Motor Vehicle Property Tax Kentucky

Andrea Ash John Charlton Mary Lyons Published. Kentucky Revised Statute Section 64012 as amended by House Bill 537 mandates the following fee changes.

Motor Vehicles Mccracken County Pva Bill Dunn

Motor Vehicles Mccracken County Pva Bill Dunn

Processing Fees Payment Methods.

Motor vehicle property tax kentucky. Online KENTUCKY Vehicle Registration Renewal Portal. All-Terrain Vehicles Low-speed Vehicles and Alternative-speed Motorcycles. The owner of the vehicles cannot have overdue property taxes on any other vehicles they own.

Buying Selling Vehicles. AVIS contains ownership records and various facts on motor vehicles and is maintained by the Transportation Cabinet. The car registration and personal property taxes deduction is allowed when you are taxed based on the value of the car.

Payment shall be made to the motor vehicle owners County Clerk. The tax is collected by the county clerk or other officer with whom the vehicle is required to be registered. All Vehicle Licensing Information.

Users are instructed to input their VIN and instructions are provided as to where their VIN can be found. It is levied at six percent and shall be paid on every motor vehicle used in Kentucky. 2020 General Election Results.

Leased vehicles cannot be renewed online. Non-historic motor vehicles are subject to full state and local taxation in Kentucky. TurboTax will allow you to input multiple lines so list your car twice- once for each of these figures.

Motor Carriers Online Services. Kentucky Weight Distance KYU International Fuel Tax Agreement IFTA E-Filing. Please enter the VIN.

Where can I find my Vehicle Identification Number VIN. It is levied at 6 percent and shall be paid on every motor vehicle used in Kentucky. Search tax data by vehicle identification number for the year 2020.

Vehicles must be currently insured with a company that is registered with the Kentucky Department of Insurance to be eligible to renew online. Motor Vehicle Property Tax Motor Vehicle Property Tax is an annual tax assessed on motor vehicles and motor boats. Personalized And Specialty Plate Options.

Motor Vehicle Usage Tax is a tax on the privilege of using a motor vehicle upon the public highways of the Kentucky and shall be separate and distinct from all other taxes imposed by the Commonwealth. Selling a Vehicle to an Out-of-State Resident. On the drivers side of the dashboard viewable through the windshield.

Historic motor vehicles are subject to state taxation only. The state tax rate for historic motor vehicles is 25 cents per 100 of value. The vehicles renewed must have unexpired registrations.

1840 Simon Kenton Way Covington KY 41011. Since both of the tax charges you described are based on the cars value you may deduct both figures in Kentucky. Replacement or Duplicate Titles.

Home 2020 Vehicle Tax Information The look-up for vehicle tax paid in 2020 is available at the bottom of the drivekygov homepage. For more information or questions about Motor Vehicle fees call 5025745700 or correspond to us by e-mail. 551 PM EST February 22 2019.

M-F 730-400 pm Please see NEWS FEED for any special hours due to any election. Motor Vehicle Usage Tax Motor Vehicle Usage Tax is collected when a vehicle is transferred from one party to another. Kentucky Citizen to Kentucky Citizen.

The state tax rate for non-historic vehicles is 45 cents per 100 of value. Not all states collect an annual property tax on motor vehicles but Kentucky is one of them. Vehicle.

There will be a 1000 fee for a Replacement or a Second Disabled Placard. Kentucky residents in the military are required to pay Kentucky. The non-refundable online renewal service fee is a percentage of the transaction total and is assessed to develop and maintain the Online KENTUCKY Vehicle Registration Renewal Portal.

Motor Vehicle Tax Rate Book 2012-2013 Download the Taxpayer Bill of Rights The Kentucky Department of Revenue conducts work under the authority of the Finance and Administration Cabinet. Voting Locations for 2020. Kentucky VIN Lookup Vehicle Tax paid in 2020.

Vehicle Taxes Paid In Prior Year. Commercial Motor Vehicle Credentials. Please allow 5-7 working days for online renewals to be processed.

Kentucky Intrastate Tax KIT E-Filing. The centralized system for property tax assessments on motor vehicles is a piggyback programs supported by the Automated Vehicle Information System AVIS. Extended Weight Coal Haul Decals.

You can find the VIN.

