Property Tax North New Jersey

Property taxes in New Jersey as is the case with most states are entirely used to fund local government operations. The General Tax Rate is a multiplier for use in determining the amount of tax levied upon each property.

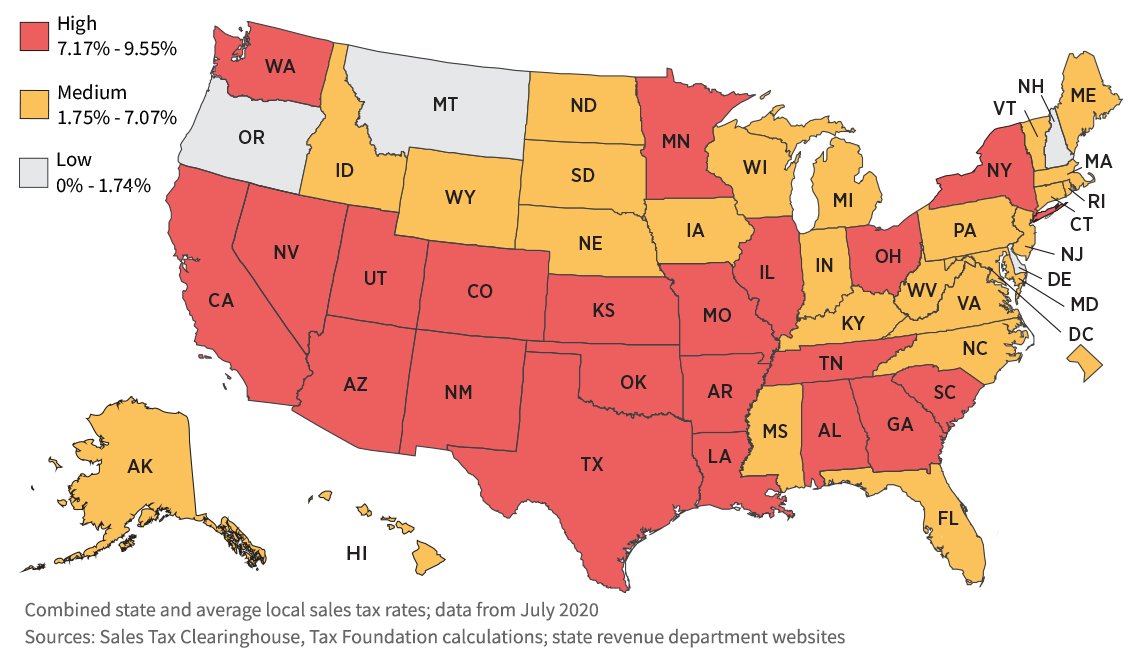

States With Highest And Lowest Sales Tax Rates

States With Highest And Lowest Sales Tax Rates

Of that 29 billion is from property taxes or 294 of total revenue.

Property tax north new jersey. A Bergen County homeowner making 150000 a year and owning a 600000 house can expect to pay as much as 12000 in property taxes and 5000 in state income taxes. The Tax Collector is responsible for the enforcement procedures for unpaid municipal charges which includes holding an annual tax sale for unpaid municipal charges. Counties in New Jersey collect an average of 189 of a propertys assesed fair market value as property tax per year.

North Bergen will soon begin its property tax revaluation which has been in the early phases for months. It is expressed as 1 per 100 of taxable assessed value. Any calendar year after 1998 in which property taxes levied for qualified property exceed the property taxes levied.

Homeowners including owners of mobile homes located in mobile home parks age 65 or older or receiving Federal Social Security disability benefits who paid property taxes on their principal residence in New Jersey either directly or through mobile home park site fees. New Jerseys average property taxes may have hit a new record high last year but you can find plenty of property tax bargains in all of of New Jerseys 21 counties. Example General Tax Rate.

Due to the COVID-19 Pandemic the State of New Jersey has extended their fiscal year until September 30 thAs in previous years this does not enable the Burlington County Tax Board to strike tax rates within the statutory timeline provided. Can I appeal my property tax bill. Although an employee of the municipality the Assessor works under the direction of the Somerset County Board of Taxation.

Applicants must be New Jersey. New Jersey has one of the highest average property tax rates in the country with only states levying higher property taxes. The base year will often be later if the following circumstances are met.

