Property Tax Assessment Lee County Fl

Failure or late filing of a return will result in a penalty andor additional costs. Please view our reminder notice explanation brochure for more information on the Lee County real estate property tax reminder notice.

Florida Property Taxes Explained

Florida Property Taxes Explained

Use the Quick Property Search below to find your parcel then click the Tax Estimator link.

Property tax assessment lee county fl. There are two types of ad valorem or property taxes collected by the Lee County Tax Collectors office -- real estate property taxes and tangible personal property taxes. In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property. Lee County Clerk of Court FL Home Menu.

Lee County has one of the highest median property taxes in the United States and is ranked 364th of the 3143 counties in order of median property taxes. Sales Dates Times. A Tangible Personal Property Tax Return DR-405 must be filed with the Property Appraiser by April 1 each year.

If the taxes remain unpaid up to June the property is at risk of having a tax certificate issued. Real estate property taxes also referred to as real property taxes are a combination of ad valorem and non-ad valorem assessments. Home FAQ Records Request Employment FeesCosts.

They are levied annually. For the purposes of this Estimator we use the tax rate from the immediately previous tax year. The median property tax in Lee County Florida is 2197 per year for a home worth the median value of 210600.

Ad valorem taxes are based on the value of property. Taxes have to be paid in full and at one time unless the property owner has filed. Tax Estimator see an estimate of the real estate taxes on the selected property.

As the author of numerous Constitutional Amendments including Save Our Homes Working Waterfronts and Portability Ken set a standard of excellence for public service. Property Fraud Alert Service. Lee County collects on average 104 of a propertys assessed fair market value as property tax.

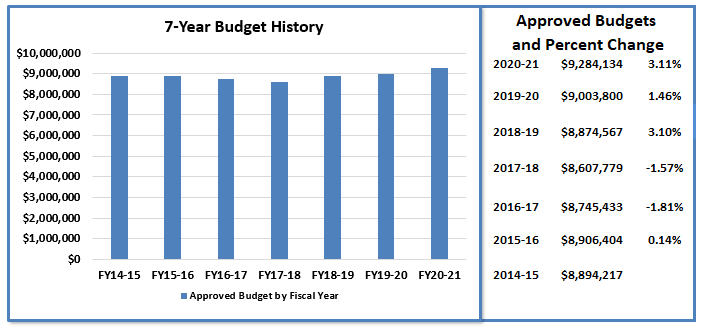

Historically tax rates have fluctuated within a fairly narrow range. There are two types of ad valorem or property taxes collected by the Lee County Tax Collectors office -- real estate property taxes and tangible personal property taxesFlorida property taxes are relatively unique because. In 2020 Matt was elected to serve as the Lee County Property Appraiser following the retirement of 40-year incumbent Ken Wilkinson.

Help with STRAP Number Folio ID searches. 22 2016 please use RealTDM Instructions. Payment of property taxes and billing of property taxes is handled by the Lee County Tax Collectors Office.

Yearly median tax in Lee County. The median property tax on a 21060000 house is 219024 in Lee County. They are levied annually.

Lee County personal property tax form for rental properties such as Single FamilyTownhouses Duplexes Condos or Co-ops. TPP Tax Return for Rentals. Lee County Property Appraiser.

If you are a business owner you will receive a Lee County tangible personal property tax notice. Non-ad valorem assessments are fees for specific services such as solid waste disposal water management sewer storm water and special improvements. The median property tax on a 21060000 house is 204282.

Inspector General Hotline Search. The Tax Collector prints mails and collects tax payments based on information contained in the current tax. Unrecorded Plats and Maps Official Records Lists of Unrecorded plats and maps.

Taxes have to be paid in full and at one time unless the property owner has filed for the installment program or for homestead tax deferrals. The actual tax rate used to calculate property taxes is set every year by the various taxing authorities in Lee County. Property taxes are assessed by Lee County Property Appraisers.

Already a homeowner in Florida with a Homestead exemption. If the documents you are searching for are not in RealTDM. If your Lee County property taxes go delinquent a reminder notice will be sent to inform you of the back taxes due.

Our staff is committed to effectively and efficiently serving the needs of the community with the best possible customer service. Property Sales Information Courts Foreclosure Tax Deed Sales. In-depth Lee County FL Property Tax Information.

Tax Deed sales are held online on Tuesdays starting at 10 am. Apply for Homestead and other exemptions. Florida property taxes are relatively unique because.

Welcome to the Tax Collectors Office serving the citizens of Lee County with a variety of convenient online services and valuable information. Search Using Property Information. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Lee County Tax Appraisers office.

Name Company Last name first. Taxes Property Lee County Tax Collector. Do not use this form for businesses leasing companies and income properties hotels motels apartment complexes warehouses storage facilities commercial rental properties see Tangible.

To search for documents related to sales on or after Nov. X Real Property Search. Parcel STRAP Number or Folio ID.

Https Floridarevenue Com Property Documents All County 202016 20dr 493s Pdf

Lee County Florida Property Search And Interactive Gis Map

Lee County Florida Property Search And Interactive Gis Map

Home Watch Maintenance Business For Sale 6684 Home Maintenance Home Maintenance Schedule Home Maintenance Checklist

Home Watch Maintenance Business For Sale 6684 Home Maintenance Home Maintenance Schedule Home Maintenance Checklist

Realestate Capecoral Leecounty Excelsiorgroup Househunting Flrealtors St Petersburg Fl St Petersburg Florida Petersburg Florida

Realestate Capecoral Leecounty Excelsiorgroup Househunting Flrealtors St Petersburg Fl St Petersburg Florida Petersburg Florida

Appealing Ad Valorem Tax Assessments Johnson Pope Bokor Ruppel Burns Llp

The Cost Of Buying And Owning A Property

The Cost Of Buying And Owning A Property

Https Floridarevenue Com Property Documents All County 202016 20dr 493s Pdf

Agent 3000 Is The Future Of Real Estate Marketing Mobile Home Doublewide Mobile Home Real Estate Marketing

Agent 3000 Is The Future Of Real Estate Marketing Mobile Home Doublewide Mobile Home Real Estate Marketing

Https Floridarevenue Com Property Documents 2018 20dr 493 20all County Pdf

Https Floridarevenue Com Property Documents 2018 20dr 493 20all County Pdf

Lee County Public Schools Infor School Department Phonics Help Cool Words

Lee County Public Schools Infor School Department Phonics Help Cool Words

You Are All Invited To The First Open House Of 2019 Check This Beautiful Property Out At 2617 Archer Pky E Cape Coral F Open House Lehigh Acres Real Estate

You Are All Invited To The First Open House Of 2019 Check This Beautiful Property Out At 2617 Archer Pky E Cape Coral F Open House Lehigh Acres Real Estate

Agent 3000 Www Agent3000 Com Is The Future Of Real Estate Marketing In Agent 3000 You Can Create Flyers Single Real Estate Fort Myers Real Estate Marketing

Agent 3000 Www Agent3000 Com Is The Future Of Real Estate Marketing In Agent 3000 You Can Create Flyers Single Real Estate Fort Myers Real Estate Marketing

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

Ft Myers Florida Beautiful Pool Home For Sale Property Flyer Beautiful Pools Fort Myers Lehigh Acres

Ft Myers Florida Beautiful Pool Home For Sale Property Flyer Beautiful Pools Fort Myers Lehigh Acres

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

Wordpress Com Told You So Real Estate Tips Best Blogs

Wordpress Com Told You So Real Estate Tips Best Blogs

Https Floridarevenue Com Property Documents 2018 20dr 493 20all County Pdf

Labels: assessment, county, property

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home