Personal Property Tax Listing Form

Explore the new law passed by the North Carolina General Assembly to create a combined motor vehicle registration renewal and property tax collections system. NCDOR extends Individual Income filing and payment deadline to May 17 to match IRS extension.

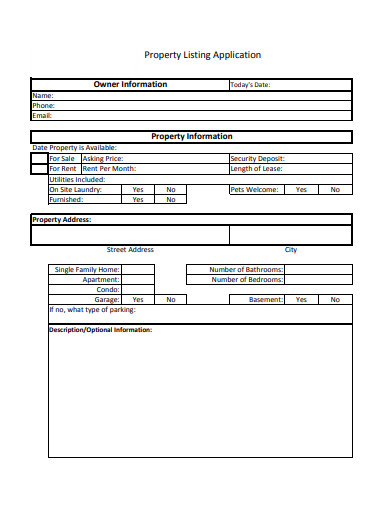

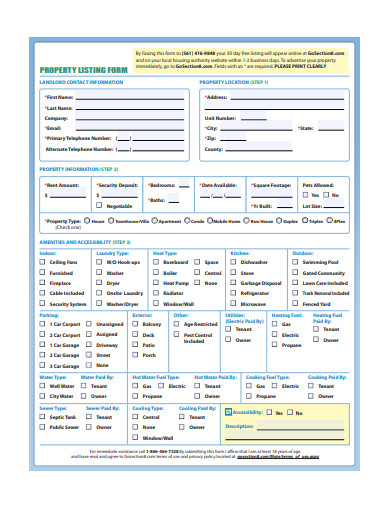

14 Property Listing Templates In Pdf Free Premium Templates

14 Property Listing Templates In Pdf Free Premium Templates

It also includes any improvements made to land leased from the government leasehold improvements.

Personal property tax listing form. Craven County Assessor Business Section PO Box 985 Mount Airy NC 27030. Business Personal Property Listing Form. Personal property listing forms.

Personal property includes machinery equipment furniture and supplies of businesses and farmers. Enter a full or partial form number or description into the Title or Number box optionally select a tax year and type from the. For 2021 property must be listed between January 1-February 15.

Box 3138 Greensboro NC 27402-3138 TO AVOID PENALTY RETURN SIGNED COMPLETE LISTING OR EXTENSION REQUEST BY FEBRUARY 1 ST TAX YEAR. Listings submitted by mail shall be deemed filed as of the date shown on the postmark affixed by the US Postal Service. A personal property tax return form 920 or form 945 is no longer required to be filed if the listed value before exemp-tion is 10000 or less.

Application required when applying for realpersonal property tax exemption. Non-Business Property Listing Form. Listing forms may be filed in one of three ways.

Listings must be submitted by mail or in person. The form must list the taxable personal property located in the county as of noon on January 1. The list must include the acquisition cost and year acquired.

Unregistered vehicles trailers cars trucks buses etc must be listed on a Personal Property Tax Listing form. The taxpayer is responsible for listing personal and real property located in Dare County as detailed below. Business Personal Property Extension Request PO.

Every person who uses personal property in a business or has taxable personal property must complete a Personal Property Tax listing form by April 30 each year. Public utility reporting forms. FOR DEPARTMENT USE ONLY OWNER ID.

Box 36819 Charlotte NC 28236-6819 Real Estate. For complete instruction for listing of personal property either by hard copy or electronically please contact your local assessor. Average original cost of all real and tangible personal property owned or used by the taxpayer in the business or.

Taxes Forms. Business personal property listings are required to be completed by all business entities by the owner as of January 1 who own tangible personal property used or held for business purposes. Personal Property Listing Form Instructions.

It is important to provide the VIN when completing the listing. Public Utility Annual Reports Refund and Waiver forms. Business Personal Property Listing Mailing address.

Guidelines for Filing Ohio Personal Property Tax Returns. Get the latest information. 2021 Business Personal Property Listing Form.

Personal Property Tax Division 30 E. For those using a software package to create your per-sonal property tax return remember to incorporate into your existing data any. Craven County Assessor Business Section 226 Pollock St New Bern NC 28560 BY MAIL.

If you do not receive a form and have property that requires listing it is your responsibility to obtain and complete a Personal Property Tax Listing Form. Click here for specific instructions regarding opening and using any of our pdf fill-in forms if you are a Windows 10 user. Business Personal Property Listing Form.

The assessor uses the form to value personal property for taxes due the. PHYSICAL ADDRESS Where Assets are located. If you listed with the tax department in the prior year a form should automatically be mailed to.

OR Principal Business Activity. Broad St 21st Floor z Columbus OH 43215. You should receive this preprinted form containing the previous years listed items by the first week of January.

Attach W-2s and or W-2 G. This booklet is published to apprise persons of the manner in which property taxes are levied in Ohio. Application required when applying for motor vehicle tax exemption.

The Tax Listing Office is responsible for mailing listing forms and valuing the personal property listed by taxpayers. 2021 Extension Request Form. Antique Automobile Value Exclusion Application.

If you listed property in the previous year a listing form will be mailed to you at the last address of record. Tax year An amount must be placed in. Motor Vehicle Exemption Application.

Electronic Filing of Personal Property Listing xlsx This form is an option to file electronically and is intended for use of first time filing only. Business Personal Property Listing Form. Complete Form IR-21 for 2021 if 2020 net tax due is more than 200.

If the tax office does not have a record of the VIN being taxed for prior years you could be rebilled for the same property as a result of an audit. Petition for Property Tax Refund Fill-In 64 0001e Income Qualification Worksheet Fill-In 64 0115e. The listing period is from January 1 through January 31 each year.

Part A TAXABLE WAGES. Property Tax - Forms. 2021 Business Personal Property Penalty Waiver Form.

Application required when applying for Antique Value exclusion. 2021 BPP Listing Form. Tag Tax System.

Listings may be submitted by mail online or email.

Read more »