Property Tax Statement Riverside County

Each year the Treasurer-Tax Collector s Office mails in excess of 700000 property-tax bills and informational copies to owners of property in Riverside County. Property tax bills are mailed out in late Septemberearly October and are payable in two equal.

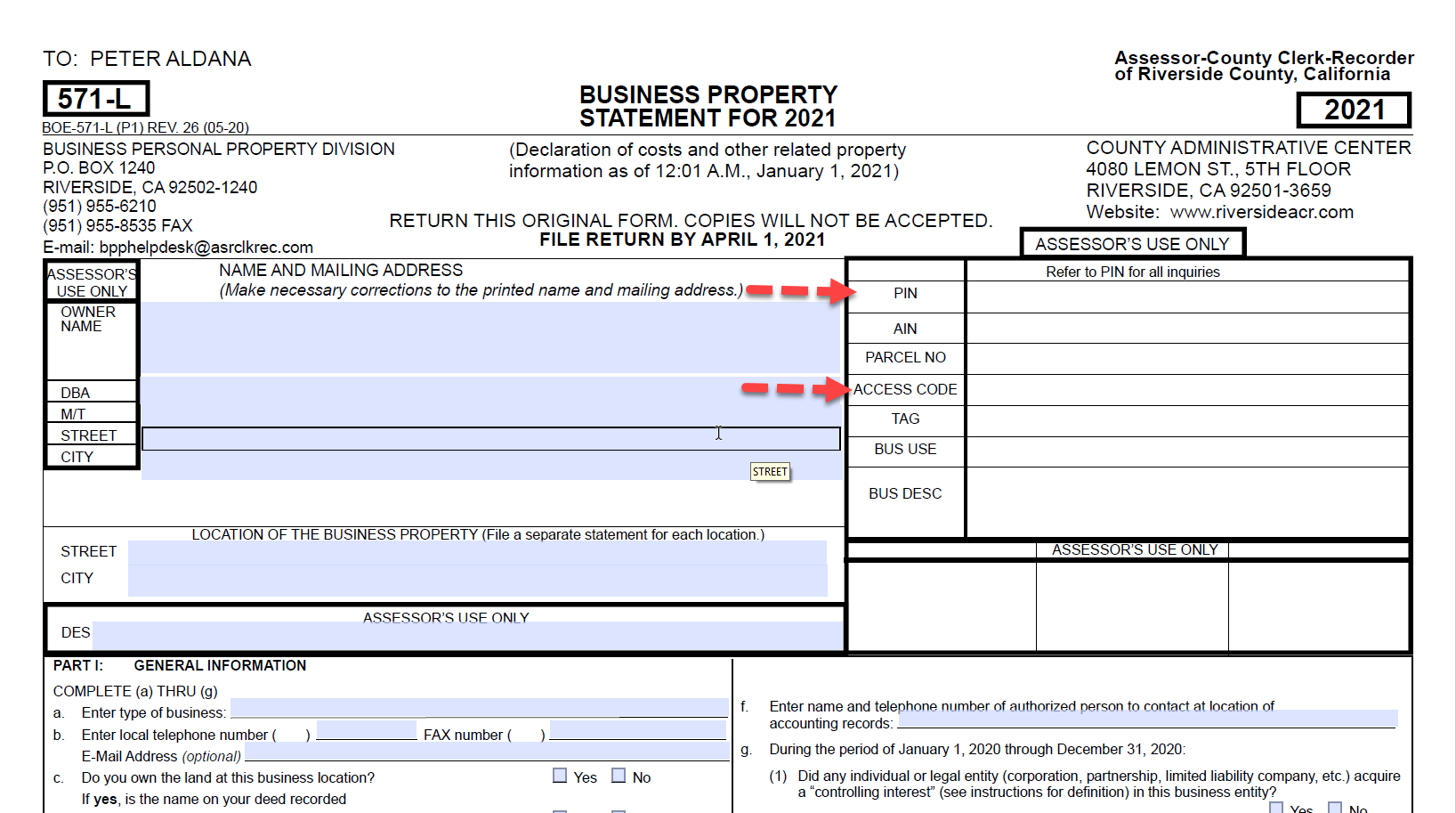

Riverside County Assessor County Clerk Recorder Business Personal Property

Riverside County Assessor County Clerk Recorder Business Personal Property

Welcome to Riverside County Assessor Online Services.

