What Is The Access Number For Homestead Tax Credit

Enter the SDAT Real Property Tax Identification Number of the property for which Homestead Eligibility is. For those homeowners who submit applications electronically the Departments website is an encrypted protected site that uses the unique 8-digit security Access Number and scrambles the individual Social Security numbers.

Elderly May Qualify For A Tax Credit Local News Dailyjournalonline Com

Elderly May Qualify For A Tax Credit Local News Dailyjournalonline Com

Maryland Department of Assessments and Taxation Homestead Tax Credit Division 301 West Preston Street Baltimore MD 212012009 PHTC-1 v10a Maryland now requires all homeowners to submit a one-time application to establish eligibility for the Homestead Tax Credit.

What is the access number for homestead tax credit. You must fill-in the property identification number in order to submit this application. These same protections and additional protections will be provided to protect the confidentiality of Social Security numbers supplied on homestead tax credit applications. This fact sheet provides a general overview of the qualifications for claiming the credit which schedule to file and the credit computation.

To submit a Homestead Tax Credit Eligibility Application through the SDAT website you must be issued an application form by the SDAT containing an Access Number and your Real Property Account Number. You must fill-in the property identification number in order to submit this application. Make sure you keep a fax confirmation.

The format is CC-DD-AAAAAAAAAA. For details and more information go to MD Department of Assessments Taxation MD Homestaed Tax Credit or Commonly Asked Questions. Enter Property Account Number.

The identification number is composed of the two digit county code where the property is located followed by an account number. Wisconsin Department of Revenue. Individuals Press Releases Tax Pro.

Do not print out the application complete it. You must fill-in the property identification number in order. How do I file a Homestead Tax Credit Eligibility Application.

The identification number is composed of the two digit county code where the property is located followed by an account number of up to 14. SDAT Real Property Tax Identification Number of the property for which Homestead Eligibility is requested. All leading zeroes must be entered.

Homestead Tax Credit Application 54-028 Notice of Transfer or Change in Use of Property Claimed for Homestead Tax Credit Iowa Code Section 4252. You can contact the SDAT Credit Office for more information on Homestead Property Tax Credit eligibility or calculations by calling 410-512-4900. State Grant Programs Funded by the Coronavirus Relief Fund That Are Excluded From Wisconsin Income.

1Your Real Property Account Number and 2 An Access Number If you do not have an Access Number call 410-767-2165 in the Baltimore Metropolitan area or. The credit for most people is based on a comparison between property taxes and total household resources. Homestead Tax Credit Division 301 West Preston Street 8th Floor Baltimore MD 21201.

Call the Homestead Division and request the access number 410-225-2165 or 1-866-50-8783. Online via the Internet To file an application online you will need. The Access number is in the box in the upper right corner of the application form mailed to you by the SDAT.

Revised May 22 2019 A new website for Baltimore County. A homestead credit claim may be filed using. They told us that the identification number is a conglomeration of.

Approved for the Homestead Tax Credit if so there is no need to reapply. You can also print out the application using the above link and fax in the application to 410-225-9344. The homestead credit program is designed to soften the impact of property taxes and rent on persons with lower incomes.

The Homestead Credit Eligibility stays in place as long as the dwelling remains your primary residence. With limited exception the real property account number consists of the two digit county code two digit assessment district and an account number which varies in length from six to ten digits. You need the Account and Access Numbers as part of the submission process.

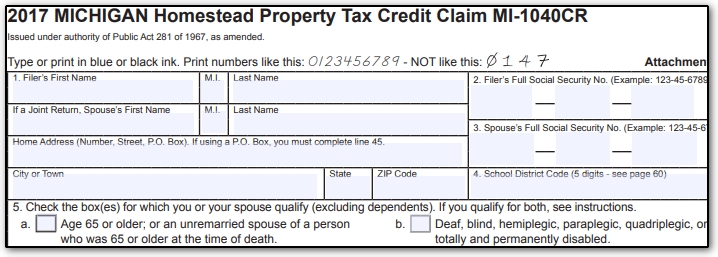

You should complete the Michigan Homestead Property Tax Credit Claim MI-1040CR to see if you qualify for the credit. The Maryland Homestead Tax Credit Eligibility Deadline. Beginning in FY 2008 Anne Arundel County authorized an enhancement to its local supplemental Homeowners Tax Credit program.

