Quitclaim Deed For Property In California

According to California law a quitclaim deed is a document that enables you to relinquish andor transfer real property interest whether recorded or not in land and or gas mineral or oil rights. Description Quitclaim Deed Form California.

Quit Claim Deed Form California 1 Great Quit Claim Deed Form California Ideas That You Can S Doctors Note Template Quitclaim Deed Letter Templates Free

Quit Claim Deed Form California 1 Great Quit Claim Deed Form California Ideas That You Can S Doctors Note Template Quitclaim Deed Letter Templates Free

One such deed is a quitclaim.

Quitclaim deed for property in california. To someone who will own the. View Sample Filled-in Quit Claim Deed. The process for completing any.

Blank forms may also be available at office supply stores. To a living trust or business owned by the current owner. Most people who sign quitclaim deeds do so when they are transferring the property to a family member.

Additional pages filed are 3. For example say you are getting divorced and you and your spouse agree that you should keep the house. I certify under PENALTY OF PERJURY under the laws of the State of California that the foregoing paragraph is true and correct.

This document a sample Quitclaim Deed can be used in the transfer process or related task. As of 2018 for example the costs in Los Angeles County include a base fee of 15 and additional fees of approximately 87. This allows that party to sell or mortgage the property without the approval or consent of the other party.

Laws of Property Quitclaim Deeds. This is because a quitclaim deed does not guarantee the grantor has. Computed on full value of property conveyed or Computed on full value less value of liens or encumbrances remaining at time of sale.

Texas voids unrecorded deeds to protect the integrity of later transactions. A quit claim deed in a divorce or legal separation gives one party the sole ownership of the property. The facts surrounding each case MUST be.

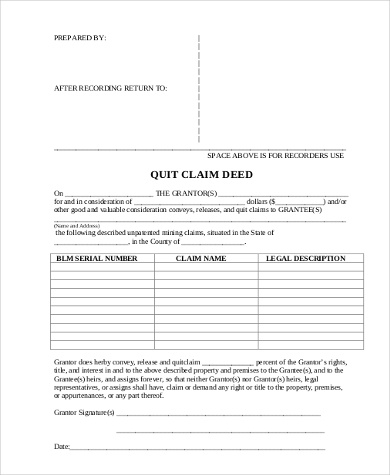

A quitclaim deed isnt always the best option. A quitclaim deed is commonly used when you want to. QUITCLAIM DEED Title Order No_____ Escrow OR LOAN No.

Transfer property to or from a revocable living trust. Step 1 In the top left-hand corner enter the name of the person requesting recording and the person to whom the deed and tax statements should be mailed most likely the grantee or person purchasing property. How to Fill Out a California Quitclaim Deed Confirm a Quitclaim Deed Is Appropriate.

This deed or deed-related form is for use in property transactions in the designated state. Transfer property in California quickly and easily using this simple legal form. As in other states a quitclaim deed in California comes with filing costs which vary by county.

The Monster Under the Bed. Many state laws penalize secret deed transfers. Transfer property to one spouse as part of a divorce.

At least two California courts have ruled in landmark decisions that a quitclaim deed does not negate community property ownership. In California quitclaim deeds are often used if the property is being transferred. When a Homes Past Holds an Unrecorded Deed.

This information can be obtained from the assessors office n the county in which the property is located. One of the first acts of the California Legislature was to adopt a recording system by which evidence of title or interests in the title could be collected and maintained in a convenient and safe public place. Transfer property to or from a revocable living trust.

This unique instrument is used to satisfy the strict regulations of the state of California and the various county. Adapt the language to fit your circumstances. If real estate is acquired during the marriage this fact overrides the provisions of any deed that transfers title into one spouses name alone.

Download a quitclaim form from your county recorders website or obtain a. Property Ownership and Deed Recording California was admitted to the Union by the United States on September 9 1850. The two most common documents used to transfer ownership are the Grant Deed and Quit Claim Deed.

You can use a quitclaim deed to. To a spouse or other family member as a gift. Signing a Quitclaim Deed Does Not Give Up Rights.

Facts Must Be Examined. The CALIFORNIA QUITCLAIM DEED is a valid document used to transfer real estate located in the state of California from one property owner to another. Thus the signing of a quitclaiminterspousal transfer deed during marriage by one spouse to the the other is not the end-all be-all of the character of the property.

To change the nature of marital property. Deeds are written instruments that convey and define property title and California Code defines simple forms for use as deeds. Information and forms are available from the Sacramento County Public Law Library.

To an ex-spouse following a divorce. Step 2 Write in the Assessors Parcel Number APN for the property. The recording of the quitclaim deed shows the new ownership status for tax assessment purposes.

Complete the Quitclaim Deed. Why Recording a Quitclaim Is So Important. It also allows that party to execute a will to give the property to anyone he or she desires.

Read more »Labels: california, property, quitclaim