Property tax statement riverside county. The Assessor must complete an assessment roll showing the assessed values for all property and maintain records of the above. These annual property-tax bills cover the period from July 1 to June 30 and reflect the assessed value of the property as of January 1st. In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property.

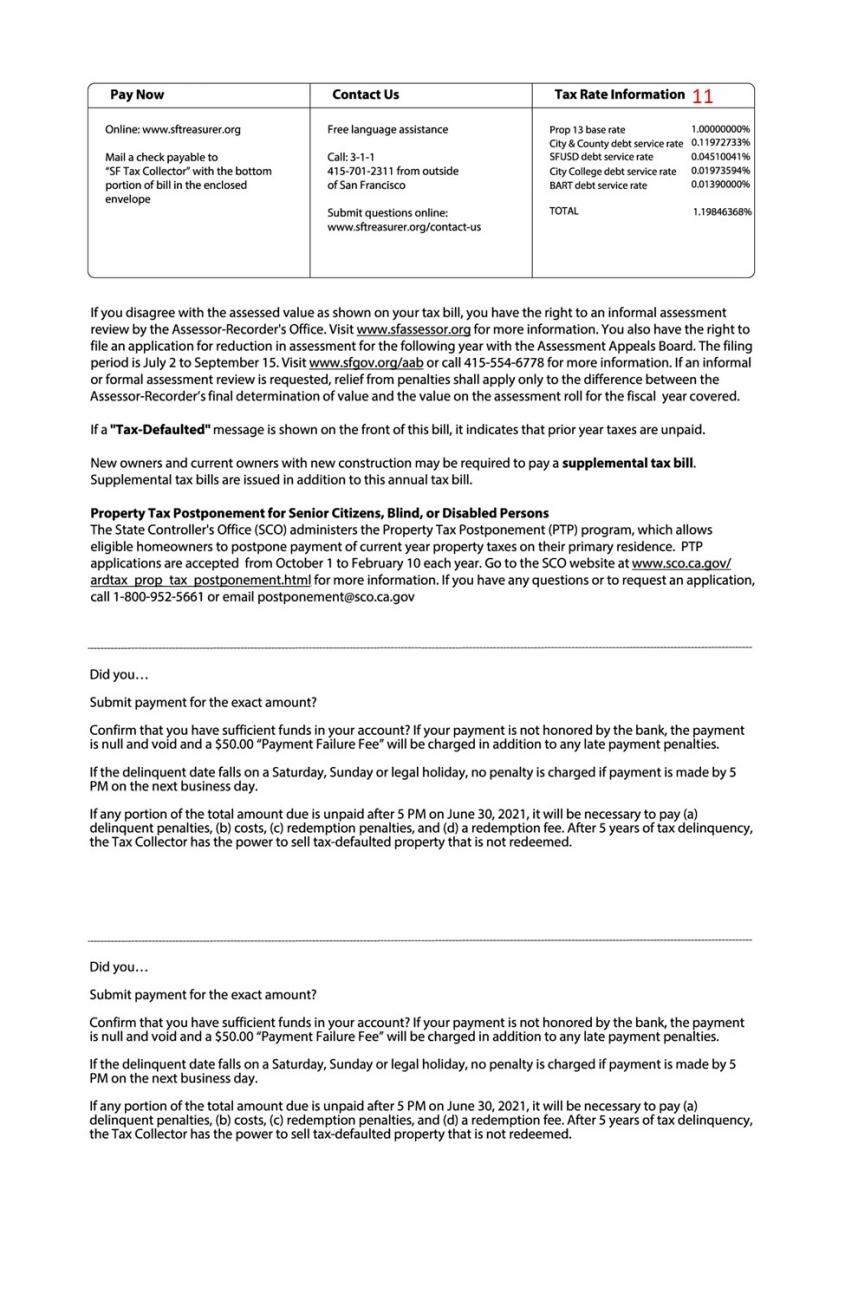

There are 4 simple steps to pay your property taxes online. OFFICE OF THE TREASURER-TAX COLLECTOR. Privacy Statement TC3 User Log In The Riverside County Treasurer-Tax Collector is responsible for the billing and collection of property taxes and for the receiving processing investing and most importantly safeguarding of public funds as mandated by the laws of the state of California.

In-depth Riverside County CA Property Tax Information. File your Business Property Statement Online. The Riverside County Tax Collector is a state mandated function that is governed by the California Revenue Taxation Code Government Code and the Code of Civil Procedures.

The last day to file without penalty is May 7 postmarked unless it falls on weekend or holiday in which case the deadline is extended to the next business day. Add your property taxes to your Payment List. The Office of the Tax Collector is responsible for collecting taxes on all secured and unsecured property in Orange County.

The Treasurer Tax Collector is committed to offering payment options to the public in the safest way possible. We accept mailed payments as timely if they are postmarked on or before the delinquent date. Riverside County Administrative Center 4080 Lemon Street Riverside CA 92501.

Print a copy of your receipt for your records. Box 12005 Riverside CA 92502-2205. The divisions fax number is 951 955-8535.

Please be advised that if for any reason you are unable to make your tax payment in an automated fashion over the phone or web you are still responsible to make payment timely in order to avoid penalties. The Assessor must determine a value for all taxable property and apply all legal exemptions and exclusions. Downtown Riverside - First Floor Effective March 22 2021 the Tax Collectors First Floor office is open by appointment only Monday Friday from 800 am.

The Business Personal Property division can be reached at 951 955-6210. 571-L 571-R 571-A or 571-F. The Assessor does not set tax amounts or collect taxes.

