Property Tax Percentage San Antonio

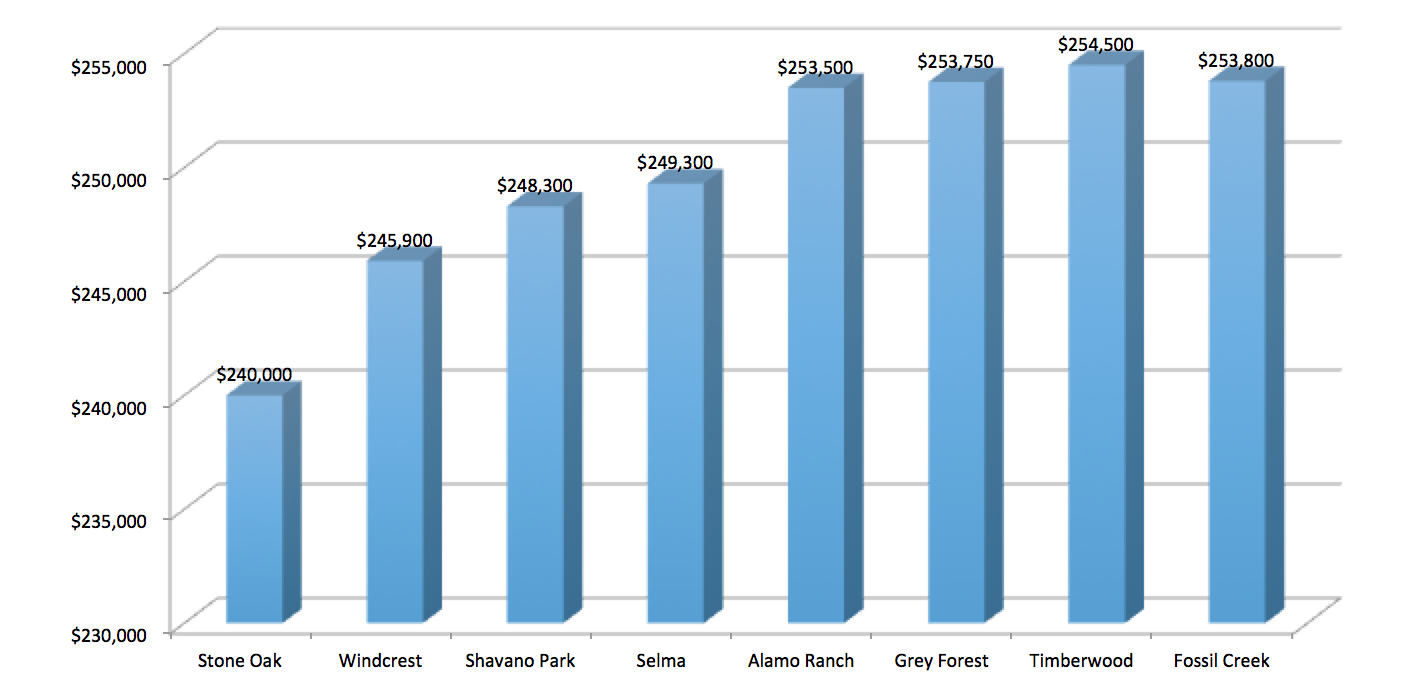

With diverse housing stock larger plots of land no city property taxes AND good schools with a comparable tax rate to other desirable San Antonio districts you can imagine why. Box 839950 San Antonio TX 78283.

Tac School Property Taxes By County

Tac School Property Taxes By County

San Antonio was the last major Texas city to implement a homestead exemption.

Property tax percentage san antonio. Texas has one of the highest average property tax rates in the country with only thirteen states levying higher property taxes. For the example above a home assessed at 180000 that translates into about a 900 per year savings or a 75 per month difference. SAN ANTONIO - The government is sending economic aid to people hit hard by the shutdown.

The median property tax on a 11710000 house is 211951 in Texas. Albert Uresti 2020 Official Tax Rates. It may seem like a.