Property owner must certify to the assessor that they no longer own the property or have ceased to use the property as a homestead claimed for a homestead tax credit. For taxpayers who as of the end of the calendar year preceding the beginning of the taxable for which the credits are sought are both at least 70 years old and have resided in a dwelling for more than 10 years their County credit automatically increase by. So we called the Maryland Homestead Tax Credit Division at 410-767-2165 to determine what they meant by an identification number.

Enter the SDAT Real Property Tax Identification Number of the property for which Homestead Eligibility isrequested.

Elderly May Qualify For A Tax Credit Local News Dailyjournalonline Com

Elderly May Qualify For A Tax Credit Local News Dailyjournalonline Com

Important Tax Credits Michigan Free Tax Help

Ny Ended The Property Tax Relief Checks Why They May Not Come Back

Ny Ended The Property Tax Relief Checks Why They May Not Come Back

Mi Over Age 65 Blind Or Deaf Special Exemption Not Automatic

Mi Over Age 65 Blind Or Deaf Special Exemption Not Automatic

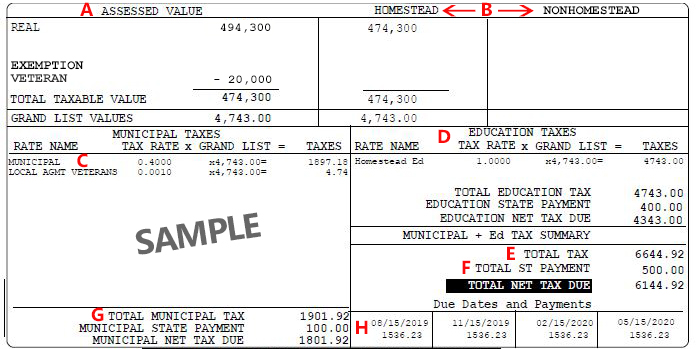

How Property Taxes Work Itep Reports Property Tax Tax Rate Income Tax

How Property Taxes Work Itep Reports Property Tax Tax Rate Income Tax

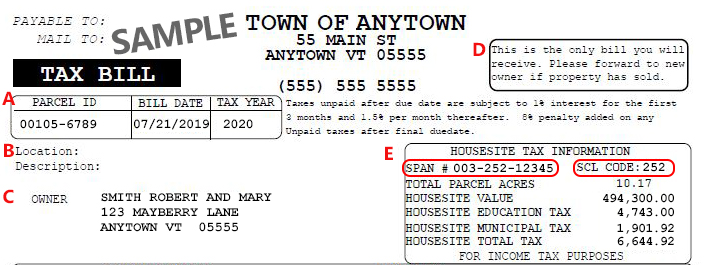

Understanding Your Property Tax Bill Department Of Taxes

Understanding Your Property Tax Bill Department Of Taxes

How To Be A Successful Landlord Being A Landlord Real Estate Rentals Real Estate Investing Rental Property

How To Be A Successful Landlord Being A Landlord Real Estate Rentals Real Estate Investing Rental Property

