Property Tax Rate The Woodlands Tx

Wednesday September 18 2019 at The Woodlands Township Town Hall 2801 Technology Forest Boulevard in The Woodlands Texas. Imperial Oaks Tax Rate.

Service After Sale The Houston Region To All Of My Buyers Request To Correct Name Or Address On A Real Property Accoun Tax Forms Harris County Accounting

Service After Sale The Houston Region To All Of My Buyers Request To Correct Name Or Address On A Real Property Accoun Tax Forms Harris County Accounting

Counties in Texas collect an average of 181 of a propertys assesed fair market value as property tax per year.

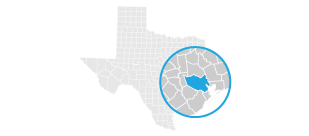

Property tax rate the woodlands tx. Property tax in The Woodlands Texas almost always takes the form of a tax levied on the appraised value of the property in question. Windsor Lakes part of the City of Conroe pays no MUD tax or Township tax. The Village of Creekside Park in The Woodlands Tax Rate.

Hc emerg srv dist 11. The tax rate is 335 Download 2021 New Construction Tax Comparison. The information set forth in this website is not intended to be an offer to sell nor a solicitation of offers to buy property in The Woodlands Hills by residents of Connecticut Hawaii Idaho New Jersey Oregon Pennsylvania or South Carolina or any other jurisdiction.

This information has been compiled from several sources. Zillow has 9 homes for sale in The Woodlands TX matching Tax Rate. Trims property tax rate.

The County sales tax rate is 0. The Village of Indian Springs in The Woodlands Tax Rate. View listing photos review sales history and use our detailed real estate filters to find the perfect place.

Town Center pays a Township tax 0224 plus Town Center Owners Association fee 018. View listing photos review sales history and use our detailed real estate filters to find the perfect place. Tax amount varies by county.

The Woodlands Township Board of Directors approved a tax rate of 2273 cents per 100 of taxable property value. Property tax rates in the US. The median property tax in Texas is 227500 per year for a home worth the median value of 12580000.

266 Homes for Sale. MUD County School District and Township is. Tax rates are subject to change.

This years no-new-revenue tax rate. Residents pay Conroe city tax 04375 plus monthly HOA fee of 19400-30400. Canyon Creek Tax Rate.

Range from 02 to around 5 of the propertys value. 3 After seven different failed attempts spread over two meetings in one week The Woodlands Township Board of Directors begrudgingly approved the 2020 property tax rate lowering the rate from. Woodlands board sets 2021 budget at 127M.

Four states impose gross receipt taxes Nevada Ohio Texas and Washington. The Woodlands Property Tax Rates. 235 Homes for Sale.

Creekwood Acres Tax Rate. 254 rows Property taxes in Texas are the seventh-highest in the US as the average effective. Harris-montgomery co mud 386.

- Single standard deduction one exemption - Sales Tax includes food and services where applicable - Real tax taxes are based on the local median home price - Car taxes. The total tax rate is 2231 cents per 100 of taxable property value which is a decrease from the current year tax rate of 2240 cents. The Village of Sterling Ridge in The Woodlands Tax Rate.

231 Homes for Sale. The Texas sales tax rate is currently 625. The The Woodlands sales tax rate is 0.

In most cases the voter-approval tax rate is the highest tax rate a taxing unit can adopt without holding an election. 259 per 100 valuation in 2010 This rate can vary depending on your county Harris County or Montgomery County your school district Conroe ISD or Tomball ISD your owners association and other factors. Zillow has 16 homes for sale in The Woodlands TX matching Low Tax Rate.

THE WOODLANDS TEXAS The Woodlands Township Board of Directors held its regular meeting on Wednesday August 22 2018 where it lowered the 2018 property tax rate and adopted the 2019 budget. The minimum combined 2021 sales tax rate for The Woodlands Texas is 825. THE WOODLANDS TEXAS September 20 2019 The Woodlands Township Board of Directors held a special meeting to adopt the 2019 Tax Rate at 6 pm.

Adopted by The Woodlands Township Board of Directors on September 10 2020. The preliminary property tax rate was set at 2231 cents per 100 of valuation of a. 95 rows Property tax tates for all 1018 Texas independent school districts are available by clicking.

The rates are given per 100 of property value. The total average tax rate for The Woodlands TX including. In order to levy this tax the tax authorities in The Woodlands Texas must have an uniform formula for figuring out the value of a given piece of property.

The Woodlands Township Board sets property tax rate at 224 cents. In each case these rates are calculated by dividing the total amount of taxes by the current taxable value with adjustments as required by state law. This is the total of state county and city sales tax rates.

Tax Rate The Woodlands Real Estate 4 Homes For Sale Zillow

Tax Rate The Woodlands Real Estate 4 Homes For Sale Zillow

What If You Could Buy A 100000 Property For 15000 Heres How Realestate Business Https T Co 9mhfxoz3ul Property Tax Buying Property Real Estate Buying

What If You Could Buy A 100000 Property For 15000 Heres How Realestate Business Https T Co 9mhfxoz3ul Property Tax Buying Property Real Estate Buying

14 Libretto Court The Woodlands Tx 77382 Photos Videos More Woodland House Huntington Homes Outdoor Living Areas

14 Libretto Court The Woodlands Tx 77382 Photos Videos More Woodland House Huntington Homes Outdoor Living Areas

Harris County Tx Property Tax Calculator Smartasset

Harris County Tx Property Tax Calculator Smartasset

Tax Rate The Woodlands Real Estate 4 Homes For Sale Zillow

Tax Rate The Woodlands Real Estate 4 Homes For Sale Zillow

70 Mediterra Way The Woodlands Tx 77389 Zillow Woodlands Woodland Zillow

70 Mediterra Way The Woodlands Tx 77389 Zillow Woodlands Woodland Zillow

December 2015 Market Reports Real Estate Marketing Marketing Texas Real Estate

December 2015 Market Reports Real Estate Marketing Marketing Texas Real Estate

Tax Rate The Woodlands Real Estate 4 Homes For Sale Zillow

Tax Rate The Woodlands Real Estate 4 Homes For Sale Zillow

How To Read Your Property Tax Bill O Connor Property Tax Reduction Experts Property Tax Tax Reduction Tax

How To Read Your Property Tax Bill O Connor Property Tax Reduction Experts Property Tax Tax Reduction Tax

States With The Highest And Lowest Property Taxes Property Tax Social Studies Worksheets States

States With The Highest And Lowest Property Taxes Property Tax Social Studies Worksheets States

Whether It S A 300 000 Condo Or A 4 000 000 Home Stuff Happens Sell My House Buy My House We Buy Houses

Whether It S A 300 000 Condo Or A 4 000 000 Home Stuff Happens Sell My House Buy My House We Buy Houses

Tax Rate The Woodlands Real Estate 4 Homes For Sale Zillow

Tax Rate The Woodlands Real Estate 4 Homes For Sale Zillow

9 Best Tax Laws Ranked By State Tax Relief Center State Tax Tax Help Tax Rules

9 Best Tax Laws Ranked By State Tax Relief Center State Tax Tax Help Tax Rules

Property Photo Dream House Exterior Home Building Design Luxury Homes Dream Houses

Property Photo Dream House Exterior Home Building Design Luxury Homes Dream Houses

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home