How To Get Property Tax Identification Number Hyderabad

Total property tax for the year. First open this website httpsptghmconlinepaymentcgggovinSearchYourPropertydo.

Pin On Properties In Hyderabad

Pin On Properties In Hyderabad

The details of the property like door number PTIN and the amount of property tax that you must pay will display.

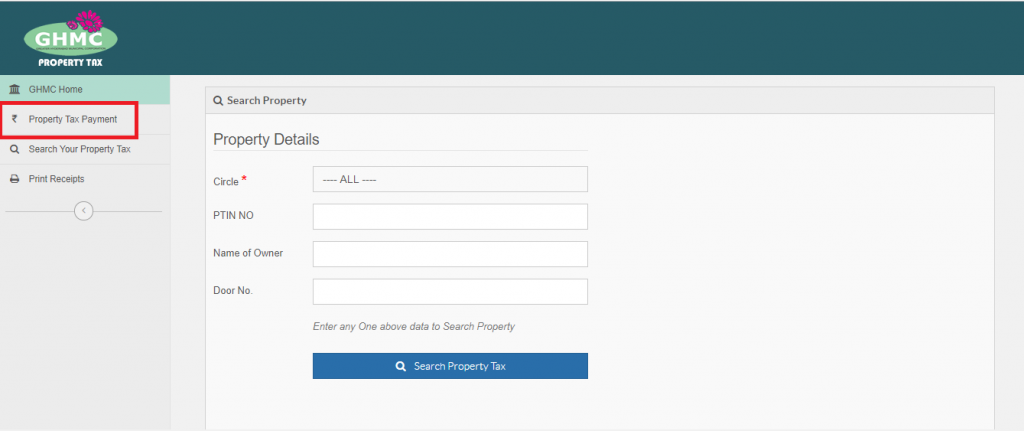

How to get property tax identification number hyderabad. Click on Search Property Tax. Property Tax Identification Number PTIN is an important Identification Number for making online payment of Hyderabad Property Tax. Login to the official GHMC website and click on the online payment portal Enter your PTIN number and click on Know property tax dues Verify the details mentioned on the screen.

Follow the Steps Below If You Dont Know Your PTIN. Click on Search property tax option. Disclaimer Designed and Developed by Centre for Good Governance.

To know your PTIN click on Search Your Property Tax tab on httpsptghmconlinepaymentcgggovinPtOnlinePaymentdo choose your GHMC circle enter your door number and click on Search Property Tax and the search result will show your PTIN. Step 3 Verify The Details And Make Payment. In the online services menu select Property Tax option.

Select your GHMC Circle from the drop-down menu. Enter the door number. PropertyAdviser a realestate propertydirectory explains in brief.

The Hyderabad property tax rate varies with the size and location of the property in the city. GHMC Property Tax payment online window will be displayed. In case of old properties the GHMC allots a 14-digit PTIN.

The main advantage of the. Know Property Tax Dues. Go to the ghmcgovin official Portal.

Go to the online payment portal of the GHMC website here. Click on the link httpsptghmconlinepaymentcgggovinSearchYourPropertydo. You may also get this number from your county assessors office.

Once you have identified you PTIN enter the PTIN in the designated column and click on Know your Property Tax Dues. In case you do not know your Property Tax Identification Number PTIN you can find the PTIN using the appropriate steps mentioned in the Query above. To pay property tax online in Hyderabad follow these steps.

On GPA basis where the buyer gives a token amount and gets the document completed said a city-based builder The Property Tax Identification number. Even as the high. Visit the GHMC property tax search online portal.

Click Know Your Property Tax Dues. Enter your PTINASMT Property Tax Identification Number to check the Dues. Enter your PTIN in the PTI No.

Search Your Property Tax. Where you have to enter your PTI NO or ASMT property identification number. Enter your Property Tax Identification Number PTIN Click on Know Property Tax Dues The search result will display the property tax payable.

Enter property person name of owner. GHMC Property Tax Search Door House Number. If you have a PTIN property tax identification number you can search on the GHMC website to find out how much property tax is due and can do through the online payment.

Online property tax payment has really reduced the burden of standing in long queues and saves time of property owners. You dont need to have bank account to pay the property tax. It is a unique fourteen digit number that is allocated specifically for a particular house.

How to generate PTIN to pay GHMC property tax. If your property tax is paid through your mortgage you can contact your lender for a copy of your bill. How to generate PTIN.

Payment of Tax Dues No manual transactions in Tax assessment issue of special notice issue of annual demand notices and receipts 100 computerization of assessments notices collection GHMC offers the following modes. This number is located on your county tax bill or assessment notice for property tax paid on your principal residence during the tax year for which you are filing your return. To know your property tax online follow the procedure given below.

Rs 8400672 Rs 9072. Before starting the process the taxpayer should be ready with his 10-digit Property Tax Identification Number PTIN. Easy way to know the PTIN Property Tax Identification Number in Hyderabad Property Adviser Do you know about PTIN and how it is used to make property tax payment in Hyderabad.

Read more »