Ghmc Property Tax Search By Ptin

The application will lead to allotment of a new door number and PTIN number for the specific property in question. Procedure for GHMC Property Tax Online - Step By Step Guide.

Thanks for visiting our site.

Ghmc property tax search by ptin. Please contact Department concerned for further queries. Click Search Your Property Tax and then choose the GHMC Circle before entering the door number and clicking on Search Property Tax. Step 3 Verify The Details And Make Payment.

Search Property Tax RESET. You can enter this number in the website and make the GHMC property tax payment online. Choose your GHMC Circle.

Select Circle. Enter your door number. The results will show the PTIN for the required property in question.

03 Jul 2018 88 Views. The GHMC has classified properties in Hyderabad into 18 Circles and you can know your PTIN number OldNew from GHMC website. 1040 and Schedules 1-3 Individual Tax Return Other 1040 Schedules Information About the Other Schedules Filed With Form 1040 Form 4868 Application for Automatic Extension of Time to File.

Last date to pay the GHMC Property Tax Given below is the due date for the payment of the GHMC Property Tax and the penalties you will incur if you delay the payment. GHMC Property Tax Identification Number PTIN is given to each taxpayer for each property. GHMC Property Tax.

Follow the steps given below to find your PTIN. If you do not know the door number then you have to apply to GHMC for property assessment. Enter Captcha tCmcuA.

You can always ask for offline or online property assessment likewise. An interest of 2 pm. This number is unique in itself and is of Fourteen digits for old PTINs and Ten digits for new PTINs.

You dont need to have bank account to pay the property tax. Disclaimer Designed and Developed by Centre for Good Governance. It is 14 digits for old PTINs and 10 digits for new PTINs.

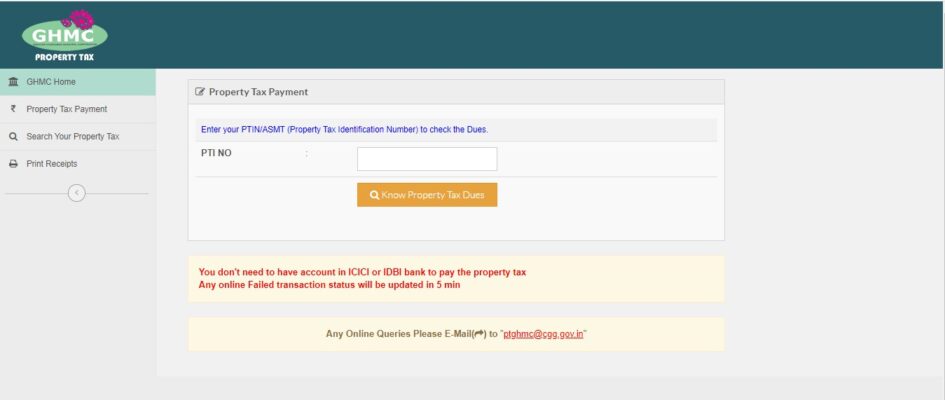

Go to Online Payment of Property Tax available in the GHMC home page as shown below Enter your PTINASMT Property Tax Identification Number to check the Dues shown below. Name of Owner. The data entered by the respective departments are displayed here for reference only.

Drainages roads public parks and all public property are significant property that. Greater Hyderabad Municipal Corporation Property Tax 2020-21. GHMC Property Tax Hyderabad Telangana Hyderabad GHMCPropertyTax PTIN.

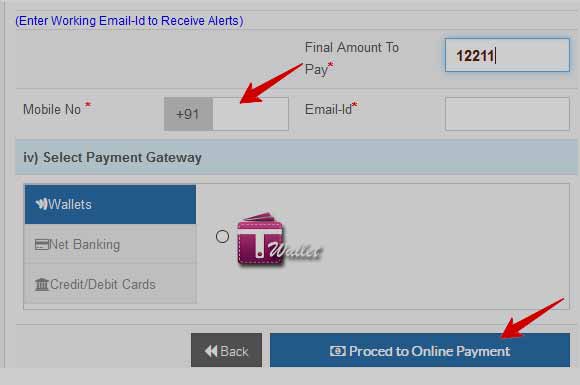

In case you do not know your Property Tax Identification Number PTIN you can find the PTIN using the appropriate steps mentioned in the Query above. One can quickly check their property details by visiting the online GHMC property tax search portal. Select the payment option net banking or debitcredit card.

The last date for the bi-annual payment of GHMC Property Tax is 31st July and 15th October. No manual transactions in Tax assessment issue of special notice issue of annual demand notices and receipts 100 computerization of assessments notices collection GHMC offers the following modes. The steps for online payment of GHMC property tax are.

GHMC Property Tax Payment. 10 May 2018 213 Views. The Indian public amenities require finances for maintenance.

You dont need to have bank account to pay the property tax Any Online failure transaction status can be updated in 5-mins Information Provided Online is up-to Date and Physical Visit to the GHMC Office Department is Not Required. PTI NO Know Property Tax Dues. Any Online failure transaction status can be updated in 5-mins Information Provided Online is up-to Date and Physical Visit to the GHMC Office Department is Not Required.

Budget 2019 Highlights - A Relief to Property Taxation. Enter any One above data to Search Property. Do you know about PTIN and how it is used to make property tax payment in Hyderabad.

15 Mar 2019 57 Views. Punch in PTIN and click on Know Your Property Dues Cross-check the details like the value of property tax arrears adjustments interest etc. You can follow the below guidelines to check Property Tax Dues.

Enter your PTINASMT Property Tax Identification Number to check the Dues. For finding your PTIN visitLocality Search and enter your Property Circle and your name or. The GHMC Property Tax Payment Online 2021-2022 Search by Door Number House Number at httpswwwghmcgovinPropertytaxaspx.

Click Search Property Tax. Logon to the official website of GHMC. Click Search Your Property Tax on the left menu.

How to pay GHMC property tax online. Once you have identified you PTIN enter the PTIN in the designated column and click on Know your Property Tax Dues. PropertyAdviser a realestate propertydirectory explains in brief.

Will be charged if you delay the payment of GHMC Property Tax. The Ohio Department of Taxation is dedicated to providing quality and responsive service to you our individual and business taxpayers our state and local governments and the tax practitioners in Ohio. Enter any One above data to Search Property.

GHMC Property Tax Search PTIN For Hyderabad Residential Properties. Our goal is to help make your every experience with our team and Ohios tax system a success.

Read more »