Property Tax Estimator New Orleans

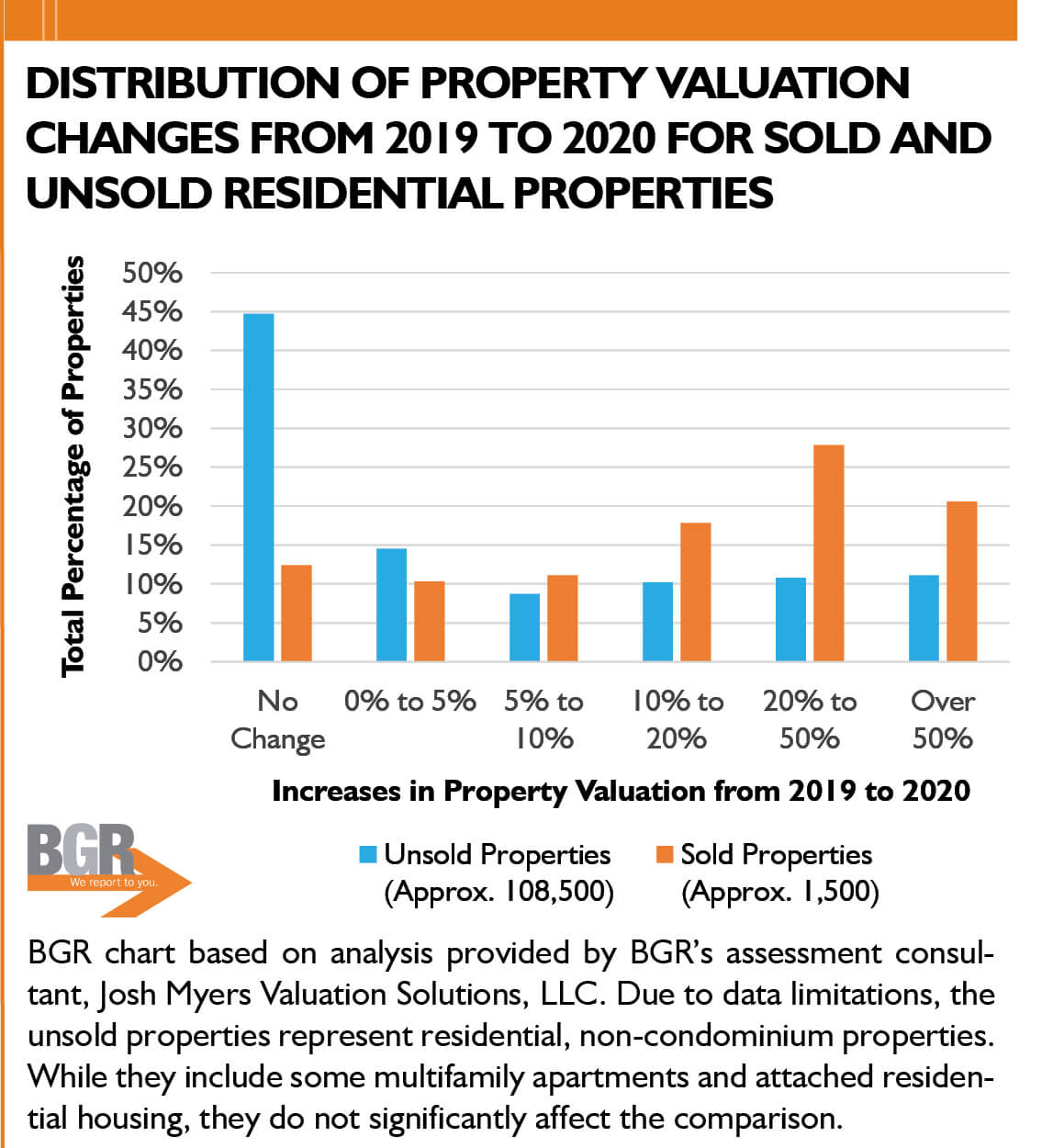

There is no city sale tax for New Orleans. Williams came under fire in recent months as overall property values in New Orleans shot up by 18 and residents grappled with higher tax bills.

Home Sale Calculator Net Proceeds Of Your Home Sale Opendoor Sale House Calculator Home Ownership

Home Sale Calculator Net Proceeds Of Your Home Sale Opendoor Sale House Calculator Home Ownership

Williams Assessor Orleans Parish Assessors Office Property Record Search This service has been provided to allow quick and easy access to real property tax assessment records and maps for properties located in Orleans Parish.

