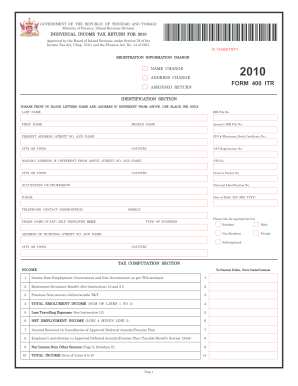

Michigan Homestead Property Tax Credit 2020 Form

Check all that apply. 24 rows Instructions included on form.

Michigans homestead property tax credit is how the State of Michigan can help you pay some of your property taxes if you are a qualified Michigan homeowner or renter and meet the requirements.

Michigan homestead property tax credit 2020 form. Filers Full Social Security No. Include any farmland preservation tax credit in your total household resources. Homestead Property Tax Credit Claim.

IRS Form 4506. Michigan Department of Treasury Rev. 2019 Tax Credit.

You claim the credit you should complete the Michigan Home Heating Credit Form MI-1040CR-7 using the instruction booklet. Resident Credit for Tax Imposed by a Canadian. Disabled applicants must complete form DTE 105E.

Real property and manufactured or mobile homes. This form is for income earned in tax year 2020 with tax returns due in April 2021. 05-19 Page 1 of 3 Amended Return 2019 MICHIGAN Homestead Property Tax Credit Claim MI-1040CR Issued under authority of Public Act 281 of 1967 as amended.

Enter dates as MM-DD-YYYY Example. This form is for income earned in tax year 2020 with tax returns due in April 2021. Homestead Exemption Application for Senior Citizens Disabled Persons and Surviving Spouses.

We last updated Michigan Form MI-1040CR-7 Instructions in February 2021 from the Michigan Department of Treasury. Computing your property tax credit claim. If you are unsure of whether or not you qualify for the Home Heating Credi t or.

Individual Income Tax Return. Download Print e-File with TurboTax. We will update this page with a new version of the form for 2022 as soon as it is made available by the Michigan government.

Form MI-1040CR requires you to list multiple forms of income such as wages interest or alimony. To use the forms provided by the City of Columbus Income Tax Division we recommend you download the forms and open them using the newest version of Acrobat Reader. Michigan Schedule of Taxes and Allocation to Each Agreement.

Download Print e-File with TurboTax. You own or were contracted to pay rent and occupied a Michigan homestead for at least 6 months during the year on which property taxes andor service fees were levied If you own your home your taxable value was. We last updated the Michigan Homestead Property Tax Credit Claim for Veterans and Blind People in March 2021 so this is the latest version of Form MI-1040CR-2 fully updated for tax year 2020.

Filers First Name MI. Form MI-1040CR-7 Instructions requires you to list multiple forms of income such as wages interest or alimony. Composite Individual Income Tax Return.

You should complete the Michigan Homestead Property Tax Credit Claim MI-1040CR to see if you qualify for the credit. You can download or print current or past-year PDFs of Form MI-1040CR-2 directly from TaxFormFinder. Address where you lived on December 31 2020 if different than reported on line 1.

We last updated the Homestead Property Tax Credit Claim in February 2021 so this is the latest version of Form MI-1040CR fully updated for tax year 2020. Homestead Property Tax Credit Claim for Veterans and Blind People FILING DUE DATE. If you checked box c enter dates of Michigan residency in 2020.

When claiming the Michigan property tax credit you need to file form 1040CR along with your income taxes. Income tax returns filed in 2020 for 2019 filed in 2019 for 2018 will be accepted including all schedules and any Homestead Property Tax Credit and Home Heating Credit returns. The deadline for submitting this form is September 30 2020.

Form MI-1040 is the most common individual income tax return filed for Michigan State residents. Include Form 5049 7. 0 Homeowners who moved during 2020 complete lines.

Enter the amount of credit you received in 2019 on line 20 or include it in net farm income on line 16. 2020 Tax Credit. We last updated the Home Heating Credit Instruction Booklet in February 2021 so this is the latest version of Form MI-1040CR-7 Instructions fully updated for tax year 2020.

Part-Year Resident 8. 2019 Tax Return. You can print other Michigan tax forms here.

Michigan Homestead Property Tax Credit Claim for Veterans and Blind People. We will update this page with a new version of the form for 2022 as soon as it is made available by the Michigan. We last updated Michigan Form MI-1040CR in February 2021 from the Michigan Department of Treasury.

Type or print in blue or black ink. Please read the instructions on the back of this form before you complete it. Address of homestead sold moved from during 2020 Number Street City State ZIP Code.

File with the county auditor on or before December 31. Farmland owned by a business entity may not be claimed for a homestead property tax credit by one of the individual members. You may qualify for a homestead property tax credit if all of the following apply.

APRIL 15 2020 WWWMICHIGANGOVTAXES WWWMIFASTFILEORG MI-1040CR-2. For all adults in the home who are not required to file income tax returns in 2019 or 2020. Fill-in Forms and Instructions Filter by year 2021 2020 2019 2018 2017 2016 2015 2014 2013 Submit.

Read more »