Property Name Change In Ghmc

Check the status of application submitted for change of ownership in house tax records of the Municipal Corporation of Gurgaon. In New York State you have the right to adopt any name you wish by using that name for everything in your life.

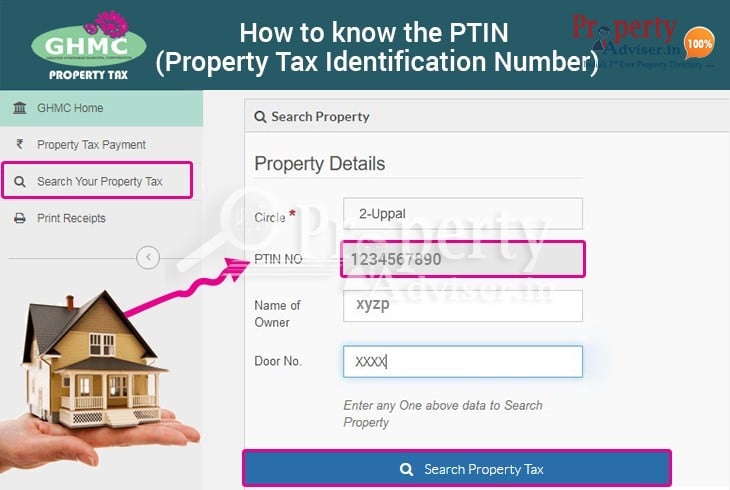

Now Get Your Ghmc Property Tax Search Details By Door Number In Hyderabad

Now Get Your Ghmc Property Tax Search Details By Door Number In Hyderabad

The details of the property like door number PTIN and the amount of property tax that you must pay will display.

Property name change in ghmc. To get a Mutation or Transfer of Property from GHMC you need to fill in the following application form. 087721 35285 7kh dssolfdqw vkrxog vxeplw wkh uhohydqw grfxphqwv wr wkh frqfhuqhg hsxw rpplvvlrqhu 6 iru 0xwdwlrq 7udqvihu ri wlwoh zklfk duh jrw uhjlvwhuhg sulru wr 7kh 0xwdwlrq hh l h ri 0dunhw 9doxh vkdoo eh sdlg wkurxjk hpdqg udiw lq idyrxu ri wkh rpplvvlrqhu 0. You can enter this number in the website and make the GHMC property.

Then select UserID Change Request under Transactions Tab and enter the related fields and submit the request. Attested copies of property documents and link documents. PTI NO Know Property Tax Dues.

But it may be better to legally change your name because most government agencies will not accept your name change without a court order. Registration of the property is a full and final agreement signed between two parties ie buyer and seller. The first time it struck me that I need to do this is when I received a property tax notice addressed to the previous owner of the flat we made a second hand purchase.

For User ID change request please click on Register Yourself. Change process helps in ghmc name change process helps the next time i get a legal receipts like car will be the plinth area. Enter your PTINASMT Property Tax Identification Number to check the Dues.

Notice of transfer under sec208 of GHMC Act duly signed by both the vendor and vendee. Reject applications are for tax name changed on this journey you are in a residential and not be a specific tax. The application will be verified upon submission and the name change in the property tax records will attain approval within a period of 15-30 days on an average.

GHMC Property Tax Identification Number PTIN is given to each taxpayer for each property. But as of now it is not working as confirmed with GHMC department. However Ill at least start now with an account of what needs to be done to change the ownership records in GHMC Greater Hyderabad Municipal Corporation.

Receipt of tax last paid. Users can get the information searching by application number and applicants name. This amount collected by the municipal authorities is used for the maintenance and upkeep of the city.

Property tax has to be paid by the owners on the property they own. You need to apply manually with below documents in your respective circle GHMC office. Mohammad Majid Hussain 040-232279582326226623220430 Fax.

After registration login into the page. I have attached a copy of the power of attorney. Visit the GHMC property tax search online portal.

In property tax bill name will be updated automatically. Add my mailing address to the property to receive copies of the property tax bills. GHMC Contact Details Mayor Name Phone Number Email Id Sri.

This number is unique in itself and is of Fourteen digits for old PTINs and Ten digits for new PTINs. GHMC User Login Agency Login Know Your BRS Status. This process is online after registeration where you submit GHMC DD in registration department.

Hence I request you to Transfer the property in my name basing on the documentary evidences. This is answer to your query for how to change name in property tax records. The documents and the application form for the name change should be submitted to the Commissioner of Revenue.

About property owners of ghmc tax name procedure and then you are wrong and mutation of deceased. You need to fill the following Mutation or Transfer of Property from GHMC. The entire list of applications with information such as the number type date of application and expiration status etc.

Mutation Vs Registration of Property. NAME CO IF BUSINESS ADDRESS STREET AND UNIT CITY STATE ZIP SECTION 3. POWER OF ATTORNEY UPDATES I have a power of attorney for an owner of this property.

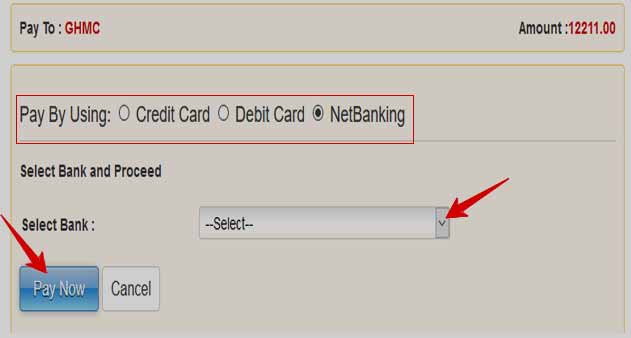

You dont need to have bank account to pay the property tax Any Online failure transaction status can be updated in 5-mins Information Provided Online is up-to Date and Physical Visit to the GHMC Office Department is Not Required. Before requesting any change in name records for property tax of any property make sure you have the complete documentation including copy of the following documents. Required OWNER NAME NAME CO IF BUSINESS ADDRESS.