Property tax estimator new orleans. Any questions about taxes or tax payments should be directed to the New Orleans Bureau of Treasury 504 658-1712 or bureauoftreasurynolagov. You have chosen. Are you looking to buy a tax lien in New Orleans LA.

GIS Property Viewer Homeland Security Human Relations Commission. In several parishes including Allen Avoyelles and Madison average property taxes are around 200 per year. The median property tax on a 18410000 house is 33138 in Louisiana.

The median property tax on a 18410000 house is 112301 in Orleans Parish. Now its easy to estimate your taxes online at the Orleans Parish assessors website. The City of New Orleans offers its residents the ability to pay apply and request city services online.

HotelMotel Tax Occupational License Renewal. Located in southeast Louisiana adjacent to the city of New Orleans Jefferson Parish has a property tax rate of 052. Search for your Real Estate bill number by visiting the Assessors website or call 504 658-1712.

Louisiana is ranked 1277th of the 3143 counties in the United States in order of the median amount of property. The calculator will automatically apply local tax rates when known or give you the ability to enter your own rate. Real Estate Property Tax.

The Orleans Parish Assessors Office does not issue tax bills nor collect taxes. Use this Louisiana property tax calculator to estimate your annual property tax payment. All tax calculations represent estimated taxes.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Orleans Parish. The calculator is clever its designed to give you property tax estimates for New Orleans area parishes and even has special assessments noted for particular subdivisions. Louisiana state allows a deduction up to 75000 for most homeowners.

If you need your Business Personal Property Tax number call 504 658-1350. The average effective property tax rate in East Baton Rouge Parish is 061 which is over half the national average. In-depth Orleans NY Property Tax Information In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property.

Home buyers and Investors buy the liens in New Orleans LA at a tax. Property taxes in Louisiana are fairly low. New Orleans LA Tax Liens and Foreclosure Homes.

Every 2021 combined rates mentioned above are the results of Louisiana state rate 445 the county rate 475 to 5. What happens when you buy a tax lien. Please allow up to 48 hours.

For confirmation of your new tax account registration. To pay your property taxes online you will need your tax bill number. You can click the More Information link to access a data sheet with detailed property tax statistics and information for your area or visit the property tax.

The median property tax in Orleans Parish Louisiana is 1131 per year for a home worth the median value of 184100. Depending on the zipcode the sales tax rate of New Orleans may vary from 4 to 945. You may file a sales tax return only after your registration is confirmed.

Property Tax Calculator. Estimate closing costs or New Orleans area property tax due on your property. This rate is based on a median home value of 180500 and a median annual tax payment of 940.

Yearly median tax in Orleans Parish. Estimate your New Orleans property taxes here. 061 of home value.

While the exact property tax rate you will pay for your properties is set by the local tax assessor you can estimate your yearly property tax burden by choosing the state and county in which your property is located and entering the approximate Fair Market Value of your property into the calculator. Business Personal Property Tax. Orleans Parish collects on average 061 of a propertys assessed fair market value as property tax.

Use this New Orleans property tax calculator to estimate your annual property tax payment. Use this free Louisiana Mortgage Calculator to estimate your monthly payment including taxes homeowner insurance principal and interest. HOME SEARCH RECORDS FREQUENTLY ASKED QUESTIONS ABOUT US E-FILE TAX ESTIMATOR FORMS ASSESSORS DESK.

Louisiana Property Tax. As of April 16 New Orleans LA currently has 3515 tax liens available. See how your monthly payment changes by.

Its only an estimate because there are special neighborhood assessment districts senior exemptions and other variables that may change your actual tax bill but youll get pretty darned close to the real number. The New Orleans Louisiana general sales tax rate is 445. In fact the average homeowner there pays just 919 annually in property taxes equal to an effective rate annual taxes paid as a percentage of home value of 053.

The median property tax on a 18410000 house is 193305 in the United States.

