Quitclaim Deed For Inherited Property

Quit Claim Deed. The Monster Under the Bed.

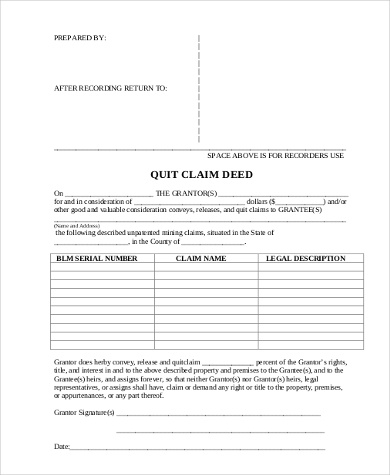

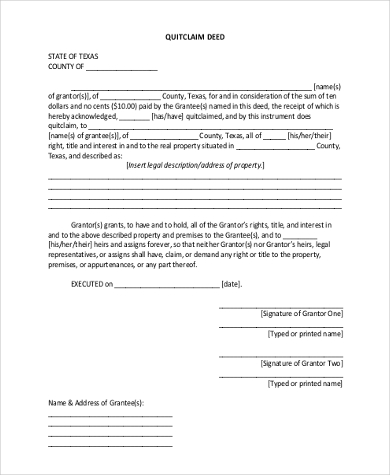

Free 6 Sample Quitclaim Deed Forms In Pdf Ms Word

Free 6 Sample Quitclaim Deed Forms In Pdf Ms Word

But while most deeds describe exactly what interest is being transferred quitclaims dont do this.

