Can A Lodger Be Evicted During Covid 19

Evictions are on hold until 90 days after the end of the COVID-19. Your landlord can now have the Sheriff enforce eviction orders.

Lodger Agreement Form Page 1 Line 17qq Com

Lodger Agreement Form Page 1 Line 17qq Com

Sheriff services have resumed.

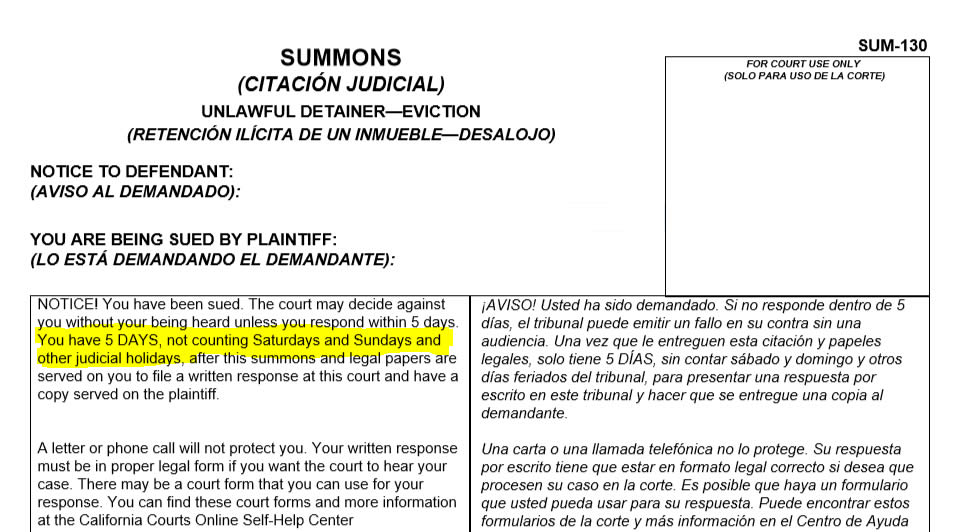

Can a lodger be evicted during covid 19. The deeds office is open and consultations related to evictions will take place. On January 13 2021 the government made an order stopping the Sheriff s office from evicting most tenants during the second covid-19 state of emergency. When lodgers can be evicted.