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

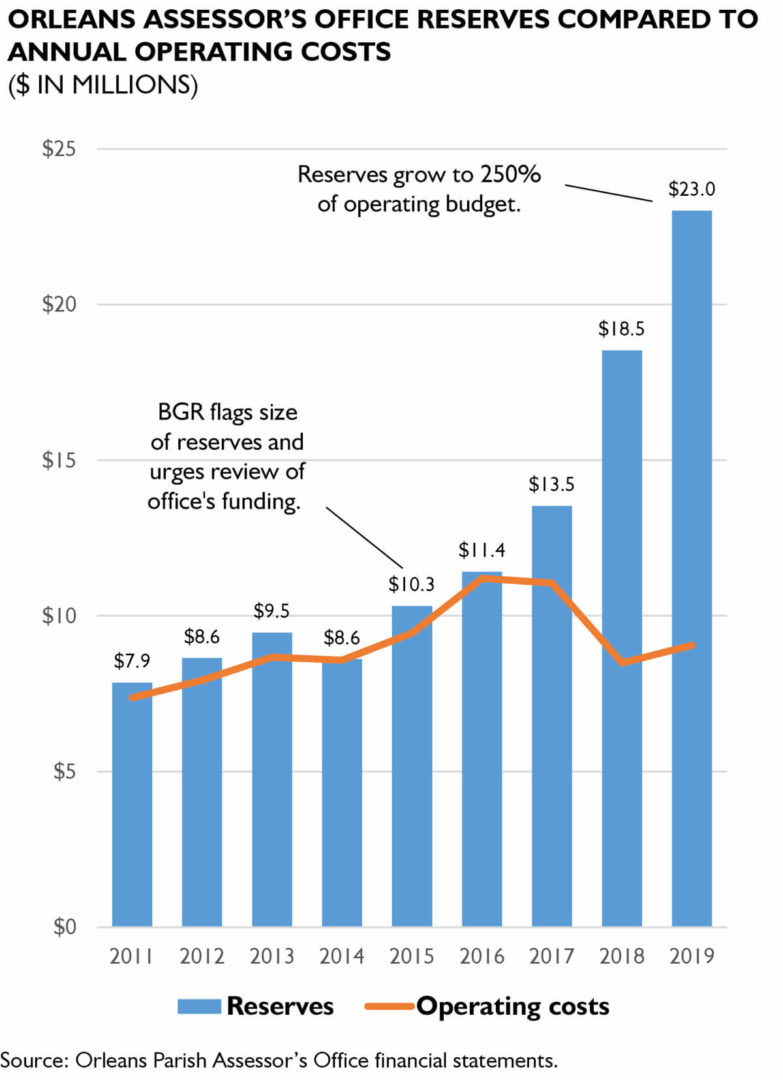

Policywatch Revisiting Assessment Issues In New Orleans

Policywatch Revisiting Assessment Issues In New Orleans

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

Investment Property Expense List For Taxes Investing Investment Property Being A Landlord

Investment Property Expense List For Taxes Investing Investment Property Being A Landlord

Expecting A Substantial Income Tax Refund This Year You Re Not Alone Over 80 Percent Of Americans Get Money Back A Tax Refund How To Get Money Eliminate Debt

Expecting A Substantial Income Tax Refund This Year You Re Not Alone Over 80 Percent Of Americans Get Money Back A Tax Refund How To Get Money Eliminate Debt

