How To Calculate Residential Property Tax In Hyderabad

Dont forget that to multiply a percentage you must either first change the percentage back. The answer you get is the amount of money you owe in property tax.

Plinth area monthly rent per sq.

How to calculate residential property tax in hyderabad. X 12 slab rate -. Rate of Property Tax. Officer GHMC Commissioner GHMC.

No manual transactions in Tax assessment issue of special notice issue of annual demand notices and receipts 100 computerization of assessments notices collection GHMC offers the following modes. Annual Property Tax for residential property Plinth Area MRV per sqft. GHMC has adopted slab rates for computation of residential property tax in Hyderabad.

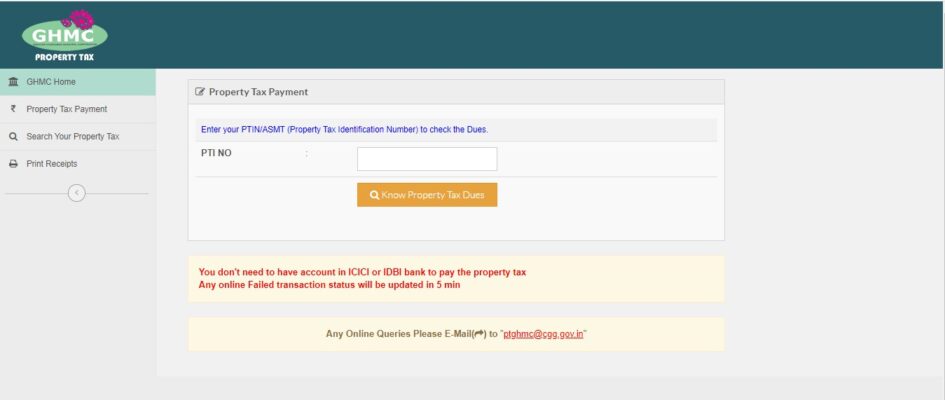

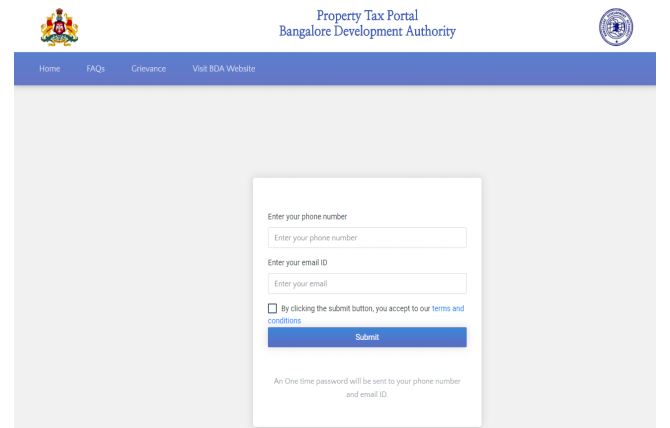

Visit httpswwwghmcgovin Step 2. You can calculate your property tax online with the Greater Hyderabad Municipal Corporation. Go to Online Payments and select the Property Tax option.

On the page that now appears verify the details including arrears interest on arrears. Property tax plinth area monthly rent per sqft. Enter your PTIN and click on Know Property Tax Dues.

How to Calculate the Commercial Hyderabad Property Tax. The annual property tax for residential property is calculated using this formula. You can also calculate your Property Tax by Clicking Here GHMC Property Tax Calculator How is my PTIN No.

Ft12slab rate -10 depreciation 8 library cess. Property tax in India depends on the location of a property in question with taxes varying from state to state. So if your home is worth 200000 and your property tax rate is.

Take your total property tax rate and multiply it by the value of the property you are dealing with. 18468 Commissioner Spl. Rs1368 Total tax per Annum.

Rs17100 Add library cess at 8 of Property tax. Annual Tax is Calculated as 35 X Total Plinth Area in Sft X Monthly Rental Value per Sft in Rs. Property tax on residential property Plinth area monthly rent per sq.

GARV Plinth area x Monthly rental value in Rs sq ft x 12. 12 017-030 depending on the monthly rental value as per the following slab 10 depreciation 8 library cess. Plinth Area MRV per sq.

How do I calculate my GHMC Property Tax. Steps to pay GHMC property tax online. GHMC Online property tax payment has reduced the burden of standing in long queues and saves the time of property owners.

Of tax as per GHMC - 10 depreciation 8 library cess. Ft X Monthly rental value per sq. On the next page that loads details of your arrears taxable amount interest on arrears adjustments etc.

Annual property tax Gross Annual Rental Value GARV X 17 30 slab rate to be determined based on MRV as fixed by GHMC 10 depreciation 8 library cess. Computation of residential tax property. Slab rate is determined based on Monthly Rental Value MRV as fixed by GHMC.

The rate of property tax is dependent on Annual Rental Value in Hyderabad. The formula for calculating residential GHMC property tax is. 30 of ARV 13.

PTIN is a 10 digit number First number is common for all circles 23 digits circle number. The amount of tax depends on various factors like location size occupancy type gender female owners attract less tax age senior citizens are not taxed heavily etc. If your property is rented out calculate the monthly rent per sqft as per your rental agreement.

To estimate your real estate taxes you merely multiply your homes assessed value by the levy. Click Property Tax Payment from Menu. Below mentioned is how you can calculate your applicable residential property tax.

The formula for calculation of property tax is as follows. Please note that GARV can be calculated using the following. The formula used for calculating property tax is given below.

Property tax per annum 30 of 57000. The formula for calculation of tax for residential property is Annual property tax Plinth area x Monthly Rental Value. You can use the following formula when calculating residential GHMC property tax.

Log on to the GHMC website. The annual property tax for the city of Hyderabad is calculated as 35 X Total plinth areas in Sq. Use the below formula to calculate property tax.

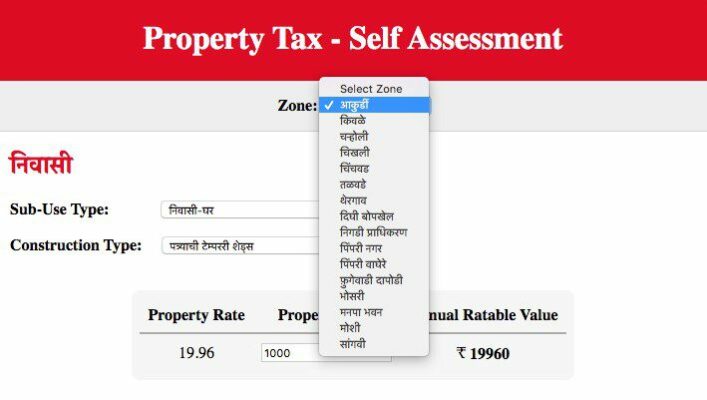

Users can calculate the tax by selecting the circle locality classification of building occupation type building construction type age of building and occupation certificate etc. You can also calculate your Annual Property Tax online and pay property tax online. 12 017-030 depending on the monthly rental value dependent on the following slab list provided by the GHMC 10 depreciation 8 library cess.

Annual Property Tax Gross Annual Rental Value GARV x 17 30 Slab Rate 10 depreciation 8 library cess. Enter your PTI number and click submit. Property tax base value built-up area Age factor type of building category of use floor factor.

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home