How To Appeal Property Tax Assessment In Santa Clara County

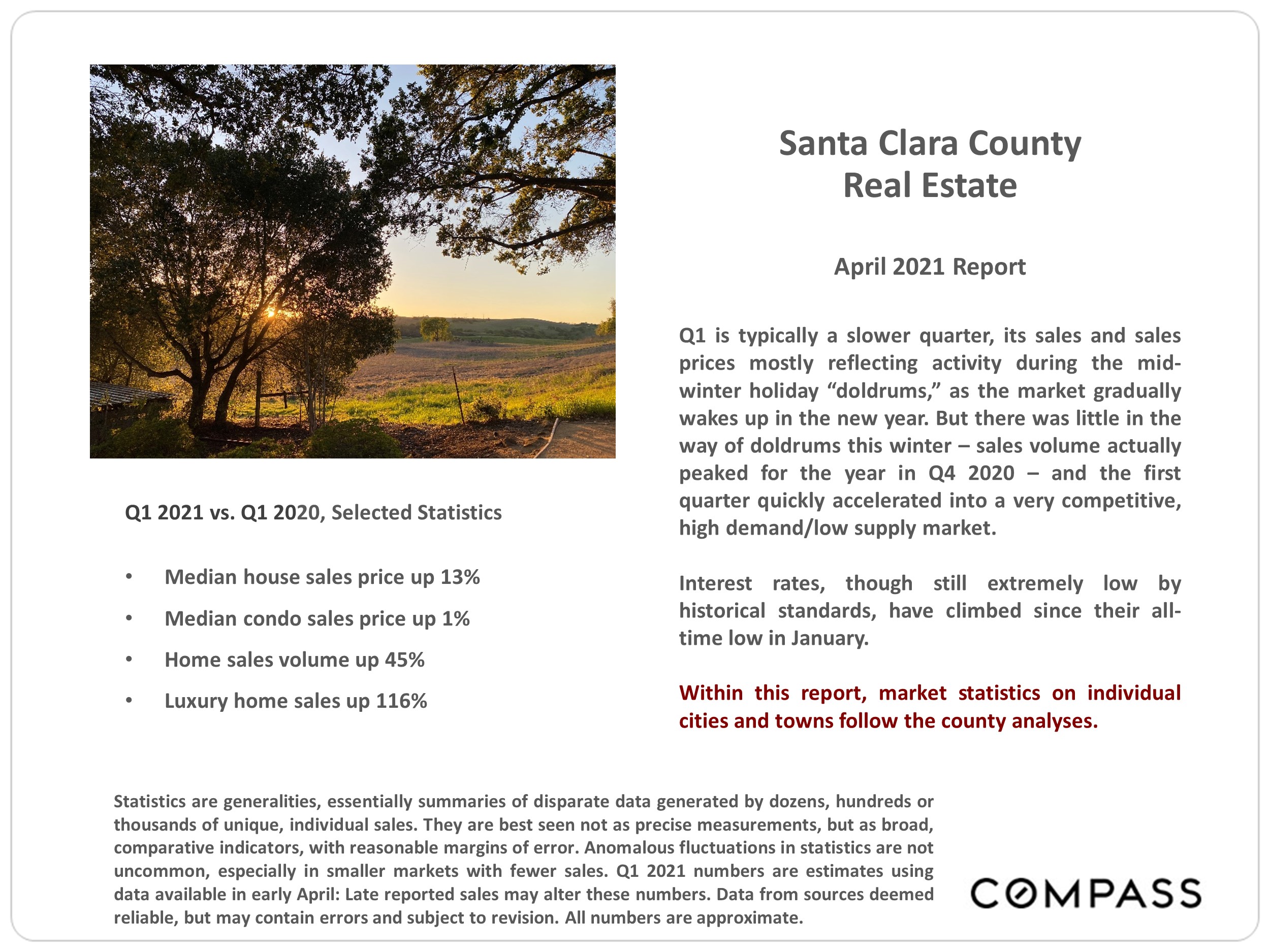

In Santa Clara County owners of one to four family dwellings can appeal before a. It limits the property tax rate to 1 of assessed value ad valorem property tax plus the rate necessary to fund local voterapproved debt.