Vehicle Title Tax Insurance Registration Costs By State For 2021

Vehicle Title Tax Insurance Registration Costs By State For 2021

Motor Vehicles Boats Martin County Clerk

Motor Vehicles Boats Martin County Clerk

Gift Card Give Back Louisvilleky Gov

Gift Card Give Back Louisvilleky Gov

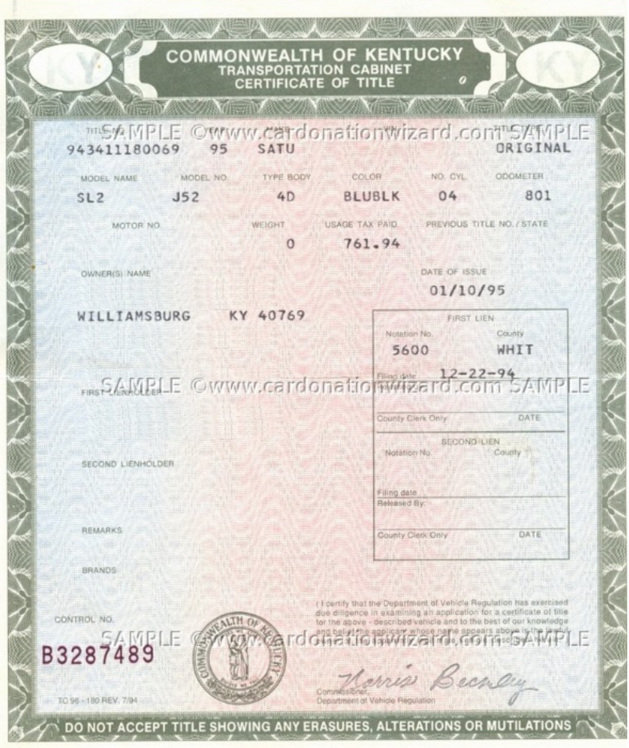

How To Sell A Car In Kentucky Transfer Ownership And More

How To Sell A Car In Kentucky Transfer Ownership And More

Nj Car Sales Tax Everything You Need To Know

Nj Car Sales Tax Everything You Need To Know

Motor Vehicles Boats Martin County Clerk

Motor Vehicles Boats Martin County Clerk

Kansas Motor Vehicle Power Of Attorney Form Tr 41 Power Of Attorney Form Power Of Attorney Power

Kansas Motor Vehicle Power Of Attorney Form Tr 41 Power Of Attorney Form Power Of Attorney Power

Enforced Collection Action Has Been Suspended Department Of Revenue

Enforced Collection Action Has Been Suspended Department Of Revenue

Hawaii Motor Vehicle Power Of Attorney Form Power Of Attorney Form Power Of Attorney Motor Car

Hawaii Motor Vehicle Power Of Attorney Form Power Of Attorney Form Power Of Attorney Motor Car

Richmond Ky Taxes Incentives Richmond Industrial Development Corporation

Richmond Ky Taxes Incentives Richmond Industrial Development Corporation

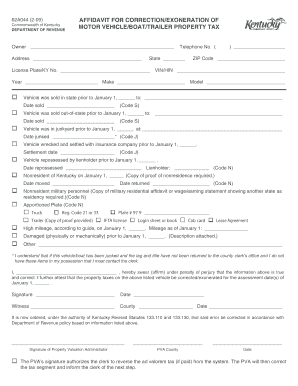

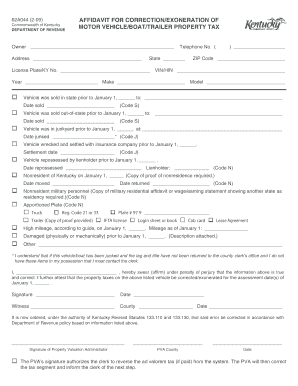

Ky Form 62a044 Fill Out And Sign Printable Pdf Template Signnow

Ky Form 62a044 Fill Out And Sign Printable Pdf Template Signnow

Kentucky Motor Vehicle Power Of Attorney Form Power Of Attorney Form Motor Car Power Of Attorney

Kentucky Motor Vehicle Power Of Attorney Form Power Of Attorney Form Motor Car Power Of Attorney

Kentucky Department Of Revenue

Lewis County Property Valuation Administrator

Lewis County Property Valuation Administrator

Vehicle Title Tax Insurance Registration Costs By State For 2021

Vehicle Title Tax Insurance Registration Costs By State For 2021

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home