Kentucky Property Tax Form 62a500

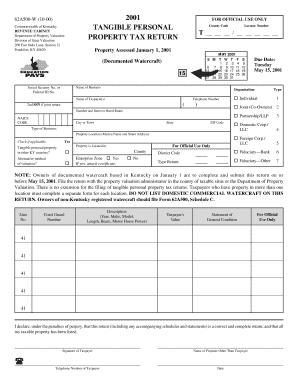

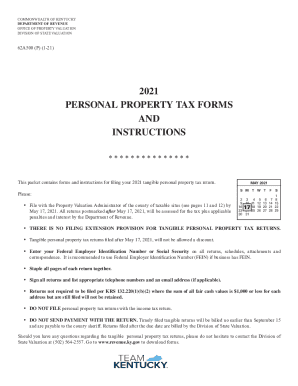

Form 62A500 is not required to be filed for tangible personal property with a sum fair cash value of 1000 or less per property location. This form 62A500 is available on the website of the Kentucky Department of Revenue.

To start the blank use the Fill Sign Online button or tick the preview image of the document.

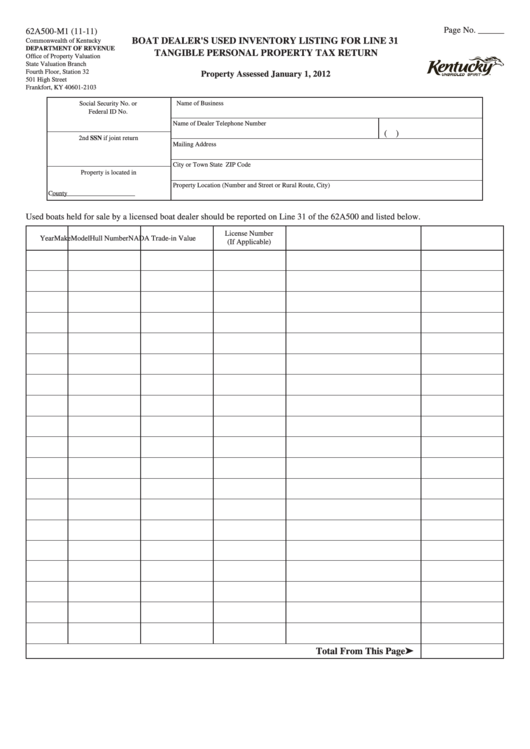

Kentucky property tax form 62a500. The return must include the property location by street address and county. For consignee reporting requirements see the instructions for Revenue Form 62A500-C. The advanced tools of the editor will direct you through the editable PDF template.

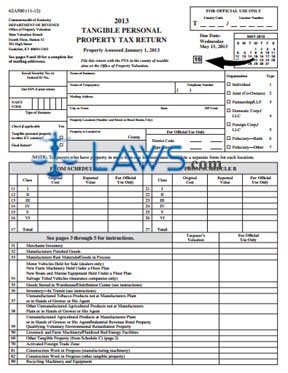

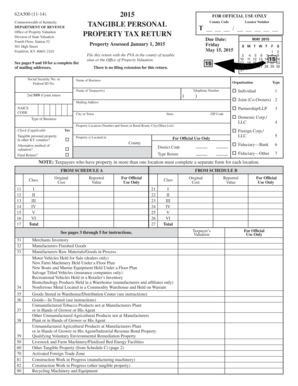

Open it up with online editor and begin altering. Lessees who have property in more than one location must complete a separate form for each location. Kentucky does not allow consolidated and joint returns.

