State Of Hawaii Property Tax Search

745 AM - 430 PM Monday - Friday. Hawaii County Tax Records Hawaii httpspaymentsehawaiigovpropertytaxhawaiiindexhtml Search Hawaii County real property tax records by parcel ID number or TMK number.

-Real Property Tax Office Website - Information Forms Instructions Property Search.

State of hawaii property tax search. Kalanimoku Building 1151 Punchbowl St. The assessment information is from the last certified tax roll. Real Property Tax Division - General Information.

Profile map values sales residential commercial out buildings permits skeches photo and buffer information. We assist the Real Property Board of Review in processing appeals. Each year on December 15th the assessment data is updated to reflect the assessment information for the.

Use this page to search for your Hawaii Tax licenses and statuses. Find property tax assessment records TMK maps and more. The Real Property Assessment Division administers the discovery listing and valuation of all real property in the County of Maui for real property tax purposes.

The role of the Real Property Tax Division is to assess all real property in a uniform and. Information and answers to the most commonly asked questions. Hawaii County Tax Warrants httpwwwhawaiicountygovfinance-real-property-tax Find Hawaii County Hawaii tax warrant and lien information by delinquent tax payer name and case number.

HONOLULU After careful consideration the Hawaii State Department of Taxation has decided not to extend the Tax Year 2020 filing deadline. Property Search Instructions Click Here Real Property Assessment Division - Property Data Search The Property Search tab on the menu bar provides access to individual property tax records of the City and County of Honolulu. Hawaii County Tax Records Hawaii httpspaymentsehawaiigovpropertytaxhawaiiindexhtml Search Hawaii County real property tax records by parcel ID number or TMK number.

Property Records Search Disclaimer The Real Property Assessment Division RPAD provides general information regarding real property tax assessments and makes no guarantee of the completeness or accuracy of any information provided on its web site. Name Instructions e-File Fillable Hand Writeable Prior Years N-288 Hawaii Withholding Tax Return for Dispositions by Nonresident Persons of Hawaii Real Property. City and County of Honolulu Public Access.

You will be asked to enter the numeric parcel IDTMK example. The City and County of Honolulu Real Property Assessment and Treasury Divisions Online property search by address account or parcel number. Taxpayers must file their returns by April 20 2021.

Leslie Kobata Registrar. Hawaii County HI Home Menu. 1-1-1-001-011-0000-000 and select an amount to pay as shown on your tax bill.

No warranties expressed or implied are provided for the data herein its use or interpretation. County of Hawaii Real Property Tax Office. 1 the amount due now or 2 new balance.

Property Record Search The County of Hawaii Real Property Tax Office makes every effort to produce the most accurate information possible. County of Hawaii Real Property Tax Office HILO. Hawaiʻi Tax Online is the convenient and secure way to get a State Tax Identification Number BB-1 file tax returns make payments manage your accounts and conduct other common transactions online with the Hawaiʻi Department of Taxation.

Ehawaiigov 808 695-4620 or Toll-free. The median property tax on a. Listed information does not include all of the information about every property located in this County.

