Union County Ohio Property Tax Due Date

ACTUAL DUE DATE FOR 2ND HALF REAL ESTATE WILL BE. The property tax millage is 13584 mills per 1000 of valuation with the effective tax rate being 10567 mills per 1000 of valuation.

In-depth Union County OH Property Tax Information.

Union county ohio property tax due date. All payments made after the due date must be made at the Treasurers office. 1-888-977-8411 fees waived Dec. Pay at the Tax Collectors office on the first floor of the Union County Government Center Monday through Friday between 800 am.

February 23rd - 10 penalty is added on the current half tax. 4th Quarter - The 15th day of twelfth 12th taxable month. Banks cannot collect delinquent tax.

June 21st - Last day to pay 2nd half taxes without penalty. In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property. You can contact the Union County Assessor for.

For other information check out the Ohio Department of Taxation. If you need to pay your property tax bill ask about a property tax assessment look up the Union County property tax due date or find property tax records visit the Union County Tax Assessors page. We strongly encourage mail and electronic contacts with the office.

Property Taxes For everything except motor vehicles taxes are due September 1st and must be paid by January 5th to avoid interest charges. If January 5th falls on the weekend taxes are due the following Monday. 2021 Union County Ohio.

3rd Quarter - The 15th day of ninth 9th taxable month. Parcel Search - Search and view real estateappraisal information GISmapping property tax information building sketches tax levy information and general land information. If due date falls between April 15 2020 and June 15 2020 the deadline has been extended to July 15 2020.

Point and Pay is authorized by the Union County Treasurer to accept online real estate tax payments. Our office is open for payments with standard protections for the public as well as employees. June 30th - 10 penalty is added on the current tax.

The Union County Assessor is responsible for appraising real estate and assessing a property tax on properties located in Union County Ohio. Click here to pay online fees waived Dec. Interest charges are 2 if paid January 6th through the 31st and an additional 34.

Checking the Union County property tax due date. Please note that the Where Your Taxes Go screen is temporarily under repair. 18 2021 - 5 of the unpaid 1st half taxes will be added as penalty.

If mailed payments must be postmarked by the US Postal Service on or before January 5th to avoid interest charges. You may pay your real estate taxes online subject to a convenience fee. Property tax assessments in Union County are the responsibility of the Union County Tax Assessor whose office is located in Marysville Ohio.

17 2021 - Last day to pay 1st half taxes without penalty. If mailed payments must be postmarked by the US Postal Service on or before January 5th to avoid interest charges. Union County Ohio - Assessors Office.

If January 5th falls on the weekend taxes are due the following Monday. My office collects and processes approximately 106 million in property tax receipts annually representing more than 30000 parcels in Union County. 2021 Union County Ohio.

The median property tax in Union County Ohio is 2449 per year for a home worth the median value of 174800. Additionally the Treasurers office is the agent for most of the County Departments and Agency banking activity. Union County has one of the highest median property taxes in the United States and is ranked 290th of the 3143 counties in order of median property taxes.

Property Taxes - For everything except motor vehicles they are due September 1st and must be paid by January 5th to avoid interest charges. For comparison the median home value in Union County is 17480000. Yearly median tax in Union County.

Failure to receive a tax bill will not relieve the tax payer of penalties accruing if taxes are not paid before the penalty date. 28 2021 - 10 of the unpaid 1st half taxes will be added as penalty. June 22nd - 5 penalty is added on the unpaid current year tax if payment and the 5 penalty are received within those 10 days.

Penalty Interest Dates. Information on your propertys tax assessment. Union County collects on average 14 of a propertys assessed fair market value as property tax.

Please visit the Point and Pay website or select the link button below for payment and convenience fee details. 2nd Quarter - The 15th day of the sixth 6th taxable month. WEDNESDAY JULY 28 2021.

The actual payment date changes from year to year but the first half is usually due the mid part of February and the second half is due the mid part of July. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Union County Tax Appraisers office. Property Taxes Unions property taxes are collected by the Montgomery County Treasurer.

