How Do You Calculate Property Plant And Equipment

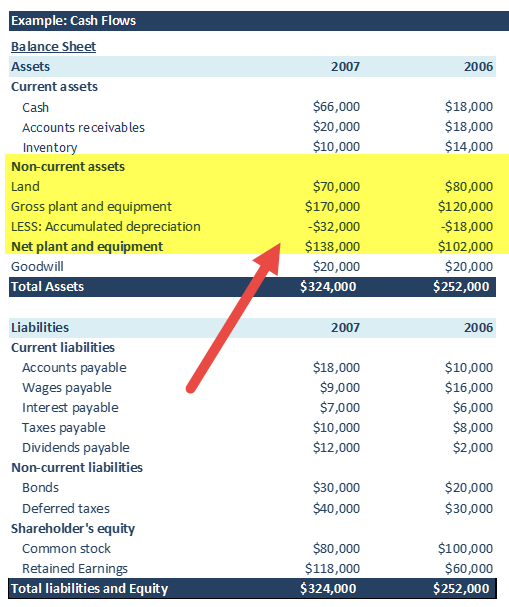

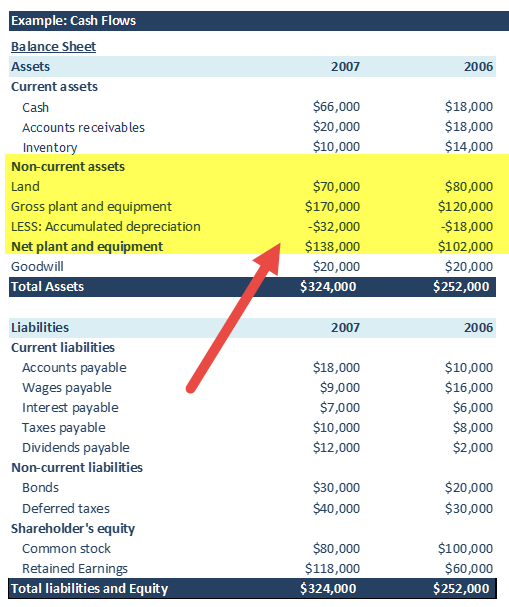

This video shows how to calculate an impairment of Property Plant and Equipment according to Generally Accepted Accounting Principles in the United States. Cash outflow from purchase of property plant and equipment PPE 120000 170000 -50000.

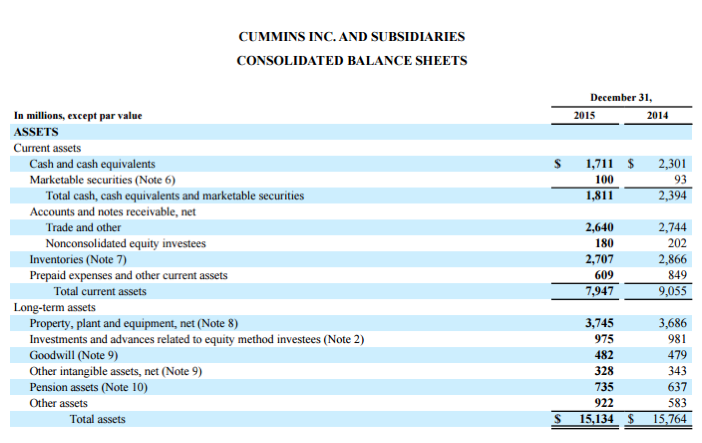

Property Plant And Equipment Pp E Formula Calculations Examples

Property Plant And Equipment Pp E Formula Calculations Examples

Calculate the ratio of the lands value to the total property assessment and the ratio of the buildings value to the total property.