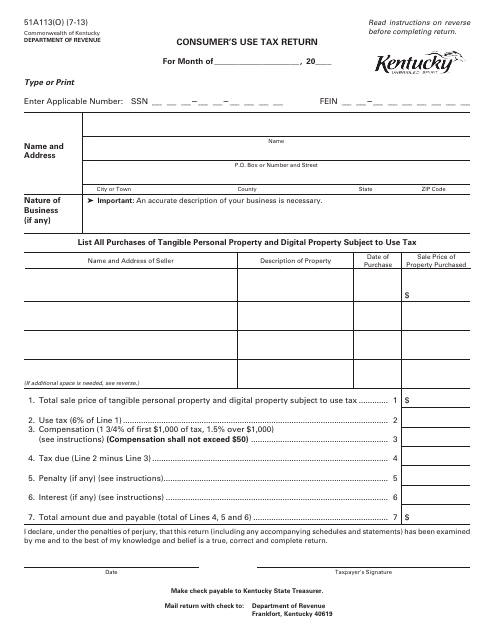

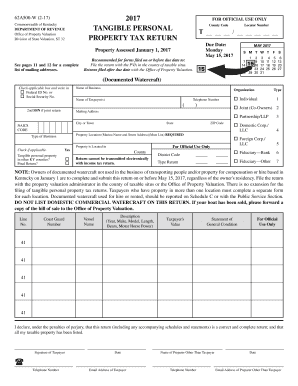

File a separate tangible property tax return Form 62A500 PDF for each property location. PROPERTY TAX RETURN MAY 2020 Cost For Official Use Only Use Only Property Location Number and Street or Rural Route CityMust List REQUIRED Yes 62A500 01-20 Commonwealth of Kentucky Type Locator Number Name of Business Property Assessed January 1 2020 ZIP Code FOR OFFICIAL USE ONLY County Code TANGIBLE PERSONAL 2020 T Federal ID No. Select the county the asset is located in from the drop-down list.

A post office box is not acceptable as the property address. Kentucky merchants must list merchandise consigned by a nonresident on the Consignee Tangible Personal Property Tax Return Revenue Form 62A500-C. You can use three available alternatives.

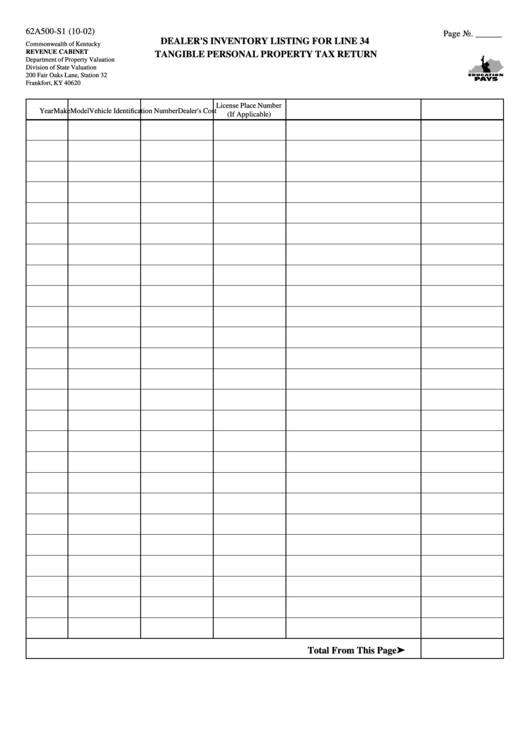

Find the form you will need in the library of legal templates. Automobile dealers must report all. 62A500 P 1-21pdf - COMMONWEALTH OF KENTUCKY DEPARTMENT OF REVENUE OFFICE OF PROPERTY VALUATION DIVISION OF STATE VALUATION 62A500 P 1-21 2021 Course Hero.

Change the template with exclusive fillable fields. Turn on the Wizard mode on the top toolbar to obtain more suggestions. Tangible property leased to local governmental jurisdictions is exempt from state and local tax under the Governmental Leasing Act.