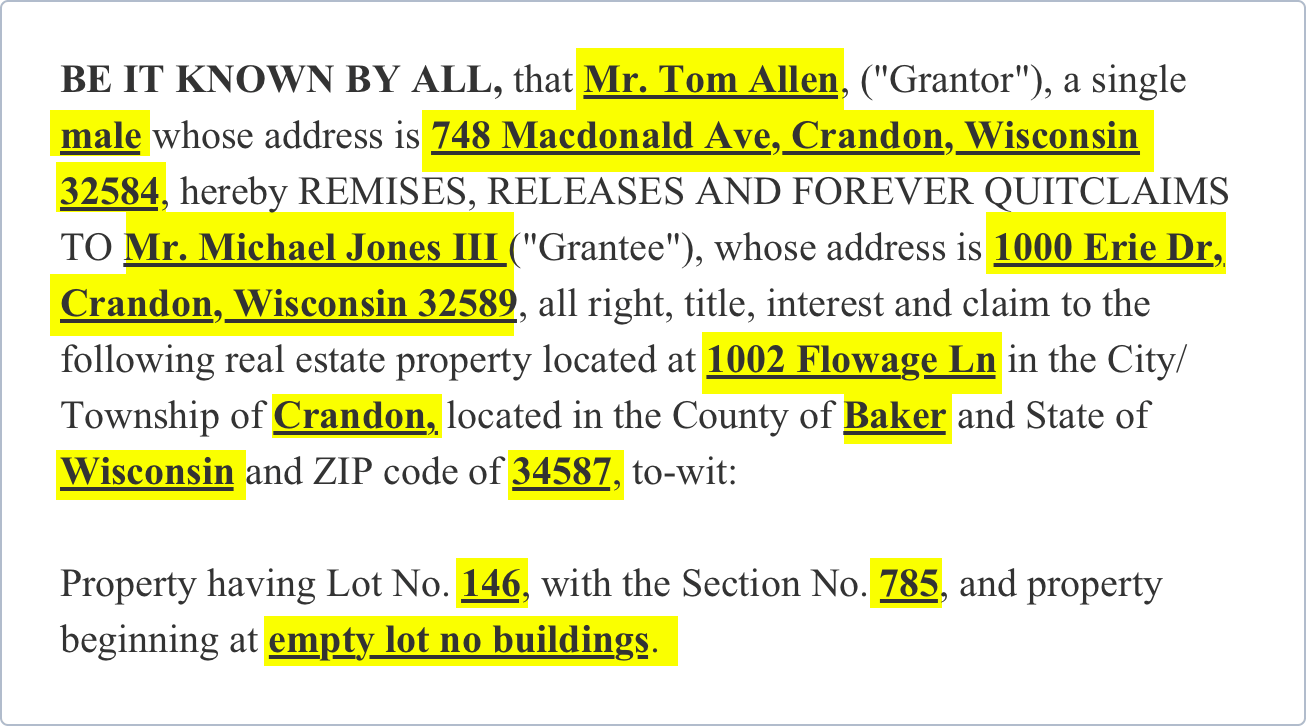

Quitclaim deed for inherited property. If the deed specifies that the brothers own the property jointly then when either passes away the remaining share of the house would go to the surviving brother rather than to the deceaseds children. For example if a mother buys a home for 100000 in 2000 and then decides to quitclaim the property to her son in 2018 when the property is worth 200000 the son receives a cost basis of 100000 what she paid. Draft a new deed that names you as the property owner.

Transfer-on-Death Deeds Sometimes owners of a property take care of inheritance issues before they die. You will have to do some research to arrive at a fair approximation of. When you receive property through a quitclaim deed or inherit it you become fully responsible for that property.

When a Homes Past Holds an Unrecorded Deed. Note that a quitclaim deed does not absolve responsibility for paying a mortgage or if there are any liens on the property so just because you were gifted a property. If you use a quitclaim deed the deed transfers whatever interest you may have in the property to the recipient.

Another potential hitch with using a quitclaim deed to own the family home together is what happens if one brother dies Simasko says. If the property owner drew up a transfer-on-death deed before she died deeding the property to you youre set. Form 8004 Quitclaim Deed.

The new deed should include your name and address the name and address of the decedent the address or location of the property the parcel. When you inherit property through a will you receive the decedents cost basis but if the property is transferred via quitclaim deed you receive the current market value. When estate planning its better to put the property in a will or trust rather than.

The fee to file a New York state quit claim deed is unique to each county. Why Recording a Quitclaim Is So Important. However as of 2018 the basic fee for filing a quit claim deed form ny of residential or farm property is 125 while the fee to file for quitclaim deed NY for all other property is.