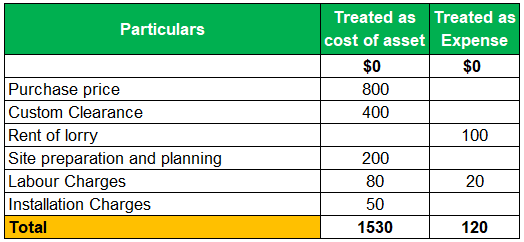

How do you calculate property plant and equipment. How Book Value of Assets Works. The cost of property plant and equipment includes the purchase price of the asset and all expenditures necessary to prepare the asset for its intended use. Calculate each assets percent of market value Asset market value total market value of all assets.

We will do a 2-step process to get the cost of each asset. Land purchases often involve real estate commissions legal fees bank fees title search fees and similar expenses. The Cost of Property Plant Equipment.

Visit httpsbitly2UVN2UQ for more infoHOW DOES TABALDI HELP YOU PASS FAC2601Tabaldi helps students pass. Cash paid for purchase of equipment has been computed as the balancing figure of the T-account. Computation of cash paid for purchase of equipment.

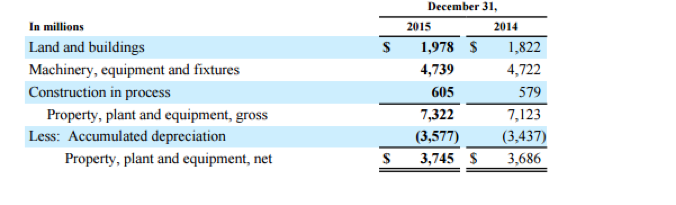

Cash flow from Investments formula Cash inflow from Sale of Land Cash outflow from. The formula for PPE Turnover is simply total revenue from the income statement divided by ending PPE from the balance sheet. The calculation of book value for an asset is the original cost of the asset minus the accumulated depreciation where accumulated depreciation is the average annual depreciation multiplied by the age of the asset in years.

This means we generated 4 in sales revenue for every 1 of PPE. The cash paid for purchase of equipment may be computed by preparing a t-account. We cannot report the assets at market value since the market value is less than we paid for the assets.

Once an assets cost is capitalized it will be written off periodically or depreciated in a systematic manner over the estimated. Property tax assessments will provide a total assessed value of the property land and building as well as a value for the building alone and the land alone. Youd need the intellectual property too including items such as the brand name trademarks and trade secrets.

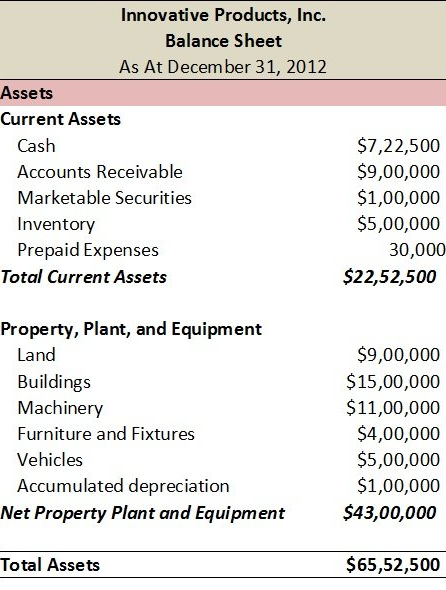

Property Plant and Equipment Property plant and equipment also called tangible fixed assets is a class of assets which have physical existence which are held for a companys internal use and which are expected to generate economic benefits for the company over more than one year. You could have the exact same property plant and equipment and you wouldnt be able to do much damage to Colgate-Palmolive because it has centuries of lead time in getting people to trust its products. 138000 22500 123500 10000 27500.

CUNYs policy to maintain accurate and complete records of property plant and equipment and to capitalize and depreciate these assets according to appropriate accounting tax and regulatory requirements. Cash inflow from sale of Land Decrease in Land BS Gain from Sale of Land 80000 70000 20000 30000. There are two main items in non-current assets Land and Property Plant and Equipment.

Want more free videos to help you pass FAC2601. If we have 8000 in revenue this year and divide that by property plant and equipment investments worth 2000 our PPE Turnover is. 8000 2000 4.

