Columbus Ohio Property Tax Percentage

Tax Rate information for each year may be found below. The median annual property tax payment is 2511.

Https Www Columbus Gov Uploadedfiles Columbus Departments Finance And Management Financial Management Group Budget Management 2019 Budget 719gf Pdf

Municipalities may offer partial or full credit to residents who pay municipal income taxes.

Columbus ohio property tax percentage. The rate is determined locally with a maximum rate of 1 without voter approval. COLUMBUS Ohio WSYX Senator Hearcel F. Tax rate for nonresidents who work in Columbus.

Contact Michael Disclaimer. There are more than 600 Ohio cities and villages that add a local income tax in addition to the state income tax. The Franklin County Treasurer makes every effort to produce and publish the most current and accurate information possible.

For all filers the lowest bracket applies to income up to 22150 and the highest bracket only applies to income above 221300. The County assumes no responsibility for errors in the information and does not guarantee that the data is free from errors or inaccuracies. If you worked in a City other than Columbus you can take credit for any city tax withheld and paid to that city.

Nonresidents who work in Columbus also pay a local income tax of 250 the same as the local income tax paid by residents. Delinquent tax refers to a tax that is unpaid after the payment due date. Michael stinziano 2019 property tax rates for 2020.

Fill-in Forms and Instructions Filter by year 2021 2020 2019 2018 2017 2016 2015 2014 2013 Submit. Multiply the market value of the property by the percentage listed for your taxing district. Taxes for a 100000 home in Columbus - 100000 x 148 148000 Whitehall -.

As a tool for our audit teams and a service to the tax community the Division of Income Tax annually compiles information from Ohio municipalities on their income tax. On average a person living in Columbus can expect to pay 2029 percent in property taxes each year. Check your W-2s to make sure a total of 25 was withheld by your employer.

Columbus Ohio 43215 Get Directions. Rates range from 0 to 4797. Rates range from 0-3 in Ohio.

Due to the COVID-19 pandemic the Division is currently closed to the public. Front Street 2nd Floor. 2020 2019 2018 2017 2016 2015 2014 2013.

Monday through Friday 900 am. It has been an ad valorem tax meaning based on value since 1825. 614 645-7193 Customer Service Hours.

Ohio is ranked number twenty two out of the fifty states in order of the average amount of property taxes collected. City of Columbus Income Tax Division 77 N. The average home price.

The divisions duties include the collection of delinquent taxes and working with property owners account holders tax lien purchasers and other interested parties with tax related issues. Credit dst spec cnty twp school vill school total class 1 class 2 no. Taxpayers may use the secure drop box located in the lobby of the 77 N.

Craig D-Columbus announced legislation to cap annual property tax increases at five percent for households at or below their countys median income. Sorted By Tax Year. The real property tax is Ohios oldest tax.

Counties in Ohio collect an average of 136 of a propertys assesed fair market value as property tax per year. The Columbus Income Tax Division provides the service of collection audit and enforcement of the 25 income tax for the City of Columbus as well as the excise lodging tax for the City of Columbus and the Franklin County Convention and Facilities Authority. If you worked in a city with a tax of 1 and only 1 was withheld you must pay an additional 15 to Columbus.

The departments Tax Equalization Division helps ensure uniformity and fairness in property taxation through its oversight of the appraisal work of local county auditors. Front Street building to drop. District name rate rate rate rate rate rate rate resagr all oth 010 010 - city of columbus 280 1912 000 8208 314 000 10714 0362970 0231288 68251481 82359895 0088937 0022234 0090456 0022614.

States law requires a flat rate within a municipality. Residents of Columbus pay a flat city income tax of 250 on earned income in addition to the Ohio income tax and the Federal income tax. That is approximately 2029 per year if you own a house valued at 100000.

To use the forms provided by the City of Columbus Income Tax Division we recommend you download the forms and open them using the newest version of Acrobat Reader. The median property tax in Ohio is 183600 per year for a home worth the median value of 13460000. For a total of 25 tax paid.

Property Tax Rates Real Estate. The countys average effective property tax rate is 218 which ranks as the second-highest out of Ohios 88 counties. Home values in Columbus can be high.