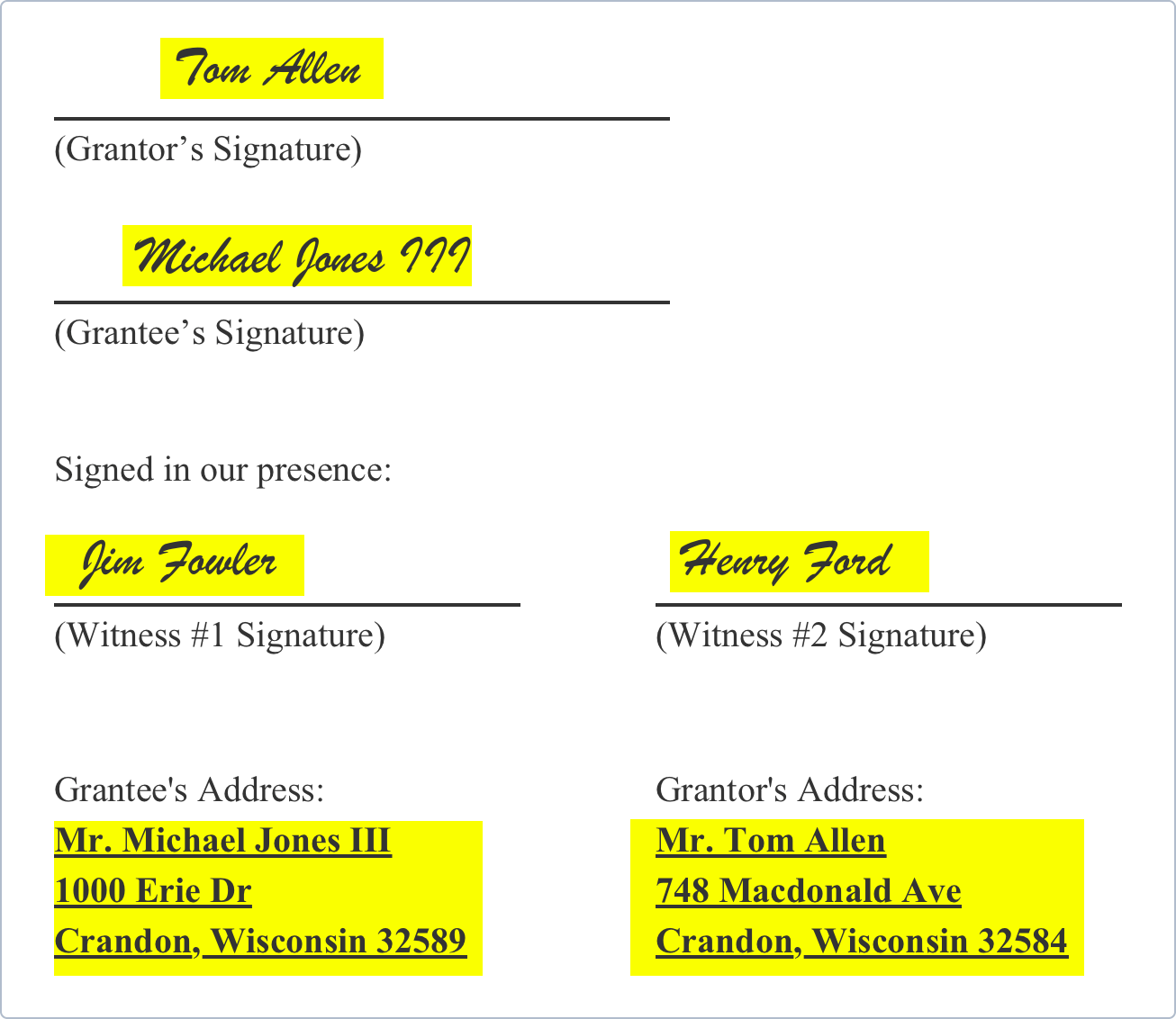

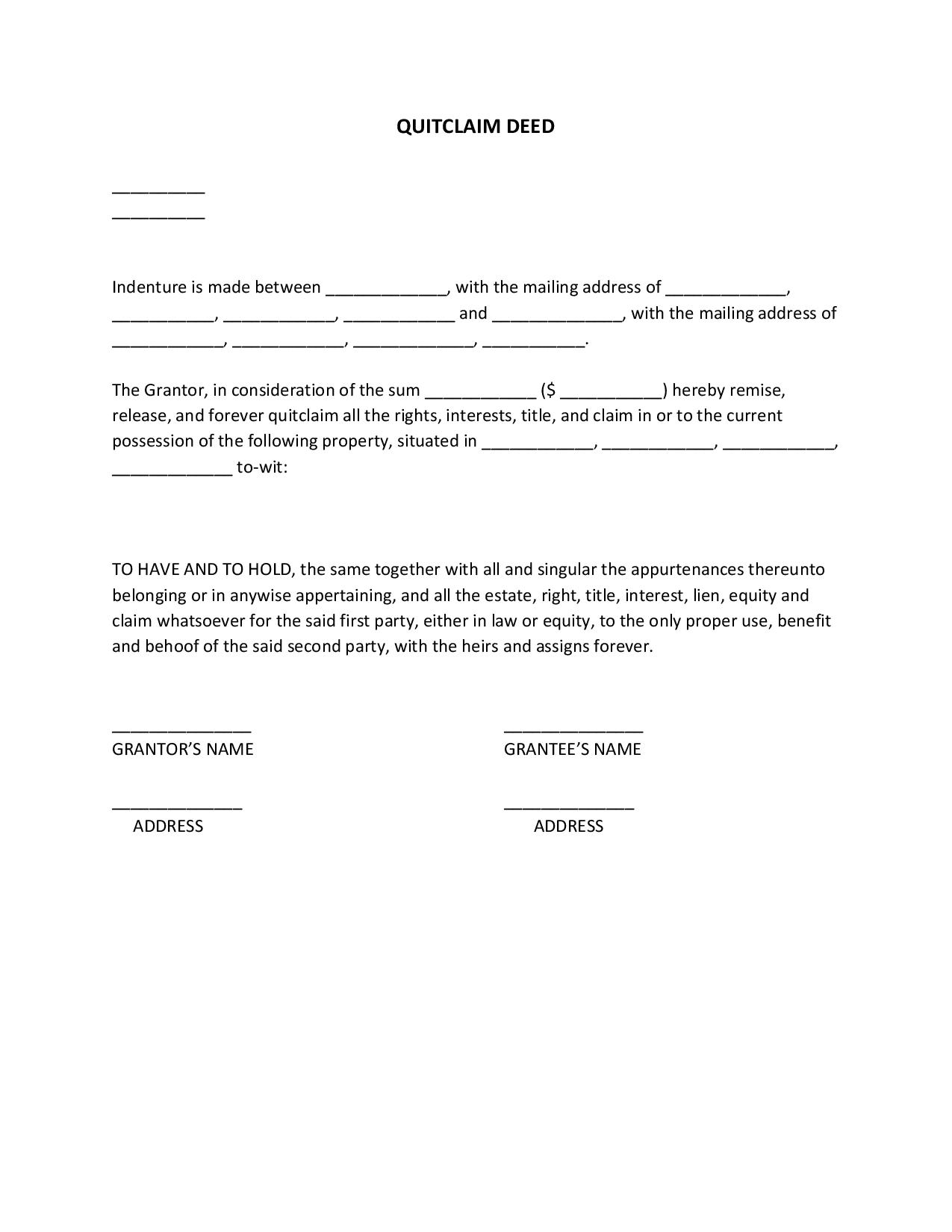

The recording of the quitclaim deed shows the new ownership status for tax assessment purposes. Remember that in deed speak the person who owns the property and who is signing the deed is known as the grantor while the recipient of the deed is referred to as the grantee. Part of your basis is considered a gift and part of it will have a inherited stepped up basis.

This means that the grantor does not guarantee that there are no other claims to the property in existence. Its better to inherit property from your parents or family members rather than receiving it through a quit claim deed. A quit claim deed transfers the owners interest in a property but includes no warranty to back it up.

This deed serves as your deed to the property once death is. Texas voids unrecorded deeds to protect the integrity of later transactions. The tax implications of receiving a property through a quit claim deed are much greater than inheriting a property.

Any taxes insurance property liens or other debts attached to the property you. Many state laws penalize secret deed transfers. Quitclaim deeds are used to transfer an interest in your home to another party.

IN WITNESS WHEREOF the party of the first part has duly executed this deed the day and year first above written. A quitclaim deed releases a persons interest in a property without stating the nature of the persons interest or rights and with no warranties of that persons interest or rights in the property. In your case it might be inferred.

A quitclaim deed is used to transfer an interest in real property. Sometimes used when a homeowner dies to transfer his property to an heir or following marriage and divorce proceedings quitclaim deeds essentially provide the holder with possession of your home or in case it has multiple owners such as following a divorce your share of the home. How do I calculate the basis on a property by quitclaim deed and rights of survivorship.

So if a grantor signs a quitclaim deed but has no interest in the property the deed ends up. A Quitclaim Deed is used to transfer any ownership that someone a grantor has in a piece of property to another party a grantee without providing a warranty. For the most part a quitclaim deed is typically used when one owner relinquishes control of their claim to a property to the other owner such as a spouse that is denying ownership over a jointly owned home.