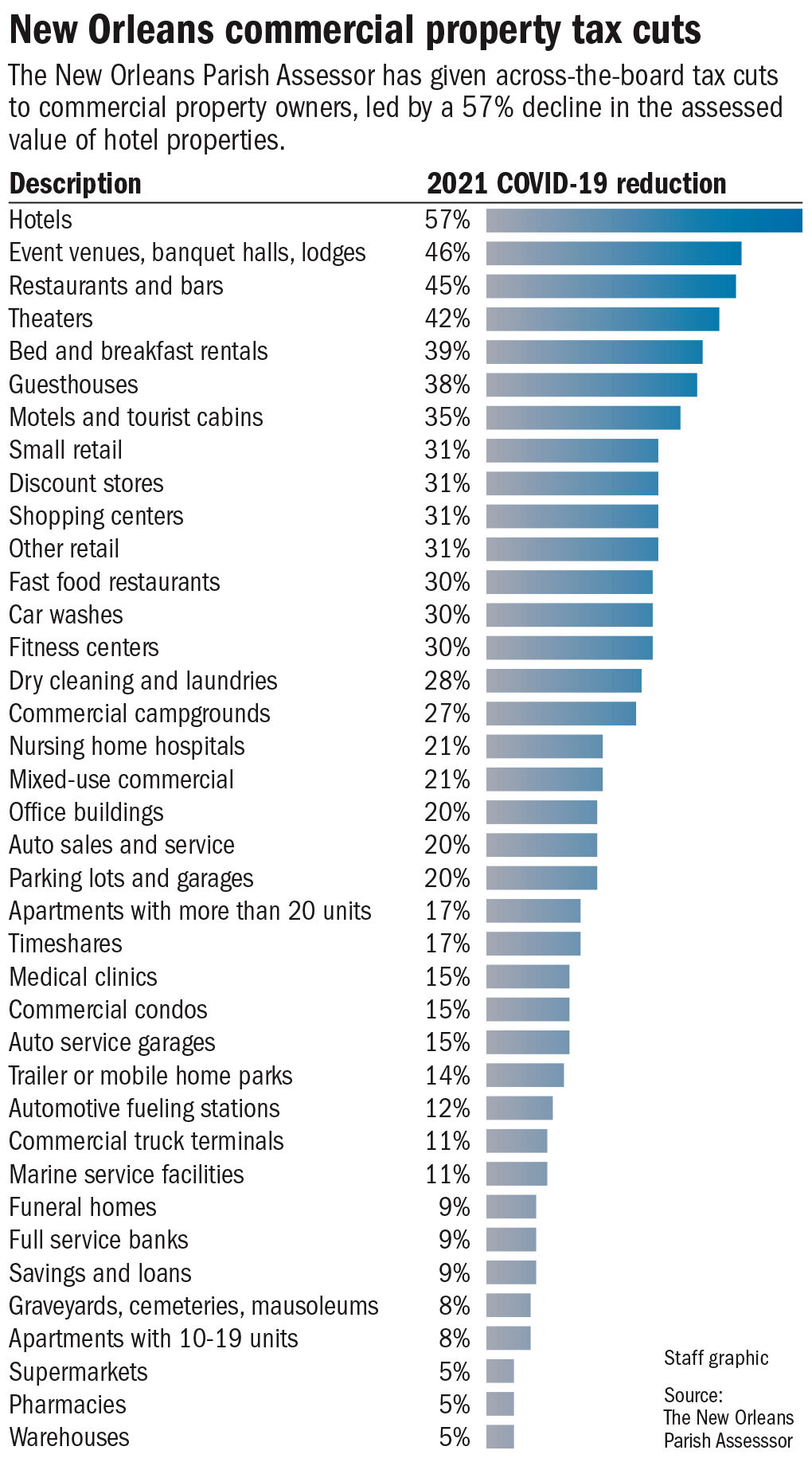

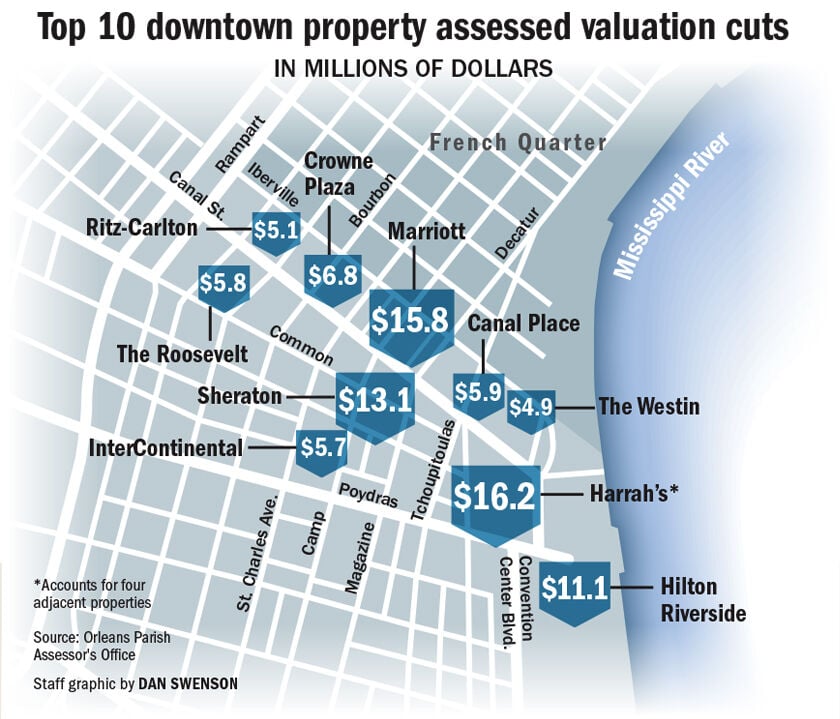

Property Taxes For New Orleans Homes Have Surged Now Businesses Could Get A Huge Tax Cut Business News Nola Com

