Property Tax Assessment Jefferson County Colorado

The County Treasurer does NOT. Raise or lower taxes.

Jefferson County has published a list of property owners who are late paying their property taxes.

Property tax assessment jefferson county colorado. OR Taxes may be paid by mail. Find documents and forms related to the Assessors office. Visa Debit for Property Taxes only not Water Sewer Assessments You must select Visa Debit in drop.

Box 2112 Beaumont TX 77704-2112. Find questions people ask the Jefferson County Assessor. The median property tax in Jefferson County Colorado is 180500 All of the Jefferson County information on this page has been verified and checked for accuracy.

The Sheriffs Office collection of the 2020 Taxes starts on November 2 2020. Taxes are Impacted by the voters and county commissioners. The Jefferson County Tax Assessor is charged with responsibility to discover list assess apply exemptions abatements current use and process real and personal property tax returns.

The Jefferson County GIS tax map system is considered the leader in the state of Alabama. OR Taxes may be paid by creditdebit cards or e-check by calling 1-866-549-1010. Jefferson County Tax Collector JT.

Bureau code is 2228888. 2021 Assessor Property Records Search Jefferson County CO. The median property tax in Jefferson County Colorado is 1805 per year for a home worth the median value of 259300.

You can search your Real Estate Taxes by Property ID Owner Name or Property Address and Personal Property Taxes by Business Tax Number or Business Name. This is your one-stop-shop to find all of the change of address forms you need to inform the Jefferson County Assessors Office of an address change. The current assessment percentage is 29 with a mill levy of 83762.

We create and update GIS maps with multi layers of data. 100 Jefferson County Parkway. Birmingham AL 35203 205 325-5500.

The assessment process involves setting standards for fair and equitable values discovering and listing information about properties and determining property values. If a mortgage company pays your taxes you may wish to mail a copy of your notice to your lender. The City of Wheat Ridge maintains the lowest property tax rate in the Denver Metro Area with a mill levy of just 1806.

E-check We do not accept HR Block cards as they require a 30 day hold. 716 Richard Arrington Jr Blvd N. Change of Address Forms.

Jefferson County collects on average 07 of a propertys assessed fair market value as property tax. Taxes Mortgage Companies Colorado law requires the Jefferson County Treasurer to mail a notice of property taxes to each owner of record even though a mortgage company may be responsible for making the payment. Contact the Assessors Office.

Allison Nathan Getz Assessor-Collector of Taxes Jefferson County Tax Office P. Welcome to Jefferson County Tax Assessor web site. All other debit cards are charged at 25 395.

Down menu on the next payment screen. The mailing address is. 2021 Assessor Property Records Search Jefferson County CO.

The Jefferson County Treasurer collects property taxes invest funds disburses money to cities and districts and acts as county banker. The Jefferson County Assessor determines the actual market value of your property the Colorado Legislature sets the assessment percentage and the taxing agencies set the mill levies. If any of the links or phone numbers provided no longer work please let us know and we will update this page.

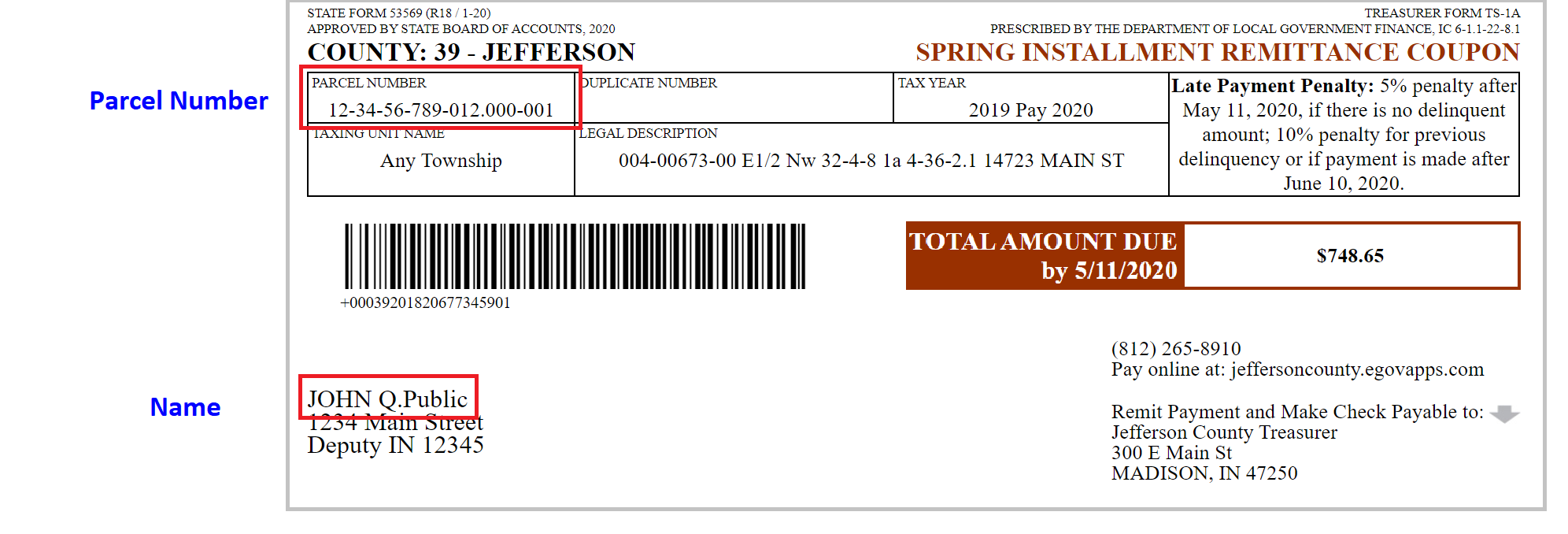

2021 Treasurer Property Records Search Jefferson County CO. Payments are posted according to the USPS. The Property and Taxes center is the place to find the main areas for residents to find information they need from multiple Jefferson County departments divisions and elected offices on both property and what is needed for taxes.

Jefferson County has one of the highest median property taxes in the United States and is ranked 563rd of the 3143 counties in order of median property taxes.

Appeal Property Tax 2015 Copernicus Center Property Tax Tax Appealing

Appeal Property Tax 2015 Copernicus Center Property Tax Tax Appealing

Say Goodbye To Disproportionately High Property Tax Bills Property Tax Property Residential

Say Goodbye To Disproportionately High Property Tax Bills Property Tax Property Residential

Https Www Jeffco Us Documentcenter View 21255 Property Taxes And Property Values During A Pandemic

Personal Exemptions Maricopa County Assessor S Office Person Maricopa County County

Personal Exemptions Maricopa County Assessor S Office Person Maricopa County County

Tax Exemption Could Save Elderly Residents Thousands On Property Taxes

Tax Exemption Could Save Elderly Residents Thousands On Property Taxes

Guide To Central Pennsylvania Property Taxes Century 21 Core Partners

Guide To Central Pennsylvania Property Taxes Century 21 Core Partners

The Market Monster Is Gobbling Up Homes We Need Your House Colorado Real Estate Real Estate Marketing Real Estate Tips

The Market Monster Is Gobbling Up Homes We Need Your House Colorado Real Estate Real Estate Marketing Real Estate Tips

Notifications From The Treasurer Jefferson County Co

My Property Tax Bill Keeps Going Up Why Does Jeffco Need To Ask For Money Jefferson County Co

Notifications From The Treasurer Jefferson County Co

Labels: assessment, county, jefferson, property

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home