Understanding Your Property Tax Bill Department Of Taxes

Understanding Your Property Tax Bill Department Of Taxes

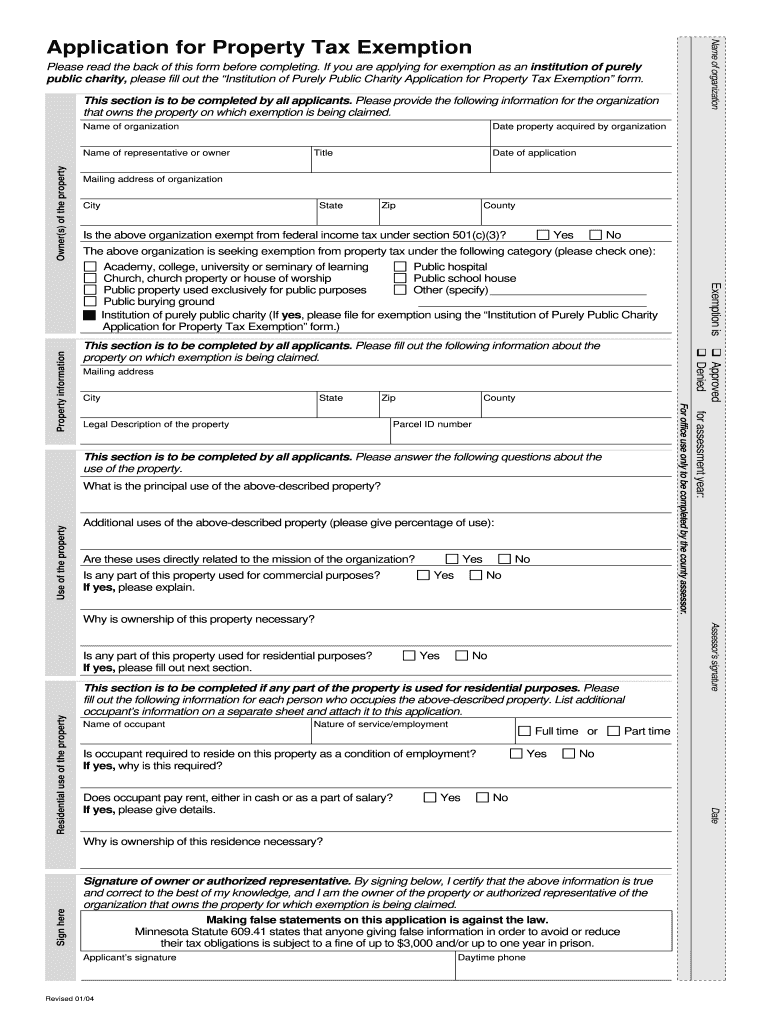

Mn Application For Property Tax Exemption Carver County 2004 2021 Fill Out Tax Template Online Us Legal Forms

Mn Application For Property Tax Exemption Carver County 2004 2021 Fill Out Tax Template Online Us Legal Forms

Http Tax Vermont Gov Sites Tax Files Documents Gb 1265 Pdf

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-02-822f6b88f3fe437caed0b5ca5bc51bdf.jpg) What Tax Breaks Are Afforded To A Qualifying Widow

What Tax Breaks Are Afforded To A Qualifying Widow

Elderly May Qualify For A Tax Credit Local News Dailyjournalonline Com

Elderly May Qualify For A Tax Credit Local News Dailyjournalonline Com

Http Tax Vermont Gov Sites Tax Files Documents Gb 1265 Pdf

American Opportunity Tax Credit H R Block

American Opportunity Tax Credit H R Block

Ks Homestead Claim And Food Sales Tax Credit

Sc Earned Income Tax Credit Increases In 2020

Sc Earned Income Tax Credit Increases In 2020

If You Bought A Home Year Or Have Never Filed For Your Homestead Tax Exemption The Deadline Is Quickly Approaching Property Tax Homesteading Tax Exemption

If You Bought A Home Year Or Have Never Filed For Your Homestead Tax Exemption The Deadline Is Quickly Approaching Property Tax Homesteading Tax Exemption

2017 Update On The Homestead Tax Credit And Wisconsin Renter S And Homeowner S School Property Tax Credit Steve Brown Apartments

2017 Update On The Homestead Tax Credit And Wisconsin Renter S And Homeowner S School Property Tax Credit Steve Brown Apartments

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home