Are Home Office Expenses Deductible In 2020 Due To Covid

WASHINGTON During Small Business Week September 22-24 the Internal Revenue Service wants individuals to consider taking the home office deduction if they qualify. If you worked more than 50 of the time from home for a period of at least four consecutive weeks in 2020 due to the COVID-19 pandemic you can claim 2 for each day you worked from home during that period.

Coronavirus And Home Office Deductions H R Block

Coronavirus And Home Office Deductions H R Block

The short answer is probably not.

Are home office expenses deductible in 2020 due to covid. In response the Canada Revenue Agency CRA has introduced new guidance around claiming home office deductions. I am currently working from home as a result of COVID-19 as directed by my employer. New Yorkers forced to work from home due to coronavirus COVID-19 pandemic wont get any federal tax breaks for their business expenses but they just might be eligible for deductions on.

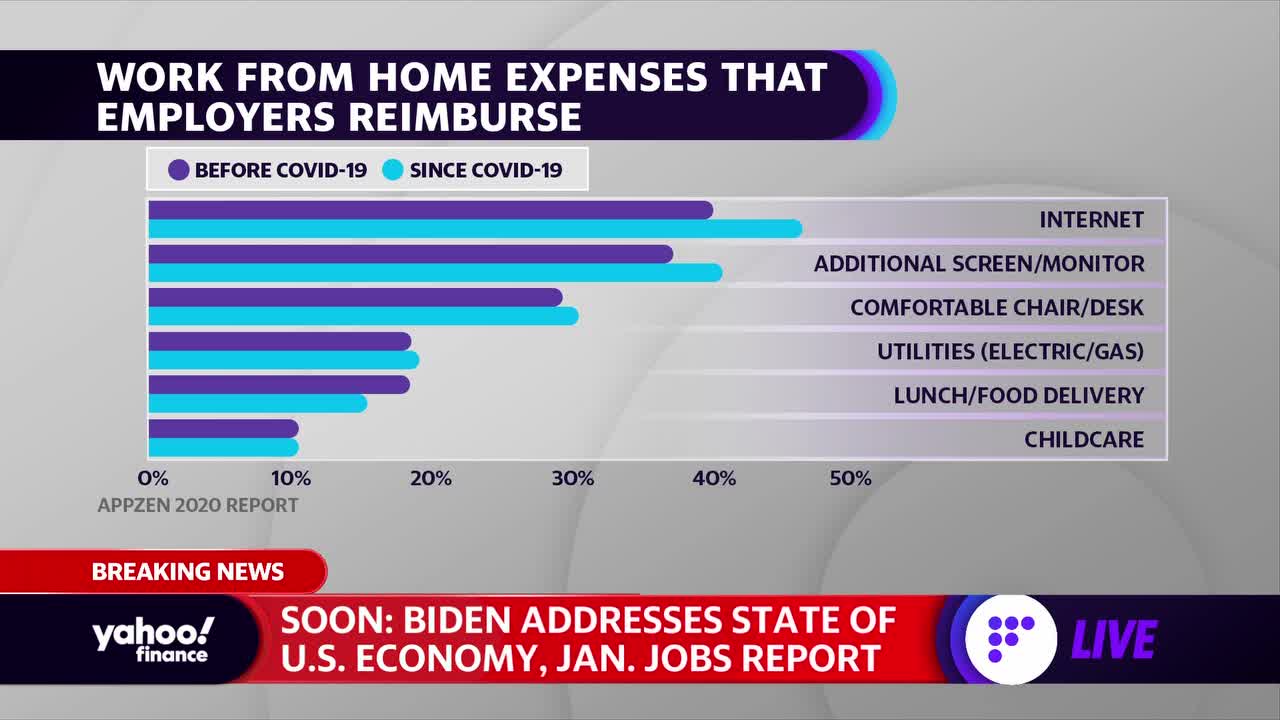

It all depends on your individual situation. The 2020 CARES Act for COVID-19 relief provided another above-the-line deduction. The COVID-19 pandemic has forced many employees to transition into working from home.

A local tax expert says maybe. Tax advisor Neville Ortiz. If your office is used exclusively for work and doesnt have a dual purpose its deductible.

If you work full-time for someone else youre out of luck. The home office deduction is available to qualifying self-employed taxpayers independent. The home office deduction was misused in the past which made it an audit red flag.

You can claim home office deductions on your 2020 tax returns if you are self-employed or an independent contractor and you meet IRS requirements such as. If so you may be wondering if youre allowed to take the home office tax deduction for those expenses on your 2020 federal tax return. In light of the coronavirus pandemic the IRS will most likely have a difficult time making the.

Will I be able to claim home office expenses on my 2020 federal tax return. Naturally you may have wondered whether the expenses you incurred during 2020 as part of your employment duties at home would be eligible for tax deductions. Despite the significant number of Americans working from home in 2020 neither Congress nor the IRS has made it any easier to get a tax benefit for a home office.

Tax season will begin on Friday Feb. IR-2020-220 September 23 2020. Thanks to the Tax Cuts and Jobs Act TCJA which went into effect in 2018 the home office deduction was suspended for employees until 2025.

This method simplifies your claim for home office expenses work-space-in-the-home expenses and office supply and phone expenses. The benefit may allow taxpayers working from home to deduct certain expenses on their tax return. You are only claiming home office expenses and are not claiming any other employment expenses on.

You worked more than 50 of the time from home for a period of at least four consecutive weeks in 2020. Certain home office expenses are generally deductible by employees or self-employed individuals who perform employment or self-employment services at home. You worked from home in 2020 due to the Covid-19 pandemic.

Many of these deductions can be taken on your state income tax return -- perhaps even your home office. But unless you meet a specific set of rules you wont be able to claim the home office deduction on your 2020 taxes. Amidst COVID-19 challenges and restrictions many Canadians were encouraged or required to work from home in 2020.

But does that mean you can write off your home office expenses for the 2020 tax year. Here we breakdown what you need to know about eligible deductions and answer some commonly asked questions. Home-office deductions for the 2020 tax year The who what and how of claiming expenses amid pandemic-related changes.

After a pandemic year some taxpayers are hoping for deductions credits and COVID-19 relief on their 2020 contributions. That means that even if you dont itemize you can deduct up to 300 for donations to 501 c 3 public charities and the cap applies to both individuals and those married and filing jointly. As the COVID-19 pandemic shifts employees from their offices to their homes many employees are left wondering whether theyll now be able to deduct home office expenses from their employment income in their 2020 tax return.

Read more »Labels: covid, deductible