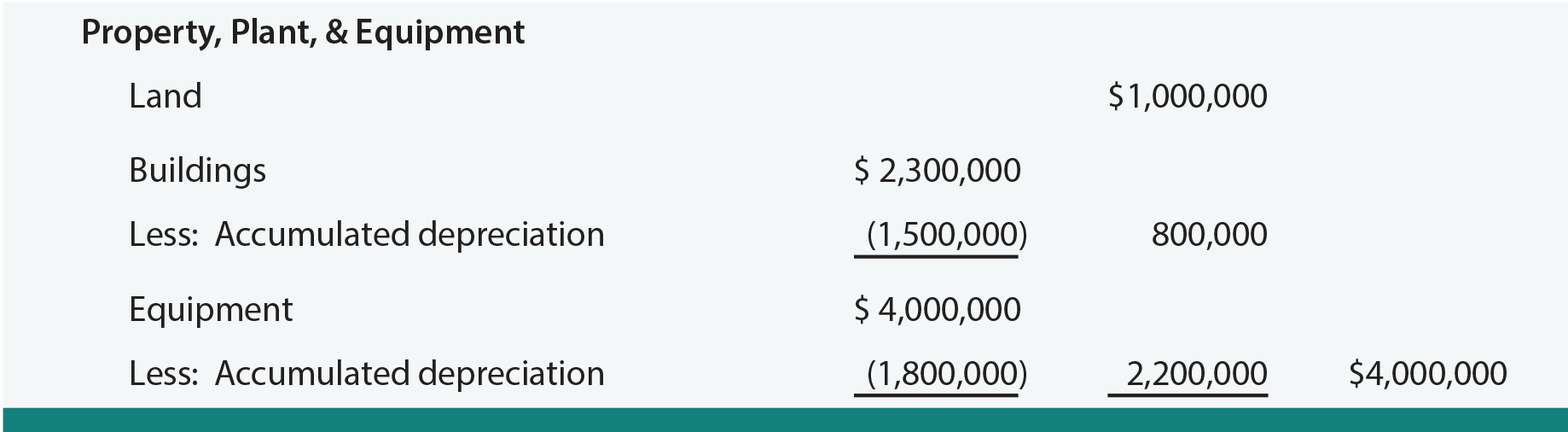

Property plant and equipment is initially measured at its cost subsequently measured either using a cost or revaluation model and depreciated so that its depreciable amount is allocated on a systematic basis over its useful life.

Pp E Property Plant Equipment Overview Formula Examples

Pp E Property Plant Equipment Overview Formula Examples

:max_bytes(150000):strip_icc()/dotdash_Final_Property_Plant_and_Equipment_PPE_Sep_2020-01-dd61e2f2fdb7481d81e95bc90b5c61d8.jpg) Property Plant And Equipment Pp E Definition