Due to a directive from the state of New Jersey and the Hudson County Board of. It does this by showing what your tax rate would look like if every house was assessed at 100 percent of what it will get on the open market. 263 Somerset Street North Plainfield New Jersey 07060.

Department of the Treasury Division of Taxation PO Box 281 Trenton NJ 08695-0281. The average equalized tax rate in New Jersey. The median property tax in New Jersey is 657900 per year for a home worth the median value of 34830000.

The state and its local governments collect an annual total revenue of 999 billion. The Assessors office is a quasi-judicial position whose statutory authority is based in the New Jersey Constitution. All unpaid municipal charges are subject to Tax.

A reba te is triggered is when the property tax rate in the current year has dropped compared to 1998 which is called the base year NJSA. 587 rows 2020 New Jersey Property Tax Rates and Average Tax Bills Scroll down for a tax rate. Assessed Value 150000 x General Tax Rate 03758 Tax.

This rate is used to compute the tax bill. A division of the Finance Office the Tax Collector bills and collects all property taxes. Impact on New Jersey and.

Tax Collector S Office City Of Englewood Nj

The Cost Of Living In New Jersey Smartasset

The Cost Of Living In New Jersey Smartasset

Here Are The 30 N J Towns With The Lowest Property Taxes Nj Com

Here Are The 30 N J Towns With The Lowest Property Taxes Nj Com

Historical New Jersey Tax Policy Information Ballotpedia

Historical New Jersey Tax Policy Information Ballotpedia

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Here Are The Towns With The Lowest Property Taxes In Each Of N J S 21 Counties Nj Com

Here Are The Towns With The Lowest Property Taxes In Each Of N J S 21 Counties Nj Com

States With The Highest And Lowest Property Taxes Property Tax Tax States

States With The Highest And Lowest Property Taxes Property Tax Tax States

New Hampshire Property Tax Calculator Smartasset

New Hampshire Property Tax Calculator Smartasset

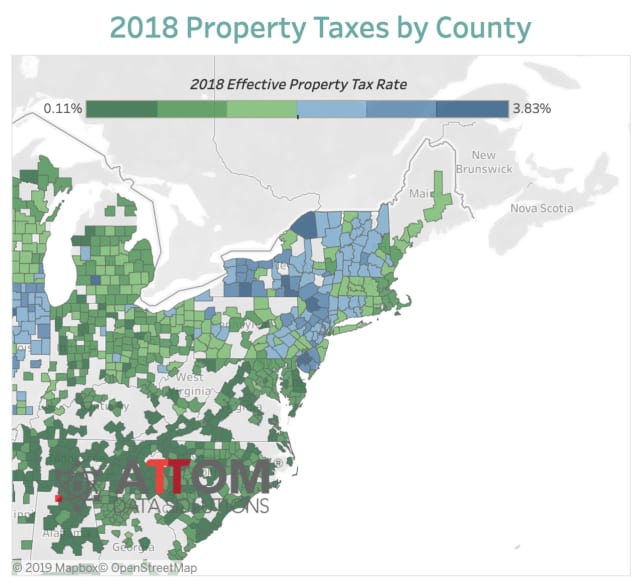

Interactive Map Where Nj S High Property Taxes Are Highest And Lowest Nj Spotlight News

Interactive Map Where Nj S High Property Taxes Are Highest And Lowest Nj Spotlight News

New Jersey Tax Forms 2020 Printable State Nj 1040 Form And Nj 1040 Instructions

New Jersey Tax Forms 2020 Printable State Nj 1040 Form And Nj 1040 Instructions

Here Are The Towns With The Lowest Property Taxes In Each Of N J S 21 Counties Nj Com

Here Are The Towns With The Lowest Property Taxes In Each Of N J S 21 Counties Nj Com

Bergen County Tax Rates For 2018 2019 Michael Shetler

Bergen County Tax Rates For 2018 2019 Michael Shetler

Here Are The 30 N J Towns With The Lowest Property Taxes Nj Com

Here Are The 30 N J Towns With The Lowest Property Taxes Nj Com

Property Tax Definition History Administration Rates Britannica

Property Tax Definition History Administration Rates Britannica

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Here Are The 30 N J Towns With The Lowest Property Taxes Nj Com

Here Are The 30 N J Towns With The Lowest Property Taxes Nj Com

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home