Home Office Tax Deduction 2020 Covid

Will I be able to claim home office expenses on my 2020 federal tax return. Ortiz Soto noted that the standard deduction for 2020 is 12400 for singles and 24800 for married couples filing jointly.

Home Office Tax Deduction Block Advisors

Home Office Tax Deduction Block Advisors

As America tries to contain the spread of COVID-19 businesses have made tough decisions to stay afloat and maintain a healthy work environment for employees.

Home office tax deduction 2020 covid. President Trumps tax overhaul from 2018 eliminated the itemized deduction for. I am currently working from home as a result of COVID-19 as directed by my employer. April 10 2020.

The benefit may allow taxpayers working from home to deduct certain expenses on their tax return. In light of the coronavirus pandemic the IRS will most likely have a. STATEN ISLAND NY.

As a result of the unprecedented challenges due to COVID-19 many people have been working at home and using their kitchens bedrooms and living rooms as their work space. The standard deduction today went up a lot so for you to itemize. The home office deduction was misused in the past which made it an audit red flag.

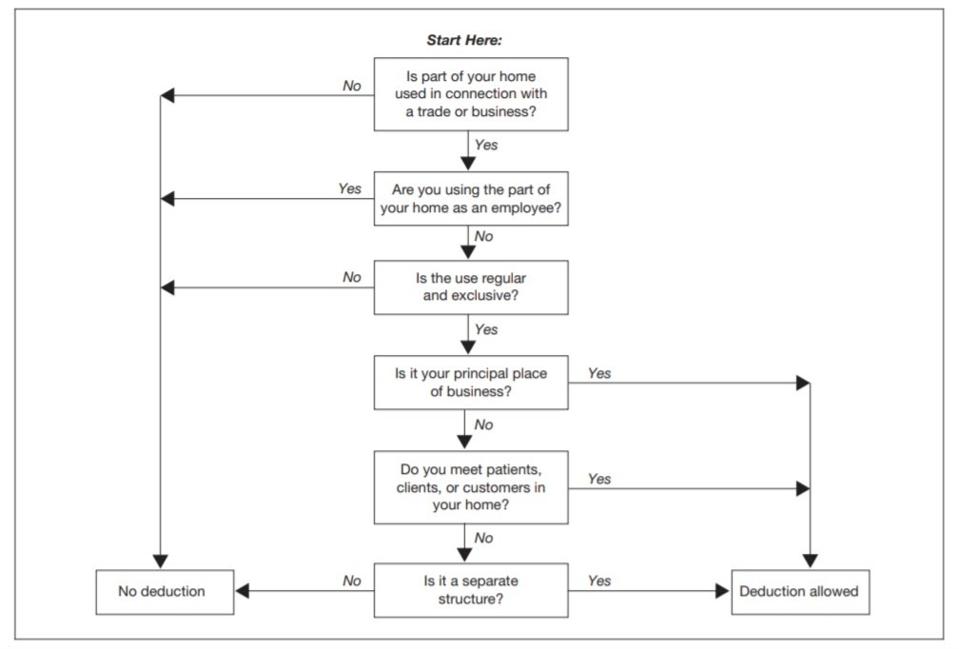

If you work full-time for someone else youre out of luck. With the traditional home office deduction you calculate your homes percentage devoted to your business. The COVID-19 pandemic has forced many employees to transition into working from home.

Now millions of Americans find themselves working from home and theyre the lucky ones. For office spaces 300 feet or less you can deduct 5 per square foot up to a 1500 deduction. Unfortunately the home office deduction is not available to anyone whos a W-2 employee.

The short answer is probably not. But unless you meet a specific set of rules you wont be able to claim the home office deduction on your 2020 taxes. New Yorkers forced to work from home due to coronavirus COVID-19 pandemic wont get any federal tax breaks for their business expenses but they just might be.

You must meet the eligibility criteria - Temporary flat rate method to claim your home office expenses. I Received COVID Relief Small Business Loan or Stimulus Checks. Naturally you may have wondered whether the expenses you incurred during 2020 as part of your employment duties at home would be eligible for tax deductions.

