Property Tax Rate Oakwood Ohio

They may increase without a change on this website. Actual taxes might differ from the figures displayed here due to various abatement and financial assistance programs.

46 Briar Hill Rd Oakwood Oh 45419 Realtor Com

46 Briar Hill Rd Oakwood Oh 45419 Realtor Com

The median property tax in Ohio is 183600 per year for a home worth the median value of 13460000.

Property tax rate oakwood ohio. Property taxes must be paid to your county of residence. The tax base is 40 of the depreciated value of the home and the rate is the total of all taxes levied in the district. The current millage rate for 2020 is 4174.

The countys average effective property tax rate is 218 which ranks as the second-highest out of Ohios 88 counties. The following data sample includes all owner-occupied housing units in Oakwood Ohio. The city of Oakwood recently published the 2020 Annual Report.

2020 Oakwood Annual Report. The millage rate is set by the elected officials. The real property tax is Ohios oldest tax.

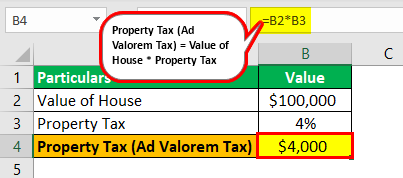

2021 State of the City Address. Use our free directory to instantly connect with verified Property Tax attorneys. All persons owning property within the city limits of Oakwood are subject to pay an Ad Valorem Tax each year.

The departments Tax Equalization Division helps ensure uniformity and fairness in property taxation through its oversight of the appraisal work of local county auditors. 136 of home value. Tax Day extended to May 17.

The 2020 Property tax bills are available now the due date is February 8 2 021. Counties in Ohio collect an average of 136 of a propertys assesed fair market value as property tax per year. Ohio is ranked number twenty two out of the fifty states in order of the average amount of property taxes collected.

The current total local sales tax rate in Oakwood OH is 7250. For example through the homestead exemption a home with a market. Tax amount varies by county.

Wide average effective or net tax rate on residential and agricultural real property was 5540 mills while the effective rate was 6403 mills on commercial and industrial property. Property owners making up to 100 of the area median income would be eligible. New law passed by the Ohio General Assembly in December of 1998 significantly changes Manufactured Home taxation by assessing the value of the home similar to.

Posted on March 26 2021. Compare the best Property Tax lawyers near Oakwood OH today. Consult a tax professional for verification of tax rates and tax advice.

Residents of the City of Oakwood are allowed a 90 credit for taxes due and paid to other cities on the same income taxed by Oakwood. Median Property Tax Charged. Montgomery County Ohio Tax.

Montgomery Countys Taxpayer Services Department may be reached at 1-937-225-4010 Option 1 by. The report highlights the major. The City of Oakwood Income Tax Department accepts credit card and debit card payments through the.

For more information please visit Ohio Countys Assessor and Auditor or look up this propertys current valuation. The December 2020 total local sales tax rate was also 7250. The exemption which takes the form of a credit on property tax bills allows qualifying homeowners to exempt up to 25000 of the market value of their homes from all local property taxes.

The median annual property tax payment is 2511. Posted on March 26 2021. Tax rates vary widely in region.

Forms may be obtained by calling our office at 937 298-0531 or go directly to the forms page. The rates listed above were updated in March 2021. It has been an ad valorem tax meaning based on value since 1825.

Confirm the tax rate stated here with the city of interest or a tax professional prior to writing a purchase offer. In Franklin County the area median income is 58700 for a. Local tax rates vary dramatically by community so much so that a family owning a 100000 home and making 60000 per year in Oakwood.

Tax per Square Foot. The statistics from this question refer to the total amount of all real estate taxes on the entire property land and buildings payable to all taxing jurisdictions including special assessments school taxes county taxes and so forth. Taxes as of Home Value.

WITHHOLDING FILING FREQUENCY If withholding amount is 2400 or more in the immediately preceding calendar year or more than 200 in any one month of the preceding calendar quarter file monthly - due date is the 15th day of the following month. The Ohio S-Corp distributive shares are taxable and should be reported on Form 37.

Read more »