Property Tax Assessment After Death

Death does not excuse a final accounting with the IRS. This legislative change occurred with the passage of the 2012-2013 Budget Bill House Bill 153.

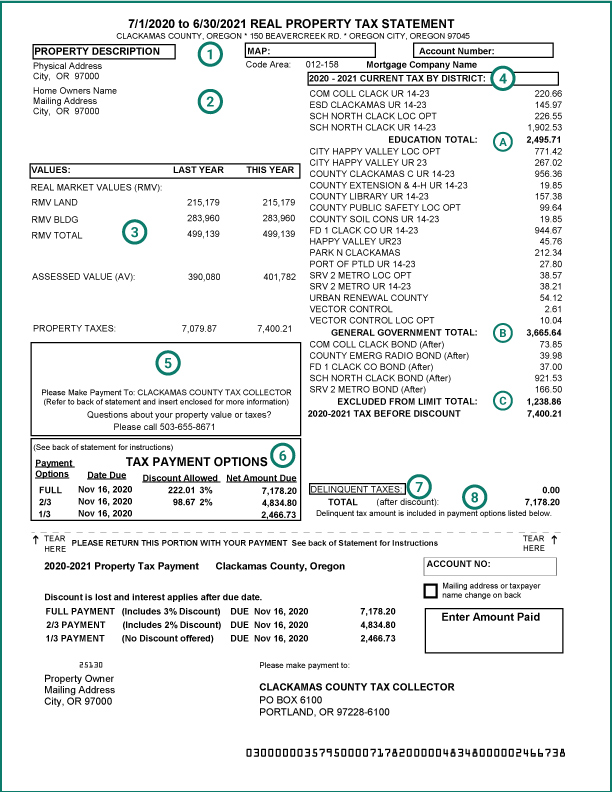

Understanding Your Property Tax Bill Clackamas County

Understanding Your Property Tax Bill Clackamas County

Rarely do people die with their finances neatly tied up and one of the frequent issues that arises is the matter of the deceased persons decedents last income tax refundIf a person dies being owed an income tax refund as thousands of people do every year what happens to the money.

Property tax assessment after death. Examples of assets that would generate income to the decedents estate include savings accounts CDs stocks bonds mutual funds and rental property. While most estates will not have to file a federal estate tax return or pay any federal estate taxes the residents of the following states or a deceased person who owns real estate in one of these states may owe state estate taxes. To take advantage of this special itemized deduction privilege for unpaid medical expenses they must pay the expenses out of the decedents estate during the one-year period beginning with the day after the date of death.

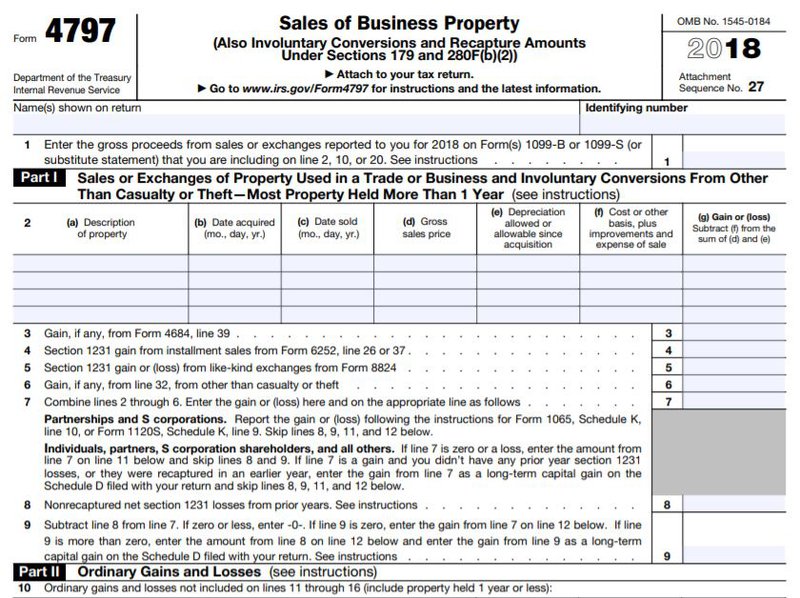

An estate is required to file an income tax return if assets of the estate generate more than 600 in annual income. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to Form 706 PDF PDF. Nothing is certain except death and taxesand the headaches that result when the two intersect.

