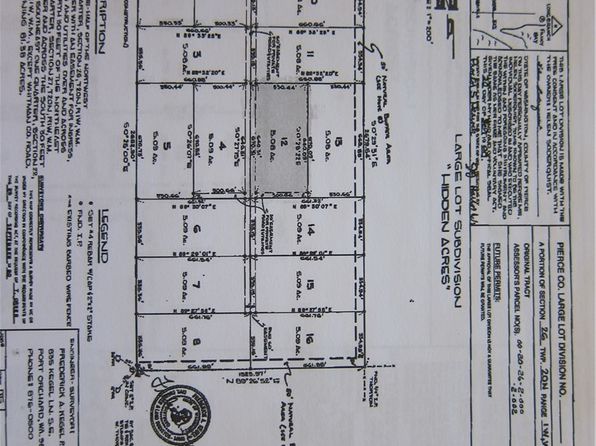

Pierce County Property Value Search

7714 E 211 St Spanaway WA 98387 MLS 1753987. Online search tool of Commercial Broker Association CBA listings for business owners brokers site selectors and communities.

The personal property listing information will be used as the basis for determining the assessed value of personal property applicable to the business.

Pierce county property value search. Valuation tables are provided by the Department of Revenue. Homes in all parts of our County continue to increase in value said Mike Lonergan Pierce County Assessor-Treasurer. These 2019 values will be used as the basis for property taxes to be billed in February of 2020.

Personal property values are based on reported cost year of acquisition and type of asset. Find available commercial and industrial sites and buildings in Pierce County along with demographics and analytics. Average Price by Bedrooms.

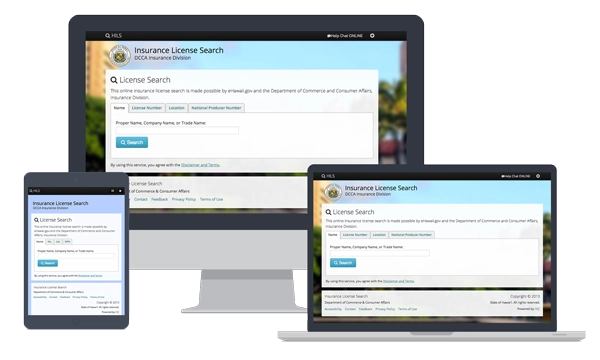

5015 70th Ave Ct W 6B University Place WA 98926 MLS 1751316. Your search for Pierce County WA property taxes is now as easy as typing an address into a search bar. Use our state-of-the-art property search including an interactive map search to find homes for sale in Pierce County.

Resolutions Ordinances Legislation County Council. 5208 25th Avenue Ct NW Gig Harbor WA 98335 MLS 1753120. Property Information Research Tools Planning Public Works.

These 2020 values will be used as the basis for property taxes to be billed in February of 2021. Property Data Search and Online Tax Payments Note. Look up your property tax payment amount.

Information can also be found online. Pierce County WA Real Estate and Homes for Sale - Property Address and MLS Number. Property Tax Status For information regarding your current property tax status please call the Automated Tax and Value Information System at 253 798-3333 or the Pierce County Assessor-Treasurer Customer Service Hotline at 253 798-6111.

Right of Way Plans for Current Road Projects. Or use our Pierce County Real Estate Guide to access information and view the available real estate listings in our featured communities. Property Value Sales Information.

These listings are updated multiple time a day from the MLS. The information contained in the Pierce County Web Site is provided as a service to the citizens of Pierce County. Property Categories Washington state law classifies property under two specific categories real and personal property.

Using the My Account menu option log in select View My Personal Property. The latest assessed values of over 327000 parcels of property throughout Pierce County have been mailed or emailed this week to the property owners. Residential property continues to increase in value although the rate of increase has slowed compared to last year said Mike Lonergan Pierce County.

Our community searches will keep you up to date with the latest properties in the Pierce County. Pierce County Deed Search httpswwwcopiercewaus359Recording Find Pierce County Washington real estate and property deeds including options for accessing records types of records and fees. Simply fill in the exact address of the property in the search form below.

Property data can be searched by parcel. Assessed values must be allocated to the taxing district in which the property is located. Pierce County reserves the right to change update correct or remove anything posted in this site.

Planning Public Works. 6709 133rd St E Puyallup WA 98373 MLS 1745111. Pierce County Assessment Rolls Report Link httpsepipcopiercewauscfappsatrepipsearchcfm Search Pierce County property assessments by tax roll.

The information is provided as is. Tacoma-Pierce County Health Department. In mid-October notification that the value information is available will be sent to the registered email address.

Affidavits are available by calling the Assessor-Treasurers Office at 253 798-7130. Pierce County Finance Department GIS Maps httpwwwcopiercewaus2281GIS-Applications View Pierce County Finance Department GIS maps list including public open data. To view andor print the Notice of Value information access eFile.

RCW 8440025 Although you may refuse private access to your property you may not deny access to the Assessor-Treasurer or his employees. The values of over 300000 parcels of property throughout Pierce County have been determined and mailed or emailed this week to the property owners and added to this website. The laws of the State of Washington require the Assessor-Treasurer or his authorized employees to periodically inspect all real property in Pierce County to determine its true and fair market value.

The Pierce County Assessor-Treasurers Office has the responsibility for appraising and taxing all property unless otherwise exempted by law.

Read more »