Property Tax Assessment Rhode Island

Hours 830 am to 430 pm Monday-Friday. The City Collectors Office sends out annual bills in June and processes quarterly payments for Real Estate Personal PropertyTangible and Motor Vehicle taxes.

Https Www Warwickri Gov Assessors Department Files Value Appeal Property 2020 Fy 2021

The Tax Collectors Office collects all property motor vehicle and tangible taxes.

Property tax assessment rhode island. Warwick City Hall 3275 Post Road Warwick RI 02886. Google names Warwick as Rhode Islands eCity. Assessors Online Database.

The mission of the Town Assessors Office is to provide for the orderly valuation of all real estate motor vehicles and tangible personal property located in the Town of South Kingstown. Rhode Island Division of Municipal Finance. To ensure consistent application of the tax law and to guarantee that the rights privacy and property of Rhode Island taxpayers are adequately protected during tax assessment collection and enforcement processes the following rights and responsibilities of taxpayers are set.

Municipal Lien Certificates are processed by this office as well. State law requires that properties are assessed at 100 of fair market value. Google names Warwick as Rhode Islands eCity.

Narragansett RI 02882 Phone. While also providing the best possible service to our residents. Taxpayers have certain rights and responsibilities in the administration of Rhode Island tax law.

The office works with banks mortgage companies and credit card companies for the receipt of taxes and payments through escrow. About Assessor and Property Tax Records in Rhode Island Rhode Island real and personal property tax records are managed by the Assessment Office in each township. 2020 Residential Tax Rate.

The on-line public records databases made accessible through the links on this page are not supported endorsed or maintained by the Rhode Island Association of REALTORS or State-Wide MLS and are totally independent of these organizations. Counties in Rhode Island collect an average of 135 of a propertys assesed fair market value as property tax per year. 2020 Commercial Tax Rate.

Tax Assessor 401 738-2005. Temporarily Vacant Deputy Tax Assessor Notices Assessors Forms. The office is an integral part of the Finance Department wherein property tax assessments are continuously maintained to ensure that the Tax Collector has the most accurate and current information for the collection of taxes in a timely manner.

Assessed values in the database do not factor exemptions tax credits or tax freezes that may be applicable. Hopkinton Tax Assessor. RI Tax Assessor Resource Note.

In West Greenwich vacant. Hopkinton Town Hall One Town House Road Hopkinton RI 02833 map. The mission of the East Providence Assessment Division is to prepare the annual assessment roll the official record of taxable and exempt property within the City of East Providence in accordance with Rhode Island general law pertaining to chapter 44- Taxation.

Including RI on Pause Application Information Learn More Now. Warwick City Hall 3275 Post Road Warwick RI 02886. Land and land improvements are considered real property while mobile property is classified as personal property.

401 574-9912 Directions Staff Directory. Tax Assessor Email Erin Jacobs Deputy Tax Assessor Email 25 Fifth Ave. The primary objective of the Department is to discover list and value all taxable and exempt property to ensure that assessments are made properly and uniformly and that the tax roll when completed is a true and accurate account of all ratable property.

In addition the division also collects Water Sewer Usage and Sewer Assessment fees. 2021 RI-1040ES Estimated Payment Coupons. The General Laws of Rhode Island require the Assessor to ensure that all assessments are fair and equitable.

File Annual Sales Tax Reconciliation - 2020 Form. Division of Municipal Finance One Capitol Hill 1st Floor Providence RI 02908 Phone. Questions about Rhode Island Form 1099-G.

Real Estate Property Taxes. 401-788-2555 Hours Monday - Friday 830 am. 2021 Rhode Island Employers Income Tax Withholding Tables.

Tax amount varies by county The median property tax in Rhode Island is 361800 per year for a home worth the median value of 26710000.

Dream House Friday Would You Rather Live In Lena Dunham S Taylor Swift S Or Lea Michele S Place Rhode Island Mansions Taylor Swift House Ocean Front Homes

Dream House Friday Would You Rather Live In Lena Dunham S Taylor Swift S Or Lea Michele S Place Rhode Island Mansions Taylor Swift House Ocean Front Homes

Real Estate Assessed Value Vs Fair Market Value Real Estate Real Estate Education Real Estate Values

Real Estate Assessed Value Vs Fair Market Value Real Estate Real Estate Education Real Estate Values

