Property Tax Search Tucson Az

Certain Tax Records are considered public record which means they are available to the public while some Tax Records. Parcel Split History View the history of Land Parcel splits.

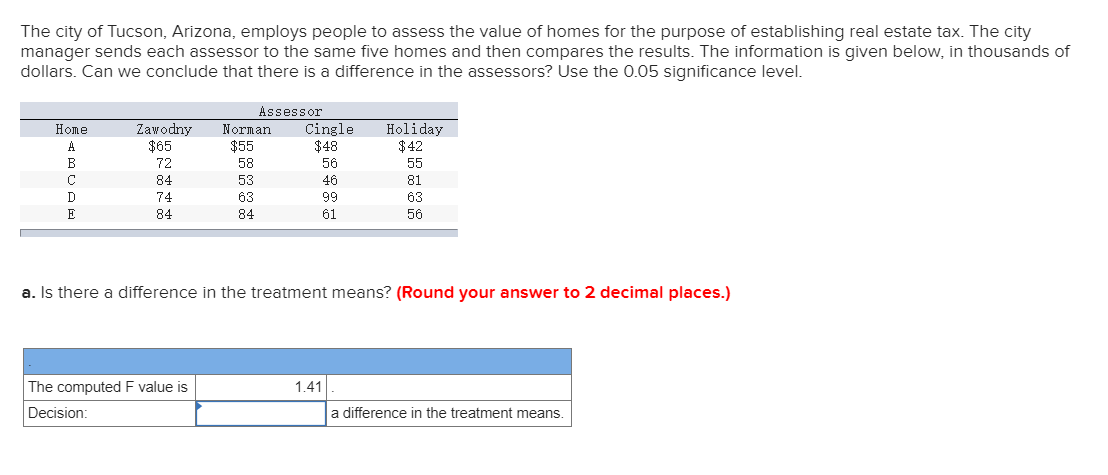

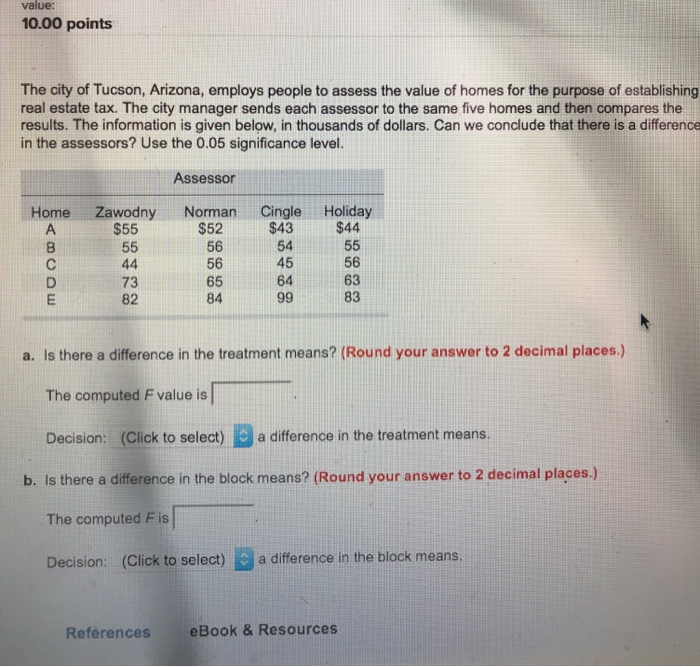

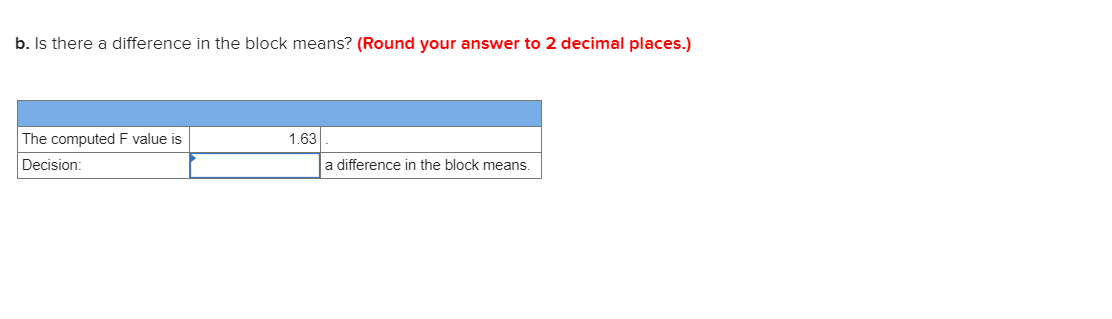

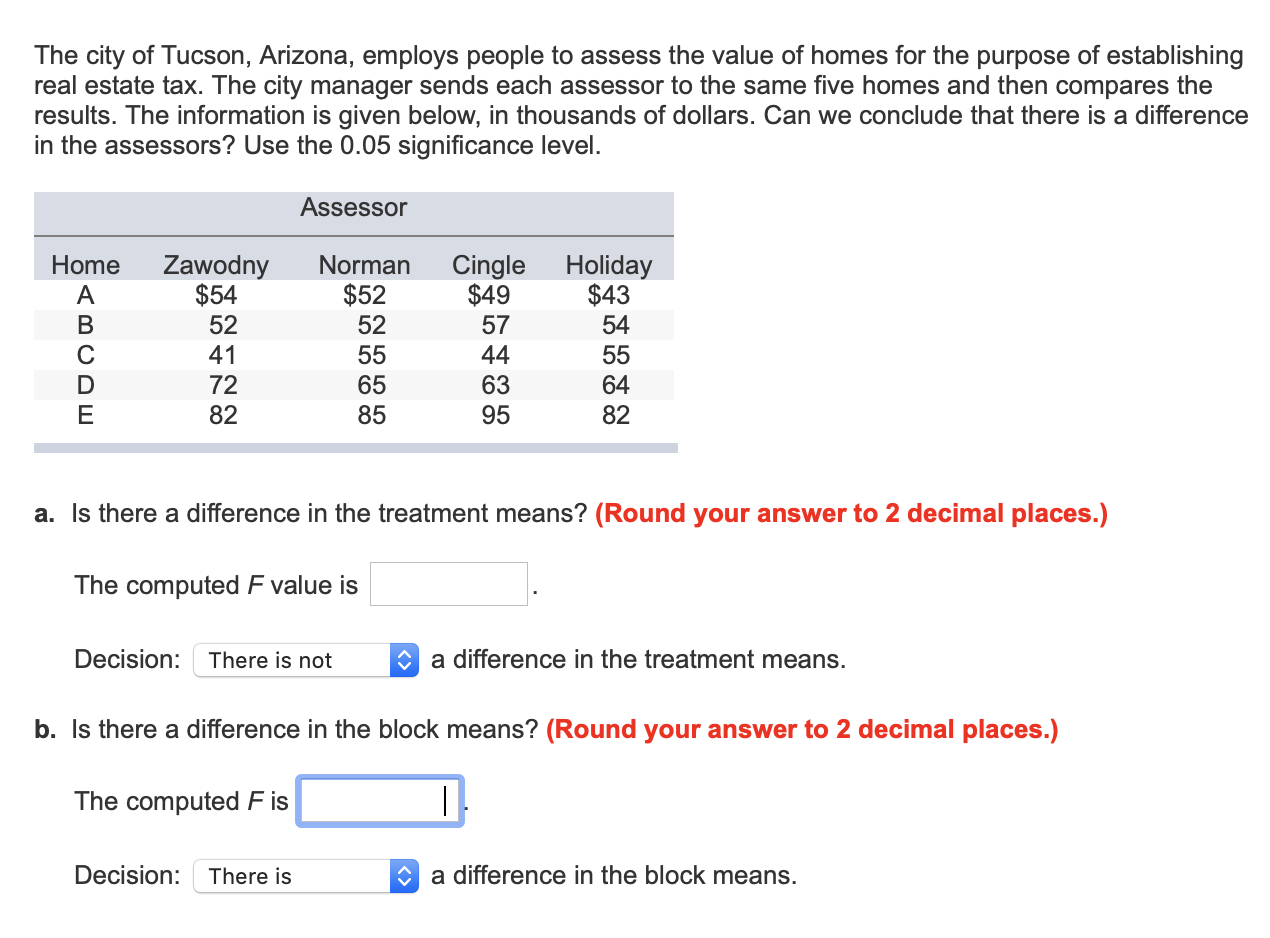

Solved The City Of Tucson Arizona Employs People To Ass Chegg Com

Solved The City Of Tucson Arizona Employs People To Ass Chegg Com

Tax Area CodesRates Search the tax Codes and Rates for your area.

Property tax search tucson az. If you need to report your business personal property as required by and did not receive the form or if you need to report your business personal property for the first time with the Assessor please contact our office at 520 724-8630 or email at asrpppimagov. Tax Bill Search Search the history of tax bills for your property. The median property tax in Arizona is 135600 per year for a home worth the median value of 18770000.

Church Ave Tucson AZ 85701 Phone 520740-8630 Fax 520792-9825. Find Tucson Tax Records. The search is not case sensitive.

