How Do I Find My Property Tax Assessment

How to Challenge Your Assessment. Nassau County Tax Lien Sale.

How To Calculate Real Estate Property Taxes Appeal Your Assessment Property Tax Estate Tax Real Estate

How To Calculate Real Estate Property Taxes Appeal Your Assessment Property Tax Estate Tax Real Estate

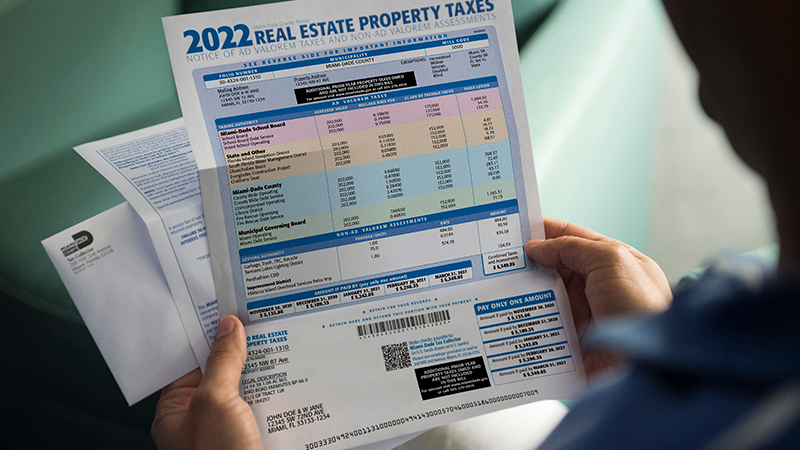

Each year property taxpayers receive three notices that provide information on the valuation of the property proposed tax amounts meetings about proposed levies and budgets and the amount of taxes due.

How do i find my property tax assessment. Most questions about property appraisal or property tax should be addressed to your countys appraisal district or tax assessor-collector. Most state and local tax authorities calculate property taxes based on the value of the homes located within their areas and some agencies also tax personal property. Some states include mapping applications whereby one may view online maps of the property and surrounding areas.

The Comptrollers office does not have access to your local property appraisal or tax information. For example on a 300000 home a millage rate of 0003 will equal 900 in taxes owed 0003 x 300000 assessed value 900. Welcome to our new Real Property landing page.

This 1099-G form is for taxpayers who itemized deductions and received a refund credit or offset. Rules of Procedure PDF Information for Property Owners. If you pay either type of property tax claiming the tax deduction is a simple matter of itemizing your personal.

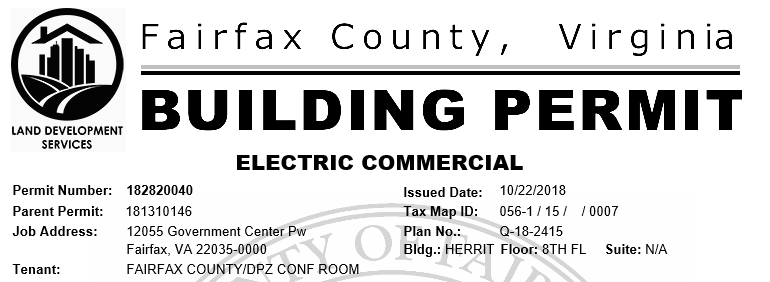

How is the value of my property determined. Property is classified based on how the property is used. Navigate to property information and.

If you have questions about personal property tax or real estate tax contact your local tax office. Find the IRS Form 1099G for Unemployment Insurance Payments which is issued by the. Appraisal districts can answer questions about.

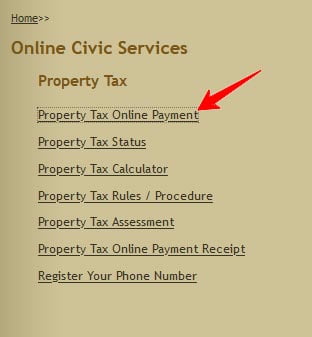

Scroll down to select the content youre looking for regarding local property tax and assessment administration. Many states offer online access to assessment records that may be searched by property address property id number and sometimes by owner name. This protection extends to your rights privacy and property.