Ohio Property Tax Calculator Smartasset

Ohio Property Tax Calculator Smartasset

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

Ohio Property Tax Calculator Smartasset

Ohio Property Tax Calculator Smartasset

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

Https Tax Ohio Gov Portals 0 Tax Analysis Tax Data Series All Property Taxes Pr6 Pr6cy16 Pdf

Rates Of Taxation For Columbus Cities Buying A Home

Rates Of Taxation For Columbus Cities Buying A Home

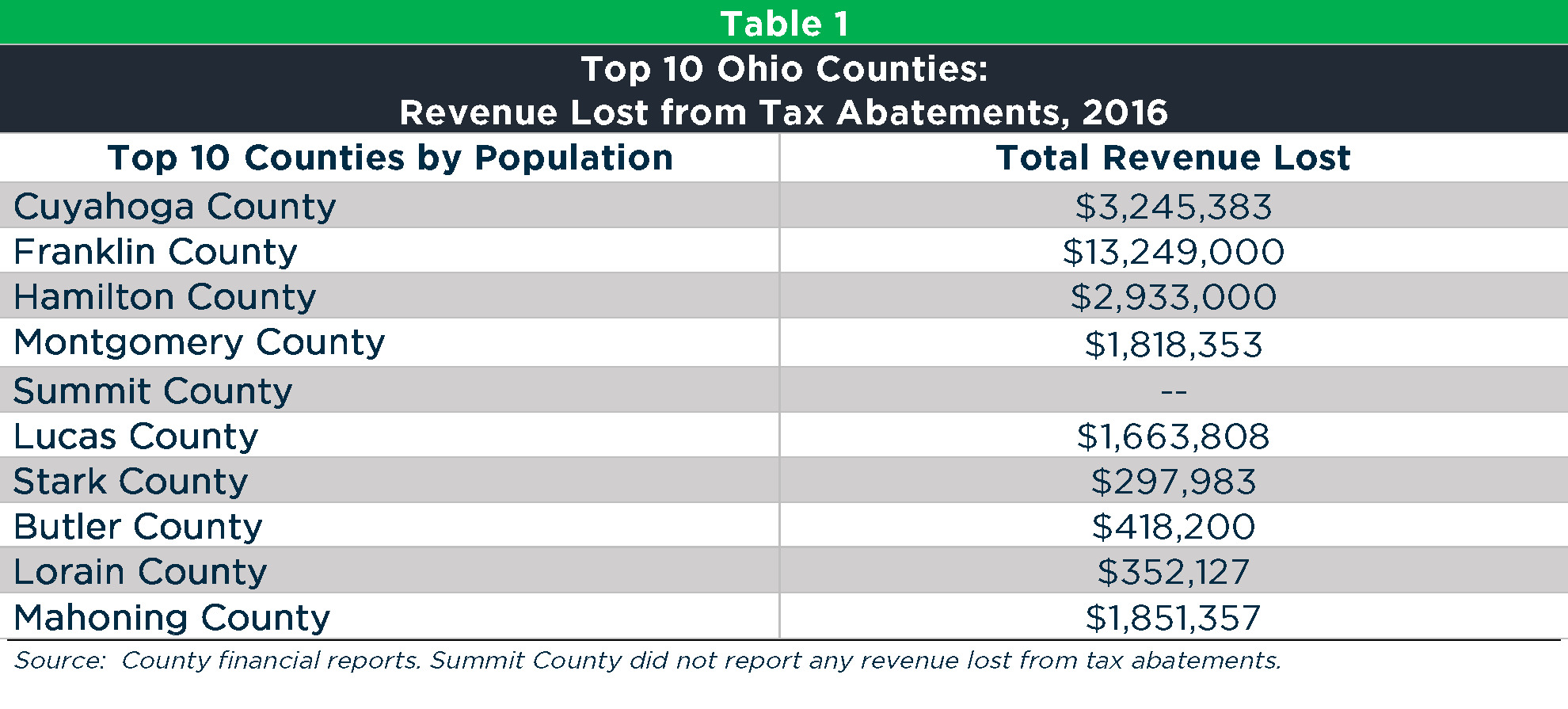

Local Tax Abatement In Ohio A Flash Of Transparency

Local Tax Abatement In Ohio A Flash Of Transparency

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

Property Taxes Levied On Single Family Homes Up 5 4 Percent Attom

Property Taxes Levied On Single Family Homes Up 5 4 Percent Attom

Stuff You Should Know Real Property Taxes In Ohio Waller Financial Planning Group

Stuff You Should Know Real Property Taxes In Ohio Waller Financial Planning Group

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

Franklin County Treasurer Tax Rates

Franklin County Treasurer Tax Rates

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

2021 Best Columbus Area Suburbs To Buy A House Niche

2021 Best Columbus Area Suburbs To Buy A House Niche

Mason Oh Property Taxes Ouch Cincinnati Warren House Schools Live In Ohio City Data Forum

Labels: ohio, percentage, property

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home