Where Can I Get A Copy Of My Property Tax Assessment

Property Taxes-Assessment How is My Property Tax Determined. For more information please call 311 or 905 874 2000 if outside of Brampton.

To order your tax return transcript by mail complete and mail either Form 4506-T or Form 4506T-EZ.

Where can i get a copy of my property tax assessment. Local assessment officials. Real Property Assessment Division - Online Services The Real Property Assessment Forms and Information tab on the menu bar provides. If you feel you are over-assessed you should contact your township assessors office.

The Property Tax Lookup is a convenient way to review your City of Toronto property tax account anytime anywhere from your computer or mobile device. Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business. To perform the oversight functions Property Taxes conducts periodic compliance audits surveys of the 58 county assessors programs and develops property tax assessment policies and.

Look Online Log on to the website of the local county recorders office in the county in which the property is located. You can also view Local Tax Billing Collection Offices information. Property Search Instructions Click Here Real Property Assessment Division - Property Data Search The Property Search tab on the menu bar provides access to individual property tax records of the City and County of Honolulu.

Checks should be made payable to the City and County of Honolulu. Our purpose is to supervise and control the valuation equalization assessment of property and collection of all Ad Valorem taxes. Once you receive your assessment notice visit taxlakecountyilgov for details on your home and check for accuracy.

Get a copy by phone Before you call. Full name and date of birth. Access to your local government 247.

Get help if you need it. An assessed return notice of assessment or reassessment other tax document or be signed in to My Account. MyCRA web app for your current notice and previous 3 years only By phone.

For more information about property tax or your property tax account please visit. You can also order by phone at 800-908-9946 and follow the prompts. This is a summary of your.

Welcome to the online Property Tax Lookup. Most likely payment of your real property tax is handled through your mortgage lender but you can view local property tax rates on SDATs Web site. Tax account transcript record of account wage and.

Property Tax sets the standards and procedures for equalization of property values in the counties and ensures property is taxed uniformly throughout the state. To verify your identify youll need. Assessment appeals filed in 2019 are applicable for tax bills paid in 2020.

Nassau County Tax Lien Sale Annual Tax Lien Sale Public Notice. Details provided include account balance current and previous billing amounts payment details due dates and more. DOR posts on website Statement of Assessment SOA approx DOR Deadline - Municipalities with population 2500 and counties e-filed Municipal Financial Report with DOR May 1 sec.

Data is updated on a weekly basis. How do I contact my municipality for a copy of my property tax bill. Department of Finance and Treasury Board 1-800-669-7070.

In-depth Pennsylvania Property Tax Information. Property owners who misplace or who do not receive their bills can download a printable version via the site which also provides detailed account information including payment history and a breakout of specific charges for property school light crossing guard taxes. You can obtain the real property assessment information on our website or a copy of the assessment may be acquired from our office with payment of search and copy fees and a self-addressed stamped envelope mailed to our Downtown or Kapolei offices.

Assessment Lookup How to Challenge Your Assessment Assessment Challenge Forms Instructions Assessment Review Calendar Rules of Procedure PDF Information for Property Owners. Then if necessary file an assessment appeal. 1 Administer tax law for 36 taxes and fees processing nearly 375 billion and more than 10 million tax filings annually.

3 Oversee property tax administration involving 109. Official site of the Property Tax Division of the Utah State Tax Commission with information about property taxes in Utah. Just click the Get Transcript by Mail button to have a paper copy sent to your address of record.

Or log in to Online Assessment Community. Form 4506-T can also be used to request other tax records. If this is the case your tax bill will list the breakdown of your tax.

2 Enforce child support law on behalf of about 1025000 children with 126 billion collected in FY 0607. Contact SDAT or visit one of their local assessment offices. Property Classification Property Tax.

The BOE acts in an oversight capacity to ensure compliance by county assessors with property tax laws regulations and assessment issues. See Property tax and assessment administration for important updates and access to New York State resources for assessors county real property tax directors and their staff. Contact your Municipality or the Department of Environment and Local Government.

In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property.

