Property Tax Form Trinidad Pdf

This Act may be cited as the Property Tax Act 2009. By sfadmin Tender 2018 Ministry of Finance Property Tax Request for Proposals RFP Capacity Building of the Valuation Division Ministry of Finance Trinidad and Tobago June 7 2018.

Cdtfa 401 A2 Form Fill Out And Sign Printable Pdf Template Signnow

Cdtfa 401 A2 Form Fill Out And Sign Printable Pdf Template Signnow

Removal of Total or Partial Exemption front side of form.

Property tax form trinidad pdf. City Town or Post Office 11. 2021 Property Tax Credit Calculator. ANNUAL PROPERTY TAX 36000 3000 32400 36000 - for voids 32400 x 3rate of tax 97200 per year or 8100 per month Property Owners would only be required to make payment upon receipt of an Assessment Notice from The Board of Inland Revenue which will be sent by post.

According to the Property Tax Act 2009 all land including vacant land in Trinidad and Tobago shall be Rated on a Rental Value basis. 13 I WILL reside in the property on which I am applying for the tax credit on July 1 2021 and for more than 6 months thereafter. Assessor Auditor-Controller Treasurer and Tax Collector and Assessment Appeals Board have prepared this property tax information site to provide taxpayers with an overview and some specific detail about the property tax process in Los Angeles County.

File your Landlord Certificate Form LC-142 online using myVTax or review the online filing instructions. Appeal Court makes new order. You may file up to one year after the due date.

Renewal Application for Total or Partial Property Tax Exemption R. Automatic Renewal of Total or Partial Exemption back side of form R. Homestead Declaration AND Property Tax Credit Claim.

URL to the PDF file must be on exactly the same domain as the current web page. The due date is August 15. 7604 PRINTED BY THE GOVERNMENT PRINTER C ARONI REPUBLIC OF TRINIDAD AND TOBAGO 2018 Legal Supplement Part C to the Trinidad and Tobago Gazette Vol.

5 COMMERCIAL 6 INDUSTRIAL with building 30. Bidder Request Form PDF Property Tax Frequently Asked Questions. 22649 Form 103-I For use in reporting true tax value of interstate carriers.

Statement of Benefits Personal Property. The information requested on the contact form is personal information that is classified as. 50-125 Application for Theater School Property Tax Exemption PDF 50-128 Application for Miscellaneous Property Tax Exemptions PDF 50-135 Application for Disabled Veterans or Survivors Exemption PDF 50-140 Application for Transitional Housing Property Tax Exemption PDF 50-214 Application for Nonprofit Water Supply or Wastewater Service Corporation Property Tax Exemption PDF.

Justice Seepersad overruled again. The property tax you will be required to pay on your residential property is 3 of its Annual Rental Value. PDF 13 KB DR-498AR.

Vista Verde Plaza Building 233 N. 18 of 2009 LS. ENACTED by the Parliament of Trinidad and Tobago as follows.

The Minnesota Department of Revenue asks you to supply this information on the contact form to verify your identity. Pecos La Trinidad San Antonio TX 78207. Zip Code Check or mark each of the following statements that pertain to you.

Full Service Title Company Locations. 7604 Property Tax LAWS OF TRINIDAD AND TOBAGO CHAPTER 7604 PROPERTY TAX ACT An Act to make provision for the assessment rating and taxation of land and for matters incidental thereto. This Act may be cited as the Property Tax Act.

Annual Rental Value ARV is the rent at which a property. Box 839950 San Antonio TX 78283. PDF 11 KB DR-499.

Trinidad and Tobago HOUSE OF REPRESENTATIVES BILL ANACT to amend the Property Tax Act Chap. All properties in Trinidad and Tobago have a rental value. Call Us 1 868 623 4663.

Short title Enactment Second Session Ninth Parliament Republic of Trinidad and Tobago REPUBLIC OF TRINIDAD AND TOBAGO Act No. Failed to fetch Error. Compliance with Statement of Benefits Personal Property.

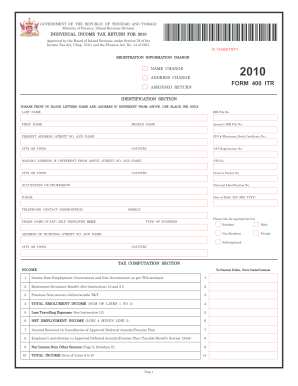

PDF 22 MB DR-498R. Forms Tax Return Tax Return Instructions Request Application Exemption Certificate Spreadsheet TD1 2019 Tax Returns e-Tax 440-EMO Emolument Income Earner File on-line through e-Tax. ASSENTEDTO31STDECEMBER2009 PART I PRELIMINARY 1.

Return for Interstate Carriers. 13 8th Feburary 2018 No. 51764 Form SB-1PP Must be submitted to the body designating the Economic Revitalization Area prior to the public hearing.

Renewal Application for Total or Partial Property Tax Exemption - Receipt 0691. PART I PRELIMINARY 1. The rental value is a calculation of the rent the property will obtain on the open market if it were put up for rent.

HS-122W Vermont Homestead Declaration andor Property Tax Credit Withdrawal. The qualified professionals at the Valuation Division of the Ministry of Finance are responsible for calculating the Annual Rental. Monday-Friday 800 am - 445 pm Wednesdays 800 am - 630 pm.

There are different ways to file your Property Tax Refund.

Read more »