What Documents Needed For Homestead Exemption In Georgia

Valid Georgia Drivers License with current residence address Proof of Motor Vehicle registration in Columbia County registration card Proof of age Drivers License State ID andor Birth. The State of Georgia offers homestead exemptions to persons that own and occupy their home as a primary residence.

Homestead Exemption Welcome To Rockdale County Georgia

Homestead Exemption Welcome To Rockdale County Georgia

Any questions pertaining to tax exemptions at the local level should be asked to and answered by your County Tax Commissioner.

What documents needed for homestead exemption in georgia. People owning and occupying property as a permanent residence as of January 1 may apply for a homestead exemption. Own and reside in the property as your primary residence prior to January 1 of the tax year. To receive the benefit of the homestead exemption the taxpayer must file an initial application.

If you make application for any homestead with income requirements you will be required to submit a copy of your current years Federal Income tax return a copy of your social security benefit statement a copy of any 1099 retirement statements IRA and interest statements. Valid Georgia Drivers License or Georgia Identification. This exemption applies to all ad valorem tax levies.

Also if the property is located within city limits the homeowner may be required to file with the city as well. Time for filing application for homestead exemption may not be extended. View the 2020 Homestead Exemption Guide Once granted exemptions are automatically renewed each year as long as the homeowner continually occupies the property under the same ownership.

In Paulding County the applications are accepted year-round and must be filed by April. You must still own and occupy the property as of January 1 to be. You will not be permitted to use homestead exemption on properties that are rented vacant or deemed commercial.

For further inquiries please contact the office at 912-652-7271. Valid Georgia Drivers License or State Issued ID. DOCUMENTS AND OTHER INFORMATION NEEDED IN FILING.

The application is filed with the Tax Assessor. The Disabled Veterans Homestead Exemption is available to certain disabled veterans in an amount up to 60000 deducted on the State portion and 85645 from the 40 assessed value of the homestead property. Automatic renewal of homestead exemptions applies only to the home originally exempted.

To receive the benefit of the homestead exemption the taxpayer must file an application. Must have homestead exemption. Most counties in Georgia still require you to deliver the homestead exemption form directly to the tax commissioners office.

However it is restricted to certain types of serious disabilities requiring proof of disability from the Veterans Administration or from a private. When applying for homestead exemption please note that you may need to provide a copy of your Warranty Deed book and page proof of residence social security numbers drivers license andor car tag info. Homestead exemption will remain on the property until there is a change in ownership.

Depending upon which application is completed one or more of the following items shall be required. Homestead exemptions may be filed for any time during the year. However exemptions must be filed for by April 1 to apply to the current year.

This exemption also applies to mobile home owners where the real estate is also owned by the taxpayer. Athens-Clarke County offers homestead exemptions that are more beneficial to the taxpayer than the exemptions offered by the state. Current Voter Registration card reflecting the current home address.

Homeowners may qualify for different homestead exemptions from the various taxing jurisdictions including school system cities and Fulton County. The local homestead increases the state exemption. Must have letter certified by a medical doctor as being 100 disabled on or before January 1st of the effective tax year.

The Warranty Deed or a copy of the closing statement may be required along with photo. The administration of tax exemptions is as interpreted by the tax commissioners of Georgias 159 counties. If qualified you will be exempt from school taxes only up to 416400 fair market value or 166560 of assessed value Disabled Veterans Exemption ES5.

Disabled Veteran Homestead Tax Exemption Disabled Veteran Homestead Tax Exemption. For non Georgia resident military personnel only Completed Trust Affidavit If property is held in a trust Visa or Permanent Residence Card Homestead Exemption removal letter If a previous resident in another countystate had a Homestead Exemption Final Divorce Decree or spouses death certificate. Upon filing submit a copy of your Georgia drivers license or Georgia ID with the property address you are applying for the exemption on.

All vehicles titled under the applicants name must be registered in Clayton County and current vehicle registration must be submitted. Once your application is approved the homestead exemption is renewed automatically each year provided that you continually reside at the home. To be eligible for Homestead Exemption applicant must.

You must bring the following with you when you file.

Https Fultoncountyga Gov Media Departments Board Of Assessors 2020 Fulton County Homestead Exemption Guide Ashx

Https Www Csdecatur Net Cms Lib Ga02000365 Centricity Domain 562 Senior 20exemption 20committee 20faq Pdf

Are We Headed For A Real Estate Crash In 2017 Those Aren T Mountains In These Charts Below But They Could Depict An Upcom Housing Market Bubbles Bubble Chart

Are We Headed For A Real Estate Crash In 2017 Those Aren T Mountains In These Charts Below But They Could Depict An Upcom Housing Market Bubbles Bubble Chart

Illinois Quit Claim Deed Form Quites Illinois The Deed

Illinois Quit Claim Deed Form Quites Illinois The Deed

Https Www Lincolninst Edu Sites Default Files Gwipp Upload Sources Georgia 2017 Ga Property Tax Exemptions 20 20dor 2017 Pdf