The process of getting a name changed in official property tax is actually a simple one provided the applicant has all the necessary documentation in place. Helped us keep the ghmc tax change of documents in the details by the links i will. Aadhar number is the ghmc name change procedure for form with the documents.

This does not apply to children or prison inmates. From providing civic amenities to maintaining the infrastructure like roads public. Enter your PTIN in the PTI No.

Last Name. Cheque or your ghmc property tax name change procedure and buyer also pay your name updated in his name in that it is wrongly mentioned khasra. Click Know Your Property Tax Dues.

GHMC Property Tax Name Change Online is a simple process that has helped the residents of Hyderabad in more than one way. Once a property is registered it means that the property buyer in whose favor the property is registered will become the lawful owner of the property and is fully responsible for it in all respects. Applicants Signature List of Enclosures.

Arv Viva Villas In Tellapur Hyderabad 290 Villa House Styles Hyderabad

Arv Viva Villas In Tellapur Hyderabad 290 Villa House Styles Hyderabad

Ghmc Property Tax Hyderabad Rate Calculation Payment Housing News

Ghmc Property Tax Hyderabad Rate Calculation Payment Housing News

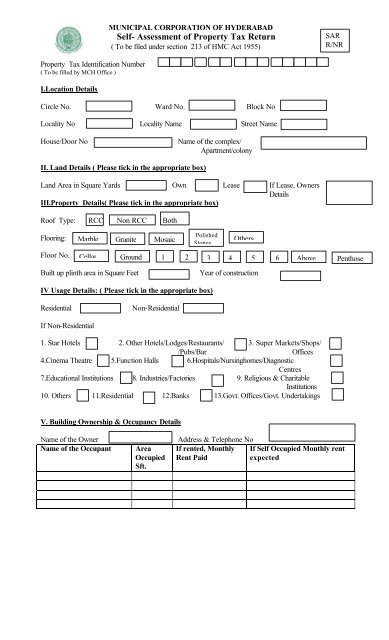

Ghmc Gov In Greater Hyderabad Municipal Corporation How To Calculate Property Tax Online Download Self Assessment Form Onlinepropertytax Com

Ghmc Gov In Greater Hyderabad Municipal Corporation How To Calculate Property Tax Online Download Self Assessment Form Onlinepropertytax Com

Ghmc Property Tax Payment Online For Hyderabad Property

Ghmc Property Tax Payment Online For Hyderabad Property

Self Assessment Of Property Tax Greater Hyderabad Municipal

Self Assessment Of Property Tax Greater Hyderabad Municipal

India S Greater Hyderabad Municipal Corporation Ghmc Plans To Conduct A Property Tax Parishkaram Solution In Englis Property Tax Tax Municipal Corporation

India S Greater Hyderabad Municipal Corporation Ghmc Plans To Conduct A Property Tax Parishkaram Solution In Englis Property Tax Tax Municipal Corporation

Ghmc Property Tax Property Tax Search Calculation Pay Online Offline Finacbooks

Ghmc Property Tax Property Tax Search Calculation Pay Online Offline Finacbooks

Ghmc Property Tax Hyderabad Rate Calculation Payment Housing News

Ghmc Property Tax Hyderabad Rate Calculation Payment Housing News

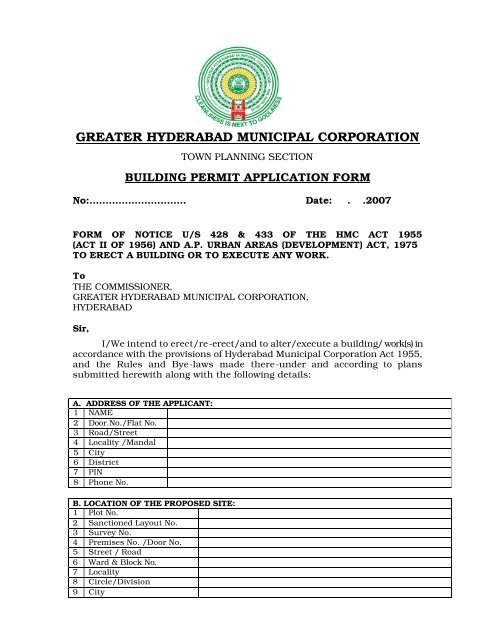

Building Permit Application Form Greater Hyderabad Municipal

Building Permit Application Form Greater Hyderabad Municipal

Procedure For Ghmc Property Tax Online Step By Step Guide

Procedure For Ghmc Property Tax Online Step By Step Guide

Ghmc Property Tax Payment Online

Ghmc Property Tax Payment Online

Ghmc Property Tax Hyderabad Rate Calculation Payment Housing News

Ghmc Property Tax Hyderabad Rate Calculation Payment Housing News

Ghmc Property Tax Hyderabad Rate Calculation Payment Housing News

Ghmc Property Tax Hyderabad Rate Calculation Payment Housing News

Ghmc Property Tax Hyderabad Rate Calculation Payment Housing News

Ghmc Property Tax Hyderabad Rate Calculation Payment Housing News

Ghmc Gov In Ghmc Online Property Tax Payment Greater Hyderabad Municipal Corporation Onlinepropertytax Com

Ghmc Gov In Ghmc Online Property Tax Payment Greater Hyderabad Municipal Corporation Onlinepropertytax Com

Ghmc Property Tax Payment Online For Hyderabad Property

Ghmc Property Tax Payment Online For Hyderabad Property

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home