How To Find Property Id In Bangalore

Click on iRTC Step 5. In your property tax receipt for 2012-2013 this new PID number will also be given.

6 Bhk 3500 Sqft Independent House For Sale At Nri Layout Bangalore Property Id 3994556 Independent House House Property

6 Bhk 3500 Sqft Independent House For Sale At Nri Layout Bangalore Property Id 3994556 Independent House House Property

Click on the image beside Bhoomi to be guided to a new window where one can navigate around the page to know what services are offered.

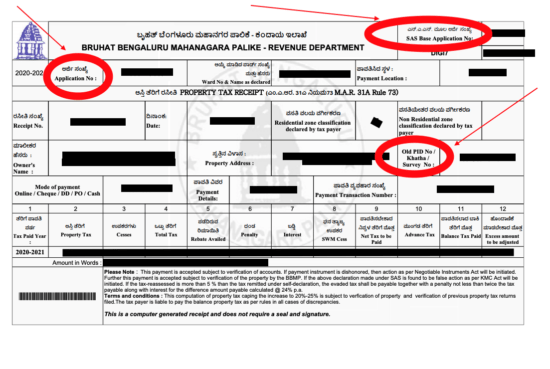

How to find property id in bangalore. Httpsbbmptaxkarnatakagovin You can retrieve your property details through your Base Application Number or Property Identifiers PID. Then users need to navigate to the GIS based new PID tab. This is a very important document when buying a resale property to know whether the previous owner had mortgaged the property and if all the dues have been paid.

The seven-digit unique ID is a permanent number which will not change even if the property ownership changes said BBMP Special Commissioner finance revenue and advertisement Manoj Rajan. Please enter your Property ID Site ID and your full name as mentioned in the registered records. BBMP has developed a GIS based Property Tax System covering whole BBMP jurisdictional area as part of this System BBMP has provided a unique Property Identification Number PID to each every Property in Bangalore.

Once your data is verified the system will request you to enter your mobile number and email ID. Launched in 2006 Magicbricks is Indias No1 online Property marketplace to buy sell and rent residential and commercial properties. The information required to fill the form are PID number or Khata number SAS 2008-2009 and 2011-2012 application numbers receipt and date.

BBMP How to find new PID number to pay property taxThe PID Number is a combination of Ward number- Street Number-Plot number. The PID Number is a combination of Ward number- Street Number-Plot number. Adjudged as the most preferred real estate portal in India by various independent surveys Magicbricks offers a one-stop destination for all Property needs.

A unique street number has been. The most convenient way to pay your property tax is online on the BBMP website with your credit or debit card or through internet banking. Enter your details First name last name 10-digit mobile number valid email ID and Aadhaar number Step 6.

Go to official link of tax collecting site. Quick tips for property tax payment BBMP started property tax collection for 2012-2013 from April 2nd. Click on Citizen services Step 4.

To find the PID number online for any property users needs to visit the BBPM website httpbbmpgovin. Property owners who enjoy full rebate on property tax. Click on citizen services Click here.

Head onto Bhoomi Bhoomi is the official site where one can check out the property owner details in Bangalore. You need to enter your name mobile number and e-mail address. You can download the Diahaank App in google store and its Karnataka Government Official App of Survey Department.

In property wise option you need to give district sub registrar office Index 2 Property type Search type and TP no or survey number. Click on Property tax payment. You can mail BBMP at bbmpsasbbmpgovin and provide your 2008-2009 application no to check your PID detail.

Citizens can get their DiGi-7 numbers by sending an SMS or calling BBMPs call centre and submitting their property identification number PID logging on to the DiGi-7 portal or downloading. A property tax rebate of 40 for the first floor and 50 rebate on the second floor would apply if the entire building is owned by one person. 8 Please note.

In search type you need to select option such as survey number TP number block number etc. This is done to update our records. Property Tax in Bangalore.

Property tax payment in Bangalore is simple and safe. Step 1. Under projects tab click on Bhoomi Step 3.

Tax evasion is a punishable act. At the site go to the right side of the homepage that is property. Property type is residential commercial or industrial.

Login to wwwlandrecordskarnatakagovin Step 2. In Bangalore the state government of Karnataka collects the property tax. This app works with the help of GPS and you get a Blue icon on your exact location if you double tap on it the owner details will be displayed along with Survey number Hobli Taluk.

If the owner has partially leased space in this establishment he will have to pay 125 times of the above mentioned rates for the leased space. The Property Identification Number will contain the information of ward number new street ID and newly allotted property number. Though BBMP has alloted Property Identification Numbers for properties in Bangalore currently there is no online facility for checking or finding a PID number.

All the real estate properties in Bangalore have been given a new PID number. I must hasten to add that the new PIDs that were announced by BBMP BDA Last year were applicable to all layout items in Bangalore with the intent of weeding out illegal or multiple ownership and to have an unique id tag for every site in Bangalore. A unique street number has been assigned to each and every Street and within.

It also lists the name of the previous owner of the property. An One time Password OTP will be sent to the mobile number and the email ID and upon entering the OTP the system will update your records. An encumbrance certificate is a document which implies a property is legally free from any mortgage or pending loan.

Read more »