King County Property Tax Filing

Real Property Tax Real Estate 206-263-2890. IMAP KCGIS Districts Reports Assessors Office Property Tax Zoning Land Use and Permits Records Search Cities and Population 2000 census King County Archives Within King County.

Effective January 1st 2021.

King county property tax filing. As part of the continued effort to stop the spread of CoVID-19 in our community King County Elections strongly recommends registering to vote updating your registration and accessing your ballot online when needed for the rest of the year. To the eFiling application. Non-attorneys are not required to e-file documents but may do so.

Taxpayers can file appeal online using. The new fee for electronic working copies submissions is 3000. If you have questions please call 206 205-9200.

These records can include King County property tax assessments and assessment challenges appraisals and income taxes. By April 30 or the taxpayer will incur a monthly penalty of 5 percent of the tax due not to exceed 25 percent. Attorneys must electronically file e-file and e-serve all documents using the Clerks online eFiling application unless King County Local General Rule 30 provides otherwise.

Jackson Street Suite 710 Seattle WA 98104 NOTE NEW MAILING ADDRESS. Please visit COVID-19 Impacts to King County District Court to learn how these changes affect you or call 206 205-9200. Some exceptions do apply.

Personal property used in a business on January 1 must be reported in that year to the assessor of the county in which the property is located. We will have Vote Centers open for those who need assistance or have missed the deadlines but ask that those who are able to. Taxpayers who believe the assessed value of their property exceeds its fair market value have the opportunity to appeal each year following receipt of the revaluation notice by filing a petition to the King County Board of AppealsEqualization BOE an independent King County agency.

For more detailed information on tax levies click here. The rate appealed must first be paid and appeals must be filed by the landowner with KCD no later than twenty-one 21 days after the due date of the first payment of annual property taxes established by King County. Electronic service of documents is required of non-attorneys upon electing to e-file documents.

If you did not file with us last year IRSgovget-transcript can help you retrieve a copy of last years. The penalty is five percent of the tax due per month not to exceed twenty-five percent RCW 8440130. City of Seattle Auburn The eCityGov Alliance cities including.

Not reporting this information by April 30 will result in a penalty being added to the tax amount billed. If you need help filing your listing. Please note not all King County District Court hearings are scheduled for videoconference or via telephone.

Mobile Homes and Personal Property Commercial Property Tax 206-263-2844. The Clerks Office eFiling application is undergoing unscheduled maintenance and currently unavailable. Tutorial 3MB PPS PDF format - Please view this tutorial prior to e-filing.

Reports must be filed. The King County Treasurer issues tax statements and taxes are paid to the King County Treasury Operations. Contact your attorney for available options to attend your scheduled hearing.

The assessed value of your property multiplied by the combined rate produces a tax amount which is your fair share of the total property tax levy in your area. Please read the full King County Clerks Alert here. Where to File Appeal.

Each agency will update its pages with current information. King County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in King County Washington. You can find it on line 7 of your 2019 return if you still have a copy of your return.

88 rows King County Treasury will begin sending out the annual property tax bills February 14. Many King County services are continually adapting because of the COVID-19 pandemic. Email personalpropertykingcountygov or Phone 206-296-5126.

Deadline for reporting is April 30 RCW 8440040 and WAC 45812060. Bellevue Bothell Issaquah Kenmore Kent Kirkland Mercer Island Sammamish. If you feel entitled to a tax refund which requires a petition please contact the Department of Assessments.

King County District Court Videoconference Access. Filing an appeal does not extend the period for payment of the rate. King County Treasury Operations 201 S.

King County District Court operations are substantially curtailed to help keep the public and our employees safe during the COVID-19 pandemic. The process must begin with the Department of Assessments.

Https Www Kingcounty Gov Depts Assessor Media Depts Assessor Documents Forms Exemptionforms Senior Fs Lawchange2020 Ashx

Covid 19 Homelessness Response King County

Covid 19 Homelessness Response King County

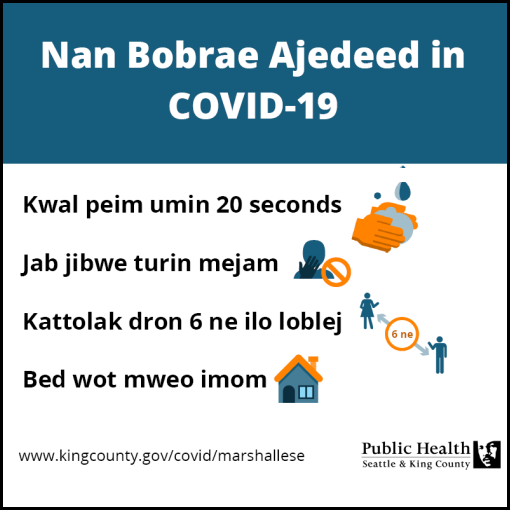

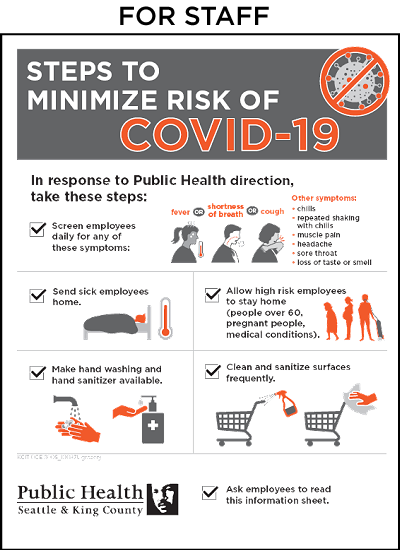

How To Care For Yourself Or Others With Covid 19 King County

How To Care For Yourself Or Others With Covid 19 King County

Covid 19 Homelessness Response King County

Covid 19 Homelessness Response King County

King County Wa Property Tax Calculator Smartasset

King County Wa Property Tax Calculator Smartasset

Seattle King County Realtors Higher End Homes Hit By Excise Tax Rate Increase

Seattle King County Realtors Higher End Homes Hit By Excise Tax Rate Increase

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home