You must have your state code book-map-parcel number for real property or reference number for personal property. Tax Records include property tax assessments property appraisals and income tax records. In the Public Works Building located at 201 North Stone Avenue Tucson AZ 85701.

Tax amount varies by county. Tax Payment History Search the history of tax payments for your property. The date must also be entered using a four-digit year.

Search Pima County property tax and assessment records by parcel taxpayer property address including subdivision maps and plats. A Tucson Property Records Search locates real estate documents related to property in Tucson Arizona. Contact Us and Hours PDSD Records is open Monday through Friday from 8 am.

Payment Options View all options for payment of property taxes. In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property. Assessor Pima County Assessor 115 N.

Arizona Property Taxes Photo credit. Data is entered as the recorded grantee on the deed. Property taxes in Arizona are paid in two semi-annual installments one due on Oct.

Tucson Tax Records include documents related to property taxes business taxes sales tax employment taxes and a range of other taxes in Tucson Arizona. Property valuation of S 5th Avenue Tucson AZ. 27 29 31 33 35 111 114 118 127 128 tax assessments.

Public Property Records provide information on land homes and commercial properties in Tucson including titles property deeds mortgages property tax. Enter last name a space and first name. Arizona is ranked number thirty one out of the fifty states in order of the average amount of property taxes collected.

The tax year must be entered as 4 digits ie 2002. 072 of home value. 1 of the current tax year and another due on March 1 of the following year.

The typical Arizona homeowner pays just 1578 in property taxes annually saving them 1000 in comparison to the national average. Taxpayer Name Search. Form 140PTC is used by qualified individuals to claim a refundable income tax credit for taxes paid on property located in Arizona that is either owned by or rented by the taxpayer.

Parcel information is derived from Pima County Assessor records and other sources. Form 140PTC provides a tax credit of up to 502. You can use our web site to look up your taxes for the current tax year for your real property and personal property taxes.

Counties in Arizona collect an average of 072 of a propertys assesed fair market value as property tax per year. See the Pima County Assessor Parcel Search for official Assessor information. By the end of September 2020 Pima County will mail approximately 454000 property tax bills for the various property taxing jurisdictions within the County.

PDSD Records can be contacted at 520 791-5550. To claim a property tax credit. We created this site to help you to understand your property tax bill and learn more about property taxes and how they are used.

20 rows Property taxes are paid to the county treasurers office. In-depth Pima County AZ Property Tax Information. Contact the county treasurer where.

Solved The City Of Tucson Arizona Employs People To Ass Chegg Com

Solved The City Of Tucson Arizona Employs People To Ass Chegg Com

Droubie And Sabbagh Vie For Pima County Assessor Post Local News Tucson Com

Droubie And Sabbagh Vie For Pima County Assessor Post Local News Tucson Com

Pima County Treasurer S Office

Pima County Treasurer S Office

Solved The City Of Tucson Arizona Employs People To Ass Chegg Com

Solved The City Of Tucson Arizona Employs People To Ass Chegg Com

Pima County Treasurer S Office

Pima County Treasurer S Office

Pima County Property Tax Due October 1 And March 1

Pima County Property Tax Due October 1 And March 1

Solved The City Of Tucson Arizona Employs People To Ass Chegg Com

Solved The City Of Tucson Arizona Employs People To Ass Chegg Com

3 Pima County Assessor Candidates Face Off In Democratic Primary Local News Tucson Com

3 Pima County Assessor Candidates Face Off In Democratic Primary Local News Tucson Com

Pima County Assessor Sets Property Tax Values

Pima County Assessor Sets Property Tax Values

Understanding Your County Tax Bill If You Live In Tusd Pi

Understanding Your County Tax Bill If You Live In Tusd Pi

Pima County Voters To Decide Assessor Recorder Races Local News Tucson Com

Pima County Voters To Decide Assessor Recorder Races Local News Tucson Com

Pima County Tax Assessor Property Search Property Walls

Pima County Tax Assessor Property Search Property Walls

Pima County Tax Assessor Property Search Property Walls

Pima County Tax Assessor Property Search Property Walls

Solved The City Of Tucson Arizona Employs People To Ass Chegg Com

Solved The City Of Tucson Arizona Employs People To Ass Chegg Com

Solved The City Of Tucson Arizona Employs People To Ass Chegg Com

Solved The City Of Tucson Arizona Employs People To Ass Chegg Com

Solved The City Of Tucson Arizona Employs People To Ass Chegg Com

Solved The City Of Tucson Arizona Employs People To Ass Chegg Com

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home