Total number of hours worked from home from 1 July 2020 to 30 June 2021 80 cents for the 202021 income year. I am a paid executive director of a non-profit where I have a exclusive home office where I work. This amount will be your claim for 2020 up to a maximum of 400 per individual.

For 2020 I am listing my home as the address for the non-profit income tax filing What deductions can I take on my 2020 personal incomes taxes for exclusive use of home office for running a. Fill in the form. March 9 2021 1137 AM 8 min read The number of people who work from home exploded in 2020 because of the COVID-19 pandemic.

If you use the shortcut method to claim a deduction include the amount at the other work-related expenses question in your tax return and include COVID-hourly rate as the description. Qualifying for a home office tax deduction during the coronavirus crisis. Home-office deductions for the 2020 tax year The who what and how of claiming expenses amid pandemic-related changes.

IR-2020-220 September 23 2020. WASHINGTON During Small Business Week September 22-24 the Internal Revenue Service wants individuals to consider taking the home office deduction if they qualify. If so you may be wondering if youre allowed to take the home office tax deduction for those expenses on your 2020 federal tax return.

Some people will be able to take a tax deduction for. Count the total number of days you worked from home in 2020 due to the COVID-19 pandemic and multiply that by 2 per day. Your home may very well double as your office these days.

Is That Taxable Income. Fortunately your COVID-19 stimulus checks PPP Loans. Thanks to the Tax Cuts and Jobs Act TCJA which went into effect in 2018 the home office deduction was suspended for employees until 2025.

In response the Canada Revenue Agency CRA has introduced a new temporary flat rate method to simplify claiming the deduction for home office expenses for the 2020 tax year. The home office deduction is available to qualifying self-employed taxpayers independent. As an employee you may be able to claim.

How People Working From Home Can Claim A Home Office Tax Deduction

How People Working From Home Can Claim A Home Office Tax Deduction

What Is Irs Form 8829 Expenses For Business Use Of Your Home Turbotax Tax Tips Videos

What Is Irs Form 8829 Expenses For Business Use Of Your Home Turbotax Tax Tips Videos

Working From Home Your Home Offices Expenses Are Probably Not Tax Deductible

Working From Home Your Home Offices Expenses Are Probably Not Tax Deductible

Home Office Tax Deduction Block Advisors

Home Office Tax Deduction Block Advisors

Working From Home Your Home Offices Expenses Are Probably Not Tax Deductible Remote Work Home Office Expenses Working From Home

Working From Home Your Home Offices Expenses Are Probably Not Tax Deductible Remote Work Home Office Expenses Working From Home

Home Office Deduction Pointers For Federal Taxes Credit Karma

Home Office Deduction Pointers For Federal Taxes Credit Karma

Setting Up A Home Office Turbotax Tax Tips Videos

Setting Up A Home Office Turbotax Tax Tips Videos

How People Working From Home Can Claim A Home Office Tax Deduction

How People Working From Home Can Claim A Home Office Tax Deduction

Home Office Deductions In The Covid 19 Era Mlr

Home Office Deductions In The Covid 19 Era Mlr

Understanding The Mortgage Interest Deduction The Official Blog Of Taxslayer

Understanding The Mortgage Interest Deduction The Official Blog Of Taxslayer

Home Office Deductions And The Ppp Bench Accounting

Home Office Deductions And The Ppp Bench Accounting

How Working From Home In Pandemic Impacts Taxes What You Can Deduct

How Working From Home In Pandemic Impacts Taxes What You Can Deduct

How Does Working From Home Change Tax Deductions In 2020

How Does Working From Home Change Tax Deductions In 2020

Quiz Do I Qualify For The Home Office Deduction

Quiz Do I Qualify For The Home Office Deduction

.png) Quiz Do I Qualify For The Home Office Deduction

Quiz Do I Qualify For The Home Office Deduction

The Hmrc Home Office Tax Deduction Rules Mileiq Uk

The Hmrc Home Office Tax Deduction Rules Mileiq Uk

Pin On Financial Career Guidance For Women

Pin On Financial Career Guidance For Women

Working From Home Your Home Offices Expenses Are Probably Not Tax Deductible

Working From Home Your Home Offices Expenses Are Probably Not Tax Deductible

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home