Pay Property Tax Knox County

Knox County collects on average 072 of a propertys assessed fair market value as. Our payment processor requires you to choose one of the following Bureau Codes depending on whether you are paying real estate or personal property.

Cash will NOT be accepted at this time.

Pay property tax knox county. To allow you to pay your 2020 property tax at one of their convenient Knox County locations. You may view and print records for personal use. Knox County Appraisal District is responsible for the fair market appraisal of.

Select the propertys Parcel ID from a list. Taxes may be paid by credit or debit card with a fee to the taxpayer of 225 or 100 minimum. Please keep in mind that you may appeal your appraisal each year during the month of June before the Knox County Board of Equalization.

Knox County Courthouse-First Floor 200 South Cherry Street Galesburg IL 61401. Property taxes can be paid by mail to PO. Please Note Knox County IN Treasurers Parcel ID is formatted like this.

If you wish to make a payment you must contact our office at 865 215-2305 or mail your payment to the Knox County. Pay At Participating Bank Locations. This website provides tax information for the City of Knoxville ONLY.

The locations and phone numbers are listed on this website. 7328 Norris Freeway Knoxville TN 37918. In Tennessee only businesses pay personal property taxes not individuals or private citizens.

However the next reappraisal will be in five 5 years in 2022. For your convenience you can continue to pay your taxes at any of our 5 area satellite locations. Questions regarding information provided here can be answered by calling 865-215-2084 or email at citytaxofficeknoxvilletngov.

You can also see a listing of area banks that will be accepting current tax payments during the month of February. For your convenience you may pay your Knox County Missouri real estate and personal property taxes online. Monday Friday 8am 430pm Phone.

They can provide data for a reasonable fee. Monday through Friday and is located in suite 453 of the City County Building 400 Main Street in downtown Knoxville. Please contact the Knox County Treasurers office at 812 885-2506 to obtain the correct payment amount.

A convenience fee may be charged for the use of this service and will be automatically calculated if applicable. Select the Statement you want to pay or view. Your actual tax rates.

Select to pay first half or second half or both. Select the county in which your property resides. No partial payments delinquent payments or tax relief.

Knox County Appraisal District is responsible for appraising all real and business personal property within Knox County. Box 15001 Knoxville TN 37901-5001 or in person at the downtown Property Tax Office. Review the total due less the.

Knox County conducts a county wide reappraisal on a four 4 year cycle. Knox County Collectors Office. The downtown Property Tax Office is open from 8 am.

Freedom of Information Officer. Please enter your Parcel ID you would like to search for. Visit Treasurer and Tax Collector website.

You may utilize this service if you are paying the 2020 tax in full. 309 343-7002 Office Hours. The district appraises property according to the Texas Property Tax Code and the Uniform Standards of Professional Appraisal Practices USPAP.

In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property. In-depth Knox County TN Property Tax Information. The information cannot be shared assigned sold leased or otherwise made available to any other party.

We have partnered with BBT. Appealing decisions on your assessed value and subsequent tax bill. The median property tax in Knox County Kentucky is 468 per year for a home worth the median value of 65000.

PAY PROPERTY TAXES ONLINE. Search for your property Real Estate or Personal. Property Tax Search and Payment Application If you are currently in an ACTIVE BANKRUPTCY DO NOT PROCEED WITH YOUR PAYMENT ONLINE.

Property Tax Bills Due May 11 2020 however due to COVID-19 situation penalties will be waived until July 10 2020. It is my goal to continue to provide the citizens of Knox County with the highest level of customer service while reducing costs to the taxpayer. We extend our sincere appreciation to them for their partnership with Knox County and providing this service.

Parties interested in acquiring bulk tax payment or billing data are advised to contact the Treasurers Office. Welcome to the Knox County Treasurers web site. This service is provided for you to be utilized at your discretion.

Check Payable and Mailed to. 309 345-3863 Fax Number.