Click on the link for each state to learn more about each states estate tax. For example if the decedent had interest dividend or rental income when alive then after death that income becomes income of the estate and may trigger the requirement to file an estate income tax return. The deceased owners estate would owe estate taxes if the total value of all their assets combined with the value of the IRA or 401 k exceeds the federal or state estate tax exemption for that year.

There are two proposals to alter the way taxes are imposed on estates at death youll want to know about. The executor can choose to include medical expenses that were paid both before and after the date of death on the final Form 1040 and can deduct expenses that are more than 75 percent of the deceased taxpayers adjusted gross income if itemizing. Remember the rules are different for determining the basis of.

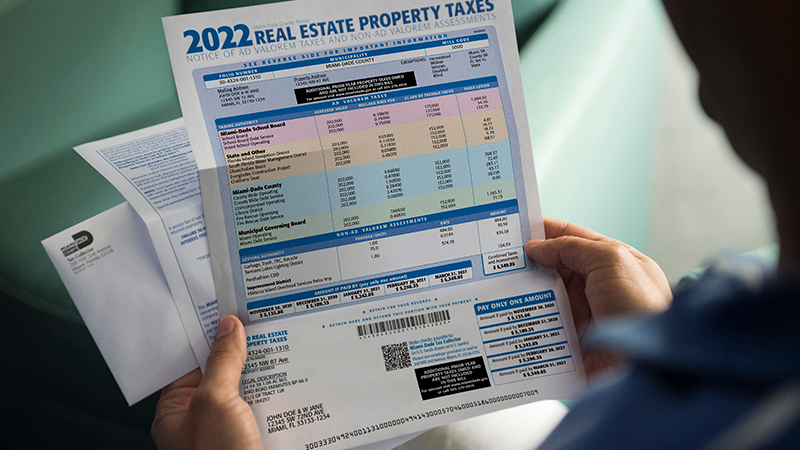

2 An estate tax is assessed by the state in which the decedent was living at the time of. Dates of death Dates of death prior to January 1 2013 to January 1 2013. Delinquent tax refers to a tax that is unpaid after the payment due date.

When a deceased relative leaves real property behind the local taxing authority will continue to assess property taxes. File the return using Form 1040 or 1040-SR or if the decedent qualifies one of the simpler forms in the 1040 series Forms 1040 or 1040-SR A. The fair market value of these items is used not necessarily what you paid for them or what their values were when you acquired them.

However IRC 1014 provides that the basis of property acquired from a decedent is its fair market value at the date of death so there is usually little or no gain to account for if the sale occurs soon after the date of death. The good news is that the estate doesnt have to pay any Capital Gains Tax on the property or assets that werent sold also known as unrealised gains before the person died. Any income those assets generate is also part of the estate and may trigger the requirement to file an estate income tax return.

The Estate Tax is a tax on your right to transfer property at your death. When someone dies their assets become property of their estate. All income up to the date of death must be reported and all credits and deductions to which the decedent is entitled may be claimed.

But if the property or asset is sold during probate and its value rose since the person died there is usually Capital Gains Tax to pay. The federal estate tax exemption is 117 million as of 2021 so this might not be a. Dates of death Dates of death on or after January 1 2013 January 1 2013.

If no one pays these taxes the taxing authority can put a lien on the. There will be no estate tax on estates of individuals with a date of death on or after January 1 2013. Connecticut District of Columbia Hawaii Illinois Maine Maryland Massachusetts Minnesota New Jersey New York Oregon Rhode Island Vermont and Washington.

