How Much Is Personal Property Tax In Missouri

Missouri State Statutes mandate the assessment of a late penalty and interest for taxes that remain unpaid after December 31st. General Information about Personal Tax Electronic Filing and Paying.

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Filing and paying taxes electronically is a fast growing alternative to mailing paper returns and payments.

How much is personal property tax in missouri. Who owes personal property tax. Total Personal Property Tax. Collector - Personal Property Tax and Real Estate Tax Department 314 622-4105 1200 Market Room 109 St.

The median property tax on a. Tax amount varies by county. 116 rows The average effective property tax rate in Missouri is 093.

The states median annual property tax payment is. Is there a calculator that anyone is aware of. Taxes are due for the entire amount assessed and billed regardless if property is no longer owned or has been moved from Jackson County.

The median property tax on a 13970000 house is 127127 in Missouri. Personal property taxes are levied annually against tangible personal property and due upon receipt of the tax bill but no later than December 31 each year. For example a payment mailed and postmarked on December 29 is considered paid on time even though the Collectors Office does not.

Sole proprietors can deduct these taxes on Schedule C. Taxes are assessed on personal property owned on January 1 but taxes are not billed until November of the same year. Personal property tax paid on equipment used in a trade or business can be deducted as a business expense.

2019 Withholding Tax and MO W-4 Changes. Calculate personal property tax vehicle missouri. Counties in Missouri collect an average of 091 of a propertys assesed fair market value as property tax per year.

The median property tax in Missouri is 126500 per year for a home worth the median value of 13970000. Missouris effective vehicle tax rate according to the study is 272 percent which means the owner of a new Toyota Camry LE four-door sedan 2018s highest-selling car valued at. Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local option use tax information.

The Missouri Department of Revenue received more than 238000 electronic payments in 2020. I am looking for a way to calculate what my personal property tax will be on my car for the state of Missouri. The postmark determines the timeliness of payment.

Every person owning or holding taxable personal property in Missouri on the first day of January including all such property purchased on that day shall be liable for taxes thereon during the same calendar year. Even if the property is not being used the property is in service when it is ready and available for its specific use. All Personal Property Taxes are due by December 31st of each year.

If you live in a state with personal property tax consider the long-term cost when you buy a vehicle. Louis Mo 63103 Monday Through Friday 8 AM - 5 PM Contact the Collector - Personal Property Tax and Real Estate Tax Department. For example this years assessment was 433300 and last years tax rate was 72764 the expected amount for this year should be 31529 and if your plan starts in March the amount per month would be 32 316 - rounded up - divided by 10 months.

Calculate Personal Property Tax - Vehicle - Missouri. That comes in a bit lower than the national average which currently stands at 107. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact your county or citys property tax assessor.

The business portion is deducted as a business expense and the remainder as a personal deduction when property is used partly for business and partly for personal reasons. Your family has to pay more than 600 each year in personal property taxes for your vehicles. Taxes not paid in full on or before December 31 will accrue interest penalties and fees.

Only the Assessors Office can change the vehicles or addresses on a personal property tax bill. Per Missouri Revised Statute 137122 property is placed in service when it is ready and available for a specific use whether in a business activity an income-producing activity a tax-exempt activity or a personal activity. To find the amount of taxes due divide the assessed value by 100 and then multiply the result by the tax rate.

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

New 2016 Tax Incentive Enhancements Mo Tax Accountant Tax Payment Tax Accountant Business Tax

New 2016 Tax Incentive Enhancements Mo Tax Accountant Tax Payment Tax Accountant Business Tax

Celebrate Tax Day With 9 Of Our Favorite Tax Maps Property Tax Tax Day Filing Taxes

Celebrate Tax Day With 9 Of Our Favorite Tax Maps Property Tax Tax Day Filing Taxes

How To Appeal Property Taxes In Missouri Property Tax Appealing Missouri

How To Appeal Property Taxes In Missouri Property Tax Appealing Missouri

Image Result For U S National Map Of Property Taxes Property Tax History Lessons Historical Maps

Image Result For U S National Map Of Property Taxes Property Tax History Lessons Historical Maps

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

1889 Tax Bill Cassville Mo Missouri Barry County For P Tranthum 80 Acres County Missouri Bills

1889 Tax Bill Cassville Mo Missouri Barry County For P Tranthum 80 Acres County Missouri Bills

Oklahoma State And Local Taxburden Combined Industries Manufacturing Utilities Educational Services And Art Entertainment Types Of Taxes Tax Burden