California Public Records Public Records California Public

California Public Records Public Records California Public

Learn more about SCC DTAC Property Tax Payment App.

How to appeal property tax assessment in santa clara county. Proposition 13 the property tax limitation initiative was approved by California voters in 1978. The Assessment Appeals hearing schedule and Agendas can be accessed through the Meeting Portal. I was able to arrange funds and pay it only 12 hours late on 1st feb but I was ch.

Application for Changed Assessment can be obtained by contacting the clerk of your appeals board. Reinstatement Request Form Fill-in. Each three member Assessment Appeals Board which is independent of the Assessor and trained by the State Board of Equalization consists of private sector property tax professionals CPAs Attorneys and appraisers appointed by the Santa Clara County Board of Supervisors.

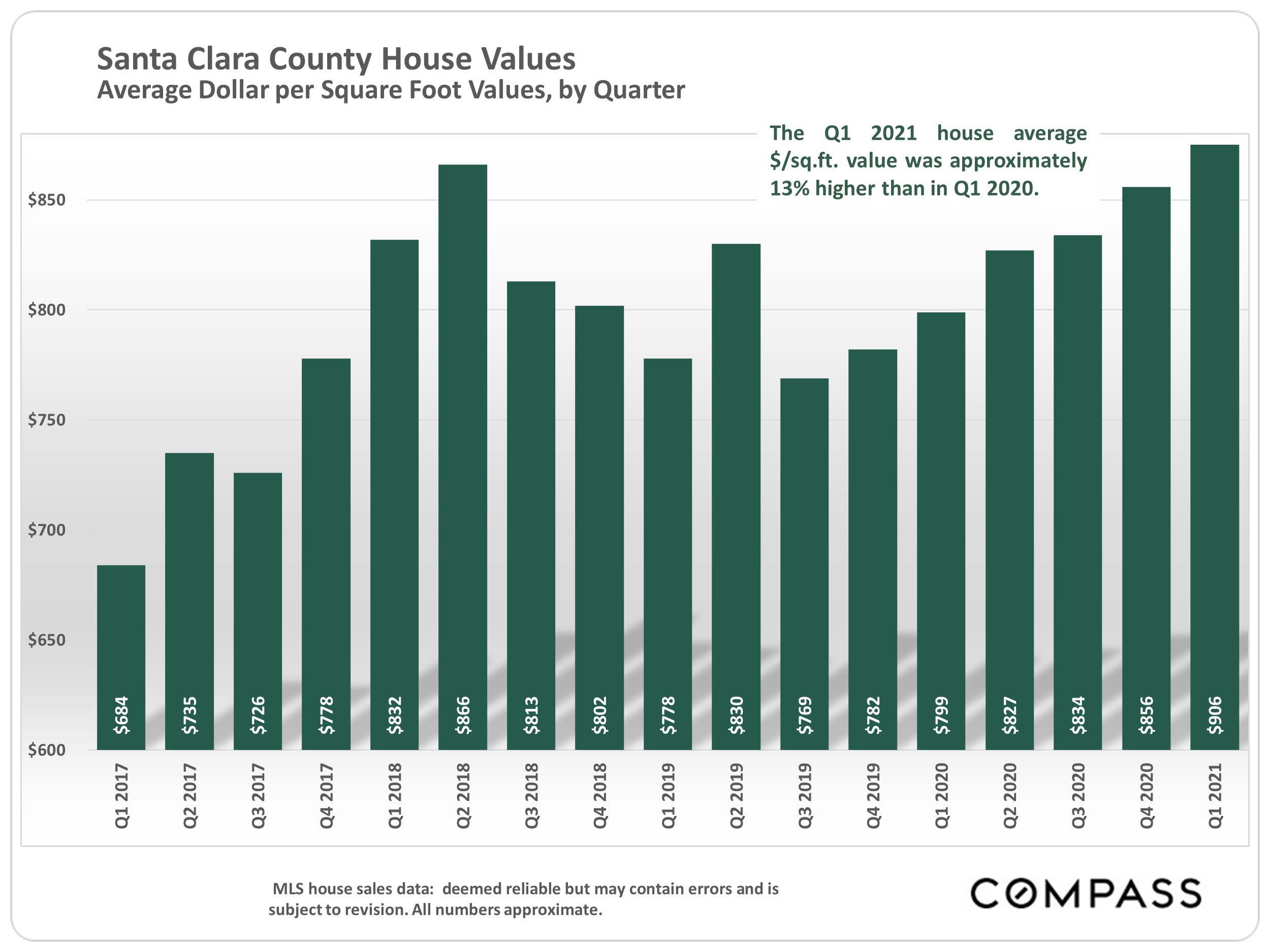

This is for Santa Clara County in North California. It saw a much larger 292 percent drop in fiscal 2017. Santa Clara Countys due date for property taxes is what it is.

I am not an expert on property tax law and I would contact the Assessors office again either in writing email or phone. But theres a little less time for property taxes. Thats not because our local tax collectors are unsympathetic.

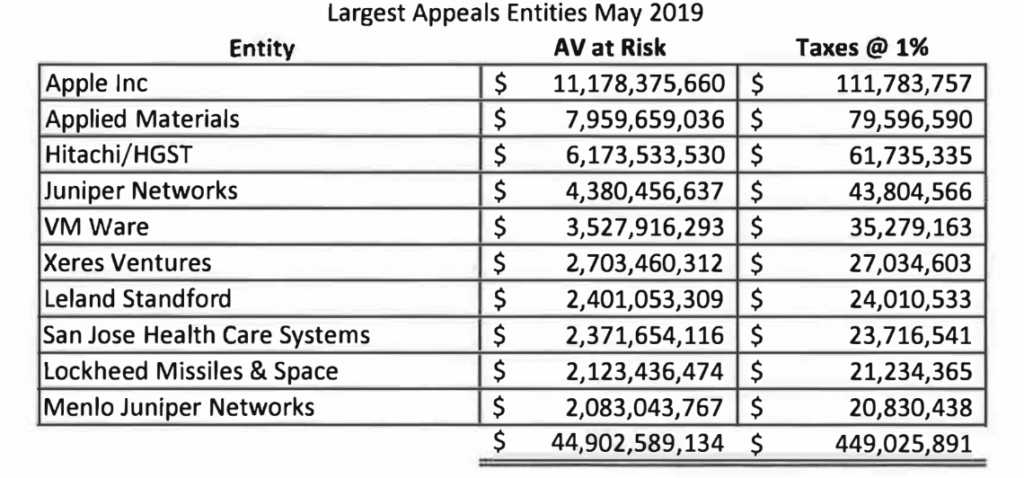

Property assessments Corporations and homeowners have the right to appeal property tax assessments. The Assessor can appeal this decision by bringing an action in the Santa Clara County Superior Court. Massive property tax reduction in Alameda County.

Apple currently has 489 open cases with the Santa Clara County tax assessor totaling 85 billion in property value dating back to 2004 according to the newspaper. Santa Clara County reported 3291 property tax appeals in fiscal 2018 a 42 percent drop from the prior year. Our client engaged Shannon Snyder to reduce the assessed value of their 87000 square foot.

I got a letter about supplemental property tax due on jan 30 2018. Additionally some counties offer. To appeal a roll correction or supplemental assessment.

The clerks of county assessment appeals boards and county boards of equalization have certified the assessment appeals filing period for their counties pursuant to the requirements of Revenue and Taxation Code section 1603. Currently you may research and print assessment information for individual parcels free of charge. Select Assessment Appeals in the Meeting Group drop down to view the current schedule.

However the appeal can only address legal disagreements with the basis of AABs calculations according to Deputy Assessor David Ginsborg. Public inquiries regarding Applications the Assessment Appeals process and hearing procedures should be directed to the Assessment Appeals Division of the Clerks office. Assessment Appeal Application form.