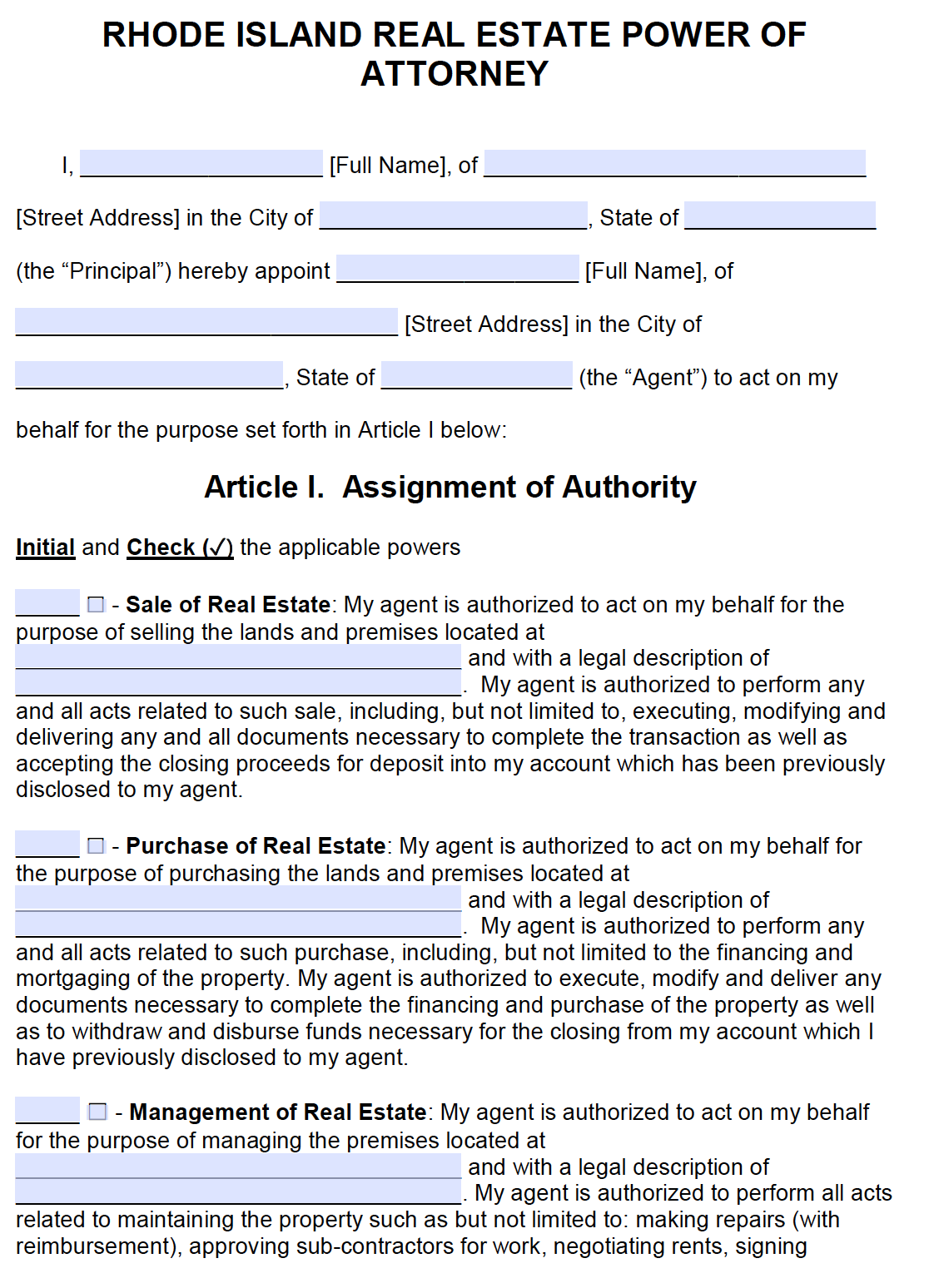

Free Rhode Island Power Of Attorney Forms Pdf Templates

Free Rhode Island Power Of Attorney Forms Pdf Templates

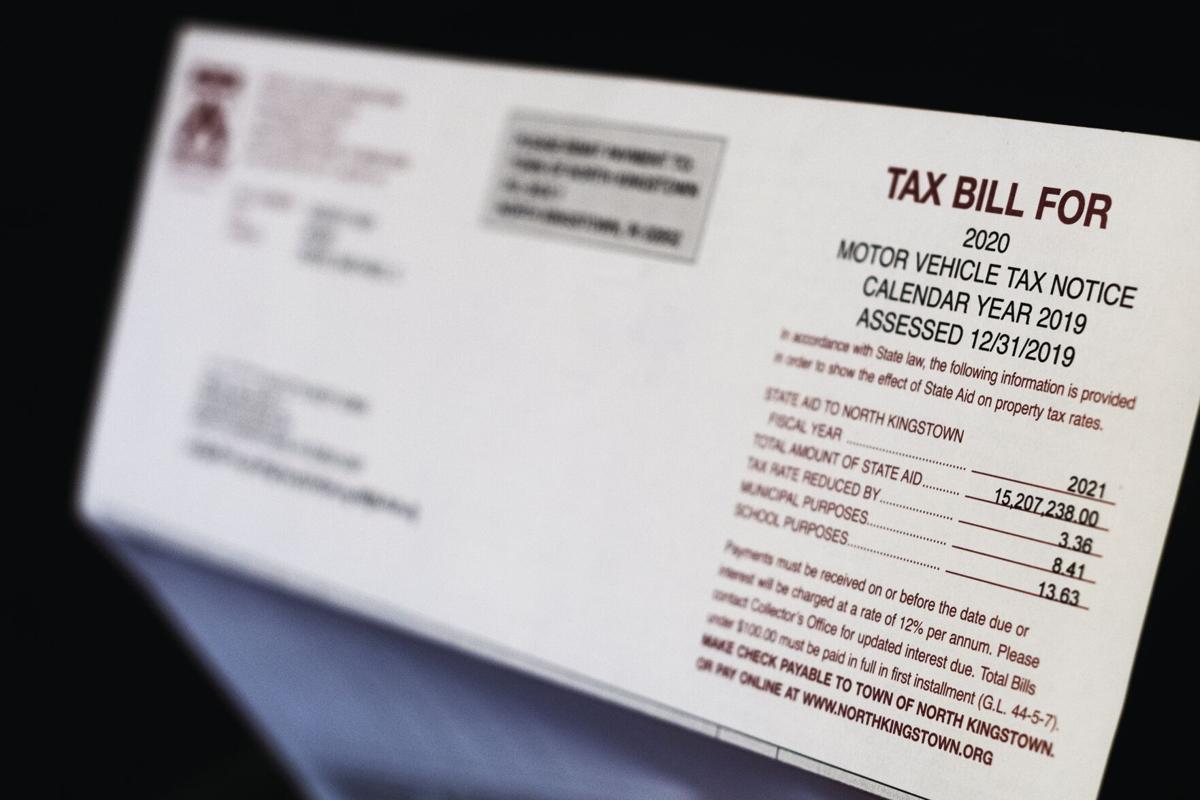

Officials Your Car Tax Bill Is Still Coming News Independentri Com

Officials Your Car Tax Bill Is Still Coming News Independentri Com

Ripropinfo Rhode Island Land Records Tax Assessors Gis Zoning And Plat Maps

Ripropinfo Rhode Island Land Records Tax Assessors Gis Zoning And Plat Maps

How To Become A Real Estate Appraiser In Rhode Island Business Regulations How To Become Work Experience

How To Become A Real Estate Appraiser In Rhode Island Business Regulations How To Become Work Experience

40 Illinois Lawmakers Are Not Taking A Pension Illinois Pensions How To Plan

40 Illinois Lawmakers Are Not Taking A Pension Illinois Pensions How To Plan

Pawtucket Rhode Island Parcel Information Map

Pawtucket Rhode Island Parcel Information Map

Smith Island Maryland Flickr Photo Sharing Abandoned Houses Abandoned Mansions Abandoned Places