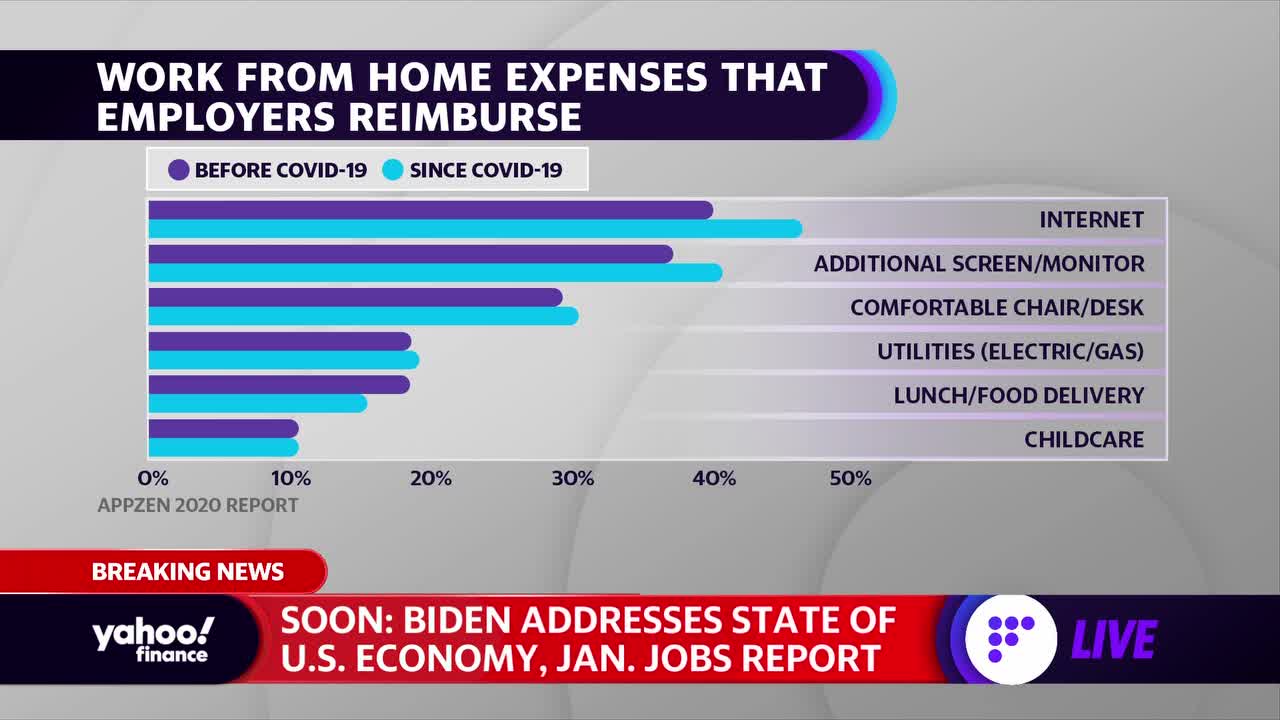

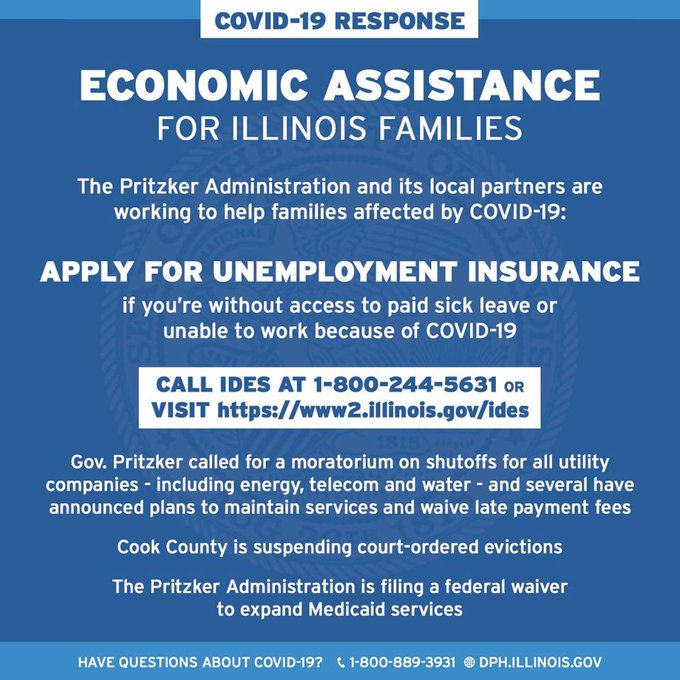

With the overwhelming loss of jobs during the COVID-19 pandemic nearly everyone will feel some financial hardship during the crisis. The bans on eviction enforcement in England Scotland and Wales have been extended. However landlords are not required to stop charging rent during the COVID-19 pandemic.

The Biden administration is extending a federal moratorium on evictions of tenants whove fallen behind on rent during the coronavirus. 31 only protects renters against evictions if they cant pay rent because of impacts of COVID-19 but landlords still reserve the right to evict tenants because of criminal activity damaging property violating codes and other causes. There is no one-size fits all approach as each tenants circumstance is different and some will be worse.

They were facing eviction. The rules for lodgers havent changed. After giving you notice if you have a rolling agreement.

Can the shift cause a tenant to be evicted. More than 73000 people filed for. It doesnt matter if the eviction order was made before or after the January 2021.

This eviction freeze has now ended. Eviction bans extended in. The answer is yes but only under extreme circumstances.

Tenants laid off because of the COVID-19 pandemic could be eligible to stay in their rental properties because of a Centers for Disease Control and Prevention moratorium on evictions. If tenant does not pay under both time periods you must serve 2 separate notices. Tenant can still be evicted based on a breach of lease agreement and other violations just cant be evicted due to non-payment.

All three countries have moved to extend their bans on bailiffs taking possession of rented properties which were set to expire on 31 March. The CDCs moratorium that runs through Dec. Here we explain the eviction rules in place around the UK and offer advice on landlord and tenant rights during COVID-19.

Without notice if youre at the end of a fixed term agreement. Your landlord can peaceably evict you. Under a Centers for Disease Control and Prevention CDC order beginning on 040121 and extended through 063021 landlords are prohibited from taking any action to evict a residential tenant for nonpayment of rent if the tenant qualifies to provide a Declaration similar to the.

CHARLOTTE NC WBTV - Some families have been struggling to keep a roof over their heads during the COVID-19 crisis. The ban expires on July 25 and it only covers renters living in. Ban on renter evictions during COVID-19 pandemic is extended.

Check the COVID-19 statewide information portal frequently for updates. COVID-19 Processing Eviction Matters. UPDATED - Information for Tenants Who Qualify for Eviction Delay.

Under AB 3088 landlords may begin filing certain eviction actions for failure to pay rent or other charges as of October 5 2020 but cannot evict tenants for failure to pay rent who have delivered to their landlord a declaration of COVID-19-related financial distress within 15-days after being served with a notice to quit by the landlord. It is illegal for a landlord to lock you out without an eviction order from a court. If youre still in a fixed term agreement then your landlord can only give you notice to leave if the contract says they can.

Eviction during the coronavirus outbreak. Congress included a federal eviction moratorium in the coronavirus relief bill known as the CARES Act passed in late March. Right after the Kentucky Supreme Court suspended all court proceedings for non-emergency cases.

However an application for an eviction order may be brought before the courts which are now able to hear cases and grant eviction orders. Local agencies like Crisis Assistance Ministry Mecklenburg County The United Way and Foundation for the Carolinas stepped in and provided about 200000 to keep them in place for a week. During this emergency you cannot be evicted from your home for not having paid rent.

Failure to comply with 117903 is grounds for eviction. Following the recommendation of her daughter Wright filled out a declaration of lost income due to COVID-19 and her landlord eased off She is. No one can be evicted from their home under level 4.

Read more »