This entry was posted in Blog and tagged California residential property tax Santa Clara tax appeal on July 28 2015 by c06577603. The regular appeals filing period will begin on July 22020 in each county and will end either on September 15 or November 30 depending on whether the County Assessor has elected to mail asses sment. The County of Santa Clara Department of Tax and Collections has partnered with an external lockbox service to process property tax payments.

Business and personal property taxpayers in Santa Clara County now have access to SCC DTAC a new mobile app launched by the County of Santa Clara Department of Tax and Collections to provide more than 500000 property owners with convenient access to pay their secured property tax payments. According to officials who spoke with us about the looming deadline they just cant do a damn thing about it. Assessment Appeal Application previously known as an.

Appeal applications must be filed between September 1 to September 15 with the Clerk of the Board Clerk of the County Board of Supervisors. The Assessor has developed an on line tool to look up basic information such as assessed value and assessors parcel number APN for real property in Santa Clara County. Make check or money order payment to.

Form used for the county where your property is located. Property taxes are levied on land improvements and business personal property. And its still April 10.

CA State Board of Equalization Publication 29 California Property Tax An Overview CA State Board of Equalization Publication 30 Residential Property Assessment Appeals Change of Address Request Form Fill-in Economic Unit Form Fill-in Property Tax Rule 3051. Check Or Money Order Payee Name. Enter Property Parcel Number APN.

Office of the Appeals Clerk - Board of Supervisors 70 West Hedding Street 10th Floor East Wing San Jose CA 95110 Email.

Real Estate Radio Live Mike D Ambrosio Chats With Santa Clara County Assessor Larry Stone Santa Clara Santa Clara County Larry

Real Estate Radio Live Mike D Ambrosio Chats With Santa Clara County Assessor Larry Stone Santa Clara Santa Clara County Larry

Https Controller Sccgov Org Sites G Files Exjcpb511 Files Property Tax Highlights Fy2017 18 20190409 Pdf

Tech Companies Buoy Property Assessments Appeals In Santa Clara County San Jose Spotlight

Tech Companies Buoy Property Assessments Appeals In Santa Clara County San Jose Spotlight

To Download The Complete Review Draft Of The Santa Clara County

To Download The Complete Review Draft Of The Santa Clara County

Covid Economy Santa Clara County Business Owners Can Seek Property Tax Relief East Bay Times

Covid Economy Santa Clara County Business Owners Can Seek Property Tax Relief East Bay Times

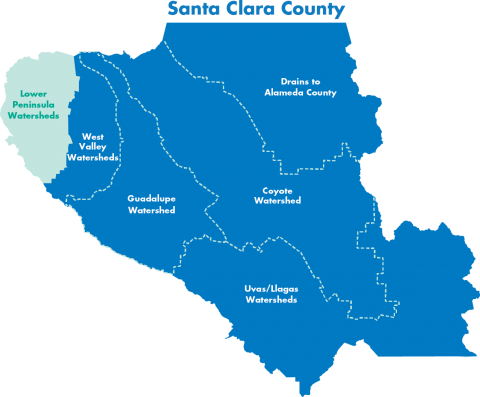

Santa Clara County Parcel Map Maping Resources

Santa Clara County Parcel Map Maping Resources

Understanding California S Property Taxes

Understanding California S Property Taxes

Assistant Assessor Job Details Tab Career Pages

Assistant Assessor Job Details Tab Career Pages

Ca Santa Clara County Rfp 2017 Prison Phone Justice

Ca Santa Clara County Rfp 2017 Prison Phone Justice

Santa Clara Shannon Snyder Cpas

Santa Clara Shannon Snyder Cpas

Santa Clara County Property Tax Tax Assessor And Collector

Santa Clara County Property Tax Tax Assessor And Collector

Santa Clara County Ca Property Tax Calculator Smartasset

Santa Clara County Ca Property Tax Calculator Smartasset

Tech Companies Buoy Property Assessments Appeals In Santa Clara County San Jose Spotlight

Tech Companies Buoy Property Assessments Appeals In Santa Clara County San Jose Spotlight

3540 Benton St Santa Clara Ca 95051 Realtor Com

3540 Benton St Santa Clara Ca 95051 Realtor Com

Labels: appeal, assessment, property

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home