Property Taxes For New Orleans Homes Have Surged Now Businesses Could Get A Huge Tax Cut Business News Nola Com

Controversial Article Gentrification And Its Discontents Notes From New Orleans By Richard Campanella New Orleans Historical Geography New Orleans Louisiana

Controversial Article Gentrification And Its Discontents Notes From New Orleans By Richard Campanella New Orleans Historical Geography New Orleans Louisiana

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

Get Help With Property Tax Abatement In New Orleans

Get Help With Property Tax Abatement In New Orleans

States With The Highest And Lowest Property Taxes Property Tax Tax States

States With The Highest And Lowest Property Taxes Property Tax Tax States

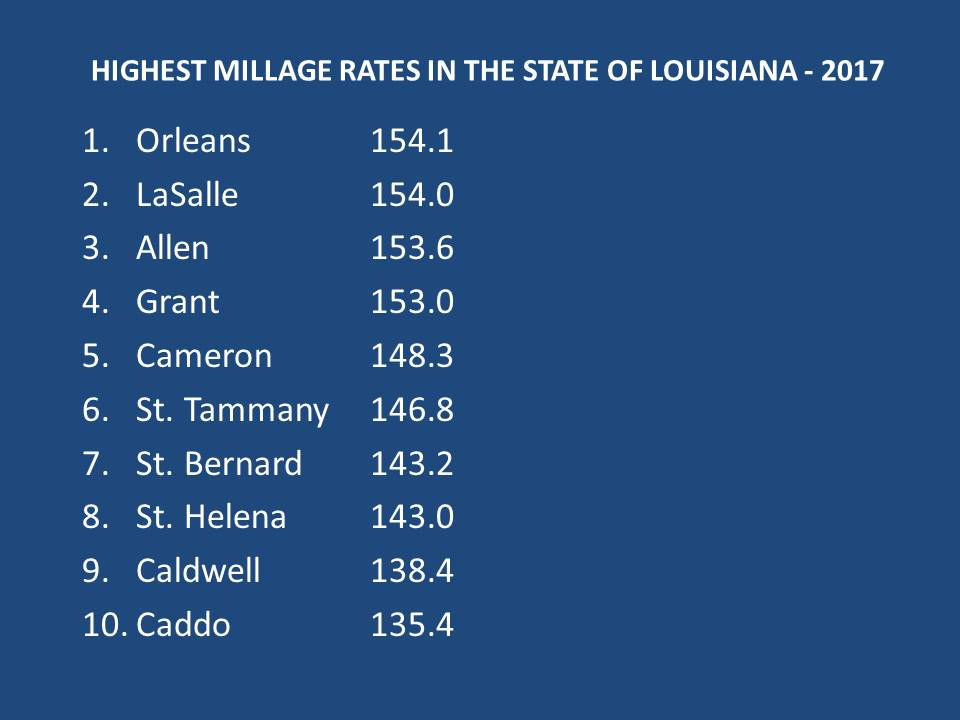

10 Louisiana Parishes With The Highest Property Tax Rates 3 Are In Metro New Orleans Archive Nola Com

10 Louisiana Parishes With The Highest Property Tax Rates 3 Are In Metro New Orleans Archive Nola Com

Property Taxes For New Orleans Homes Have Surged Now Businesses Could Get A Huge Tax Cut Business News Nola Com

Property Taxes For New Orleans Homes Have Surged Now Businesses Could Get A Huge Tax Cut Business News Nola Com

Louisiana Property Tax Calculator Smartasset

Louisiana Property Tax Calculator Smartasset

What Is Title Insurance And Why Do I Need It New Orleans La Title Company Crescent Title Llc Title Insurance Title Insurance

What Is Title Insurance And Why Do I Need It New Orleans La Title Company Crescent Title Llc Title Insurance Title Insurance

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

Real Estate Property Tax Calculator Southern Title

Real Estate Property Tax Calculator Southern Title

Bus Tickets From Austin To Houston Bus Tickets Amtrak Train Train Tickets

Bus Tickets From Austin To Houston Bus Tickets Amtrak Train Train Tickets

Assessing Progress On Property Assessment Reform In New Orleans

Assessing Progress On Property Assessment Reform In New Orleans

Property Tax Maui Maui Real Estate Property Tax Maui

Property Tax Maui Maui Real Estate Property Tax Maui

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home