Smith Island Maryland Flickr Photo Sharing Abandoned Houses Abandoned Mansions Abandoned Places

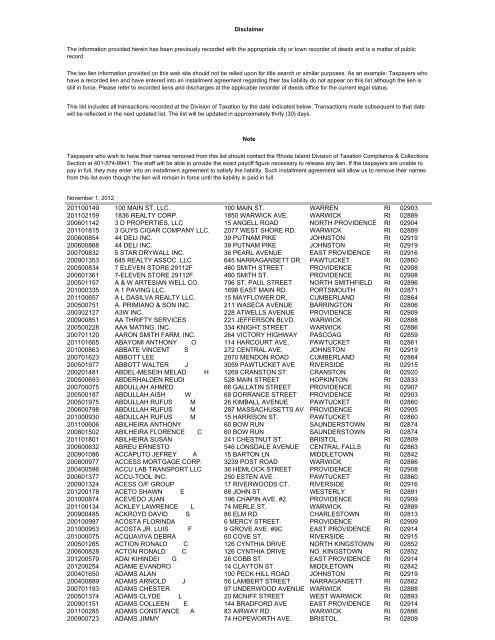

Note Rhode Island Division Of Taxation

Note Rhode Island Division Of Taxation

City Of Providence Tax Assessor City Of Providence

City Of Providence Tax Assessor City Of Providence

Chase North Kingston Rhode Island North Kingstown House Styles Island

Chase North Kingston Rhode Island North Kingstown House Styles Island

Twitter Real Estate Guest Suite Breathtaking Views

Twitter Real Estate Guest Suite Breathtaking Views

![]() Ri Tax Assessor Resource Rhode Island Association Of Realtors

Ri Tax Assessor Resource Rhode Island Association Of Realtors

Rhode Island Property Tax Calculator Smartasset

Rhode Island Property Tax Calculator Smartasset

Official Rhode Island Residential Purchase Agreement 2021

Official Rhode Island Residential Purchase Agreement 2021

Labels: assessment, property, rhode

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home