Property Plant And Equipment Pp E Definition

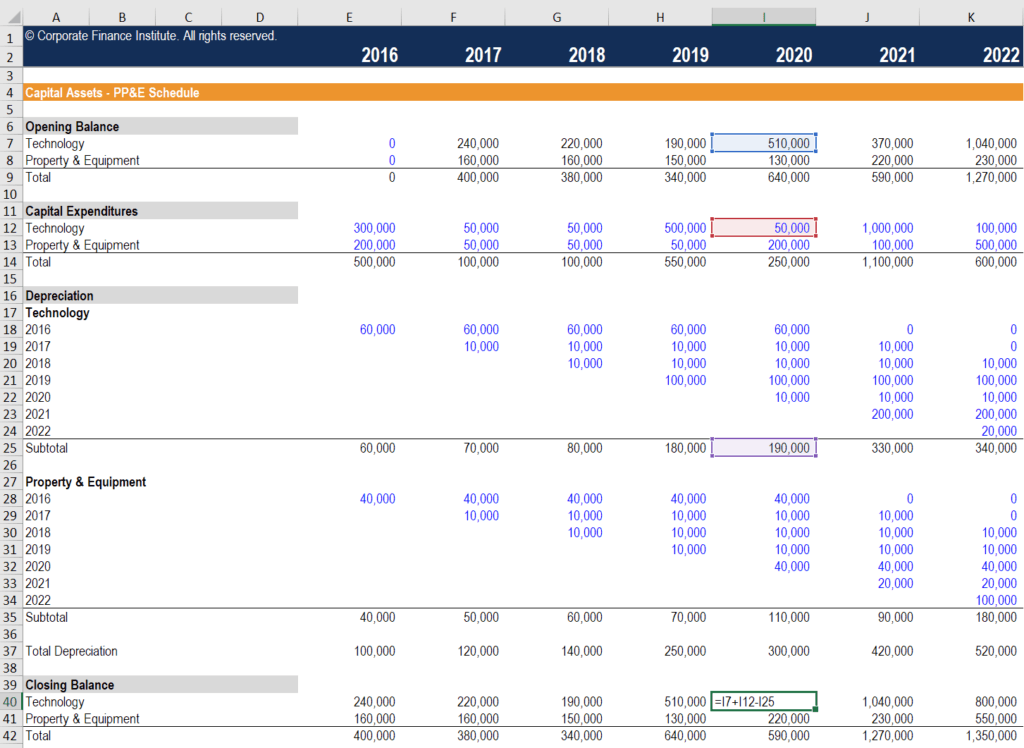

Property Plant And Equipment Schedule Template Download Free Excel

Property Plant And Equipment Schedule Template Download Free Excel

:max_bytes(150000):strip_icc()/dotdash_Final_How_Current_and_Noncurrent_Assets_Differ_Oct_2020-01-e74218e547134e3db0ac9e9a7446d577.jpg) Current And Noncurrent Assets The Difference

