Claim For Homeowners Property Tax Exemption Riverside County

The full exemption is available if the filing is made by 5 pm. REV09 8-06 There are a number of alternatives by which a Disabled Veterans Property Tax Exemption may be granted.

Personal Property Assessments Los Angeles County Office Of The Assessor

Personal Property Assessments Los Angeles County Office Of The Assessor

New property owners will automatically receive a Claim For Homeowners Property Tax Exemption.

Claim for homeowners property tax exemption riverside county. The claim form BOE-266 Claim for Homeowners Property Tax Exemption is available from the county assessor. Tax Savings for Seniors see below Veterans Exemptions. If a claim is filed between February 16 and 5 pm.

It allows the taxable value of the original home to be transferred to the replacement home preventing an increase in property tax due to the relocation. Disabled Veterans Exemption. A person filing for the first time on a property may file anytime after the property or claimant becomes eligible but no later than February 15 to receive the full exemption for that year.

For claims filed after that time 85 percent of the exemption is available. A Homeowners Exemption could save you at least 70 per year. This exemption will reduce your annual tax bill by at least 70.

The full exemption is available to the Low-Income Exemption claimant if the filing is made by 5 pm. On December 10 80 percent of the exemption is available. Parent to Child Exclusion see below Review When Values Decline.

In order to be eligible for this exemption properties must be a primary residence. Homeowners Exemption Form Download this form fill in online save and then print when needed. Call 213974-3211 or 18888072111 for forms and additional information.

For further information or claim forms please contact the Office of the Assessor at 951 955-6200 or 1 800 746-1544 within the 951 and 760 area codes. To be eligible the property sold must be within the State of California and the property purchased must be within Riverside County. Currently our office is waiting on additional information and direction from the State of California Board of Equalization office.

Since property tax is calculated as a percentage of the assessed home value lowering the taxable value of the home means youll be paying less in taxes each year. Your original property must eligible for the Homeowners Exemption or Disabled Veterans Exemption either at the time it was sold or within two years of the purchase or construction of the replacement property. REV11 5-12 California property tax laws provide two alternatives by which the Homeowners Exemption up to a maximum of 7000 of assessed value may be granted.

SEE INSTRUCTIONS BEFORE COMPLETING FOR ASSESSORS USE ONLY Received Approved Denied Reason for denial. REV09 8-06 2014 - BOE-261. REV12 5-14 2014 - BOE-266.

The original property must be subject to reappraisal at. Use these forms to claim or cancel a homeowners exemption if the real property is transferred or becomesceases to be the primary residence. Proposition 60 and 90 are property tax savings programs for homeowners age 55 or better who sold their home and bought another of equal or lesser value before April 1 2021.

SEE INSTRUCTIONS BEFORE COMPLETING NAME AND MAILING ADDRESS. If you are a California veteran who is rated 100 disabled blind or a paraplegic due to service-connected disability while in the armed forces or if you are the un-remarried surviving spouse of such a veteran or of one who died of service-connected causes while on active duty you may be eligible for an exemption of up to 150000 off the assessed value of your. If you build or acquire a home and there was no exemption on the annual tax roll you may apply for a Homeowners Exemption on the supplemental tax roll.

Homeowners Exemptions may also apply to a supplemental assessment if the prior owner did not claim the exemption. The exemption is available to an eligible owner of a dwelling which is occupied as the owners principal place of residence as of 12. CLAIM FOR HOMEOWNERS PROPERTY TAX EXEMPTION If eligible sign and file this form with the Assessor on or before February 15 or on or before the 30th day following the date of notice of supplemental assessment whichever comes first.

The Assessor-County Clerk-Recorders Office will mail a Claim for Homeowners Property Tax Exemption application as a courtesy whenever there is a purchase or transfer of residential property. On December 10 90 percent of the exemption is available. CLAIM FOR HOMEOWNERS PROPERTY TAX EXEMPTION If eligible sign and file this form with the Assessor on or before February 15 or ono r before the 30th day following the date of notice of supplemental assessment whichever comes first.

Late filed exemptions will receive the full exemption. If you own and occupy your principal place of residence on January 1 you may apply for a Homeowners Exemption that will exempt 7000 of your homes assessed value from taxation. Riverside Countys Homeowners Exemption reduces the taxable value of a qualifying home by 7000.

REV09 8-06 2015 - BOE-261. Homeowners Exemption Form pdf If you own a home and occupy it as your principal place of residence on January 1 you may apply for a Homeowners Exemption. Further instructions are included with the claim form.

Homeowners Exemption claimants are responsible for notifying the assessor when they are no. The exemption is available to an eligible owner or the veteran spouse of an owner of a dwelling that is occupied as the principal place of residence for. On February 15 of each yearIf a claim for the Low-Income exemption is filed after that time but by 5 pm.