Ohio Property Tax Appeal Franklin County Tax Lawyer

Ohio Property Tax Appeal Franklin County Tax Lawyer

Faq Allen County Treasurer S Office

Faq Allen County Treasurer S Office

Bergen County Property Tax Records Bergen County Property Taxes Nj

Bergen County Property Tax Records Bergen County Property Taxes Nj

Hudson County Property Tax Records Hudson County Property Taxes Nj

Hudson County Property Tax Records Hudson County Property Taxes Nj

Somerset County Property Tax Records Somerset County Property Taxes Nj

Somerset County Property Tax Records Somerset County Property Taxes Nj

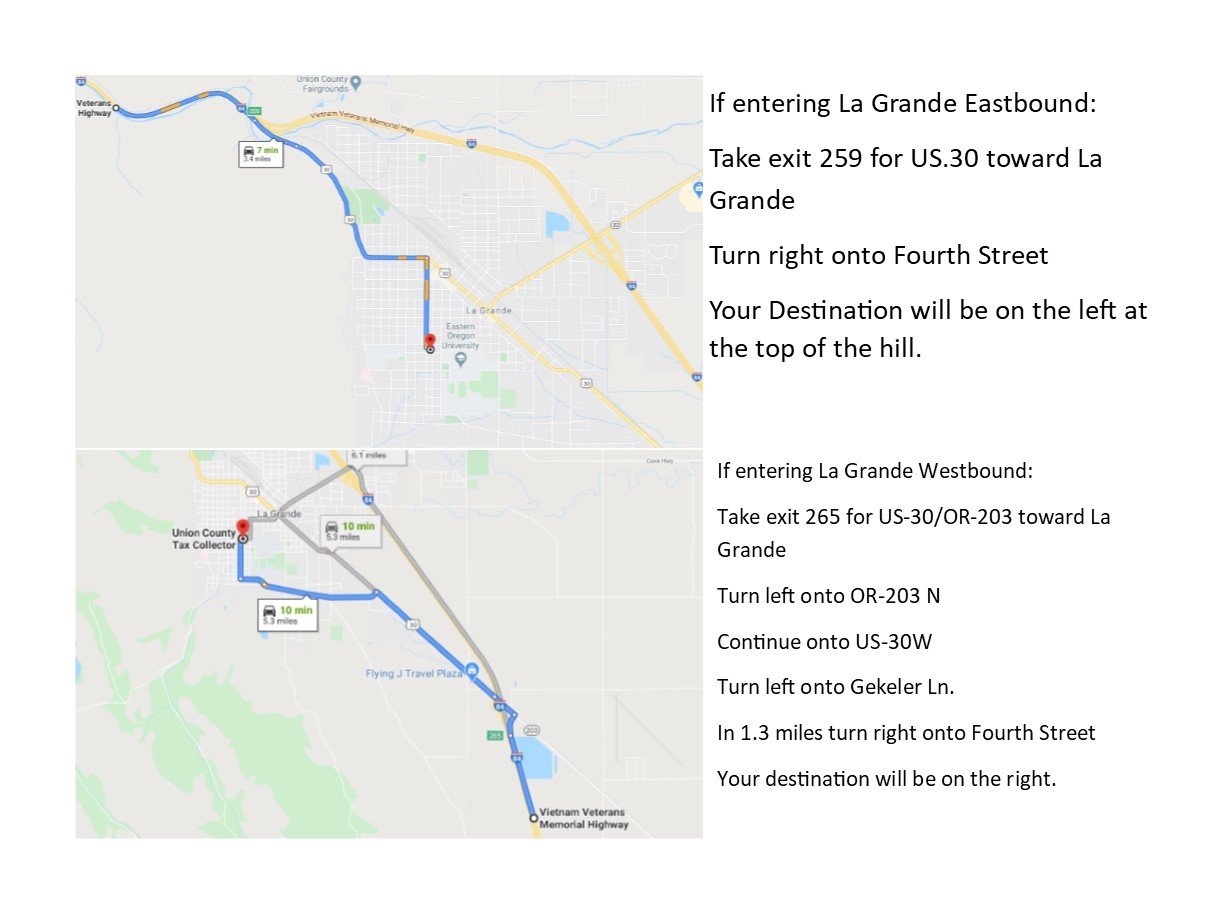

Assessor Tax Collector Union County

Assessor Tax Collector Union County

Passaic County Property Tax Records Passaic County Property Taxes Nj

Passaic County Property Tax Records Passaic County Property Taxes Nj

Hudson County Property Tax Records Hudson County Property Taxes Nj

Hudson County Property Tax Records Hudson County Property Taxes Nj

Hudson County Property Tax Records Hudson County Property Taxes Nj

Hudson County Property Tax Records Hudson County Property Taxes Nj

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home