Oklahoma State And Local Taxburden Combined Industries Manufacturing Utilities Educational Services And Art Entertainment Types Of Taxes Tax Burden

Understanding Your Property Tax Bill Department Of Taxes

Understanding Your Property Tax Bill Department Of Taxes

Chart 2 Louisiana State And Local Tax Burden By Type Of Tax Fy 1950 To 2016 Jpg Types Of Taxes Tax Burden

Chart 2 Louisiana State And Local Tax Burden By Type Of Tax Fy 1950 To 2016 Jpg Types Of Taxes Tax Burden

2019 Property Tax By State Property Tax States In America Estate Tax

2019 Property Tax By State Property Tax States In America Estate Tax

New Hampshire Property Tax Calculator Smartasset

New Hampshire Property Tax Calculator Smartasset

Understanding Your Property Tax Bill Department Of Taxes

Understanding Your Property Tax Bill Department Of Taxes

Jackson County Mo Property Tax Calculator Smartasset

Jackson County Mo Property Tax Calculator Smartasset

Taxable Income Calculator India Income Business Finance Mo Money

Taxable Income Calculator India Income Business Finance Mo Money

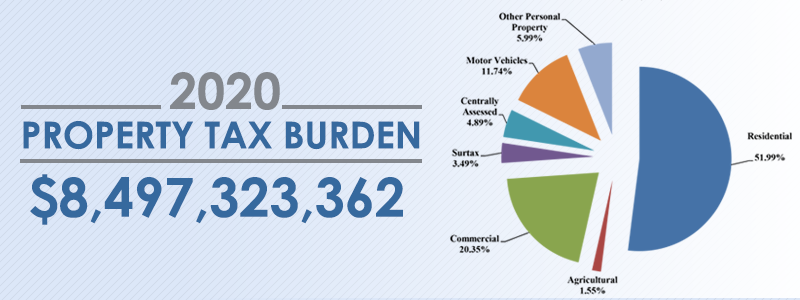

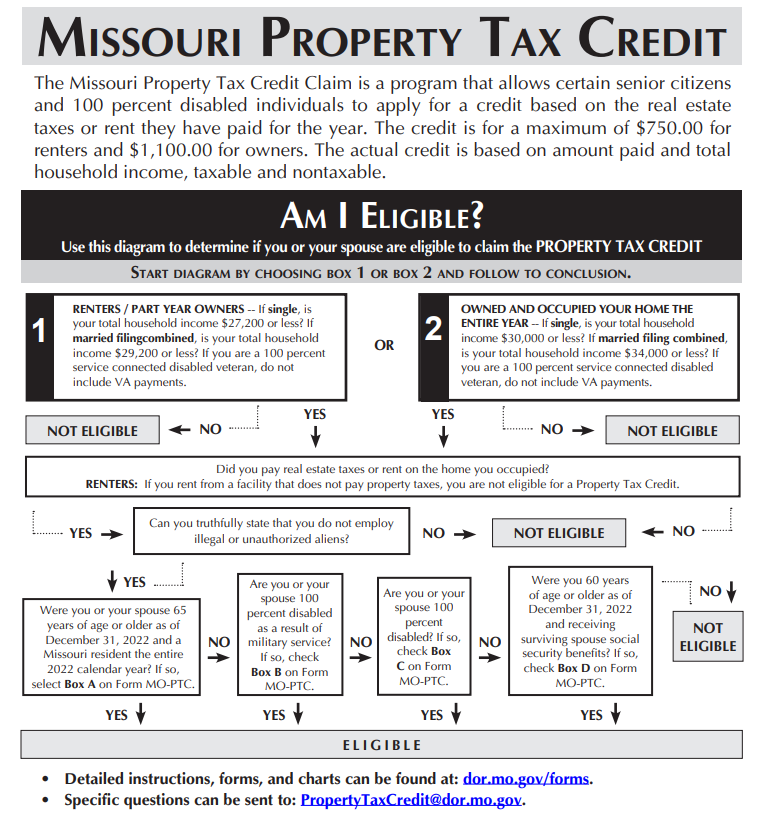

Property Tax Claim Eligibility

Property Tax Claim Eligibility

Missouri Property Tax Calculator Smartasset

Missouri Property Tax Calculator Smartasset

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home