Trustee Knox County Tennessee Government

Trustee Knox County Tennessee Government

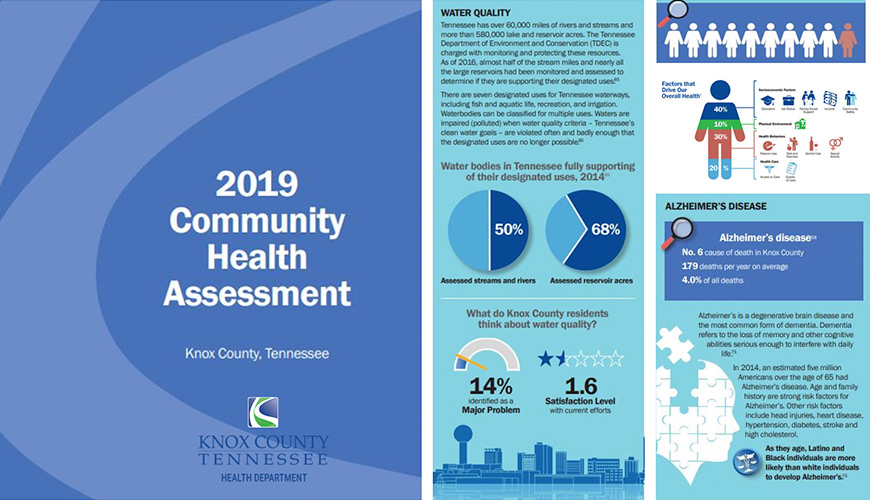

Community Health Assessment Health Department Knox County Tennessee Government

Community Health Assessment Health Department Knox County Tennessee Government

5701 Goldenrod Circle House Styles Real Estate Land For Sale

5701 Goldenrod Circle House Styles Real Estate Land For Sale

![]() Trustee Knox County Tennessee Government

Trustee Knox County Tennessee Government

Knox County Surplus Real Estate Properties Powell Auction Realty

Knox County Surplus Real Estate Properties Powell Auction Realty

The Property Located At 115 East Gambier Street Mount Vernon Ohio 43050 Sold By The Sam Miller Team Of Re Mount Vernon Ohio Ohio Real Estate Knox County Ohio

The Property Located At 115 East Gambier Street Mount Vernon Ohio 43050 Sold By The Sam Miller Team Of Re Mount Vernon Ohio Ohio Real Estate Knox County Ohio

County Clerk Knox County Tennessee Government

County Clerk Knox County Tennessee Government

Trustee Knox County Tennessee Government

Trustee Knox County Tennessee Government

Knox County Tn Property Tax Records Property Walls

Knox County Tn Property Tax Records Property Walls

Equestrian Estate For Sale In Knox County Tennessee Private Estate Sitting On 10 6 Acres Built For Separate Livin Victorian Homes Property Bed And Breakfast

Equestrian Estate For Sale In Knox County Tennessee Private Estate Sitting On 10 6 Acres Built For Separate Livin Victorian Homes Property Bed And Breakfast

Knox County Ohio Residential Property Tax Appraisals Decline Mount Vernon Ohio Homes Knox County Ohio Knox County Mount Vernon Ohio

Knox County Ohio Residential Property Tax Appraisals Decline Mount Vernon Ohio Homes Knox County Ohio Knox County Mount Vernon Ohio

Knoxville Knox County Tennessee Land For Sale 99 Acres Land For Sale Tennessee Land Knox County

Knoxville Knox County Tennessee Land For Sale 99 Acres Land For Sale Tennessee Land Knox County

Www Knoxcounty Org Img Backgrounds N Waterfall

Www Knoxcounty Org Img Backgrounds N Waterfall

County Commission Knox County Tennessee Government

County Commission Knox County Tennessee Government

Trustee Knox County Tennessee Government

Trustee Knox County Tennessee Government

Map Of Knox Co Tennessee Library Of Congress

Knox County Is A Phase Ii Municipal Separate Storm Sewer System Ms4 Stormwater Engineering Public Works Knox County Tennessee Government

Knox County Is A Phase Ii Municipal Separate Storm Sewer System Ms4 Stormwater Engineering Public Works Knox County Tennessee Government

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home