Small business filers with one or a few locations may file the following forms online. It is our hope that this directory will assist in locating the site resource or contact information you need as a taxpayer in Riverside. This office is also responsible for the sale of property subject to the power to sell properties that have unpaid property taxes that have been delinquent over five years.

Effective March 22 2021 the Treasurer-Tax Collectors downtown Riverside office located on the 1st floor of the County Administrative Center will be open by appointment only. Property taxes are collected by the county although they are governed by California State Law. The Tax Collector of Riverside County collects taxes on behalf of the following entities.

Some information relating to property taxes is provided below. Title Company Electronic Payments. We STRONGLY encourage taxpayers to make their tax payments using either our online payment system make.

If a business fails to file the Business Property Statement or Agricultural Property Statement or it is filed late a 10 penalty will be applied pursuant to Revenue and Taxation 463. The system does all the calculations for you. Riverside County Assessor-County Clerk-Recorder Vision Statement To uphold and protect public trust through extraordinary public service careful stewardship of public funds transparency and accessibility employee empowerment innovation collaboration effectiveness and leadership in local government.

Statements are completed one at a time by filling in the blanks. Phone - call 951 955-3900 for direct access CreditDebit card only - all tax types except prior year unsecured Online CreditDebit card or e-check Wires ACH Payments. The Business Personal Property Division is responsible for the discovery and assessment of all taxable business property boatsvessels non-commercial aircraft and racehorses within the County of Riverside.

The Tax Collector is responsible for the billing and collection of secured unsecured supplemental transient occupancy tax as well as various other special assessments for the county school and community colleges and. Please make checks payable to. The offices of the Assessor Treasurer-Tax Collector Auditor-Controller and Clerk of the Board have prepared this site to introduce taxpayers to the organizations that handle the property tax process in Riverside County.

Select your payment method and enter your account information and submit your payment. The county most of the countys incorporated cities school districts and all other taxing agencies located in the county including special districts eg flood control districts sanitation districts. Welcome to the Riverside County Property Tax Portal.

Search for your property tax. If you have.

Read more »