Https Www State Nj Us Treasury Taxation Pdf Homestead Hownerappins Pdf

Https Www Waterboards Ca Gov Sandiego Water Issues Programs Stormwater Docs 2015 0914 Rc Copermittees Pdf

Types Of Property Tax Exemptions Millionacres

Types Of Property Tax Exemptions Millionacres

Https Assessor Lacounty Gov Wp Content Uploads 2021 01 Assr Prop60and90 20210120 Interactive Pdf

Persons With Disabilities Exemption Cook County Assessor S Office

Persons With Disabilities Exemption Cook County Assessor S Office

Homestead Exemption California The Ultimate Guide Talkov Law

Homestead Exemption California The Ultimate Guide Talkov Law

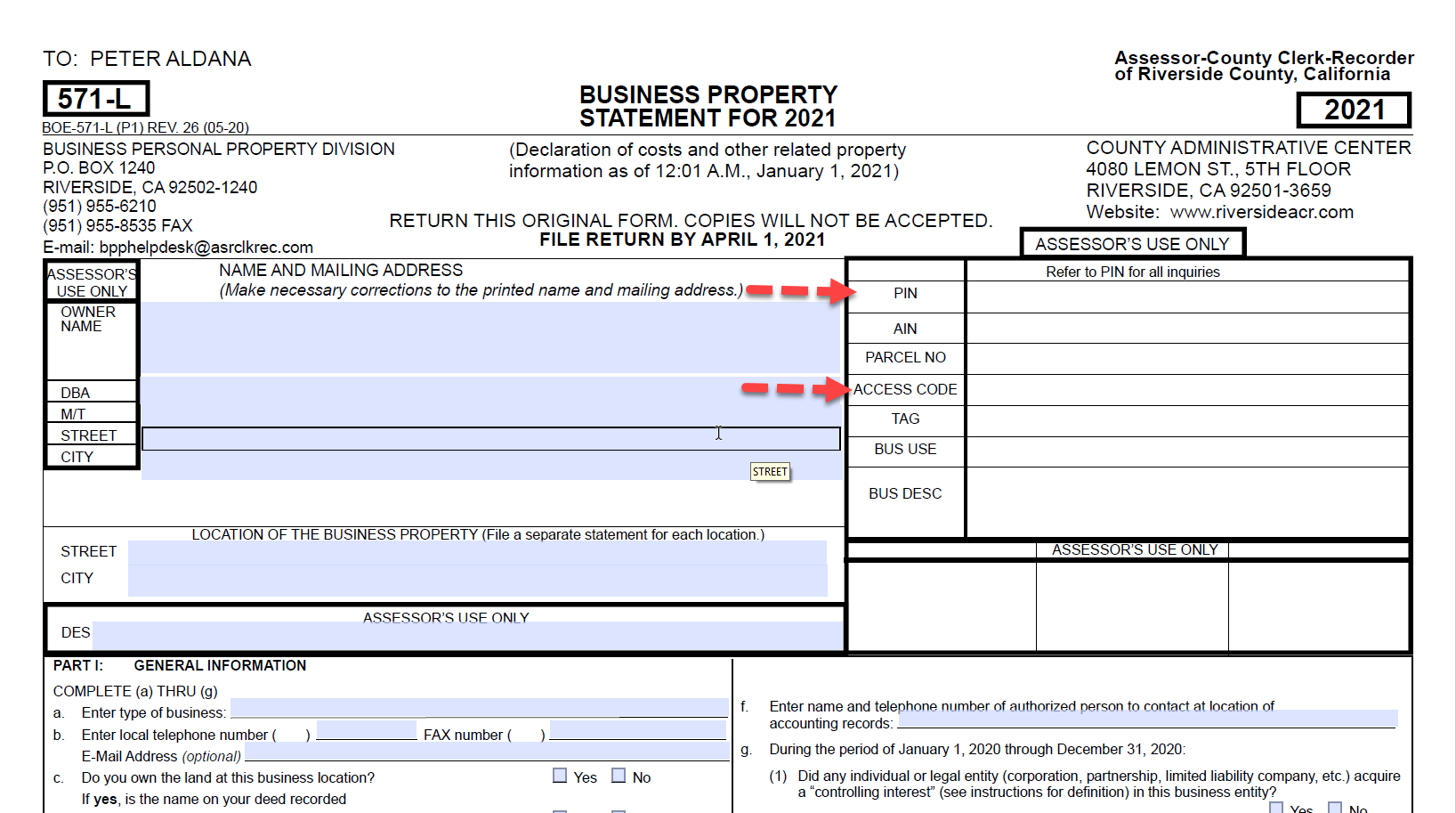

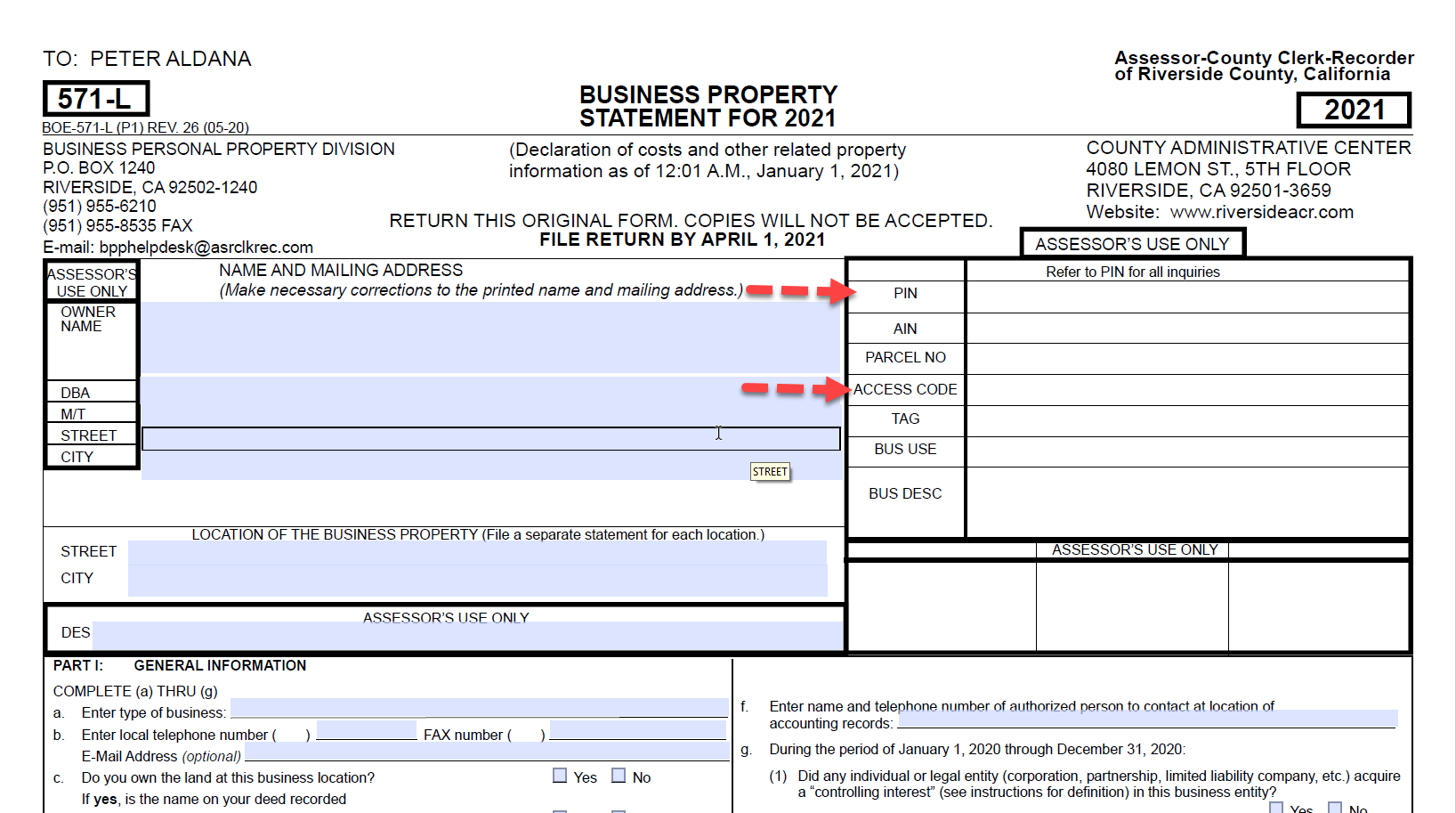

Riverside County Assessor County Clerk Recorder Business Personal Property

Riverside County Assessor County Clerk Recorder Business Personal Property

Editor A Famous Person From The 1960s Words Speak To The Turmoil Today In America I Won T Reveal Hi In 2021 El Dorado County Catastrophic Events Homeowners Insurance

Editor A Famous Person From The 1960s Words Speak To The Turmoil Today In America I Won T Reveal Hi In 2021 El Dorado County Catastrophic Events Homeowners Insurance

How To Find California Property Owners Information We Lease San Diego

How To Find California Property Owners Information We Lease San Diego

Slo County Homeowners Property Tax Exemption Deadline Approaches Atascadero News

Slo County Homeowners Property Tax Exemption Deadline Approaches Atascadero News

Can You Get Your Property Tax Bill Lowered The Motley Fool

Can You Get Your Property Tax Bill Lowered The Motley Fool

Riverside County Assessor County Clerk Recorder Proposition 13

Riverside County Assessor County Clerk Recorder Proposition 13

What Is A Homestead Exemption California Property Taxes

What Is A Homestead Exemption California Property Taxes

What Does Homeowner Exemption Mean

What Does Homeowner Exemption Mean

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Https Www Capropeforms Org Counties Riverside

Get Tax Relief From The Cook County Homeowner Exemption

Get Tax Relief From The Cook County Homeowner Exemption

New California Homestead Exemption 2021 Oaktree Law

New California Homestead Exemption 2021 Oaktree Law

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home