How To Change Property Management Company

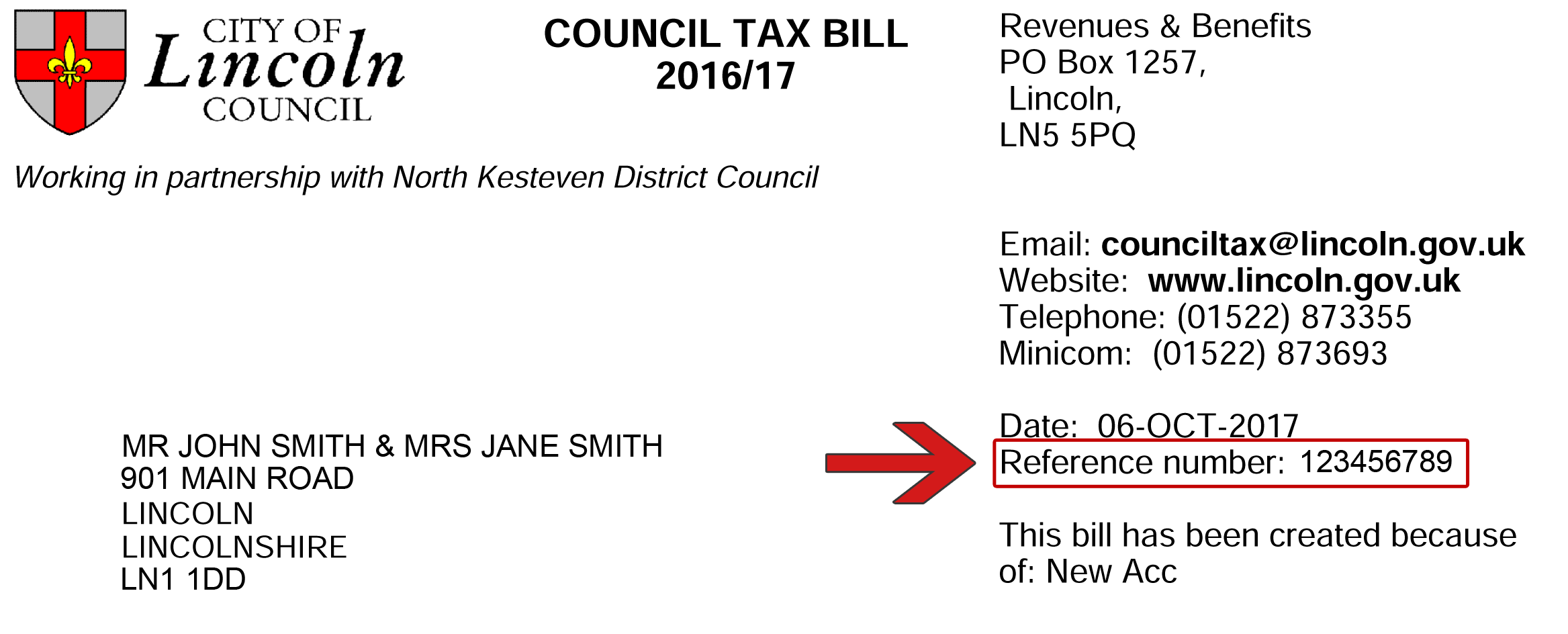

Provide your notification to terminate the management contract in writing and not by email. Letter to Tenant Stating Property is Under New Management.

Best Property Management Services Texas Property Manager Texas Westrom Group Property Management Property Management Euless Tenant Screening

Best Property Management Services Texas Property Manager Texas Westrom Group Property Management Property Management Euless Tenant Screening

Ask a tribunal to appoint a new manager.

How to change property management company. Writing a clear concise letter that introduces the new management to your tenants is a great way of ensuring they are up to date on. Not all management companies are the same and this may lead you to require changing property management company at some time during the ownership of your property. We specifically tailor our management style to how the board wants the property run he said.