Current And Noncurrent Assets The Difference

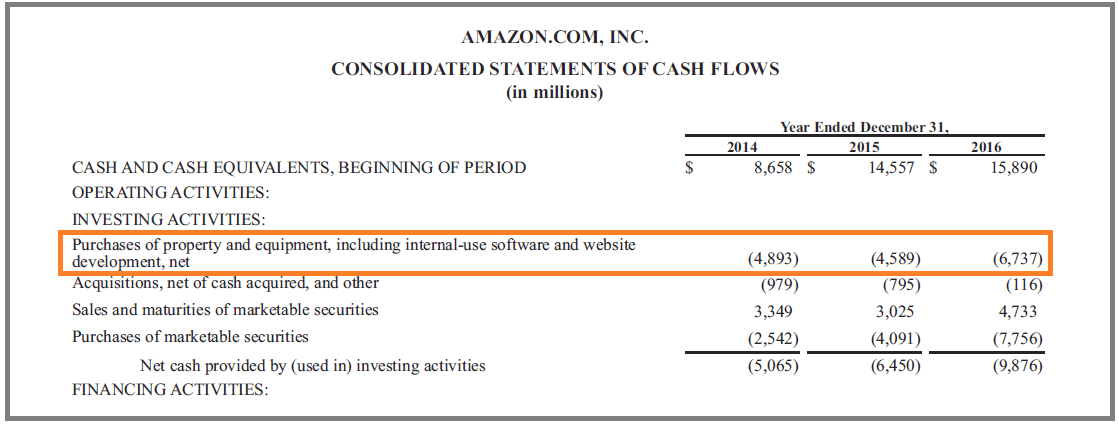

Cash Flow From Investing Activities Formula Calculations

Cash Flow From Investing Activities Formula Calculations

Property Plant And Equipment Pp E Formula Calculations Examples

Property Plant And Equipment Pp E Formula Calculations Examples

Pp E Property Plant Equipment Overview Formula Examples

Pp E Property Plant Equipment Overview Formula Examples

What Costs Are Included In Property Plant Equipment Principlesofaccounting Com

What Costs Are Included In Property Plant Equipment Principlesofaccounting Com

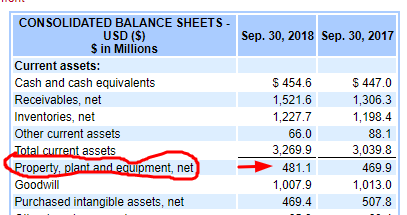

Property Plant And Equipment Pp E Net Financial Edge

Property Plant And Equipment Pp E Net Financial Edge

Property Plant And Equipment Pp E Net Financial Edge

Property Plant And Equipment Pp E Net Financial Edge

Pp E Property Plant Equipment Overview Formula Examples

Pp E Property Plant Equipment Overview Formula Examples

Capital Expenditure Capex Guide Examples Of Capital Investment