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

People Are Not Always Satisfied With Their Property Assessment Most Of The Time Property Assessed By Computerized Syst Tax Protest Property Tax Tax Reduction

People Are Not Always Satisfied With Their Property Assessment Most Of The Time Property Assessed By Computerized Syst Tax Protest Property Tax Tax Reduction

Understanding Your Property Tax Bill Department Of Taxes

Understanding Your Property Tax Bill Department Of Taxes

Can You Appeal A Property Tax Assessment What To Do When You Think Your Bill Is Too High Real Estate Fun Real Estate Trends Home Financing

Can You Appeal A Property Tax Assessment What To Do When You Think Your Bill Is Too High Real Estate Fun Real Estate Trends Home Financing

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

How To Calculate Real Estate Property Taxes Appeal Your Assessment Property Tax Estate Tax Real Estate

How To Calculate Real Estate Property Taxes Appeal Your Assessment Property Tax Estate Tax Real Estate

6 Tips To Reduce Property Tax How To Reduce Property Tax Steps To Reduce Property Tax Tips To Reduce Property Tax Property Tax Tax Reduction Tax Consulting

6 Tips To Reduce Property Tax How To Reduce Property Tax Steps To Reduce Property Tax Tips To Reduce Property Tax Property Tax Tax Reduction Tax Consulting

Image Result For Tax Reduction Letter Sample Letter Sample Lettering Tax Reduction

Image Result For Tax Reduction Letter Sample Letter Sample Lettering Tax Reduction

Appealing Property Taxes How To Challenge Your Tax Assessment Property Tax Assessment Real Estate Advice

Appealing Property Taxes How To Challenge Your Tax Assessment Property Tax Assessment Real Estate Advice

Does The Value Of My Home Determine My Property Taxes In The U S How The Value Is Assessed Varies Depending On Where In T In 2020 Property Tax My Property Estate Tax

Does The Value Of My Home Determine My Property Taxes In The U S How The Value Is Assessed Varies Depending On Where In T In 2020 Property Tax My Property Estate Tax

/GettyImages-1042505068-d5c7b095f4704a5286a5cabcc25f4495.jpg) Your Property Tax Assessment What Does It Mean

Your Property Tax Assessment What Does It Mean

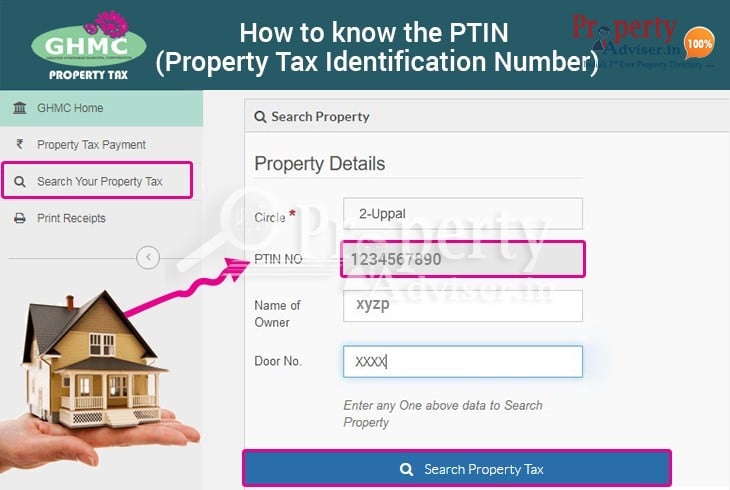

Now Get Your Ghmc Property Tax Search Details By Door Number In Hyderabad

Now Get Your Ghmc Property Tax Search Details By Door Number In Hyderabad

10 Ways To Lower Your Property Taxes Property Tax Tax Tax App

10 Ways To Lower Your Property Taxes Property Tax Tax Tax App

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

Understanding Your Property Tax Bill Department Of Taxes

Understanding Your Property Tax Bill Department Of Taxes

Understanding Property Tax In California Property Tax Tax Understanding

Understanding Property Tax In California Property Tax Tax Understanding

Appealing Property Taxes How To Challenge Your Tax Assessment Property Tax Real Estate Articles Real Estate Information

Appealing Property Taxes How To Challenge Your Tax Assessment Property Tax Real Estate Articles Real Estate Information

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home