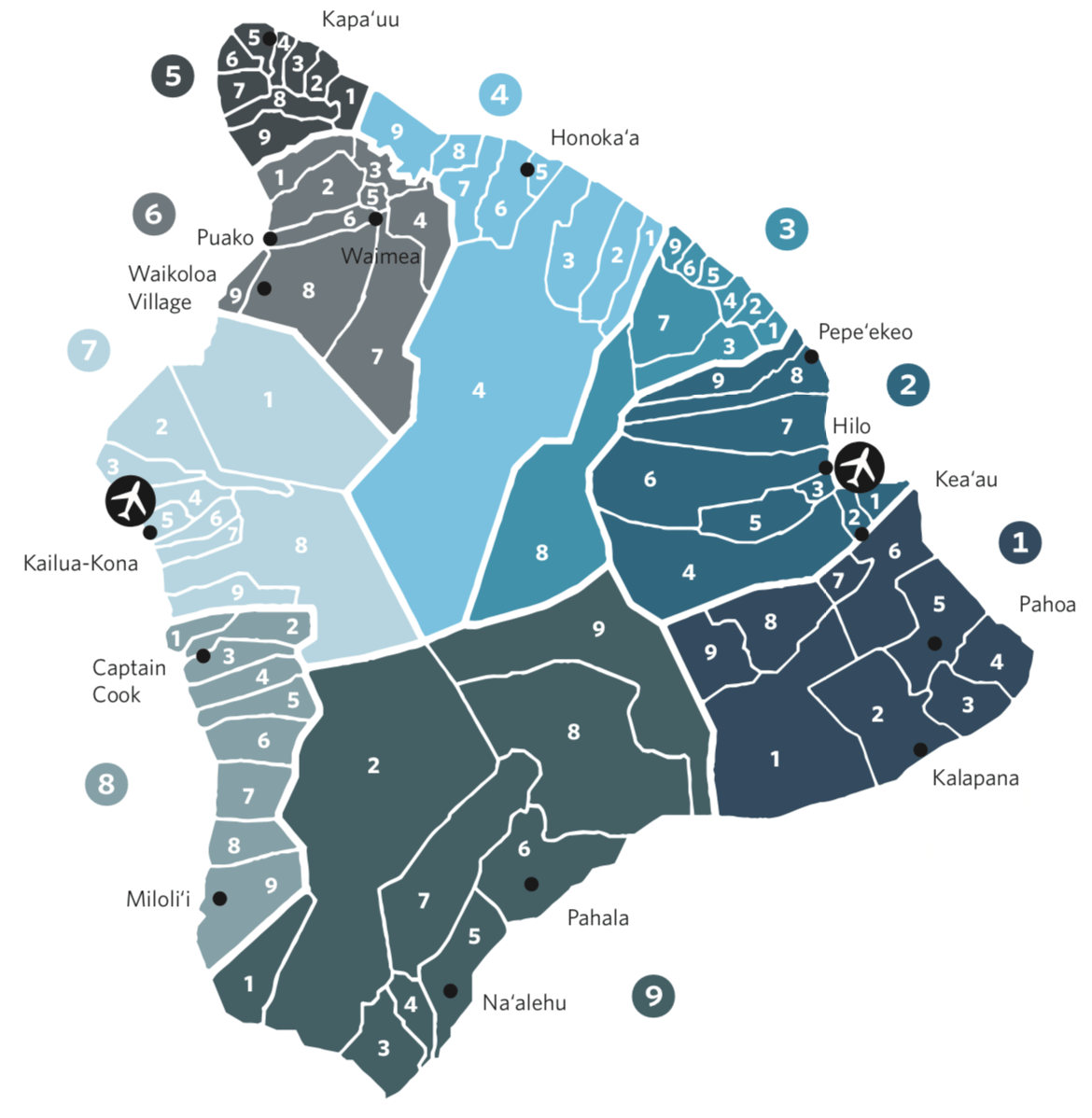

All other data is subject to change. Property Tax Records County of Maui Public Records Information County of Maui Public Records Information provides images of issued building plumbing electrical grading and driveway permits as well as approved final subdivision plats civil as-built construction plans and scanned. The Division maintains tax map keys TMK and the geographic information system GIS parcel layer.

808 323-4880 or email. Real Property Tax TMK Maps. See a full list of all available functions on the site.

HARPTA Withholding Tax on Sales of Hawaii Real Property by Nonresident Persons Tax Forms Form No. Pay your real property tax online or by telephone by credit card. The median property tax on a 51760000 house is 134576 in Hawaii.

HARPTA Withholding Tax on Sales of Hawaii Real Property by Nonresident Persons. 808 587-0136 Administrative Rules. Data is updated on a weekly basis.

Disclaimer This site was designed to provide quick and easy access to real property tax assessment records and maps for properties located in the County of Hawaii and related general information about real property tax procedures. COVID-19 Business Support Kīlauea Recovery Contact Us. 1 866 448-0725 or email.

Real Property Assessment Division - Online Services The Real Property Assessment Forms and Information tab on the menu bar. Hawaii Department of Budget and Finance Unclaimed Property httpswwwehawaiigovliloapp Search Hawaii Department of Budget and Finance unclaimed property records database by first last and business. 120 Honolulu HI 96813 Ph.

Most questions can best be resolved by contacting the state agency directly. Tax Services Hawaiʻi Tax Online. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact your county or citys property tax assessor.

Electronic payments will be accepted until further notice.

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home