What Is Property Tax On Vacant Land

How can I include all costs of 30 year vacant land ownership to IRS when reporting the sale. Depending on the location and zoning of your land the taxes might be a few hundred dollars or a few thousand dollars.

Texas Land For Sale Real Estate Investment Property In Tx High Value Wholesale Texas Land For Sale Texas Land Rural Land

Texas Land For Sale Real Estate Investment Property In Tx High Value Wholesale Texas Land For Sale Texas Land Rural Land

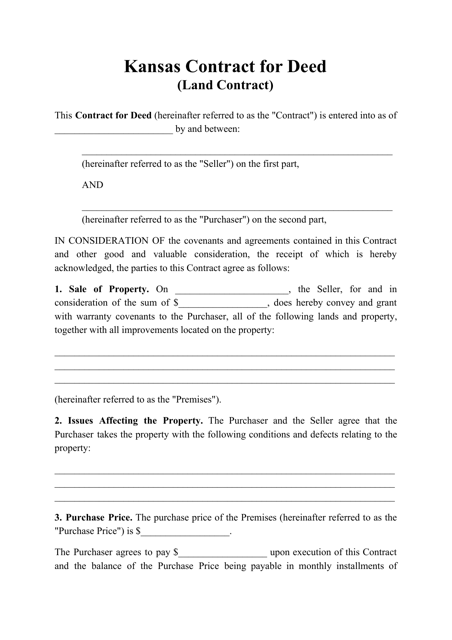

Total Tax Rate for the property is 167100 0167 167 per 100 of appraised value Without an Ag-use or open space use this land would normally be taxed at 167 x 150000 the appraised value in this example resulting in a property tax bill of 2505.