California Quitclaim Deed Ezlandlordforms

California Quitclaim Deed Ezlandlordforms

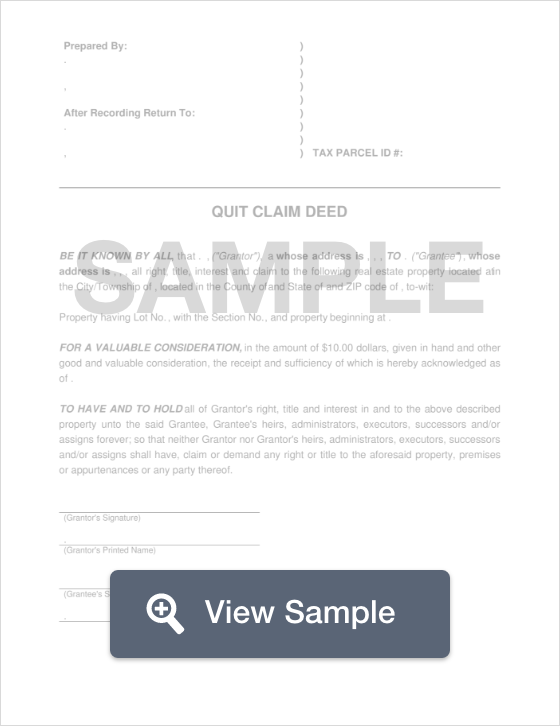

Quitclaim Deed Form Create Download For Free Pdf Word Formswift

Quitclaim Deed Form Create Download For Free Pdf Word Formswift

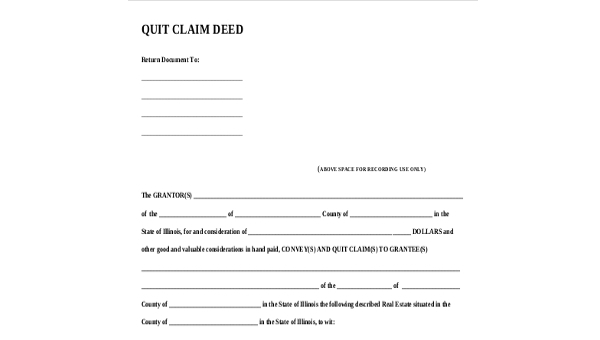

In Quit Claim Deed Form Complete Legal Document Online Us Legal Forms

In Quit Claim Deed Form Complete Legal Document Online Us Legal Forms

Quit Claim Deed Form Arizona Fill Online Printable Fillable Blank Pdffiller

Quit Claim Deed Form Arizona Fill Online Printable Fillable Blank Pdffiller

Quitclaim Deed Ez Estate Planner

Quitclaim Deed Ez Estate Planner

Free 6 Sample Quitclaim Deed Forms In Pdf Ms Word

Free 6 Sample Quitclaim Deed Forms In Pdf Ms Word

Browse Our Image Of Quit Claim Letter Template Quitclaim Deed Letter Templates Doctors Note Template

Browse Our Image Of Quit Claim Letter Template Quitclaim Deed Letter Templates Doctors Note Template

Quit Claim Deed Form Free Quit Claim Deed Template With Sample Quitclaim Deed Funeral Program Template Templates

Quit Claim Deed Form Free Quit Claim Deed Template With Sample Quitclaim Deed Funeral Program Template Templates

California Quitclaim Deed Ezlandlordforms

California Quitclaim Deed Ezlandlordforms

Should I Sign A Quitclaim Deed During Or After Divorce

Should I Sign A Quitclaim Deed During Or After Divorce

Free 6 Sample Quitclaim Deed Forms In Pdf Ms Word

Free 6 Sample Quitclaim Deed Forms In Pdf Ms Word

Quitclaim Deed Information Guide Examples And Forms Deeds Com

Quitclaim Deed Information Guide Examples And Forms Deeds Com

Quitclaim Deed Download Your Free Quitclaim Deed Form Pdf Word

Quitclaim Deed Download Your Free Quitclaim Deed Form Pdf Word

Quitclaim Deed Form Create Download For Free Pdf Word Formswift

Quitclaim Deed Form Create Download For Free Pdf Word Formswift

Maryland Quitclaim Deed Ezlandlordforms

Maryland Quitclaim Deed Ezlandlordforms

Quitclaim Deed Form Create Download For Free Pdf Word Formswift

Quitclaim Deed Form Create Download For Free Pdf Word Formswift

Quitclaim Deed Information Guide Examples And Forms Deeds Com

Quitclaim Deed Information Guide Examples And Forms Deeds Com

Quit Claim Deed Form Nj 5 Great Quit Claim Deed Form Nj Ideas That You Can Share With Your F Quitclaim Deed Letter Templates Free Templates

Quit Claim Deed Form Nj 5 Great Quit Claim Deed Form Nj Ideas That You Can Share With Your F Quitclaim Deed Letter Templates Free Templates

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home