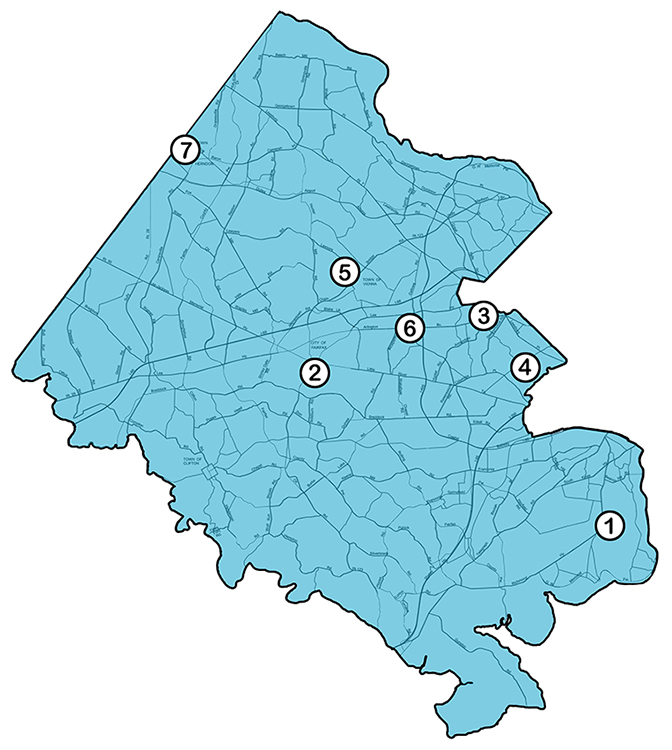

If you dont remember your 5 digit PINa you do have another option moving forward. Use the map below to find your city or countys website to look up rates due dates payment information and contact information. Statutory assessment percentages are applied to.

Contact your states department of revenue to find out your rights and whether you have a taxpayer advocate or ombudsman. Log on to the website of the local county recorders office in the county in which the property is located. You can find a digital copy of your current Notice of Valuation by going to the Find Details on your Property Tax Notice page and entering your Parcel Number.

You can use the IRS Get My Payment site to see what is expected for your 3rd stimulus check. The first notice a valuation notice is. The Self-Select PIN is a random 5-digit number that you enter as your electronic signature when e-filing your.

To put it all together take your assessed value and subtract any applicable exemptions for which youre eligible and you get the taxable value of your property. TurboTax cannot track your 3rd stimulus or tell you when it will arrive. Weve redesigned the page to provide easy access to content and tools for property owners local officials and real estate professionals.

While youre here enter your email address in the Subscribe box to sign up for our Tax Tips for Property Owners email list. If youre having trouble viewing or using the map below use the map here instead. Your areas property tax levy can be found on your local tax assessor or municipality website and its typically represented as a percentagelike 4.

Taxpayers now can search for their 1099-G and 1099-INT on the Georgia Tax Center by selecting the View your form 1099-G or 1099-INT link under Individuals. Find State and Local Personal Income Tax Resources. Then multiply the product by the tax rate.

Information on how to apply for an exemption along with other property-assessment-related information can be found at kingcountygovassessor. Agricultural and special appraisal. Assessment Challenge Forms Instructions.

The value and property type of your home or business property is determined by the Salt Lake County Assessor. Property owners can find tax levy rates and more property related information by visiting the eReal Property Search on the King County Assessors website or by calling 206-296-7300. Results may include owner name tax valuations land characteristics and sales history.

The IRS is issuing 3rd stimulus checks on its own timetable. If you pay taxes on your personal property and owned real estate they may be deductible from your federal income tax bill. To calculate your property tax multiply the appraised value by the assessment ratio for the propertys classification.

Your state taxpayer advocate can offer protection during the assessment and collection of taxes.

Read more »Labels: assessment, property