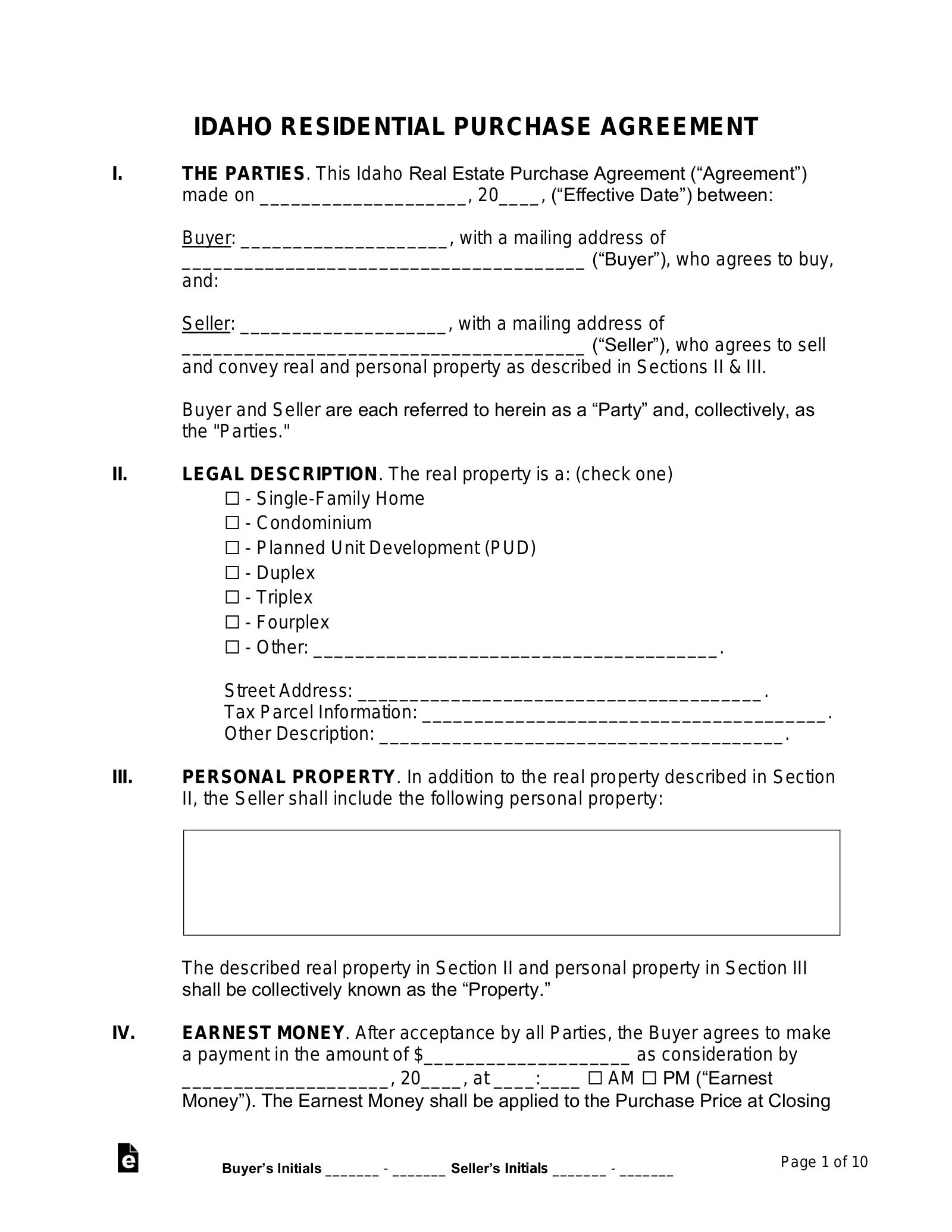

What is property tax on vacant land. Nor is it subject to the 10000 annual limit on deducting property tax paid on a main or second home. The Property Class Codes above do not describe the type of ownership of parcels or whether land has water frontage. In order to file the sale of vacant land with the IRS you must use Form 8949 Sales and Other Dispositions of Capital Assets to determine the amount of loss or gain you incurred from the sale.

Agricultural vacant land productive. Paid in schoolcounty taxes and also inflation. For the March 1 2010 assessment date for taxes payable in 2011 the cap credit under Ind.

A property is considered vacant if it is in use less than fifty 50 days in a calendar year and not subject to any of ten 10 exemptions. Land tax is very nominal and being collected as per Govt norms. 2020 Special Tax Rate.

The amount of tax a landowner pays depends on the propertys assessment. Different property types have various types of tax assessed on the land and its structures. While the method of assessment differs between vacant and built-out land the process determines the lots reasonable market value having regard to local conditions.

Property taxes are calculated on vacant land the amount of property taxes that you owe on vacant land are calculated from your county tax assessor and are generally based on thehighest and best use potential of the plotie. The costs in 30 years includes the selling price 2000000 loan interest nearly 30000. If you own any vacant land for investment you might want to make an election under Code Section 266 to capitalize expenses generated from the investment property instead of deducting them.

The VPT Act establishes an annual tax of 3000 to 6000 on vacant property. Village Administrative Officer - they sit in taluk office or separate office may be there. The real estate taxes paid on vacant land before the passing of the Tax Cuts and Jobs Act were an itemized deduction on Schedule A.

Vacant lot subjected to 3 Indiana property tax cap as nonresidential real property. With the new tax law changes it may be more beneficial for you to make the election. Another potential annual fee is the property owners.

If you hold onto your vacant land and dont do anything with it you might end up paying double or triple what you did for the land in annual taxes and have nothing to show for it but the same piece of vacant land. Waterfront - ownership codes. Indiana applies caps to taxpayers property tax liabilities depending on the type of property.

Therefore it would appear at first that with the new rules. Read on to learn more about how you can take advantage of the election and how it will affect your. Transition assessments for exempt state-owned land Real Property Tax Law Section 545 Top of page.

So the problem with vacant land is not as easy as A-B-C or even Do Re Mi. The old adage that the two things that are inescapable are death and taxes holds true for vacant land investments. The caps are really credits against taxes imposed above the designated percentage.

Enquire in taluk office. Blindly assuming that interest and taxes may be added to ACB could become a costly trap in the end This entry was posted in Canadian Income Tax and tagged Canada Canadian Income Tax Canadian Tax Consultant CRA David Wilkenfeld interest Law Montreal. I am paying Rs100- year for a vacant land measuring 1600 Sft at Poonamallee.

The special tax rates are shown below. While you are not collecting rent and may not even have any near-term plans to. In addition to the assessed value of your property your bill is based on what your property is used for residential agricultural apartment office commercial vacant land and so on.

An investor can also deduct property taxes paid on vacant land as a personal itemized deduction on Schedule A. One example is vacant land held for investment. Assessing Property Tax.

This deduction is not limited to the amount of net investment income. Individuals who own vacant land generally do not receive any income from the land and also are not entitled to any business deductions related to it. An investor can also deduct property taxes paid on a vacant land as a personal itemized deduction on Schedule A.

This deduction is not limited to the amount of net investment income. Its most rewarding use. You can use the property tax assessors values to compute a ratio of the value of the land to the building While the IRS doesnt explicitly state that the tax assessors opinion of land value is the only option that can be used based on this statement the IRS seems to prefer this approach.

Nevertheless you can anticipate the amount youll spend for vacant land is a lot less. For example vacant land will have a significantly lower assessed value than a. Thanks for your quick reply.

May 1 2019.

Read more »

/ScreenShot2021-02-06at4.24.16PM-695c2638669a4d1d81d1bfcd47a2d04b.png)