Property Tax Statement Lane County Oregon

Learn about how Oregon Property Tax began here. 2020-21 Tax Statements.

Assessor Douglas County Government

Assessor Douglas County Government

If paid in full on or before November 15th there is a 3 discount.

Property tax statement lane county oregon. You can view copies of your bill back through 2018. The property tax system is one of the most important sources of revenue for more than 1200 local taxing districts in Oregon. Lane County Justice Court Fees.

We are a broad service organization mandated by the Oregon Constitution and Oregon law and collect revenue for 85 taxing jurisdictions including local governments schools and special districts that provide essential public services for the citizens of Lane County. Links to county websites take me to ORMAP. 2020-21 Typical Home Value Chart.

Find Lane County Tax Records. How Oregon Property Tax Began Learn where your Property Taxes go here. Property Tax Deferral for Disabled and Senior Citizens As a disabled or senior citizen you can borrow from the State of Oregon to pay your property taxes to the county.

To get a copy of your bill before 2018 contact Customer Service via phone email or chat. Intangible personal property is not taxable and tangible personal property may or may not be taxable. Our mission is to uphold Oregon law by appraising all property equitably collecting and distributing taxes accurately and providing public service with quality and creditable standards.

Parole. Personal property is taxable in the county where its located as of January 1 at 1 am. INTEREST IS CHARGED ON PROPERTY TAX AT THE RATE OF 133 PER MONTH OR 1600 ANNUALLY ON DELINQUENT TAXES.

All personal property must be valued at 100 percent of its real market value unless otherwise exempt ORS 307020. Lane County taxpayers will receive their 2020-2021 property tax statements beginning on October 21 2020. Property Tax Payment Discounts and Dates.

Where do my Property Taxes go. Quick links 2019 Industrial property return 2019 Personal property return 2019 Real property return FAQ. Lane Code Chapter 14 Application Review and Appeals Contact Us.

Understanding your Tax Statement. 2 of 23rds of your property tax. More complete property information is available by subscribing to the Regional Land Information Database RLID through the Lane.

300 4th Ave SW Rm 214. Property taxes rely on county assessment and taxation offices to value the property calculate and collect the tax and distribute the money to taxing districts. If 23rds paid on or before November 15th there is a 2 discount.

Oregon tax law resources. One-third of your full property tax amount. Property Tax Information Videos.

Most information is updated weekly. No discount is allowed on payments for less than 23rds. This must be done after you receive your tax statement but before December 31 or the next business day if.

Tax Time Frequently Asked Questions. 3 of your full property tax amount. Sheriffs Office Real Property Sales.

Personal property is either tangible or intangible. Property tax is set by and paid to the county where your property is located. Lane County Park Reservations and Passes.

Property Taxes - Whats In It For Me. 2020-21 Median Assessed Value Data. We would like to show you a description here but the site wont allow us.

If you qualify for the program the Oregon Department of Revenue will pay your county property taxes on November 15 of each year. This public site contains the most commonly requested Assessment Taxation information on property located within Lane County. The department sends billing statements and collects all property taxes and penalties in the county and distributes the tax money to the appropriate taxing districts.

One-third of your full property tax amount. You can see property value and tax information back through 2008. In most cases appeal your property value by filing a petition with the Board of Property Tax Appeals BOPTA clerks in the county where the property is located.

The first payment is due on November 16 2020. How does the program work. No discount will be applied.

Maps and GIS Data. One-third of your full property tax amount.

Oregon Property Tax Calculator Smartasset

Oregon Property Tax Calculator Smartasset

Ticket For Motorcycle Hill Climb Wagner S Butte Benton County Oregon Sunday Afternoon May 11 At 2 00 P M Sponsored B Hill Climb Motorcycle Clubs Oregon

Ticket For Motorcycle Hill Climb Wagner S Butte Benton County Oregon Sunday Afternoon May 11 At 2 00 P M Sponsored B Hill Climb Motorcycle Clubs Oregon

Property Taxes Add Up Levies Taxes Bonds Can Cause Your Increase To Be More Kval

Property Taxes Add Up Levies Taxes Bonds Can Cause Your Increase To Be More Kval

Homeowners Beware Fraud Claiming Imminent Property Seizure Makes Its Way To Lane County Kmtr

Homeowners Beware Fraud Claiming Imminent Property Seizure Makes Its Way To Lane County Kmtr

Property Taxes Add Up Levies Taxes Bonds Can Cause Your Increase To Be More Kval

Property Taxes Add Up Levies Taxes Bonds Can Cause Your Increase To Be More Kval

Property Deeds Jackson County Oregon

Property Deeds Jackson County Oregon

Homeowners Beware Fraud Claiming Imminent Property Seizure Makes Its Way To Lane County Kmtr

Homeowners Beware Fraud Claiming Imminent Property Seizure Makes Its Way To Lane County Kmtr

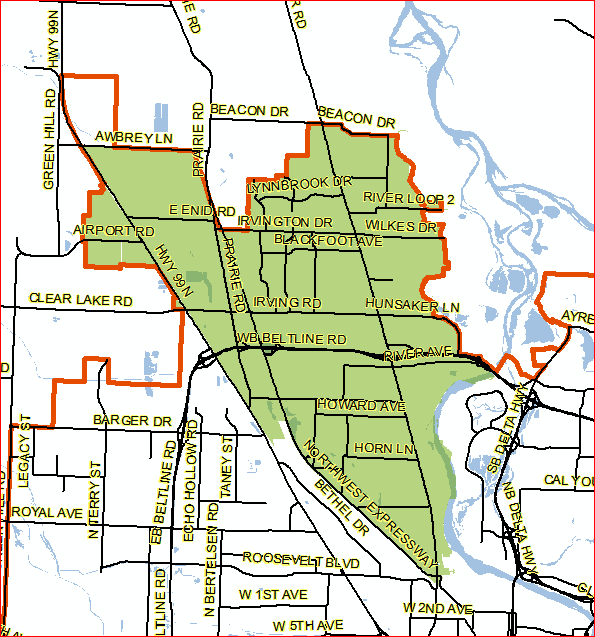

City Of Eugene Planning And Development Annexation Property Tax Estimator

City Of Eugene Planning And Development Annexation Property Tax Estimator

Property Data Online Jackson County Oregon

Property Data Online Jackson County Oregon

Property Taxes In Salem Oregon Salem Or Homes For Sale

Property Taxes In Salem Oregon Salem Or Homes For Sale

Lane County Property Tax Statements Available Online

Http Www Oregon Gov Dor Forms Formspubs Local Budget Book Education 504 075 Pdf

Property Taxes Add Up Levies Taxes Bonds Can Cause Your Increase To Be More Kval

Property Taxes Add Up Levies Taxes Bonds Can Cause Your Increase To Be More Kval

Https Www Oregon Gov Dor Forms Formspubs Utility Large Communication 302 131 Pdf

Carmichael Stanton Llc Oregon Property Tax Appeal Attorneys

Carmichael Stanton Llc Oregon Property Tax Appeal Attorneys

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home