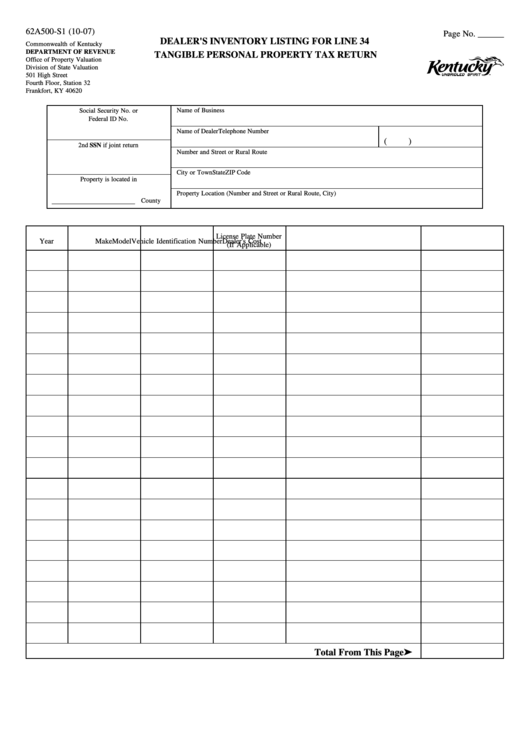

Hit the Get Form button to begin modifying. Complete this form if you have included the leased property on your Form 62A500. Follow these simple guidelines to get 62a500 S1 11 11 Form completely ready for submitting.

Complete Revenue Form 62A500 for each fluidized bed energy production facility. Open the template in our online editor. Enter your official identification and contact details.

This information transfers to the Property Location field on Form 62A500 62A500-A or 62A500-W. Include the daytime and place your e-signature. Engaged parties names addresses and numbers etc.

Read the guidelines to discover which info you have to include. Select the Sign button and create a signature. Fluidized Bed Energy Production FacilitiesProperty certified as a fluidized bed energy production facility as defined in KRS 211390 is subject to a state rate only.

However taxpayers must still keep records of property owned. How to complete the Get And Sign Form 62a500 2019 on the internet. 5 6 7 8 9 10 11 list of mailing addresses.

Find the KY DoR 62A500 P you require. Or merchandising inventory must list the property. KENTUCKY TANGIBLE PERSONAL PROPERTY TAX RETURN Form 62A500 Kentucky business owners must file an annual tangible personal property tax return documenting all such assets related to their companies.

62A500 01-19 FOR OFFICIAL USE ONLY County Code Locator Number Commonwealth of Kentucky 2019 T DEPARTMENT OF REVENUE Station 32 TANGIBLE PERSONAL PROPERTY TAX RETURN MAY 2019 Property Assessed January 1 2019 S M T W T F S 1 2 3 4 See pages 11 and 12 for a complete Forms filed on or before due date. Attach additional schedules if necessary. The maximum number of characters that transfer is 35.

Returns filed by the due date are assessed by the local PVA. Tangible property leased to local governmental jurisdictions is exempt from state and local tax under the Governmental Leasing Act. A property tax return is created for each location entered.

Or Social Security No. Each individual partnership or corporation that has taxable personal property must file return Form 62A500 between January 1 and May 15 with their local Property Valuation Administrator PVA. See pages 11 and 12 for a complete list COUNTY PVA PHONE NUMBERS AND ADDRESSES Code Phone Number City 001 Adair 270-384-3673.

Typing drawing or uploading one. Add the date to the form with the Date function. Select the fillable fields and add the requested data.

Property leased to Communications Service Providers and Multi-Channel Video Programming Service Providers under an operating lease must be reported on Form 62A500 by the lessor. 8 2020 - Effective January 1 2020 a new state law KRS 132220 1 b 2 b changes the filing requirements for tangible personal property tax returns. The Kentucky Revenue Cabinet.

Property leased to Communications Service Providers and Multi-Channel Video Programming Service Providers under an operating lease must be reported on Form 62A500 by the lessor. List qualifying property on Form 62A500 Schedule B. 2021 Tangible Personal Property Tax Return Instructions FORM 62A5009 pdf View Form TANGIBLE_ 62A500 1-21 PERSONAL PROPERTY TAX RETURN Excel.

Be sure the details you fill in KY DOR 62A500-W is up-to-date and correct. Fill in the empty areas. Fill out each fillable field.

Kentucky Department Of Revenue

Https Revenue Ky Gov Forms 61a500 P 1 20 2020 Pdf

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home