Franklin County Missouri Property Tax Lookup

63084 p 636-583-6348 fax 636-583-6383. Go to Data Online.

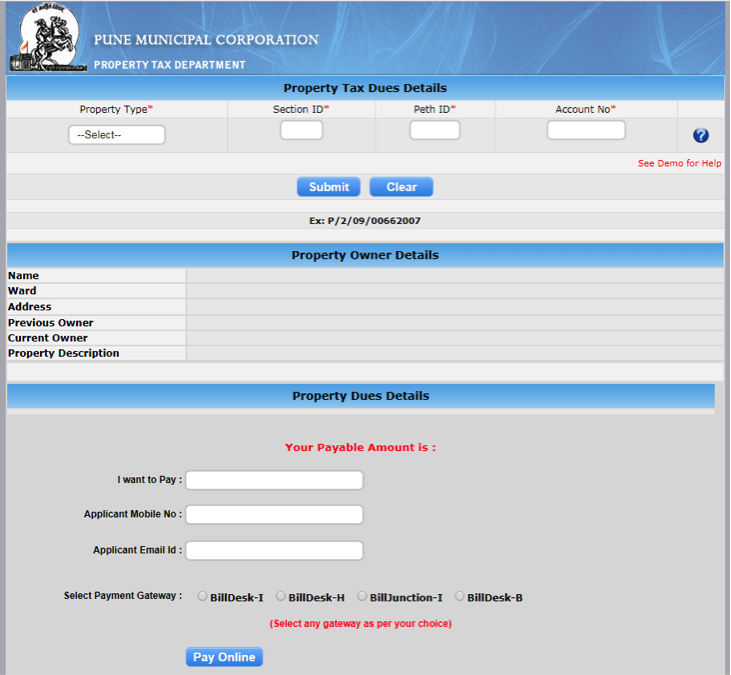

Quickly search submit and confirm payment through the Pay Now button.

Franklin county missouri property tax lookup. Go to Data Online. Franklin Recorder 636 583 - 6367. Franklin County Property Tax Exemptions httpsdormogovpersonalptc View Franklin County Missouri property tax exemption information including homestead exemptions low income assistance senior and veteran exemptions.

Find Franklin County residential property records including owner names property tax assessments payments rates bills sales transfer history deeds mortgages parcel land zoning structural descriptions valuations more. Franklin County GIS Maps http96472011348040Public Find Franklin County GIS maps tax maps and parcel viewers to search for and identify land and property records. GISintegrates hardware software and data and is used to capture store analyze and display information or data identified by location.

Heshe is not assessed until January 1 2022 and does not pay taxes on property. The Franklin County Collector of Revenue is responsible for the collection and distribution of current and delinquent taxes for the county and 64 other taxing entities within Franklin County. Real Estate Tax Information Real Estate Tax Inquiry.

123 Main Parcel ID Ex. Pay your bills anytime anywhereon-the-go or via computer. Therefore you will need to contact your local county collector andor assessor regarding changes of address payment and billing tax receipts and all other questions regarding your account.

Search for a Property Search by. Taxpayers must submit a list of personal property to the Assessor before March 1 of each calendar year. In no event will the assessor be liable to anyone for damages arising from the use of the property data.

Property is assessed as of January 1. Pay your real estate taxes online by clicking on the link below. Historic Aerials 480 967 - 6752.

GIS can relate unrelated information by using location and is a major. These records can include Franklin County property tax assessments and assessment challenges appraisals and income taxes. Franklin County Real Estate Tax.

Assessor Franklin County Assessor 400 East Locust Room 105 Union MO 63084 Phone. Franklin Co Assessor 400 East Locust Suite 105B Union MO 63084-1608 Voice. The Franklin County Assessor may provide property information to the public as is without warranty of any kind expressed or implied.

Franklin Tax Collector 636 583 - 6353. Taxes are due on December 31 on property owned on assessment date ie. The County assumes no responsibility for errors in the information and does not guarantee that the.

Room 105A Union MO. Use this inquiry search to access Franklin Countys real estate tax records. Search for Franklin County property tax and assessment records by owner name parcel PIN situs address DBA or subdivision.

John Smith Street Address Ex. Property Taxes and Tax Receipts. You assume responsibility for the selection of data to achieve your intended results and for the.

Please have your tax bill and credit card information available as you will need information from both to complete this transaction. 400 E Locust St. Franklin County uses this software to maintain property information.

In addition to collecting taxes for real and personal property the Collector also collects levee railroad and utility taxes along with issuing merchants and manufacturers. Property values are assessed and paid locally. A person moves into Missouri on March 1 2021.

The Franklin County Treasurer makes every effort to produce and publish the most current and accurate information possible. Data and Maps are stored as layers of information which makes it possible to perform complex analyses. Franklin County Real Estate Tax Inquiry Real Estate Tax Payments.

Franklin County Property Records provided by HomeInfoMax. Tom Copeland Assessor 400 E Locust Room 105 Union MO 63084. Go to Data Online.

If you live in Franklin County as of January 1st of that year you must file with the assessors office. Welcome to Franklin County MO Bill Pay Website for Real Estate and Personal Property Taxes. Franklin Assessor 636 583 - 6348.

Property Reports ownership information property details tax records legal descriptions Title History ownership title history deeds and mortgage records. Additional information may be found under Taxpayer. It is your responsibility to send a completed form to the assessor by March 1 listing all the taxable.

Map of Franklin County Tax Collectors Office. Find Franklin County Tax Records Franklin County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Franklin County Missouri. To print a copy of the Property Tax Bill or to see the breakdown of gross taxes click on the Taxes tab and click Print Tax Details or Print Tax Bill at the bottom left-hand side of the page.

Property tax payments are accepted as soon as tax bills are available in. A complete listing of collectors and assessors can be found at the Directories tab.

Read more ».JPG)