Some go as low relatively speaking as 1000000. The divisions duties include the collection of delinquent taxes and working with property owners account holders tax lien purchasers and other interested parties with tax related issues. Death and taxes may be equally inevitable but the taxman demands the last word.

The first is the federal estate tax exemption.

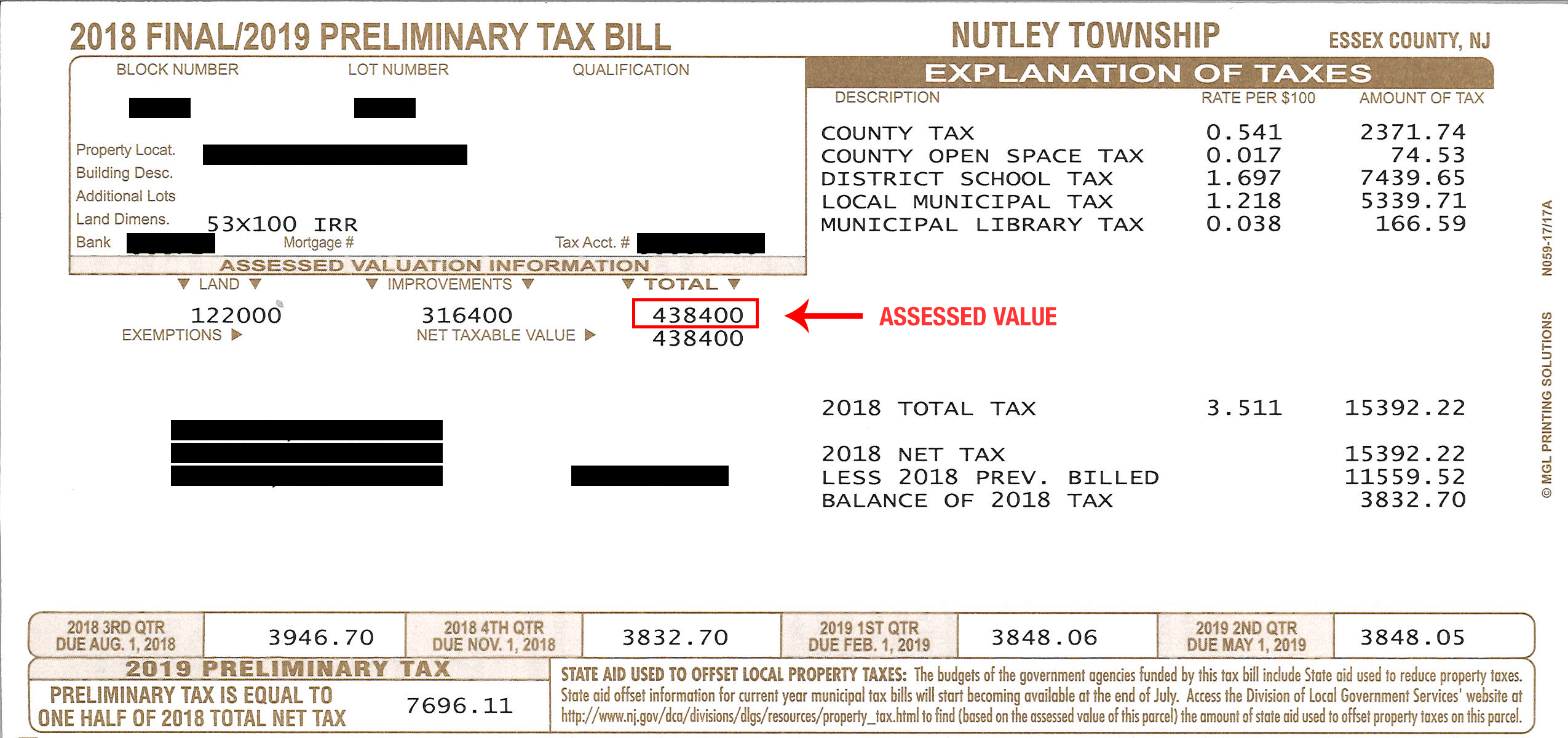

Nutley New Jersey Property Tax Calculator

Nutley New Jersey Property Tax Calculator

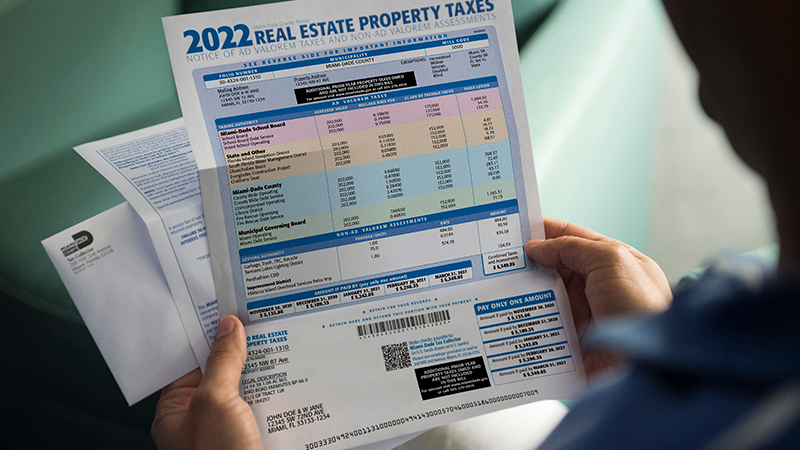

Pin By Bobbie Persky Realtor On Finance Real Estate Property Tax Tax Attorney Debt Relief Programs

Pin By Bobbie Persky Realtor On Finance Real Estate Property Tax Tax Attorney Debt Relief Programs

Nutley New Jersey Property Tax Calculator

Nutley New Jersey Property Tax Calculator

Assessor S Office Frequently Asked Questions Property Tax Q A Property Tax This Or That Questions Types Of Taxes

Assessor S Office Frequently Asked Questions Property Tax Q A Property Tax This Or That Questions Types Of Taxes

