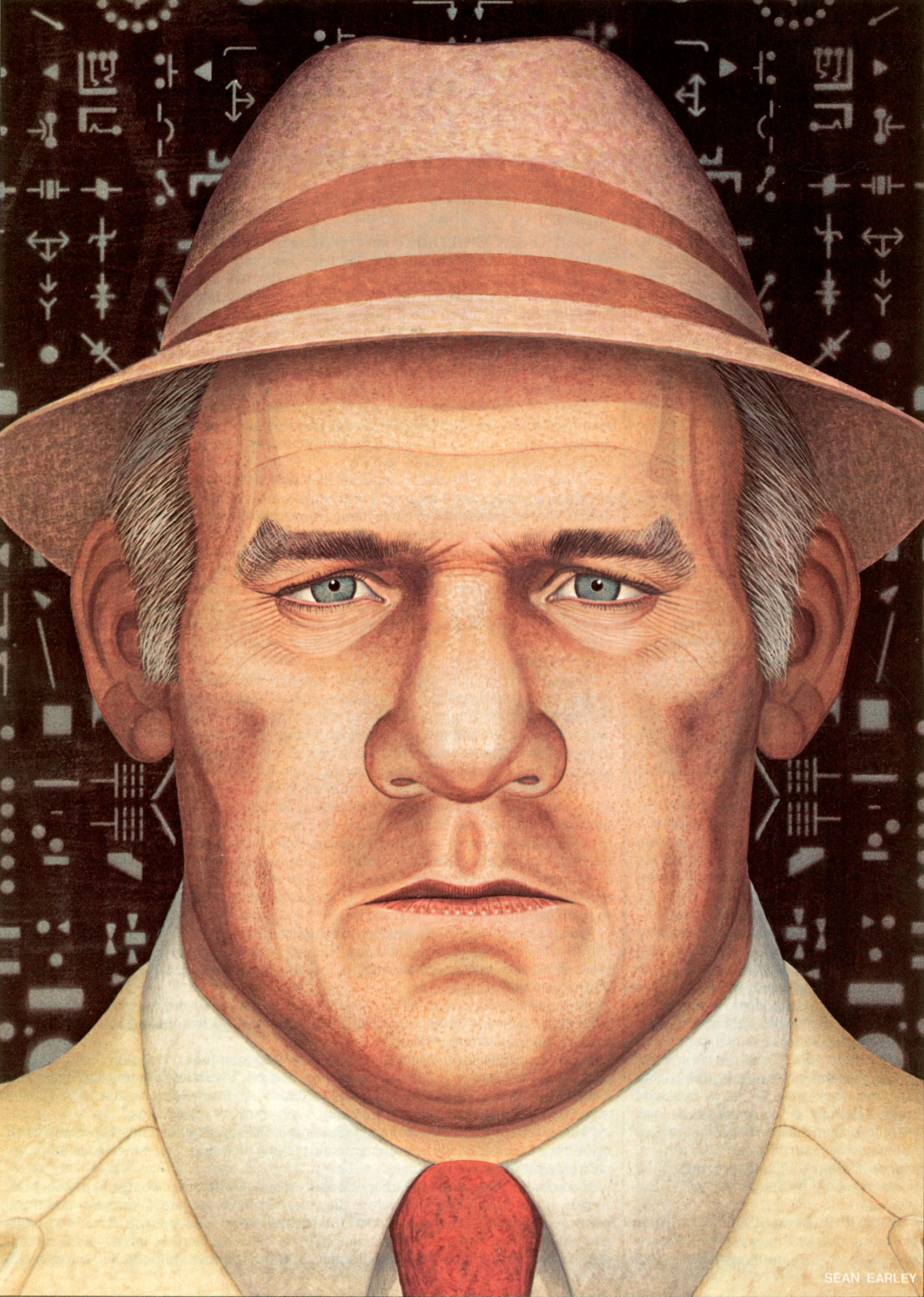

From Bankruptcy And Divorce To Fame And Prepping For Fatherhood The Property Brothers Tell All We Wanted To Be Honest People Property Brothers Jonathan Scott Scott Brothers

From Bankruptcy And Divorce To Fame And Prepping For Fatherhood The Property Brothers Tell All We Wanted To Be Honest People Property Brothers Jonathan Scott Scott Brothers

Scott revealed to People.

Which property brother got married and divorced. Family Code 770 states. The plan was for a post-pandemic wedding between the twice-divorced Deschanel and the HGTV star. Jonathan opened up about his divorce in the brothers memoir It Takes Two.

Known as the third member of the Property Brothers JD Scott recently got married in untraditional Halloween wedding to his fiancée Annalee Belle Dunn. We are getting divorce but he is stating that the home was an inheritance. The two wed in.

The Property Brothers star married Scott Brothers Global creative director Linda Phan in a whimsical outdoor ceremony on Saturday in. The bride-to-be got ready for her big day alongside friends. Marital property and separate property.

The eldest Scott brother regularly appears on his siblings. Linda Drew Say I Do premieres June 2 at 98c on TLC. Any property owned by either spouse before the marriage and.

Californias separate property laws apply to a house owned before marriage. Most of the details of the so-called Jonathan Silver Scott divorce have been kept under wraps -- until now. Not only was their wedding day unique the Property Brother did something extra special for his bride that most men have never thought of doing - taking Annalees last name.

Jonathan And Drew Scott Both Getting Hitched. The Property Brothers are known as the HGTV hunks and now the latest rumors suggest that the Property Brothers are married --. 1 All property owned by the person before marriage.

Drew Scott is officially a married man. First we look to the law. Is the property an inheritance or am I entitled to the home too.

In a community property divorce spouses typically get to keep their separate property. A Separate property of a married person includes all of the following. With respect to married couples there are two types of property.

The property went into probate and later was refinanced by both of us and both names are on the Deed before we got married. Drew Scott Jonathans fellow Property Brother was said to have had his. Our Story noting that The pain ended up outlasting the marriage.

2 All property acquired by the person after marriage by gift bequest devise or descent. Jonathan Scott who has been tight-lipped about his romantic past opened up about his divorce from an airline-crew scheduler named Kelsey. March 29 2017.

Upon divorce the court seeks to divide proper equitably. Considering how much eye-rolling and infighting goes on between Property Brothers prospective homebuyers you could be thinking every couple on the show filed for divorce once the cameras stopped. Twins Drew and Jonathan Scott have always done everything together and the Property Brothers stars 42 can now add becoming fathers to.

Courts will however take a close look at the character of the property meaning whether your property is community joint or separate owned by only one spouse. Property Brothers star Jonathan Scott has long been quiet about his past divorce but now that he is in a serious relationship the HGTV celeb is ready to speak out. As many fans of the hit HGTV show Property Brothers are aware Jonathan Silver Scott -- the constructor half of the twin brother duo -- went through a divorce before he and his twin brother Dancing with the Stars contestant Drew Scott became famous.

Read more »