Capital Expenditure Capex Guide Examples Of Capital Investment

Plant Assets What Are They And How Do You Manage Them The Blueprint

Plant Assets What Are They And How Do You Manage Them The Blueprint

Property Plant And Equipment Ppe Covering Financials Reynolds Center

Property Plant And Equipment Ppe Covering Financials Reynolds Center

Maintenance Capital Expenditures The Easy Way To Calculate It

Maintenance Capital Expenditures The Easy Way To Calculate It

Property Plant And Equipment Ppe Covering Financials Reynolds Center

Property Plant And Equipment Ppe Covering Financials Reynolds Center

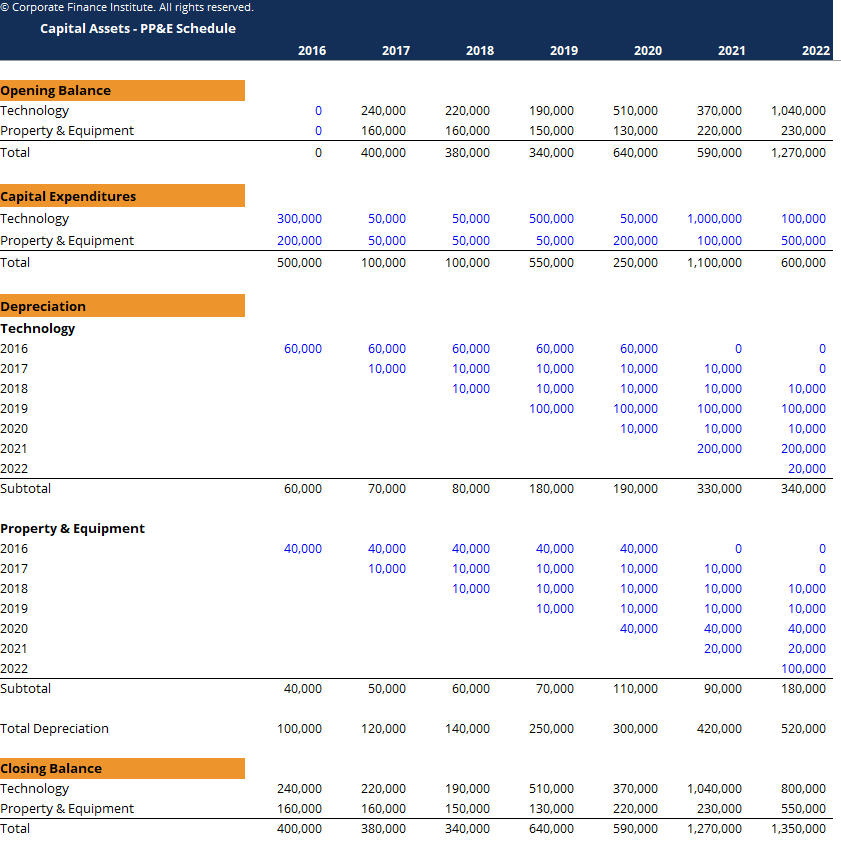

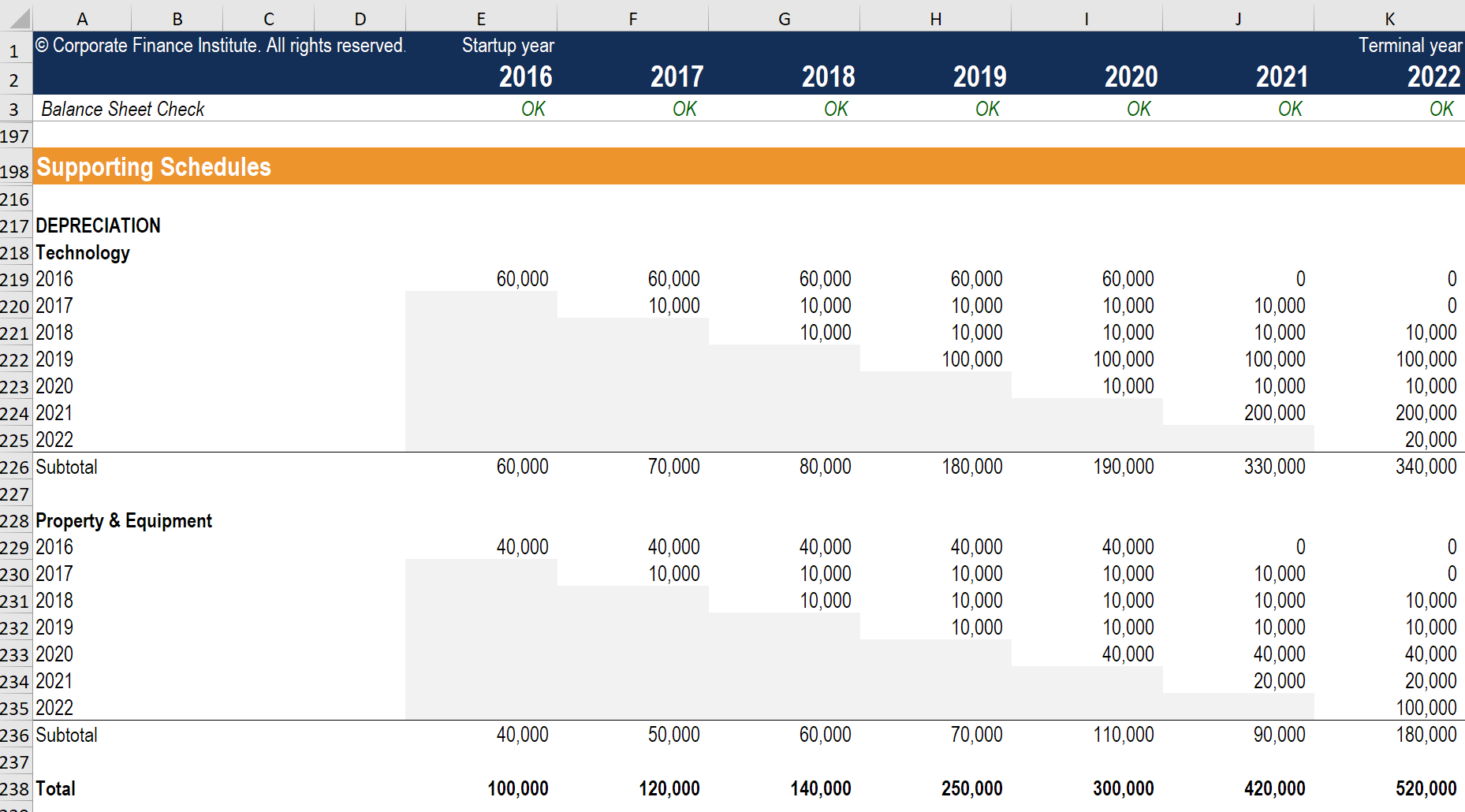

Depreciation Schedule Guide Example Of How To Create A Schedule

Depreciation Schedule Guide Example Of How To Create A Schedule

/ExxonLongtermAssets2018-5c5485414cedfd0001efdb2c.jpg)

/ExxonLongtermAssets2018-5c5485414cedfd0001efdb2c.jpg)

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home