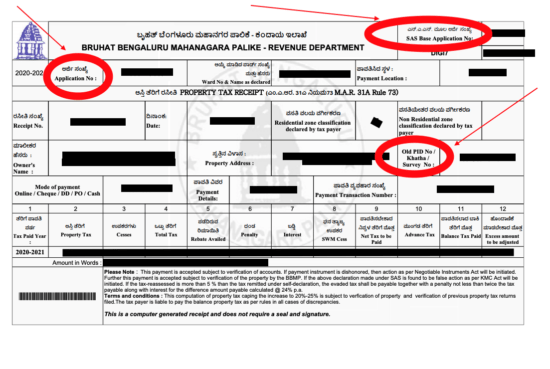

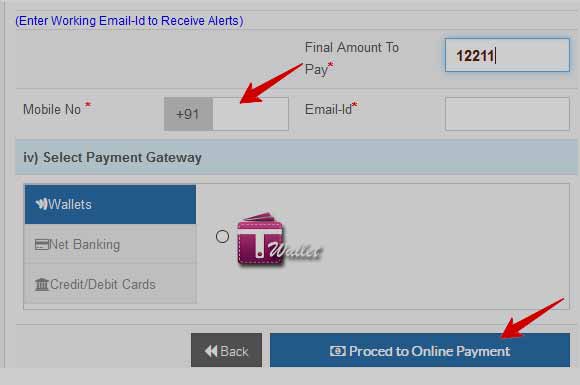

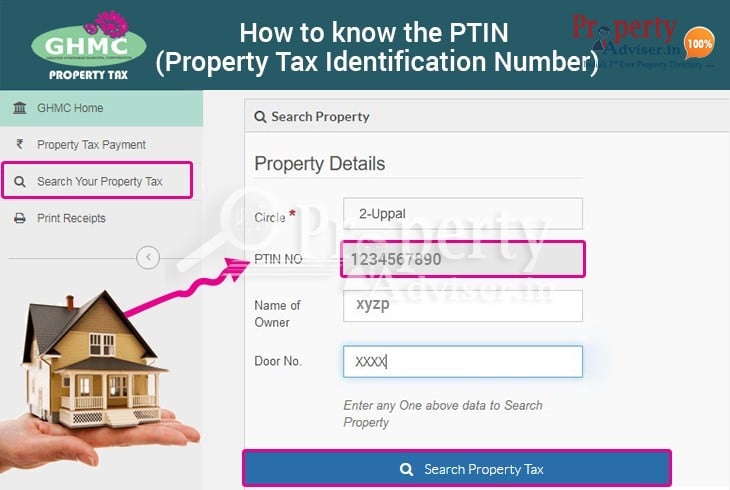

You may be able to change the management of your building if youre unhappy with the way its being run and you live in a leasehold flat. You can change property management companies by filling in two forms transfer from and a Department of Housing change of landlord or agent form. The average cost of property management is between 7 and 10 of the monthly rent according to Kevin Ortner chief executive officer of Renters Warehouse a company that manages around 23000 properties throughout the US.

A property manager can be. While it may make sense to take the do-it-yourself approach if youre a handy. A management company thats flexible offers the best chance for being a good fit with a property said Les Williams COO of Meyer Services which runs nine condominiums in Florida and Alabama.

If you have decided to hire a new property manager or switch management companies you should let your tenant know. However the total rental property management cost youll incur may be higher if there are any additional fees in the contract for things like evicting a tenant or. When you are on the hunt to select a property management company you want to look for one that is already well-versed in.

If youve owned income property for any length of time you know that managing a rental can be financially rewarding. Changing Property Managers Requires Specific Steps for HOAs. A Seasoned Company.

A property manager can be responsible for all aspects of tenant acquisition including marketing a vacancy showing vacant units screening prospective tenants signing lease agreements and collecting security deposits. Please take a tour of our available properties for lease or for sale. Inevitably in the life of a condominium or townhouse association the board of directors will vote to fire the current property management company and hire a new one.

The management company did not follow up on projects and was remiss in doing its. What you have a right to do as leaseholders is take over that responsibility from the freeholder and then you can decide how to manage the property either by doing it yourselves or by appointing your own choice of management company to. This includes collecting rent and dealing with tenant issues and complaints.

At the same time youve also likely discovered that property management requires a large commitment of time and effort. We also offer homes for sale. The management company is appointed by the freeholder so it is the freeholders decision who to appoint.

Hiring a property manager for your property can be extremely beneficial for your rental business. Generally this event comes about for one of three reasons. Make sure you include the effective date of the contract termination.

In order to submit the Change of Management packet there is information like the lease the tenants voucher number and tenants contact information that you want to make sure you get from your current Property Manager and in the hands of the new Property Manager. Best practice is to send the notice by certified mail return receipt requested so you will have a record that it was sent and that the property manager received it.

Read more »Labels: change, company, management, property