Tax Exempt Status Irs Taxes Irs Website Tax

Tax Exempt Status Irs Taxes Irs Website Tax

Residence Homestead Exemption Information Williamson Cad

Delaware Small Estate Affidavit Form Estates Delaware Small

Delaware Small Estate Affidavit Form Estates Delaware Small

Homestead Exemption 2020 Information South Fulton Ga

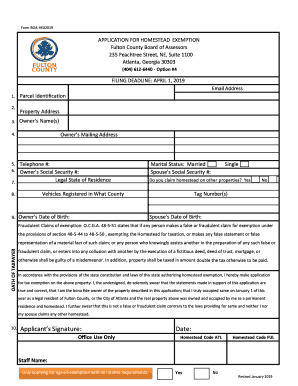

Ga Application For Cobb County Homestead Exemptions 2020 2021 Fill Out Tax Template Online Us Legal Forms

Ga Application For Cobb County Homestead Exemptions 2020 2021 Fill Out Tax Template Online Us Legal Forms

What Is A Homestead Exemption And How Does It Work Lendingtree

What Is A Homestead Exemption And How Does It Work Lendingtree

How To Apply For Homestead Exemption In Georgia Growatlantahomes Com

How To Apply For Homestead Exemption In Georgia Growatlantahomes Com

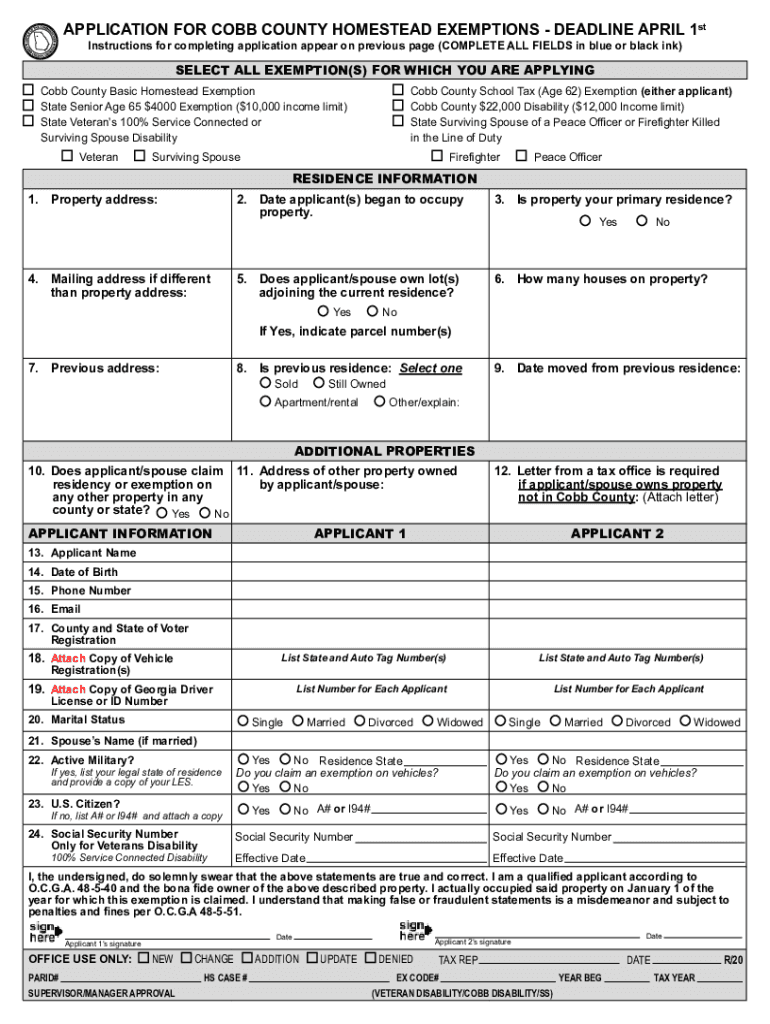

Ga Form Homestead Exemption Fill Out And Sign Printable Pdf Template Signnow

Ga Form Homestead Exemption Fill Out And Sign Printable Pdf Template Signnow

Homestead Exemption What You Need To Know To Save Big Money The Marshall Berch Group

How To Get Your Farm Tax Exempt Number Sapling Farm Haybale Gardening Hobby Farms

How To Get Your Farm Tax Exempt Number Sapling Farm Haybale Gardening Hobby Farms

The Mortgage Dean Documentation Checklist What You Need To Know Homebridge Financial Services Inc De Mortgage Loan Originator Mortgage Loans Mortgage Tips

The Mortgage Dean Documentation Checklist What You Need To Know Homebridge Financial Services Inc De Mortgage Loan Originator Mortgage Loans Mortgage Tips

The Mortgage Dean Documentation Checklist What You Need To Know Homebridge Financial Services Inc De Mortgage Loan Originator Mortgage Loans Mortgage Tips

The Mortgage Dean Documentation Checklist What You Need To Know Homebridge Financial Services Inc De Mortgage Loan Originator Mortgage Loans Mortgage Tips

Us Median Home Price Outlook Upward Housing Market House Prices Real Estate

Us Median Home Price Outlook Upward Housing Market House Prices Real Estate

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home