What Are Real Estate Taxes Real Estate Tax Basics Millionacres

What Are Real Estate Taxes Real Estate Tax Basics Millionacres

Dupage County Il Treasurer Sample Tax Bill

Dupage County Il Treasurer Sample Tax Bill

Pay Your Property Tax Bill Online

Pay Your Property Tax Bill Online

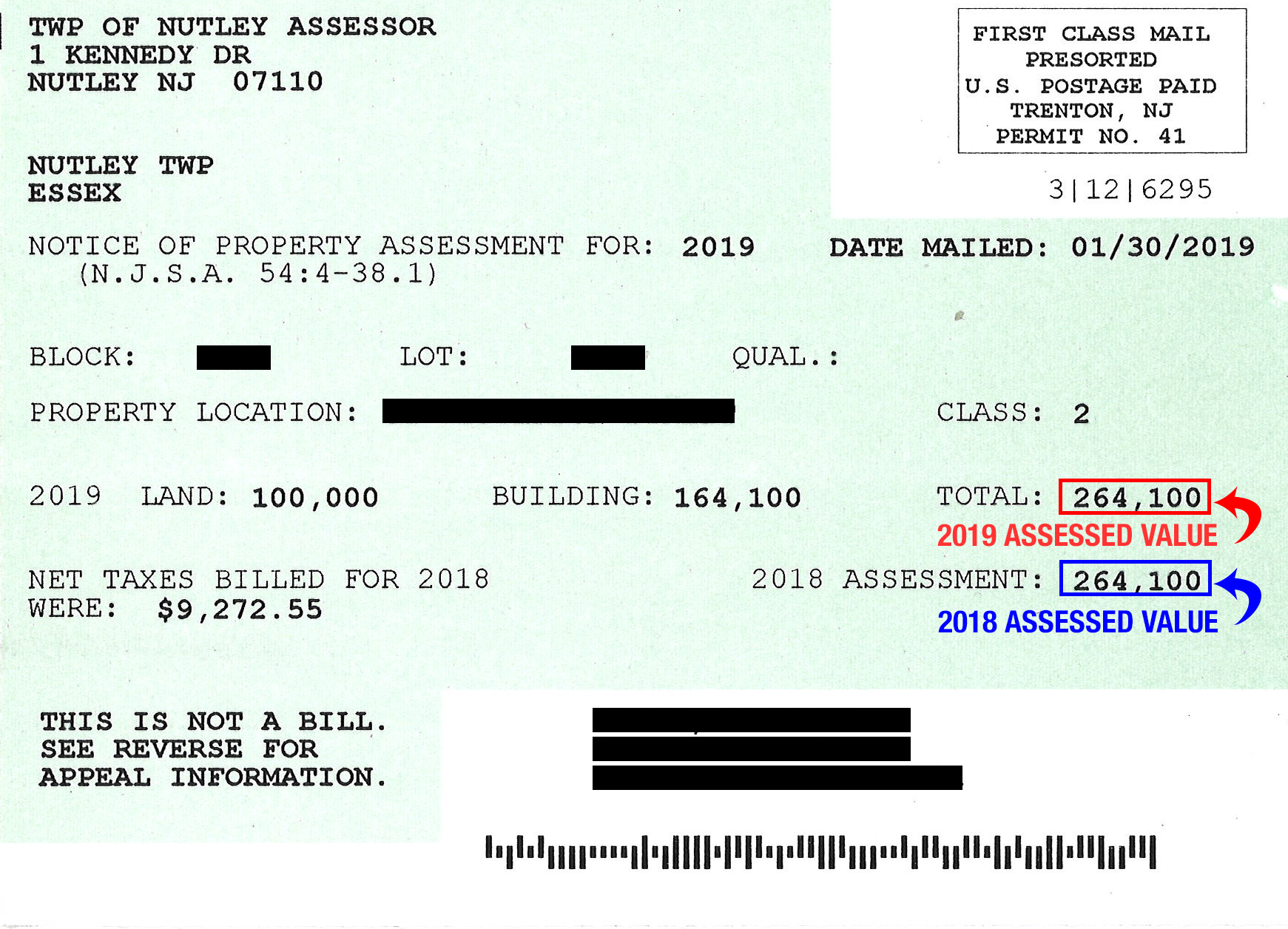

Your Property Tax Assessment What Does It Mean

Your Property Tax Assessment What Does It Mean

Sample Rural Property Tax Notice Province Of British Columbia

Sample Rural Property Tax Notice Province Of British Columbia

What Are The Advantages Of Homesteading Your Property In Certain States Homeowners Can Take Advantage Of What S Cal Property Tax Homeowner Republic Of Texas

What Are The Advantages Of Homesteading Your Property In Certain States Homeowners Can Take Advantage Of What S Cal Property Tax Homeowner Republic Of Texas

/GettyImages-1042505068-d5c7b095f4704a5286a5cabcc25f4495.jpg) Your Property Tax Assessment What Does It Mean

Your Property Tax Assessment What Does It Mean

Writing A Property Tax Appeal Letter With Sample Lettering Writing Property Tax

Writing A Property Tax Appeal Letter With Sample Lettering Writing Property Tax

Pin By Carol Fortner On Death Taxes Real Estate Humor Real Estate Fun Real Estate Memes

Pin By Carol Fortner On Death Taxes Real Estate Humor Real Estate Fun Real Estate Memes

Property Taxes By State Why We Should All Embrace Higher Property Taxes

Property Taxes By State Why We Should All Embrace Higher Property Taxes

2019 20 Sacramento County Property Assessment Roll Tops 179 Billion

2019 20 Sacramento County Property Assessment Roll Tops 179 Billion

Dupage County Il Treasurer Sample Tax Bill

Dupage County Il Treasurer Sample Tax Bill

Labels: after, assessment, property

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home