Downtown - 233 N. The median property tax in Texas is 227500 per year for a home worth the median value of 12580000. The median property tax on a 11710000 house is 122955 in the United States.

Texas property owners facing tax increase in the midst of Covid-19 shutdown. The combined rate used in this calculator 825 is the result of the Texas state rate 625 the San Antonio tax rate 125 and in some case special rate 075. 33 rows The following table provides 2017 the most common total combined property tax rates for 46 San.

For 2018 officials have set the tax rate at 34677 cents per 100 of taxable value for maintenance and operations. The San Antonio sales tax rate is 125. The Texas sales tax rate is currently 625.

A home that does not require city taxes will normally have a tax rate of about 22. The tax rate varies from year to year depending on the countys needs. The minimum combined 2021 sales tax rate for San Antonio Texas is 825.

Counties in Texas collect an average of 181 of a propertys assesed fair market value as property tax per year. The FY 2021 Debt Service tax. Email the Tax Office.

The San Antonios tax rate may change depending of the type of purchase. The County sales tax rate is 0. Property Tax Rate Calculation Worksheets.

The property tax rate for the City of San Antonio consists of two components. A recent report indicates that 1800 businesses moved to Texas in 2016 from California alone. Actual taxes are calculated by multiplying the rate shown above times every 100 in value of eligible taxable property.

This is the total of state county and city sales tax rates. 254 rows The average homeowner in Bexar County pays 2996 annually in property taxes on a. But it looks like theres one.

Every 2021 combined rates mentioned above are the results of Texas state rate 625 the county rate 0 to 05 the San Antonio tax rate 0 to 1375 and in some case special rate 05 to 2. The City Council approved a 001 exemption of your homes value. Taxing Entity Officials List.

Maintenance Operations MO and Debt Service. The Commissioners Court also voted Tuesday to approve the proposed tax rate of 0301097 per 100 of valuation. The City of San Antonio has an interlocal agreement with the Bexar County Tax Assessor-Collectors Office to provide property tax billing and collection services for the City.

This calculator can only provide you with a rough estimate of your tax liabilities based on the. City of San Antonio Property Taxes are billed and collected by the Bexar County Tax Assessor-Collectors Office. The Fiscal Year FY 2021 MO tax rate is 34677 cents per 100 of taxable value.

Physical Address Vista Verde Plaza Building 233 N. Texass median income is 62353 per year so the. The tax rate is the same as the 2019-2020 fiscal year though the County estimates it will collect 159 million more in tax revenue compared with last year.

At a total tax rate of just under 218 a tax bill in Timberwood Park for a 240000 home is 524325. Public Sale of Property PDF. Pecos La Trinidad San Antonio TX 78207.

This results in a commercial property owners taxes going up even when the rate stays the same. Property taxes for debt repayment are set at 21150 cents per 100 of taxable value.

Tac School Property Taxes By County

Tac School Property Taxes By County

Tac School Property Taxes By County

Tac School Property Taxes By County

Bexar County Property Tax Records Bexar County Property Taxes Tx

Bexar County Property Tax Records Bexar County Property Taxes Tx

Everything You Need To Know About Bexar County Property Tax

Everything You Need To Know About Bexar County Property Tax

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

Tax Rates Bexar County Tx Official Website

Bexar County Property Tax Records Bexar County Property Taxes Tx

Bexar County Property Tax Records Bexar County Property Taxes Tx

Bexar County Property Tax Records Bexar County Property Taxes Tx

Bexar County Property Tax Records Bexar County Property Taxes Tx

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

San Antonio Property Tax Rates H David Ballinger

San Antonio Property Tax Rates H David Ballinger

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

Why Are Texas Property Taxes So High Home Tax Solutions

Why Are Texas Property Taxes So High Home Tax Solutions

How School Funding S Reliance On Property Taxes Fails Children Npr

How School Funding S Reliance On Property Taxes Fails Children Npr

2021 Best San Antonio Area Suburbs To Buy A House Niche

2021 Best San Antonio Area Suburbs To Buy A House Niche

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

Tax Rates Bexar County Tx Official Website

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

Labels: percentage, property

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home